Match each industry to the particular financial statement

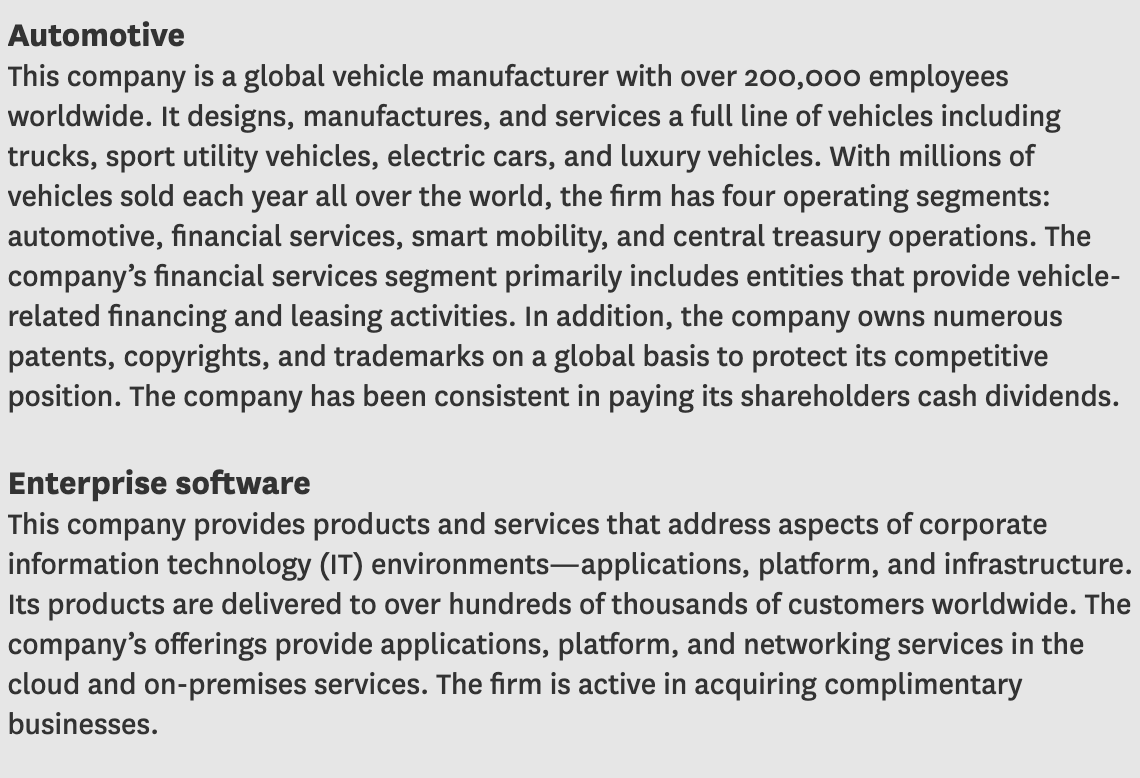

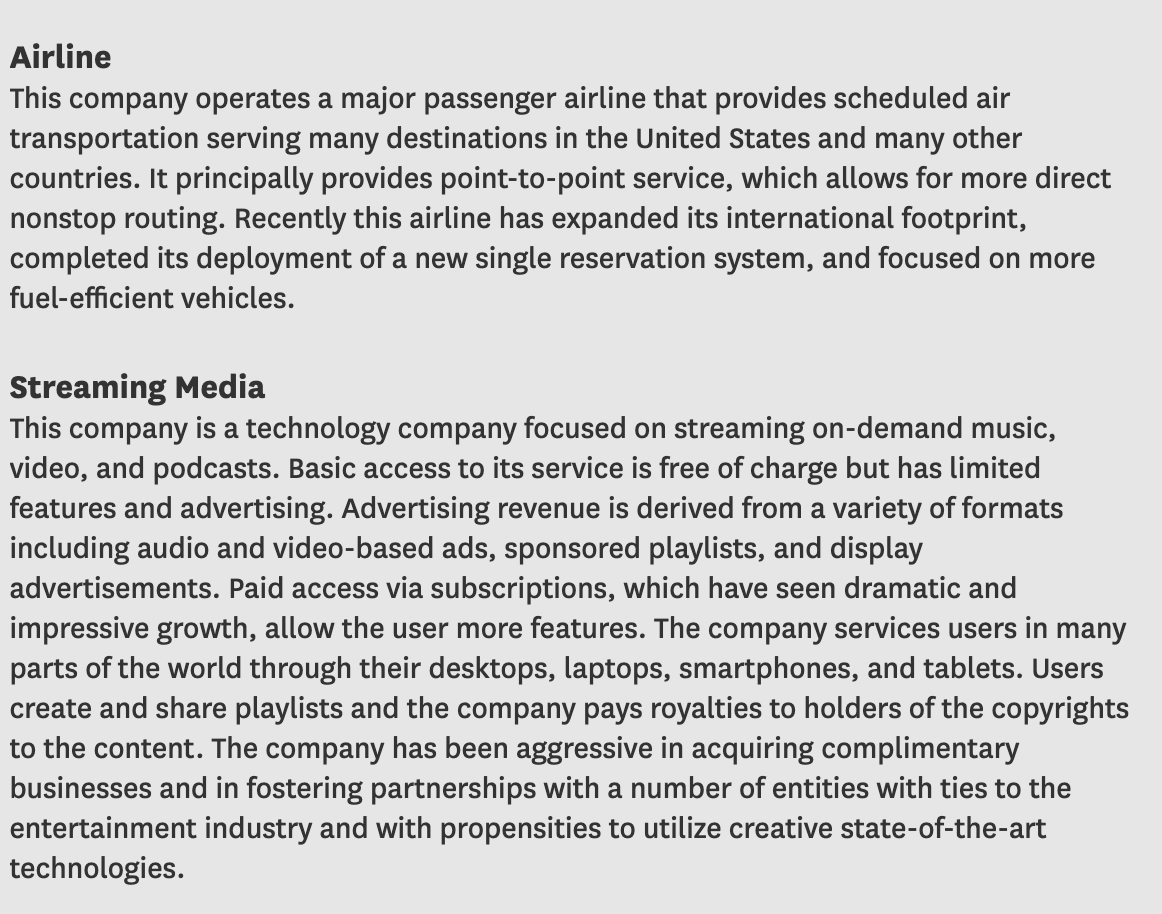

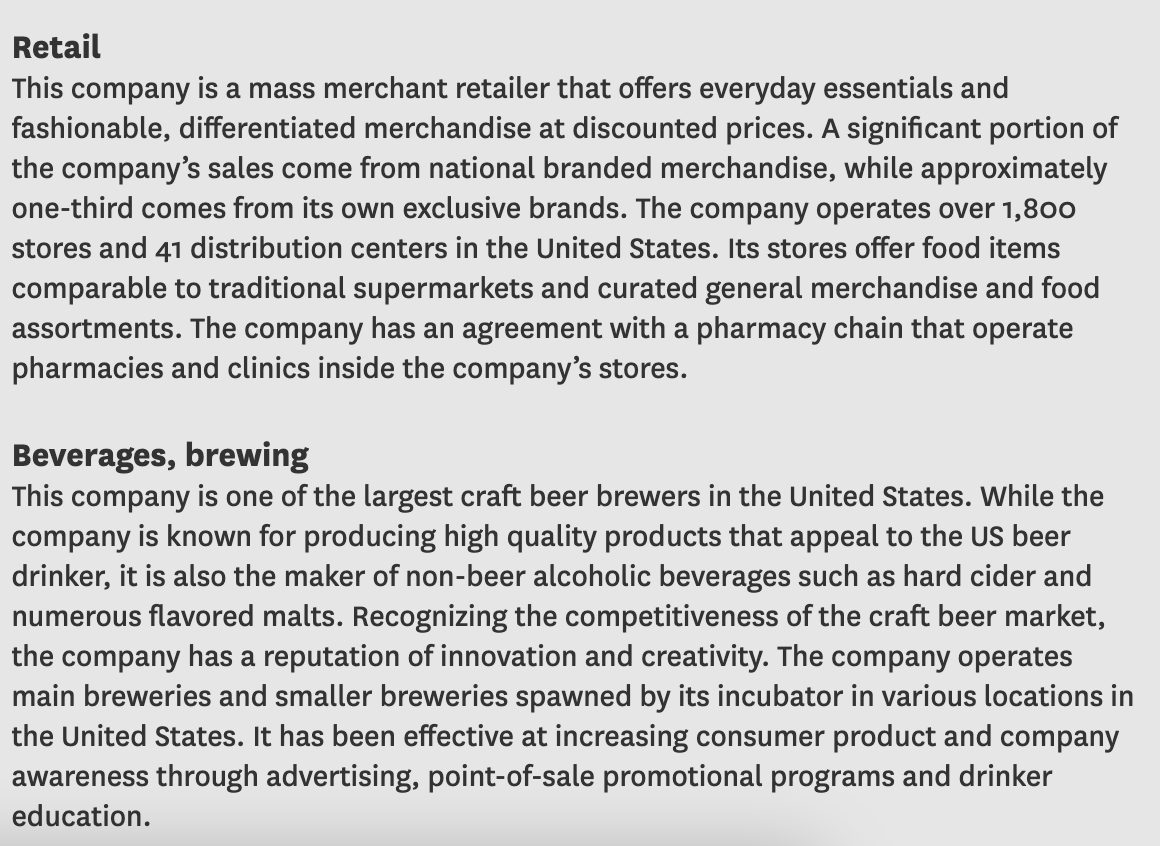

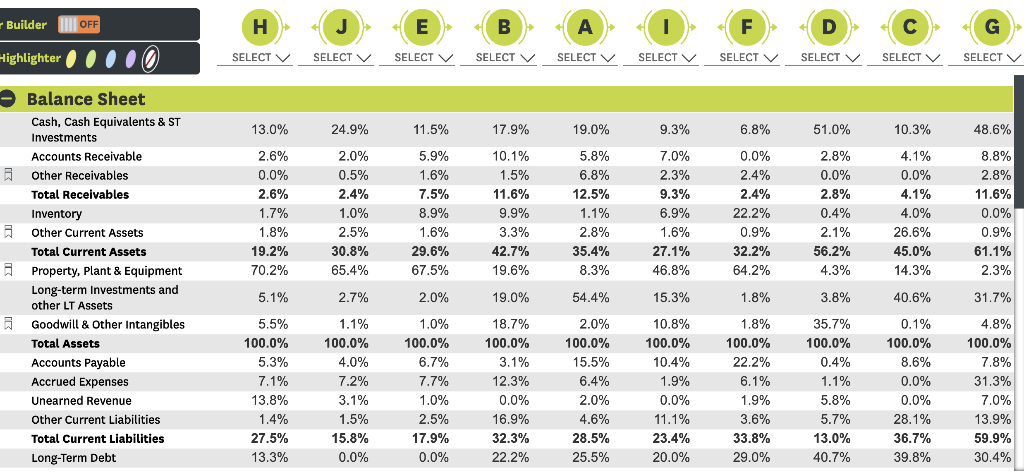

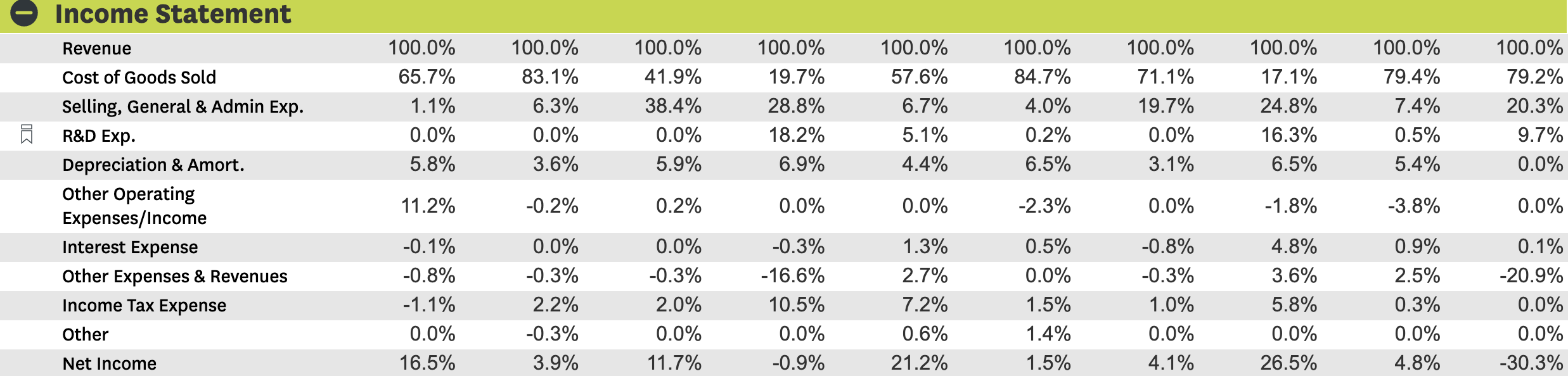

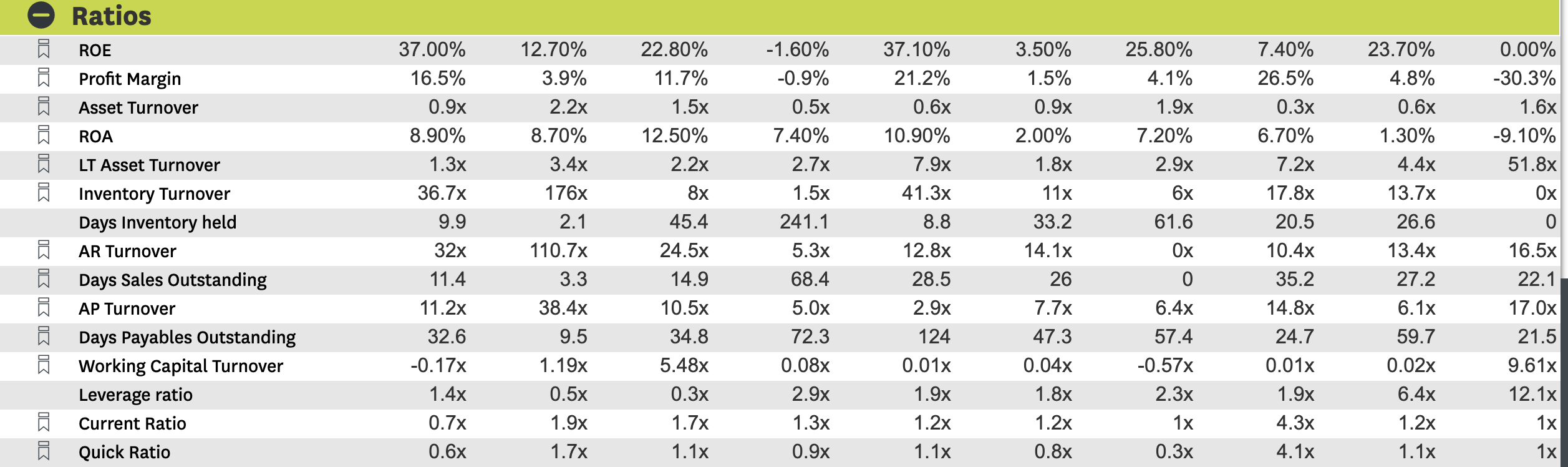

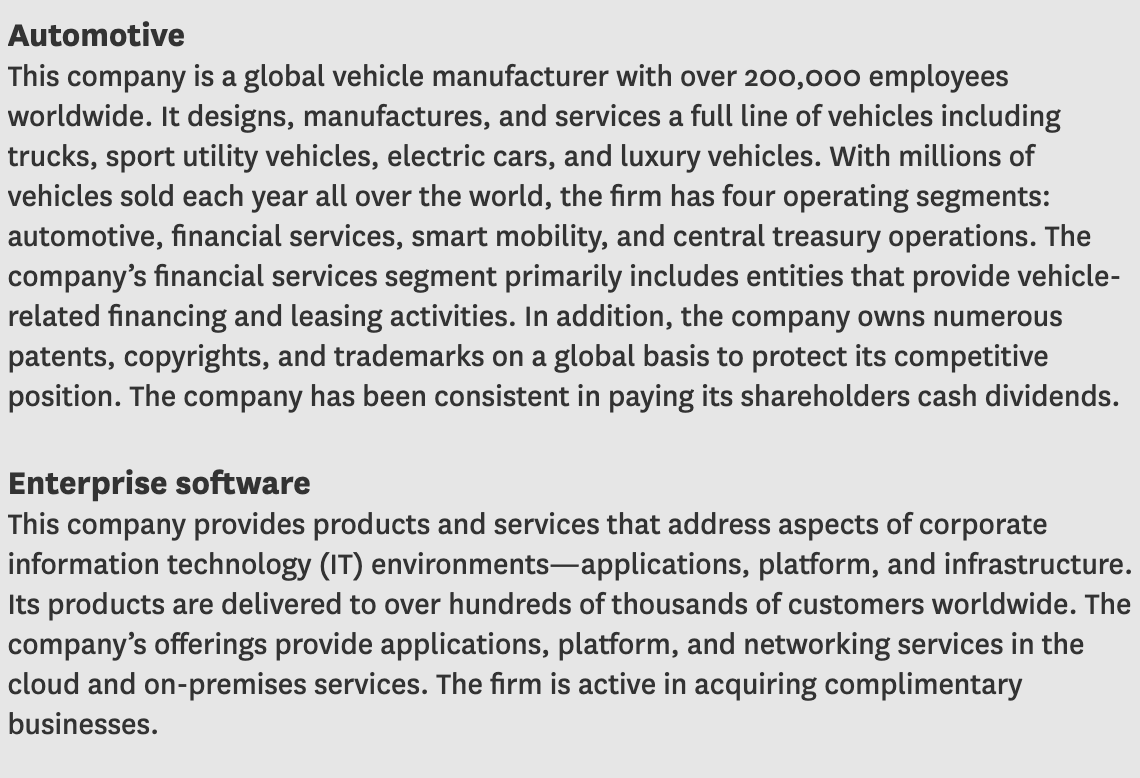

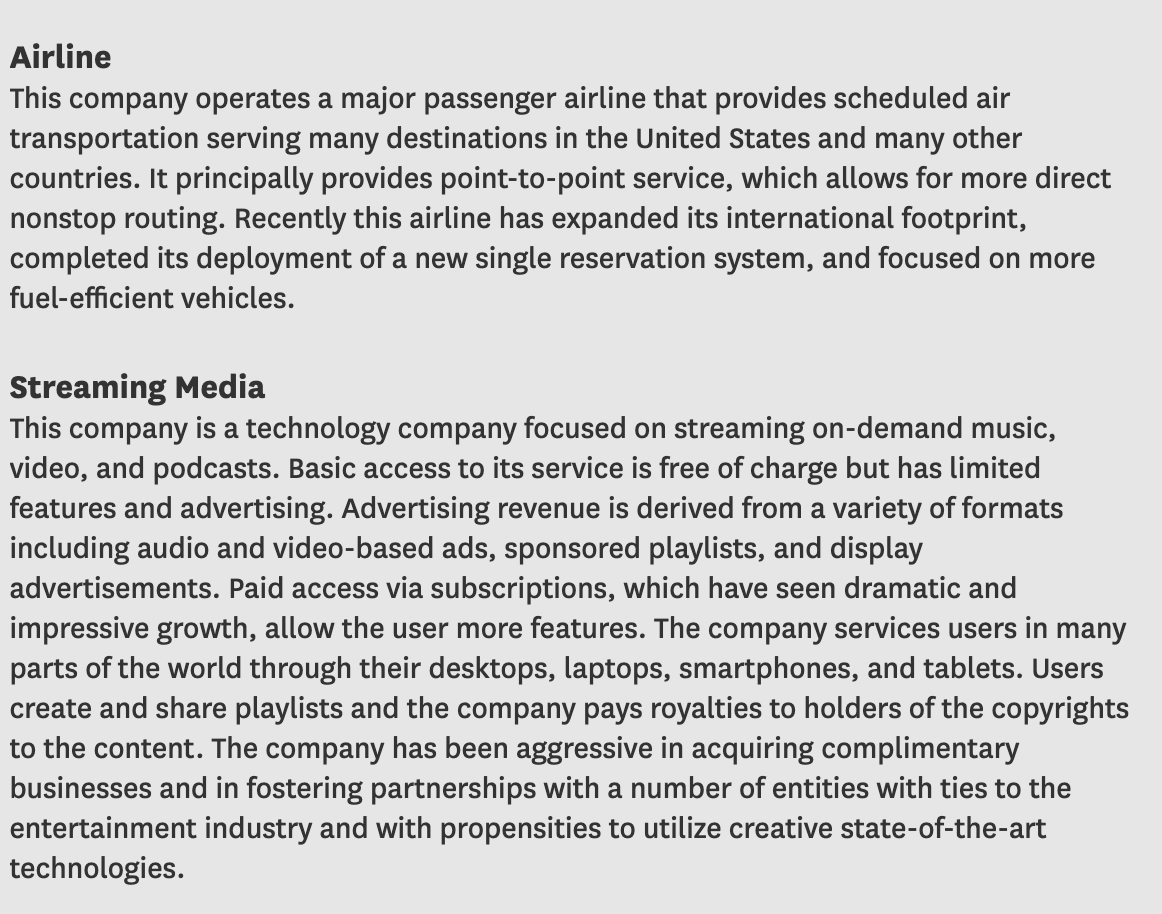

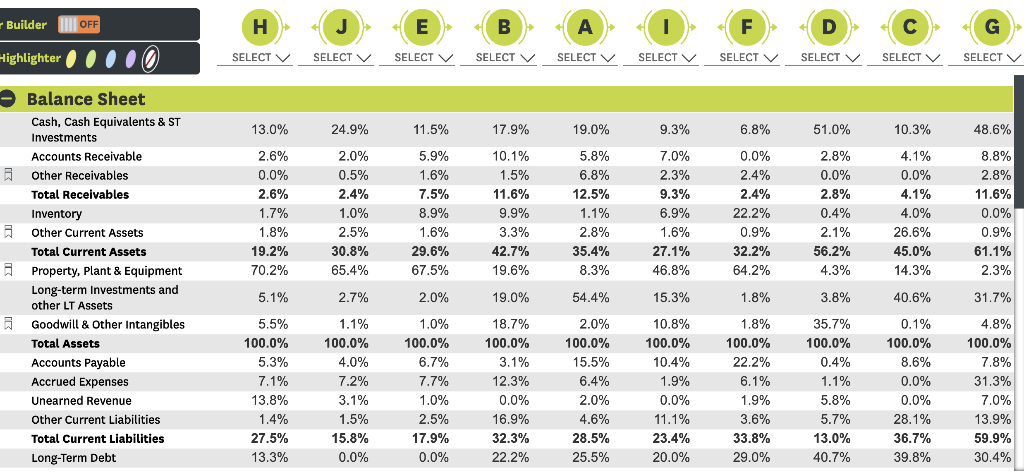

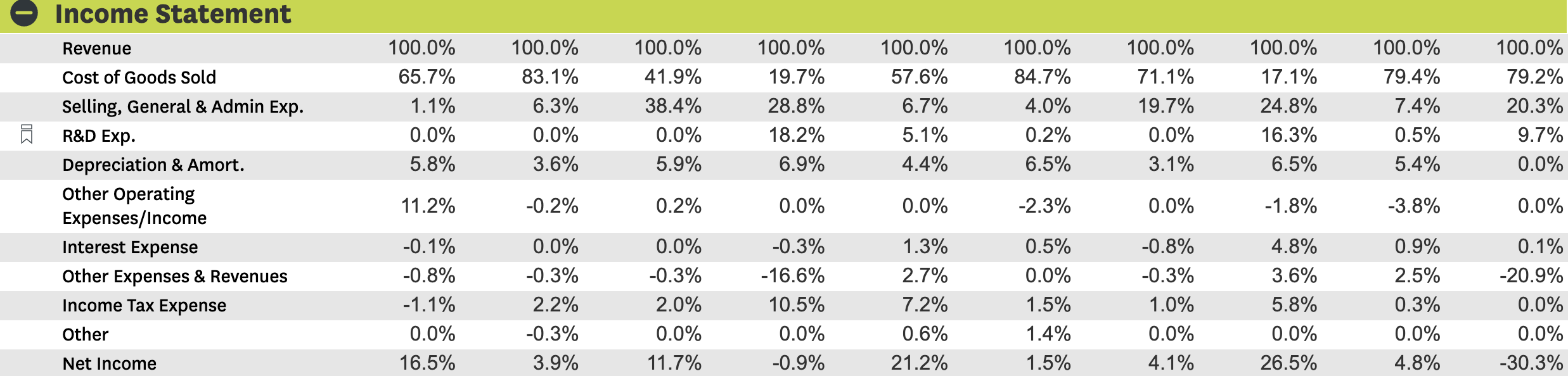

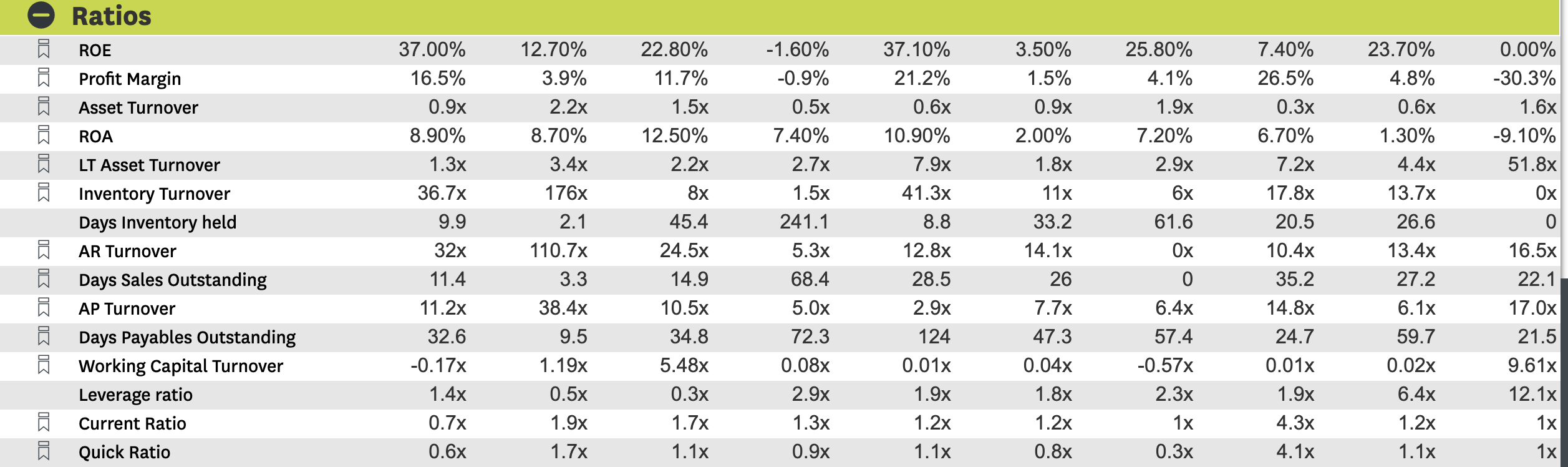

Consumer Electronics This company is a designer, manufacturer, and marketer of mobile communication and media devices and personal computers. The company also sells a variety of related software, services, accessories, networking solutions, and third-party digital content. It sells its products worldwide through its retail stores, online stores, and direct sales force, as well as through third-party cellular network carriers, wholesalers, and retailers. The company sells and delivers digital content and applications through its online platform. Substantially all of its hardware products are manufactured by outsourcing partners. oil and gas This company is a multinational oil and gas company headquartered in Europe and operating in 70 countries. Its market capitalization ranks it as a very large entity within the oil and gas industry. Although considered an energy company as it conducts oil and gas exploration, drilling, and refinery on land and offshore, this company also manufactures and markets raw materials used in thousands of everyday products. Expanding beyond fossil fuels, it has product lines in the renewables space including biofuels, bio-power, wind energy, and solar energy. The company is heavily involved in transportation and logistical activities, moving fuels and other products to market through pipelines and by ship, truck, and rail. Fast Food This company is a global restaurant chain with over 2,000 restaurants worldwide. The company offers its customers a focused menu and seeks to use fresh ingredients and responsibly raised meat and produce. It strives to create an excellent guest experience, to develop technologically innovative initiatives, and to implement a multipronged marketing strategy to connect to and attract customers. Although the company operates in a highly competitive environment, it has experienced substantial growth during recent years. While the company enjoys significant revenue growth, it also experiences a higher cost of operations. The company has decided to retain its earnings for the use