Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. 16. Timothy is currently pursuing a financial planning degree with a 100% performance scholarship at Campbellsville University. After graduation, if he expects to earn

.

.

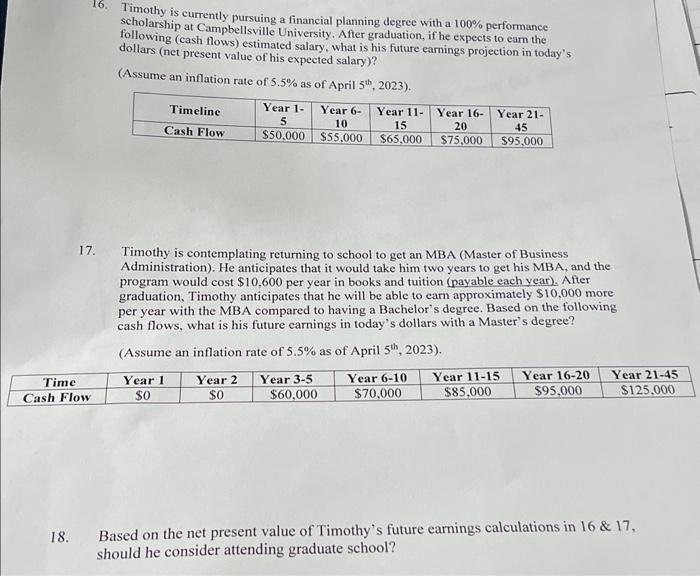

16. Timothy is currently pursuing a financial planning degree with a 100% performance scholarship at Campbellsville University. After graduation, if he expects to earn the following (cash flows) estimated salary, what is his future earnings projection in today's dollars (net present value of his expected salary)? (Assume an inflation rate of 5.5% as of April 5th, 2023). Year 6- Year 11- Year 16- Year 21- 10 $50,000 $55,000 Timeline Cash Flow Year 1- 5 15 20 45 $65,000 $75,000 $95,000 17. Timothy is contemplating returning to school to get an MBA (Master of Business Administration). He anticipates that it would take him two years to get his MBA, and the program would cost $10,600 per year in books and tuition (payable each year). After graduation, Timothy anticipates that he will be able to earn approximately $10,000 more per year with the MBA compared to having a Bachelor's degree. Based on the following cash flows, what is his future earnings in today's dollars with a Master's degree? (Assume an inflation rate of 5.5% as of April 5th, 2023). Time Cash Flow 18. Year 1 $0 Year 2 Year 3-5 $0 $60,000 Year 6-10 $70,000 Year 11-15 $85,000 Year 16-20 Year 21-45 $95,000 $125,000 Based on the net present value of Timothy's future earnings calculations in 16 & 17, should he consider attending graduate school?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started