Answered step by step

Verified Expert Solution

Question

1 Approved Answer

17. A private lender has a second mortgage loan for $25,000. This loan generates a quarterly cash flow of $1,600. The lender wishes to know

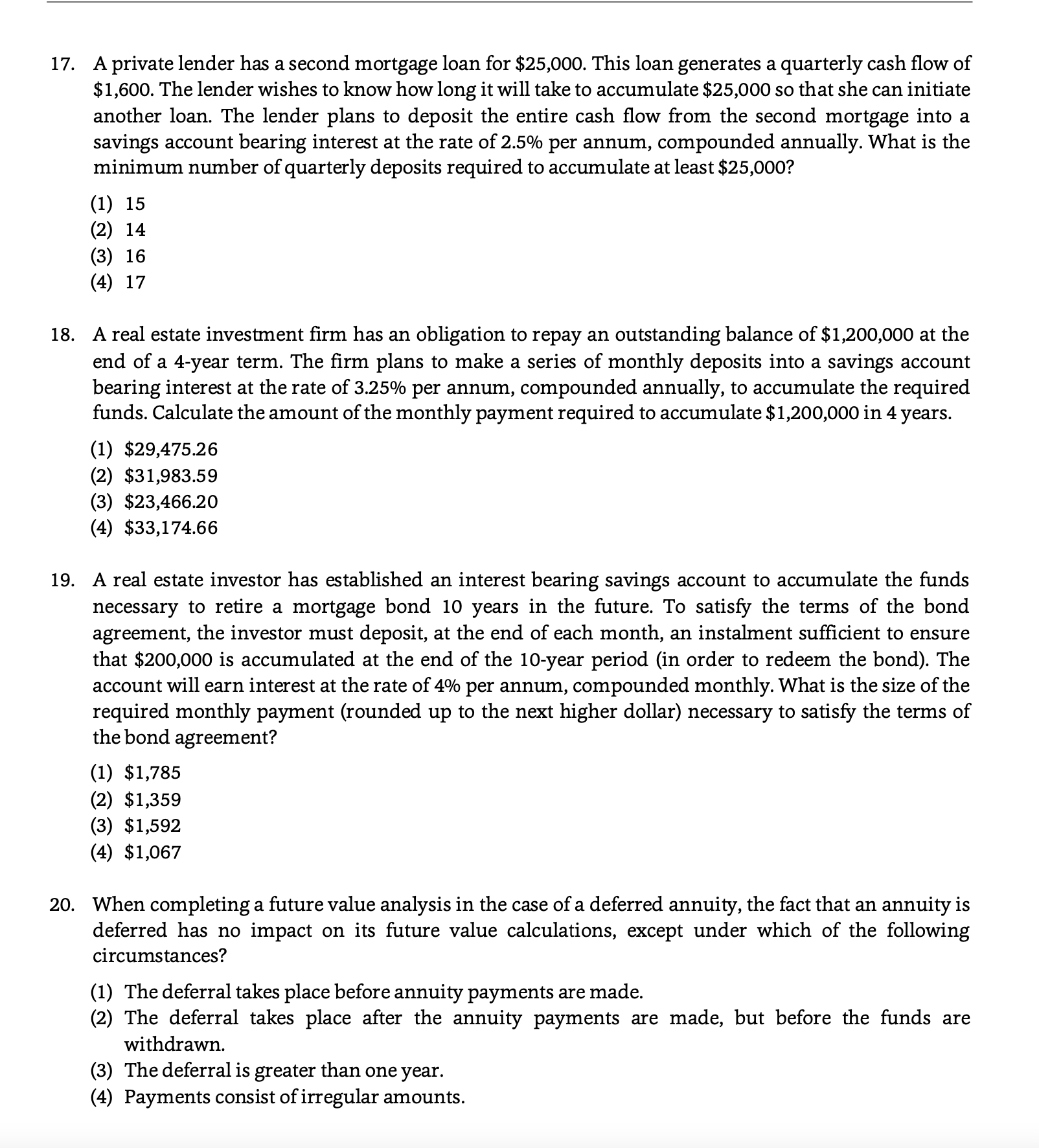

17. A private lender has a second mortgage loan for $25,000. This loan generates a quarterly cash flow of $1,600. The lender wishes to know how long it will take to accumulate $25,000 so that she can initiate another loan. The lender plans to deposit the entire cash flow from the second mortgage into a savings account bearing interest at the rate of 2.5% per annum, compounded annually. What is the minimum number of quarterly deposits required to accumulate at least $25,000 ? (1) 15 (2) 14 (3) 16 (4) 17 18. A real estate investment firm has an obligation to repay an outstanding balance of $1,200,000 at the end of a 4-year term. The firm plans to make a series of monthly deposits into a savings account bearing interest at the rate of 3.25% per annum, compounded annually, to accumulate the required funds. Calculate the amount of the monthly payment required to accumulate $1,200,000 in 4 years. (1) $29,475.26 (2) $31,983.59 (3) $23,466.20 (4) $33,174.66 19. A real estate investor has established an interest bearing savings account to accumulate the funds necessary to retire a mortgage bond 10 years in the future. To satisfy the terms of the bond agreement, the investor must deposit, at the end of each month, an instalment sufficient to ensure that $200,000 is accumulated at the end of the 10-year period (in order to redeem the bond). The account will earn interest at the rate of 4% per annum, compounded monthly. What is the size of the required monthly payment (rounded up to the next higher dollar) necessary to satisfy the terms of the bond agreement? (1) $1,785 (2) $1,359 (3) $1,592 (4) $1,067 20. When completing a future value analysis in the case of a deferred annuity, the fact that an annuity is deferred has no impact on its future value calculations, except under which of the following circumstances? (1) The deferral takes place before annuity payments are made. (2) The deferral takes place after the annuity payments are made, but before the funds are withdrawn. (3) The deferral is greater than one year. (4) Payments consist of irregular amounts