of operation and the repurchase of its common stock instead of paying any dividends in the foreseeable future. Pharmaceuticals This company is a leading drug manufacturing company with two distinct business segments, human pharmaceutical products and animal health products. The company sells its products in over 125 countries and has operations in the United States, Puerto Rico, and 14 other countries. The company faces strong global competition, and as a result it invests heavily in research and development. The company employs more than 8,000 employees in its R&D operation and owns a large number of patents to maintain its competitive edge. The company has been consistent in paying its shareholders cash dividends. In recent years, the company has repurchased a large amount of its common stock. Automotive This company is a global vehicle manufacturer with over 200,000 employees worldwide. It designs, manufactures, and services a full line of vehicles including trucks, sport utility vehicles, electric cars, and luxury vehicles. With millions of vehicles sold each year all over the world, the firm has four operating segments: automotive, financial services, smart mobility, and central treasury operations. The company's financial services segment primarily includes entities that provide vehicle- related financing and leasing activities. In addition, the company owns numerous patents, copyrights, and trademarks on a global basis to protect its competitive position. The company has been consistent in paying its shareholders cash dividends. Enterprise software This company provides products and services that address aspects of corporate information technology (IT) environments-applications, platform, and infrastructure. Its products are delivered to over hundreds of thousands of customers worldwide. The company's offerings provide applications, platform, and networking services in the cloud and on-premises services. The firm is active in acquiring complimentary businesses. Airline This company operates a major passenger airline that provides scheduled air transportation serving many destinations in the United States and many other countries. It principally provides point-to-point service, which allows for more direct nonstop routing. Recently this airline has expanded its international footprint, completed its deployment of a new single reservation system, and focused on more fuel-efficient vehicles. Streaming Media This company is a technology company focused on streaming on-demand music, video, and podcasts. Basic access to its service is free