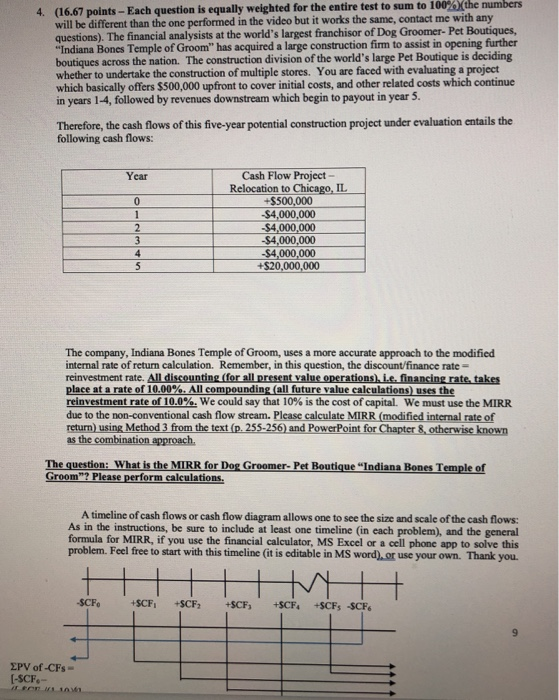

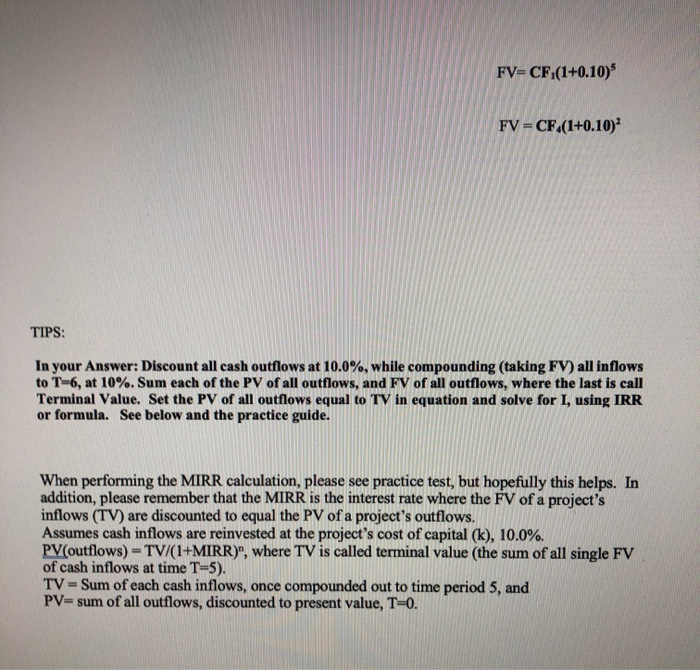

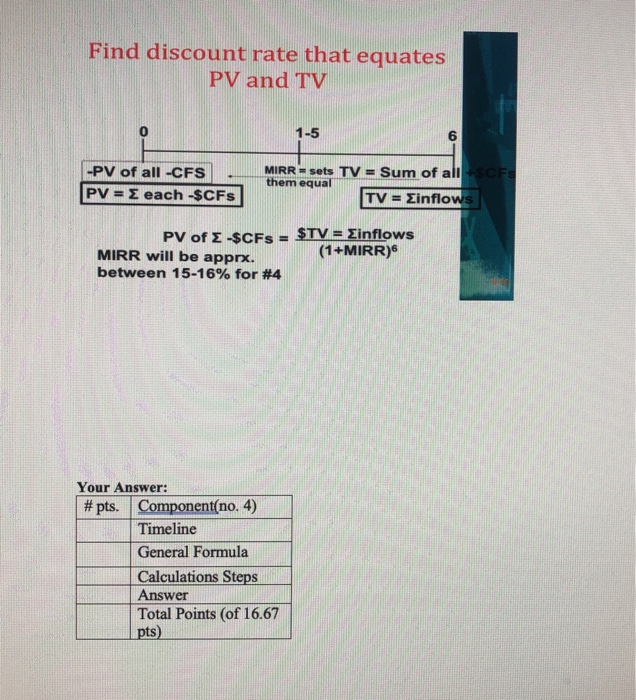

(16.67 points-Each question is equally weighted for the entire test to sum to 100%)(the numbers will be different than the one performed in the video but it works the same, contact me with any questions). The financial analysists at the world's largest franchisor of Dog Groomer- Pet Boutiques, "Indiana Bones Temple of Groom" has acquired a large construction firm to assist in opening further boutiques across the nation. The construction division of the world's large Pet Boutique is deciding whether to undertake the construction of multiple stores. You are faced with evaluating a project which basically offers $500,000 upfront to cover initial costs, and other related costs which continue in years 1-4, followed by revenues downstream which begin to payout in year 5. 4. Therefore, the cash flows of this five-year potential construction project under evaluation entails the following cash flows: Cash Flow Project- Relocation to Chicago, IL +$500,000 $4,000,000 -$4,000,000 -$4,000,000 $4,000,000 +$20,000,000 Year The company, Indiana Bones Temple of Groom, uses a more accurate approach to the modified internal rate of return calculation. Remember, in this question, the discount/finance rate- reinvestment rate. All discounting (for all present value operations),ie.financing rate, takes place at a rate of 10.00%. All compounding(all futurevalue calculations) uses the reinvestment rate of 10.0%; we could say that 10% is the cost of capital, we must use the MIRR due to the non-conventional cash flow stream. Please calculate MIRR (modified internal rate of return) using Method 3 from the text (p. 255-256) and PowerPoint for Chapter 8, otherwise known The question: What is the MIRR for Dog Groomer- Pet Boutique "Indiana Bones Temple of Groom"? Please perform calculations. A timeline of cash flows or cash flow diagram allows one to see the size and scale of the cash flows: As in the instructions, be sure to include at least one timeline (in each problem), and the general formula for MIRR, if you use the financial calculator, MS Excel or a cell phone app to solve this problem. Feel free to start with this timeline (it is editable in MS word),or use your own. Thank you. 9 EPV of-CFs- [-SCF FV- CF (1+0.10) FV-CF (I+0.10) TIPS: In your Answer: Discount all cash outflows at 10.0%, while compounding (taking FV) all inflows to T-6, at 10%. Sum each of the PV of all outflows, and FV of all outflows, where the last is call Terminal Value. Set the PV of all outflows equal to TV in equation and solve for I, using IRR or formula. See below and the practice guide. When performing the MIRR calculation, please see practice test, but hopefully this helps. In addition, please remember that the MIRR is the interest rate where the FV of a project's inflows (TV) are discounted to equal the PV of a project's outflows. Assumes cash inflows are reinvested at the project's cost of capital (k), 10.0%. PV(outflows) TV(1+MIRR), where TV is called terminal value (the sum of all single FV of cash inflows at time T-5). TV = Sum of each cash inflows., once compounded out to time period 5, and PV= sum of all outflows, discounted to present value, T-0. Find discount rate that equates PV and TV 0 1-5 6 MIRRe sets TV = Sum of all them equal FS . Ev-teach scES] =Einflo TV = nflows PV of -SCFs = STV-Einflows (1+MIRR)* MIRR will be apprx. between 15-16% for #4 Your Answer: # pts. | Component(no.4) Timeline General