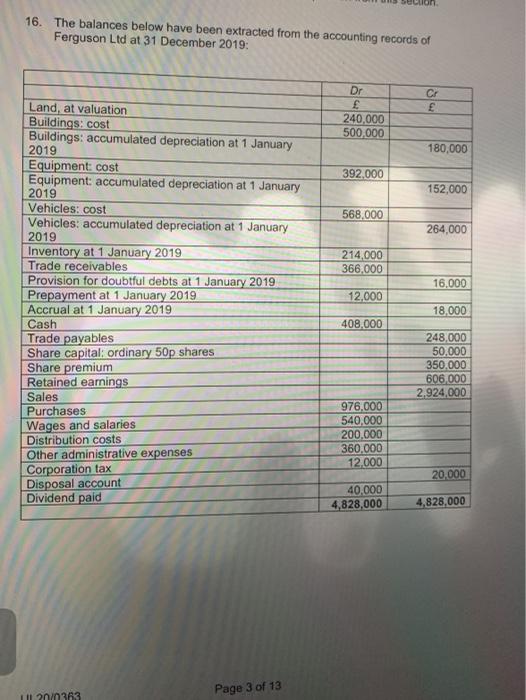

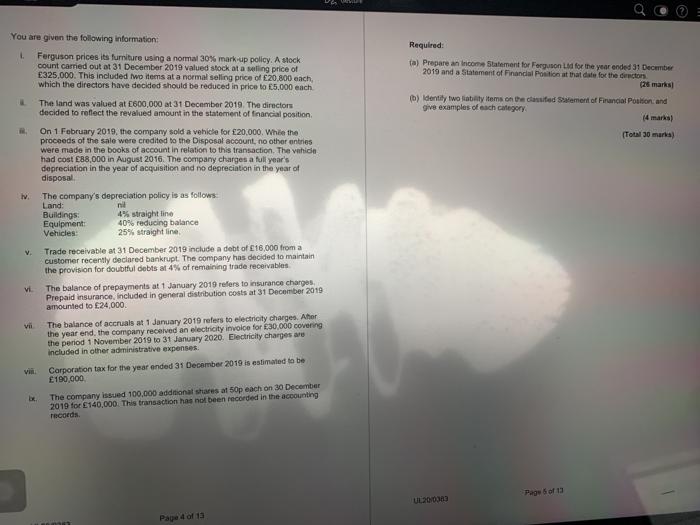

16. The balances below have been extracted from the accounting records of Ferguson Ltd at 31 December 2019: Cr Dr 240,000 500.000 180,000 392,000 152,000 568,000 264,000 214,000 366,000 16.000 Land, at valuation Buildings: cost Buildings: accumulated depreciation at 1 January 2019 Equipment cost Equipment: accumulated depreciation at 1 January 2019 Vehicles: cost Vehicles: accumulated depreciation at 1 January 2019 Inventory at 1 January 2019 Trade receivables Provision for doubtful debts at 1 January 2019 Prepayment at 1 January 2019 Accrual at 1 January 2019 Cash Trade payables Share capital: ordinary 50p shares Share premium Retained earings Sales Purchases Wages and salaries Distribution costs Other administrative expenses Corporation tax Disposal account Dividend paid 12.000 18,000 408,000 248.000 50.000 350.000 606,000 2.924,000 976.000 540,000 200.000 360,000 12.000 20,000 40.000 4,828,000 4,828,000 Page 3 of 13 Il 20/0363 You are given the following information: Ferguson prices its furniture using a normal 30% mark-up policy. A stock count carried out at 31 December 2019 valued stock at a selling price of 325,000. This included two items at a normal selling price of 20,800 each, which the directors have decided should be reduced in price to 5.000 each Required: ta) Prepare an income Statement for Ferguson Lod for the year ended 31 December 2019 and a Statement of Financial Position at that date for the director (25 marks (b) Identity two liability items on the classified Statement of Financial Position and give examples of each category 14 marks (Total 30 marks) The land was valued at 600,000 at 31 December 2019. The directors decided to reflect the revalued amount in the statement of financial position V On 1 February 2019, the company sold a vehicle for 20,000. Whoe the proceeds of the sale were credited to the Disposal account, no other entries were made in the books of account in relation to this transaction. The vehida had cost 88,000 in August 2016. The company charges a full year's depreciation in the year of acquisition and no depreciation in the year of disposal The company's depreciation policy is as follows: Land nil Buildings 4% straight line Equipment 40% reducing balance Vehicles 25% straight line Trade receivable at 31 December 2019 include a debt of 16,000 from a customer recently declared bankrupt. The company has decided to maintain the provision for doubtfuldebts al 4% of remaining trade receivables The balance of prepayments at 1 January 2010 refers to insurance charges Prepaid insurance, included in general distribution costs at 31 December 2019 amounted to 24,000. The balance of accruals at 1 January 2019 refers to electricity charges. Ahor the year end, the company received an electricity involo for 30,000 covering the period 1 November 2019 to 31 January 2020 Electricity charges are included in other administrative expenses. Corporation tax for the year ended 31 December 2019 is estimated to be 100,000 The company issued 100.000 additionat shares at Op each on 30 December 2019 for 140,000. This transaction has not been recorded in the accounting records vi Vi Page 4 of 13