of charge but has limited features and advertising. Advertising revenue is derived from a variety of formats including audio and video-based ads, sponsored playlists, and display advertisements. Paid access via subscriptions, which have seen dramatic and impressive growth, allow the user more features. The company services users in many parts of the world through their desktops, laptops, smartphones, and tablets. Users create and share playlists and the company pays royalties to holders of the copyrights to the content. The company has been aggressive in acquiring complimentary businesses and in fostering partnerships with a number of entities with ties to the entertainment industry and with propensities to utilize creative state-of-the-art technologies. Retail This company is a mass merchant retailer that offers everyday essentials and fashionable, differentiated merchandise at discounted prices. A significant portion of the company's sales come from national branded merchandise, while approximately one-third comes from its own exclusive brands. The company operates over 1,800 stores and 41 distribution centers in the United States. Its stores offer food items comparable to traditional supermarkets and curated general merchandise and food assortments. The company has an agreement with a pharmacy chain that operate pharmacies and clinics inside the company's stores. Beverages, brewing This company is one of the largest craft beer brewers in the United States. While the company is known for producing high quality products that appeal to the US beer drinker, it is also the maker of non-beer alcoholic beverages such as hard cider and numerous flavored malts. Recognizing the competitiveness of the craft beer market, the company has a reputation of innovation and creativity. The company operates main breweries and smaller breweries spawned by its incubator in various locations in the United States. It has been effective at increasing consumer product and company awareness through advertising, point-of-sale promotional programs and drinker education. Builder OFF H J E B D F D G Highlighter 1000 SELECTV SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECTV SELECT V SELECT 13.0% 24.9% 11.5% 17.9% 19.0% 9.3% 6.8% 51.0% 10.3% 48.6% 2.6% 0.0% 2.6% 1.7% 1.8% 19.2% 70.2% 2.0% 0.5% 2.4% 1.0% 2.5% 30.8% 65.4% 5.9% 1.6% 7.5% 8.9% 1.6% 29.6% 67.5% 10.1% 1.5% 11.6% 9.9% 3.3% 42.7% 19.6% 5.8% 6.8% 12.5% 1.1% 2.8% 35.4% 8.3% 7.0% 2.3% 9.3% 6.9% 1.6% 27.1% 46.8% 0.0% 2.4% 2.4% 22.2% 0.9% 32.2% 64.2% 2.8% 0.0% 2.8% 0.4% 2.1% 56.2% 4.3% 4.1% 0.0% 4.1% 4.0% 