Formula Calculations Steps Answer Total Points (of 16.67 pts) (16.67 points-Each question is equally weighted for the entire test to sum to 100%)(the numbers will be different than the one performed in the video but it works the same, contact me with any questions). The financial analysists at the world's largest franchisor of Dog Groomer- Pet Boutiques, "Indiana Bones Temple of Groom" has acquired a large construction firm to assist in opening further boutiques across the nation. The construction division of the world's large Pet Boutique is deciding whether to undertake the construction of multiple stores. You are faced with evaluating a project which basically offers $500,000 upfront to cover initial costs, and other related costs which continue in years 1-4, followed by revenues downstream which begin to payout in year 5. 4. Therefore, the cash flows of this five-year potential construction project under evaluation entails the following cash flows: Cash Flow Project- Relocation to Chicago, IL +$500,000 $4,000,000 -$4,000,000 -$4,000,000 $4,000,000 +$20,000,000 Year The company, Indiana Bones Temple of Groom, uses a more accurate approach to the modified internal rate of return calculation. Remember, in this question, the discount/finance rate- reinvestment rate. All discounting (for all present value operations),ie.financing rate, takes place at a rate of 10.00%. All compounding(all futurevalue calculations) uses the reinvestment rate of 10.0%; we could say that 10% is the cost of capital, we must use the MIRR due to the non-conventional cash flow stream. Please calculate MIRR (modified internal rate of return) using Method 3 from the text (p. 255-256) and PowerPoint for Chapter 8, otherwise known The question: What is the MIRR for Dog Groomer- Pet Boutique "Indiana Bones Temple of Groom"? Please perform calculations. A timeline of cash flows or cash flow diagram allows one to see the size and scale of the cash flows: As in the instructions, be sure to include at least one timeline (in each problem), and the general formula for MIRR, if you use the financial calculator, MS Excel or a cell phone app to solve this problem. Feel free to start with this timeline (it is editable in MS word),or use your own. Thank you. 9 EPV of-CFs- [-SCF FV- CF (1+0.10) FV-CF (I+0.10) TIPS: In your Answer: Discount all cash outflows at 10.0%, while compounding (taking FV) all inflows to T-6, at 10%. Sum each of the PV of all outflows, and FV of all outflows, where the last is call Terminal Value. Set the PV of all outflows equal to TV in equation and solve for I, using IRR or formula. See below and the practice guide. When performing the MIRR calculation, please see practice test, but hopefully this helps. In addition, please remember that the MIRR is the interest rate where the FV of a project's inflows (TV) are discounted to equal the PV of a project's outflows. Assumes cash inflows are reinvested at the project's cost of capital (k), 10.0%. PV(outflows) TV(1+MIRR), where TV is called terminal value (the sum of all single FV of cash inflows at time T-5). TV = Sum of each cash inflows., once compounded out to time period 5, and PV= sum of all outflows, discounted to present value, T-0. Find discount rate that equates PV and TV 0 1-5 6 MIRRe sets TV = Sum of all them equal FS . Ev-teach scES] =Einflo TV = nflows PV of -SCFs = STV-Einflows (1+MIRR)* MIRR will be apprx. between 15-16% for #4 Your Answer: # pts. | Component(no.4) Timeline General Formula Calculations Steps Answer Total Points (of 16.67 pts)