17. A private lender has a second mortgage loan for $25,000. This loan generates a quarterly cash flow of $1,600. The lender wishes to know how long it will take to accumulate $25,000 so that she can initiate another loan. The lender plans to deposit the entire cash flow from the second mortgage into a savings account bearing interest at the rate of 2.5% per annum, compounded annually. What is the minimum number of quarterly deposits required to accumulate at least $25,000 ? (1) 15 (2) 14 (3) 16 (4) 17 18. A real estate investment firm has an obligation to repay an outstanding balance of $1,200,000 at the end of a 4-year term. The firm plans to make a series of monthly deposits into a savings account bearing interest at the rate of 3.25% per annum, compounded annually, to accumulate the required funds. Calculate the amount of the monthly payment required to accumulate $1,200,000 in 4 years. (1) $29,475.26 (2) $31,983.59 (3) $23,466.20 (4) $33,174.66 19. A real estate investor has established an interest bearing savings account to accumulate the funds necessary to retire a mortgage bond 10 years in the future. To satisfy the terms of the bond agreement, the investor must deposit, at the end of each month, an instalment sufficient to ensure that $200,000 is accumulated at the end of the 10-year period (in order to redeem the bond). The account will earn interest at the rate of 4% per annum, compounded monthly. What is the size of the required monthly payment (rounded up to the next higher dollar) necessary to satisfy the terms of the bond agreement? (1) $1,785 (2) $1,359 (3) $1,592 (4) $1,067 20. When completing a future value analysis in the case of a deferred annuity, the fact that an annuity is deferred has no impact on its future value calculations, except under which of the following circumstances? (1) The deferral takes place before annuity payments are made. (2) The deferral takes place after the annuity payments are made, but before the funds are withdrawn. (3) The deferral is greater than one year. (4) Payments consist of irregular amounts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started