26.6% 45.0% 14.3% 8.8% 2.8% 11.6% 0.0% 0.9% 61.1% 2.3% - Balance Sheet Cash, Cash Equivalents & ST Investments Accounts Receivable Other Receivables Total Receivables Inventory Other Current Assets Total Current Assets Property, Plant & Equipment Long-term Investments and other LT Assets Goodwill & other intangibles Total Assets Accounts Payable Accrued Expenses Unearned Revenue Other Current Liabilities Total Current Liabilities Long-Term Debt 5.1% 2.7% 2.0% 19.0% 54.4% 15.3% 1.8% 3.8% 40.6% 31.7% 5.5% 100.0% 5.3% 7.1% 13.8% 1.4% 27.5% 13.3% 1.1% 100.0% 4.0% 7.2% 3.1% 1.5% 15.8% 0.0% 1.0% 100.0% 6.7% 7.7% 1.0% 2.5% 17.9% 0.0% 18.7% 100.0% 3.1% 12.3% 0.0% 16.9% 32.3% 22.2% 2.0% 100.0% 15.5% 6.4% 2.0% 4.6% 28.5% 25.5% 10.8% 100.0% 10.4% 1.9% 0.0% 11.1% 23.4% 20.0% 1.8% 100.0% 22.2% 6.1% 1.9% 3.6% 33.8% 29.0% 35.7% 100.0% 0.4% 1.1% 5.8% 5.7% 13.0% 40.7% 0.1% 100.0% 8.6% 0.0% 0.0% 28.1% 36.7% 39.8% 4.8% 100.0% 7.8% 31.3% 7.0% 13.9% 59.9% 30.4% Income Statement 100.0% 65.7% 1.1% 0.0% 5.8% 100.0% 83.1% 6.3% 0.0% 3.6% 100.0% 41.9% 38.4% 0.0% 100.0% 19.7% 28.8% 18.2% 6.9% 100.0% 57.6% 6.7% 5.1% 4.4% 100.0% 84.7% 4.0% 0.2% 6.5% 100.0% 71.1% 19.7% 0.0% 3.1% 100.0% 17.1% 24.8% 16.3% 6.5% 100.0% 79.4% 7.4% 0.5% 5.4% 100.0% 79.2% 20.3% 9.7% 0.0% 5.9% Revenue Cost of Goods Sold Selling, General & Admin Exp. R&D Exp. Depreciation & Amort. Other Operating Expenses/Income Interest Expense Other Expenses & Revenues Income Tax Expense Other 11.2% -0.2% 0.2% 0.0% 0.0% -2.3% 0.0% -1.8% -3.8% 0.0% -0.1% -0.8% -1.1% 0.0% 16.5% 0.0% -0.3% 2.2% -0.3% 3.9% 0.0% -0.3% 2.0% 0.0% 11.7% -0.3% -16.6% 10.5% 0.0% -0.9% 1.3% 2.7% 7.2% 0.6% 21.2% 0.5% 0.0% 1.5% 1.4% 1.5% -0.8% -0.3% 1.0% 0.0% 4.1% 4.8% 3.6% 5.8% 0.0% 26.5% 0.9% 2.5% 0.3% 0.0% 4.8% 0.1% -20.9% 0.0% 0.0% -30.3% Net Income Ratios ROE Profit Margin Asset Turnover IK IK IK IK IK IK ROA LT Asset Turnover Inventory Turnover Days Inventory held AR Turnover Days Sales Outstanding AP Turnover Days Payables Outstanding Working Capital Turnover Leverage ratio Current Ratio Quick Ratio IK IK IK IK IK 37.00% 16.5% 0.9x 8.90% 1.3x 36.7x 9.9 32x 11.4 11.2x 32.6 -0.17x 1.4x 0.7x 0.6x 12.70% 3.9% 2.2x 8.70% 3.4x 176x 2.1 110.7x 3.3 38.4x 9.5 1.19x 0.5x 1.9x 1.7x 22.80% 11.7% 1.5x 12.50% 2.2x 8x 45.4 24.5x 14.9 10.5x 34.8 5.48x 0.3x 1.7x 1.1x -1.60% -0.9% 0.5x 7.40% 2.7x 1.5x 241.1 5.3x 68.4 5.Ox 72.3 0.08x 2.9x 1.3x 0.9x 37.10% 21.2% 0.6x 10.90% 7.9x 41.3x 8.8 12.8x 28.5 2.9x 124 0.01x 1.9x 1.2x 1.1x 3.50% 1.5% 0.9x 2.00% 1.8x 11x 33.2 14.1x 26 7.7x 47.3 0.04x 1.8x 1.2x 0.8x 25.80% 4.1% 1.9x 7.20% 2.9x 6x 61.6 0 6.4x 57.4 -0.57% 2.3x 1x 0.3x 7.40% 26.5% 0.3x 6.70% 7.2x 17.8x 20.5 10.4x 35.2 14.8x 24.7 0.01x 23.70% 4.8% 0.6x 1.30% 4.4x 13.7x 26.6 13.4x 27.2 6.1x 59.7 0.02x 6.4x 1.2x 1.1x 0.00% -30.3% 1.6x -9.10% 51.8x 0 16.5x 22.1 17.0x 21.5 9.61x 12.1x 1x 1x IK IK 1.9x 4.3x 4.1x Consumer Electronics This company is a designer, manufacturer, and marketer of mobile communication and media devices and personal computers. The company also sells a variety of related software, services, accessories, networking solutions, and third-party digital content. It sells its products worldwide through its retail stores, online stores, and direct sales force, as well as through third-party cellular network carriers, wholesalers, and retailers. The company sells and delivers digital content and applications through its online platform. Substantially all of its hardware products are manufactured by outsourcing partners. oil and gas This company is a multinational oil and gas company headquartered in Europe and operating in 70 countries. Its market capitalization ranks it as a very large entity within the oil and gas industry. Although considered an energy company as it conducts oil and gas exploration, drilling, and refinery on land and offshore, this company also manufactures and markets raw materials used in thousands of everyday products. Expanding beyond fossil fuels, it has product lines in the renewables space including biofuels, bio-power, wind energy, and solar energy. The company is heavily involved in transportation and logistical activities, moving fuels and other products to market through pipelines and by ship, truck, and rail. Fast Food This company is a global restaurant chain with over 2,000 restaurants worldwide. The company offers its customers a focused menu and seeks to use fresh ingredients and responsibly raised meat and produce. It strives to create an excellent guest experience, to develop technologically innovative initiatives, and to implement a multipronged marketing strategy to connect to and attract customers. Although the company operates in a highly competitive environment, it has experienced substantial growth during recent years. While the company enjoys significant revenue growth, it also experiences a higher cost of operations. The company has decided to retain its earnings for the use of operation and the repurchase of its common stock instead of paying any dividends in the foreseeable future. Pharmaceuticals This company is a leading drug manufacturing company with two distinct business segments, human pharmaceutical products and animal