Answered step by step

Verified Expert Solution

Question

1 Approved Answer

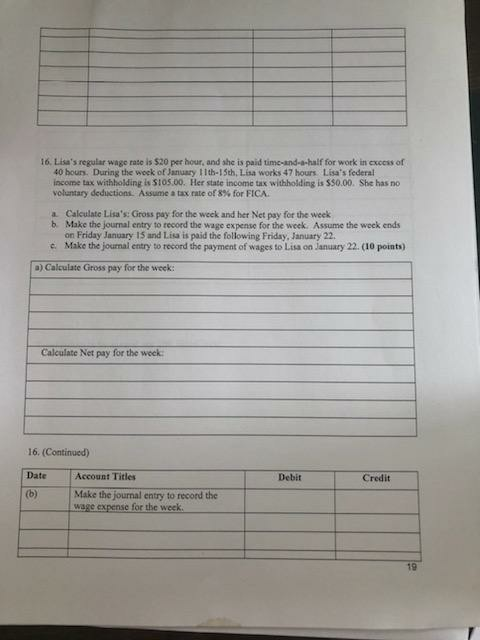

16. Lisa's regular wage rate is $20 per hour, and she is paid time-and-a-half for work in excess of 40 hours. During the work of

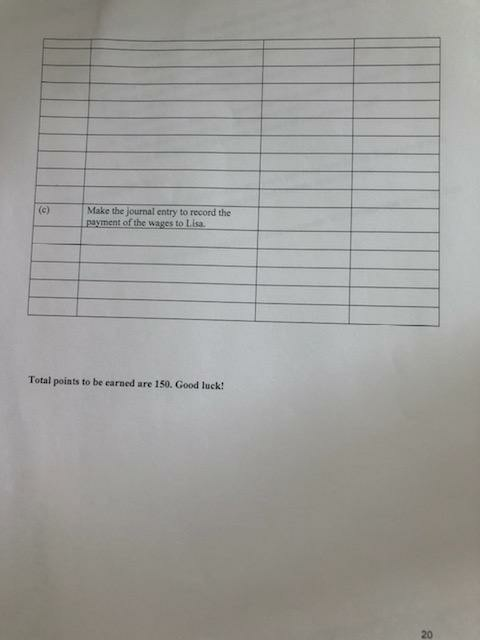

16. Lisa's regular wage rate is $20 per hour, and she is paid time-and-a-half for work in excess of 40 hours. During the work of January 11th-Sth, Lisa works 47 hours Lisa's federal income tax withholding is S105.00. Her state income tax withholding is $50.00. She has no voluntary deductions. Assume a tax rate of 8% for FICA Calculate Lisa's: Gross pay for the week and her Net pay for the week Make the journal entry to record the wage expense for the week. Assume the week ends on Friday January 15 and Lisa is paid the following Friday, January 22. Make the journal entry to record the payment of wages to Lisa on January 22. (10 points) a) Calculate Gross pay for the week: Calculate Net pay for the wock 16. (Continued) Date Debit Credit (b) Account Titles Make the journal entry to record the wage expense for the week. 19 (c) Make the journal entry to record the payment of the wages to Liisa Total points to be earned are 150. Good luck! 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started