16

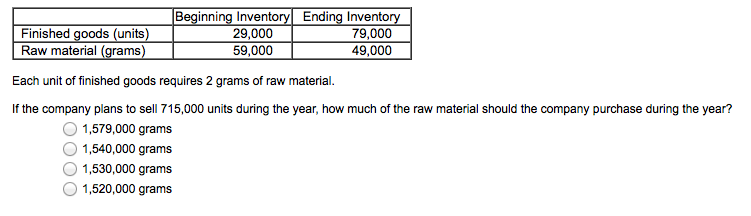

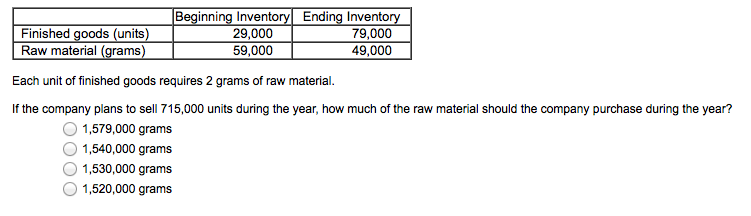

Sartain Corporation is in the process of preparing its annual budget. The following beginning and ending inventory levels are planned for the year.

17

17

18

18

19

19

20

20

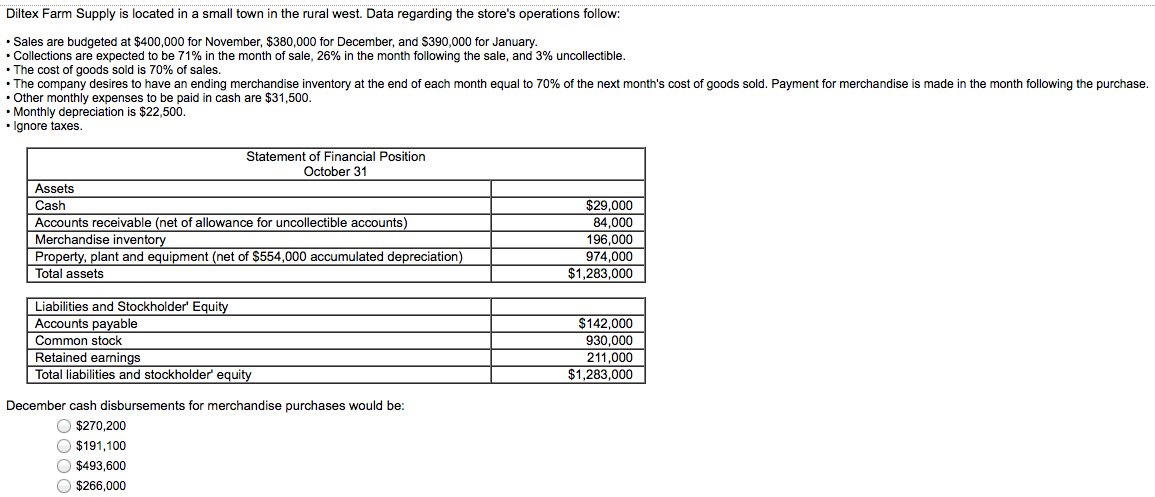

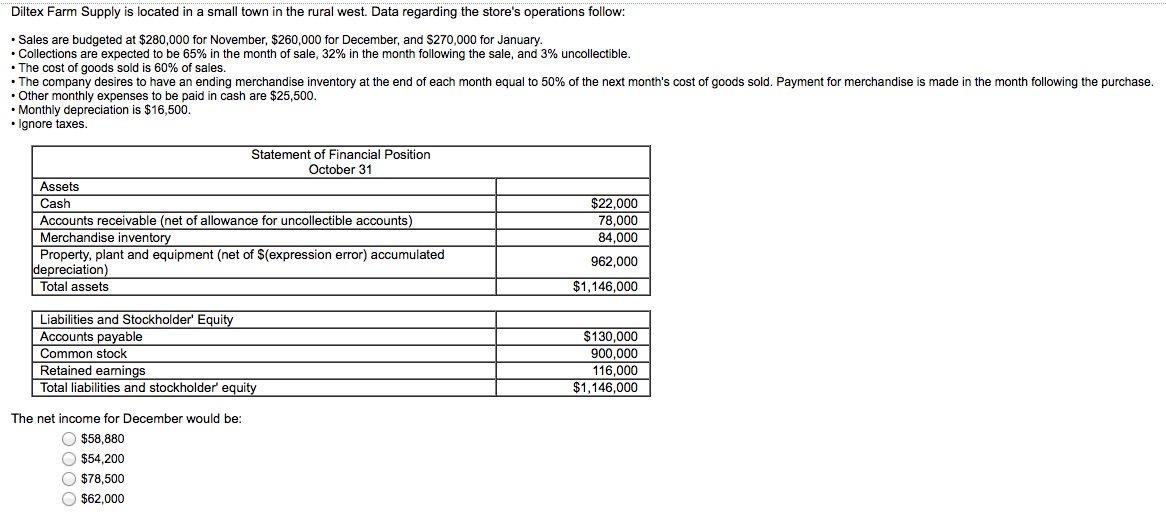

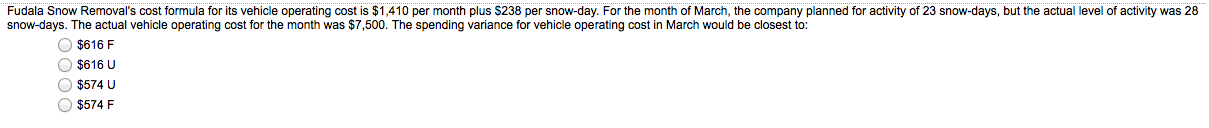

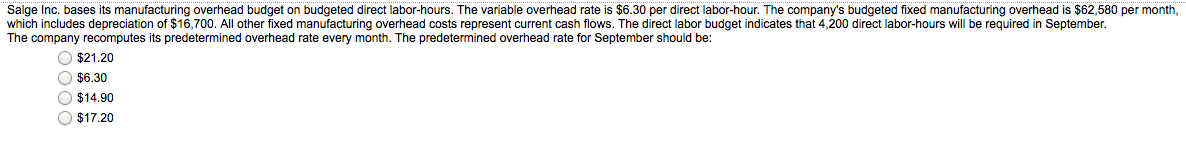

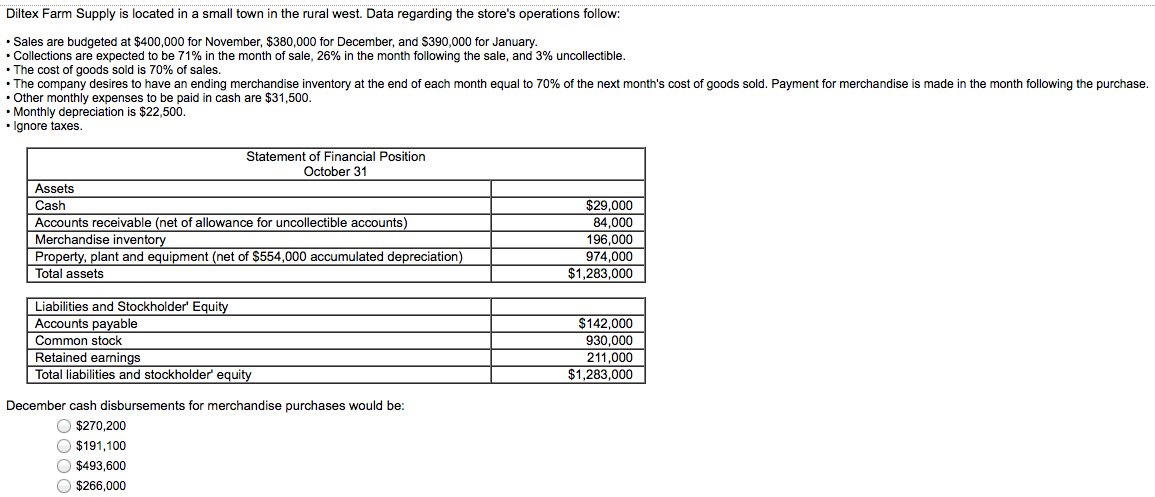

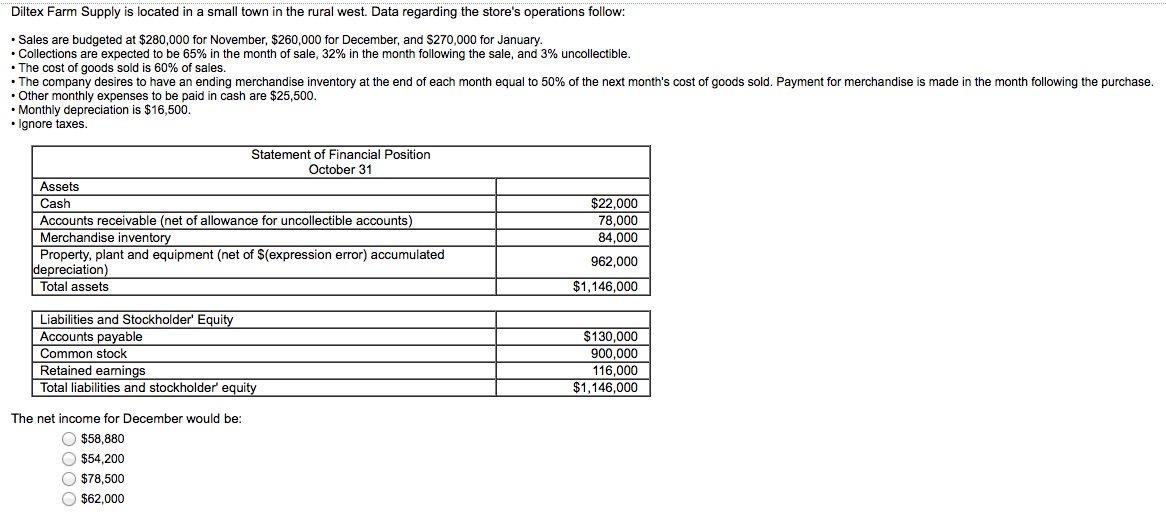

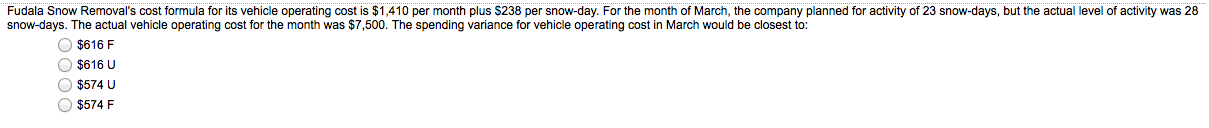

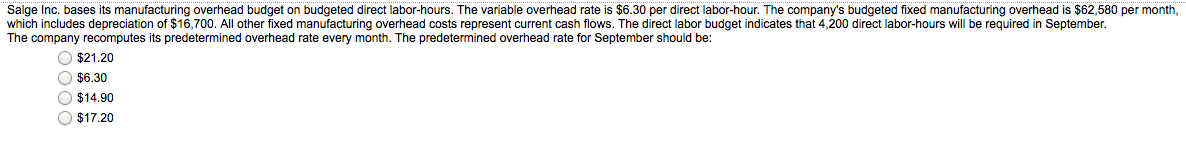

Each unit of finished goods requires 2 grams of raw material. If the company plans to sell 715,000 units during the year, how much of the raw material should the company purchase during the year? 1,579.000 grams 1,540.000 grams 1,530.000 grams 1,520,000 grams Diltex Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow: Sales are budgeted at $280,000 for November, $260,000 for December, and $270,000 for January. Collections are expected to be 65% in the month of sale. 32% in the month following the sale, and 3% uncollectible. The cost of goods sold is 60% of sales. The company desires to have an ending merchandise inventory at the end of each month equal to 50% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $25,500. Monthly depreciation is $16,500. Ignore taxes. The net income for December would be: $58,880 $54,200 $78,500 $62,000 Fudala Snow Removal's cost formula for its vehicle operating cost is $1,410 per month plus $238 per snow-day. For the month of March, the company planned for activity of 23 snow-days, but the actual level of activity was 28 snow-days. The actual vehicle operating cost for the month was $7,500. The spending variance for vehicle operating cost in March would be closest to: $616 F $616 U $574 U $574 F Salge Inc. bases its manufacturing overhead budget on budgeted direct labor-hours. The variable overhead rate is $6.30 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $62,580 per month, which includes depreciation of $16,700. All other fixed manufacturing overhead costs represent current cash flows. The direct labor budget indicates that 4,200 direct labor-hours will be required in September. The company recomputes its predetermined overhead rate every month. The predetermined overhead rate for September should be: $21.20 $6 30 $14.90 $17.20 Diltex Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow: Sales are budgeted at $400,000 for November, $380,000 for December, and $390,000 for January. Collections are expected to be 71% in the month of sale. 26% in the month following the sale, and 3% uncollectible. The cost of goods sold is 70% of sales. The company desires to have an ending merchandise inventory at the end of each month equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $31,500. Monthly depreciation is $22,500. Ignore taxes. December cash disbursements for merchandise purchases would be: $270,200 $191,100 $493,600 $266,000 Each unit of finished goods requires 2 grams of raw material. If the company plans to sell 715,000 units during the year, how much of the raw material should the company purchase during the year? 1,579.000 grams 1,540.000 grams 1,530.000 grams 1,520,000 grams Diltex Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow: Sales are budgeted at $280,000 for November, $260,000 for December, and $270,000 for January. Collections are expected to be 65% in the month of sale. 32% in the month following the sale, and 3% uncollectible. The cost of goods sold is 60% of sales. The company desires to have an ending merchandise inventory at the end of each month equal to 50% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $25,500. Monthly depreciation is $16,500. Ignore taxes. The net income for December would be: $58,880 $54,200 $78,500 $62,000 Fudala Snow Removal's cost formula for its vehicle operating cost is $1,410 per month plus $238 per snow-day. For the month of March, the company planned for activity of 23 snow-days, but the actual level of activity was 28 snow-days. The actual vehicle operating cost for the month was $7,500. The spending variance for vehicle operating cost in March would be closest to: $616 F $616 U $574 U $574 F Salge Inc. bases its manufacturing overhead budget on budgeted direct labor-hours. The variable overhead rate is $6.30 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $62,580 per month, which includes depreciation of $16,700. All other fixed manufacturing overhead costs represent current cash flows. The direct labor budget indicates that 4,200 direct labor-hours will be required in September. The company recomputes its predetermined overhead rate every month. The predetermined overhead rate for September should be: $21.20 $6 30 $14.90 $17.20 Diltex Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow: Sales are budgeted at $400,000 for November, $380,000 for December, and $390,000 for January. Collections are expected to be 71% in the month of sale. 26% in the month following the sale, and 3% uncollectible. The cost of goods sold is 70% of sales. The company desires to have an ending merchandise inventory at the end of each month equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $31,500. Monthly depreciation is $22,500. Ignore taxes. December cash disbursements for merchandise purchases would be: $270,200 $191,100 $493,600 $266,000

17

17 18

18 19

19 20

20