health products. The company sells its products in over 125 countries and has operations in the United States, Puerto Rico, and 14 other countries. The company faces strong global competition, and as a result it invests heavily in research and development. The company employs more than 8,000 employees in its R&D operation and owns a large number of patents to maintain its competitive edge. The company has been consistent in paying its shareholders cash dividends. In recent years, the company has repurchased a large amount of its common stock. Automotive This company is a global vehicle manufacturer with over 200,000 employees worldwide. It designs, manufactures, and services a full line of vehicles including trucks, sport utility vehicles, electric cars, and luxury vehicles. With millions of vehicles sold each year all over the world, the firm has four operating segments: automotive, financial services, smart mobility, and central treasury operations. The company's financial services segment primarily includes entities that provide vehicle- related financing and leasing activities. In addition, the company owns numerous patents, copyrights, and trademarks on a global basis to protect its competitive position. The company has been consistent in paying its shareholders cash dividends. Enterprise software This company provides products and services that address aspects of corporate information technology (IT) environments-applications, platform, and infrastructure. Its products are delivered to over hundreds of thousands of customers worldwide. The company's offerings provide applications, platform, and networking services in the cloud and on-premises services. The firm is active in acquiring complimentary businesses. Airline This company operates a major passenger airline that provides scheduled air transportation serving many destinations in the United States and many other countries. It principally provides point-to-point service, which allows for more direct nonstop routing. Recently this airline has expanded its international footprint, completed its deployment of a new single reservation system, and focused on more fuel-efficient vehicles. Streaming Media This company is a technology company focused on streaming on-demand music, video, and podcasts. Basic access to its service is free of charge but has limited features and advertising. Advertising revenue is derived from a variety of formats including audio and video-based ads, sponsored playlists, and display advertisements. Paid access via subscriptions, which have seen dramatic and impressive growth, allow the user more features. The company services users in many parts of the world through their desktops, laptops, smartphones, and tablets. Users create and share playlists and the company pays royalties to holders of the copyrights to the content. The company has been aggressive in acquiring complimentary businesses and in fostering partnerships with a number of entities with ties to the entertainment industry and with propensities to utilize creative state-of-the-art technologies. Retail This company is a mass merchant retailer that offers everyday essentials and fashionable, differentiated merchandise at discounted prices. A significant portion of the company's sales come from national branded merchandise, while approximately one-third comes from its own exclusive brands. The company operates over 1,800 stores and 41 distribution centers in the United States. Its stores offer food items comparable to traditional supermarkets and curated general merchandise and food assortments. The company has an agreement with a pharmacy chain that operate pharmacies and clinics inside the company's stores. Beverages, brewing This company is one of the largest craft beer brewers in the United States. While the company is known for producing high quality products that appeal to the US beer drinker, it is also the maker of non-beer alcoholic beverages such as hard cider and numerous flavored malts. Recognizing the competitiveness of the craft beer market, the company has a reputation of innovation and creativity. The company operates main breweries and smaller breweries spawned by its incubator in various locations in the United States. It has been effective at increasing consumer product and company awareness through advertising, point-of-sale promotional programs and drinker education. Builder OFF H J E B D F D G Highlighter 1000 SELECTV SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECTV SELECT V SELECT 13.0% 24.9% 11.5% 17.9% 19.0% 9.3% 6.8% 51.0% 10.3% 48.6% 2.6% 0.0% 2.6% 1.7% 1.8% 19.2% 70.2% 2.0% 0.5% 2.4% 1.0% 2.5% 30.8% 65.4% 5.9% 1.6% 7.5% 8.9% 1.6% 29.6% 67.5% 10.1% 1.5% 11.6% 9.9% 3.3% 42.7% 19.6% 5.8% 6.8% 12.5% 1.1% 2.8% 35.4% 8.3% 7.0% 2.3% 9.3% 6.9% 1.6% 27.1% 46.8% 0.0% 2.4% 2.4% 22.2% 0.9% 32.2% 64.2% 2.8% 0.0% 2.8% 0.4% 2.1% 56.2% 4.3% 4.1% 0.0% 4.1% 4.0% 26.6% 45.0% 14.3% 8.8% 2.8% 11.6% 0.0% 0.9% 61.1% 2.3% - Balance Sheet Cash, Cash Equivalents & ST Investments Accounts Receivable Other Receivables Total Receivables Inventory Other Current Assets Total Current Assets Property, Plant & Equipment Long-term Investments and other LT Assets Goodwill & other intangibles Total Assets Accounts Payable Accrued Expenses Unearned Revenue Other Current Liabilities Total Current Liabilities Long-Term Debt 5.1% 2.7% 2.0% 19.0% 54.4% 15.3% 1.8% 3.8% 40.6% 31.7% 5.5% 100.0% 5.3% 7.1% 13.8% 1.4% 27.5% 13.3% 1.1% 100.0% 4.0% 7.2% 3.1% 1.5% 15.8% 0.0% 1.0% 100.0% 6.7% 7.7% 1.0% 2.5% 17.9% 0.0% 18.7% 100.0% 3.1% 12.3% 0.0% 16.9% 32.3% 22.2% 2.0% 100.0% 15.5% 6.4% 2.0% 4.6% 28.5% 25.5% 10.8% 100.0% 10.4% 1.9% 0.0% 11.1% 23.4% 20.0% 1.8% 100.0% 22.2% 6.1% 1.9% 3.6% 33.8% 29.0% 35.7% 100.0% 0.4% 1.1% 5.8% 5.7% 13.0% 40.7% 0.1% 100.0% 8.6% 0.0% 0.0% 28.1% 36.7% 39.8% 4.8% 100.0% 7.8% 31.3% 7.0% 13.9% 59.9% 30.4% Income Statement 100.0% 65.7% 1.1% 0.0% 5.8% 100.0% 83.1% 6.3% 0.0% 3.6% 100.0% 41.9% 38.4% 0.0% 100.0% 19.7% 28.8% 18.2% 6.9% 100.0% 57.6% 6.7% 5.1% 4.4% 100.0% 84.7% 4.0% 0.2% 6.5% 100.0% 71.1% 19.7% 0.0% 3.1% 100.0% 17.1% 24.8% 16.3% 6.5% 100.0% 79.4% 7.4% 0.5% 5.4% 100.0% 79.2% 20.3% 9.7% 0.0% 5.9% Revenue Cost of Goods Sold Selling, General & Admin Exp. R&D Exp. Depreciation & Amort. Other Operating Expenses/Income Interest Expense Other Expenses & Revenues Income Tax Expense Other 11.2% -0.2% 0.2% 0.0% 0.0% -2.3% 0.0% -1.8% -3.8% 0.0% -0.1% -0.8% -1.1% 0.0% 16.5% 0.0% -0.3% 2.2% -0.3% 3.9% 0.0% -0.3% 2.0% 0.0% 11.7% -0.3% -16.6% 10.5% 0.0% -0.9% 1.3% 2.7% 7.2% 0.6% 21.2% 0.5% 0.0% 1.5% 1.4% 1.5% -0.8% -0.3% 1.0% 0.0% 4.1% 4.8% 3.6% 5.8% 0.0% 26.5% 0.9% 2.5% 0.3% 0.0% 4.8% 0.1% -20.9% 0.0% 0.0% -30.3% Net Income Ratios ROE Profit Margin Asset Turnover IK IK IK IK IK IK ROA LT Asset Turnover Inventory Turnover Days Inventory held AR Turnover Days Sales Outstanding AP Turnover Days Payables Outstanding Working Capital Turnover Leverage ratio Current Ratio Quick Ratio IK IK IK IK IK 37.00% 16.5% 0.9x 8.90% 1.3x 36.7x 9.9 32x 11.4 11.2x 32.6 -0.17x 1.4x 0.7x 0.6x 12.70% 3.9% 2.2x 8.70% 3.4x 176x 2.1 110.7x 3.3 38.4x 9.5 1.19x 0.5x 1.9x 1.7x 22.80% 11.7% 1.5x 12.50% 2.2x 8x 45.4 24.5x 14.9 10.5x 34.8 5.48x 0.3x 1.7x 1.1x -1.60% -0.9% 0.5x 7.40% 2.7x 1.5x 241.1 5.3x 68.4 5.Ox 72.3 0.08x 2.9x 1.3x 0.9x 37.10% 21.2% 0.6x 10.90% 7.9x 41.3x 8.8 12.8x 28.5 2.9x 124 0.01x 1.9x 1.2x 1.1x 3.50% 1.5% 0.9x 2.00% 1.8x 11x 33.2 14.1x 26 7.7x 47.3 0.04x 1.8x 1.2x 0.8x 25.80% 4.1% 1.9x 7.20% 2.9x 6x 61.6 0 6.4x 57.4 -0.57% 2.3x 1x 0.3x 7.40% 26.5% 0.3x 6.70% 7.2x 17.8x 20.5 10.4x 35.2 14.8x 24.7 0.01x 23.70% 4.8% 0.6x 1.30% 4.4x 13.7x 26.6 13.4x 27.2 6.1x 59.7 0.02x 6.4x 1.2x 1.1x 0.00% -30.3% 1.6x -9.10% 51.8x 0 16.5x 22.1 17.0x 21.5 9.61x 12.1x 1x 1x IK IK 1.9x 4.3x 4.1x