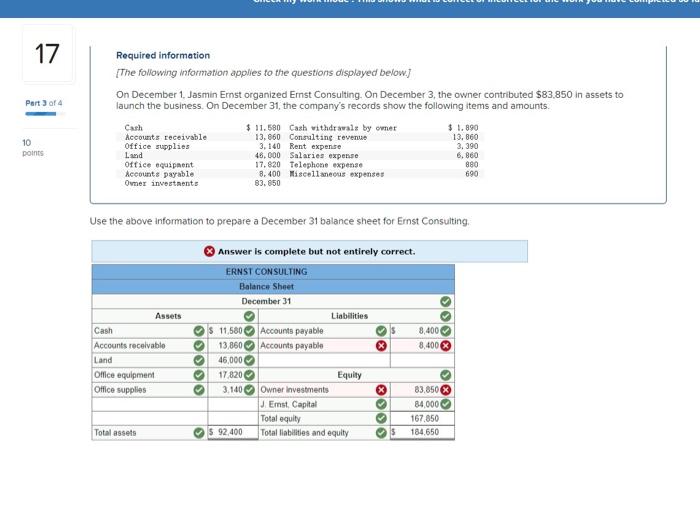

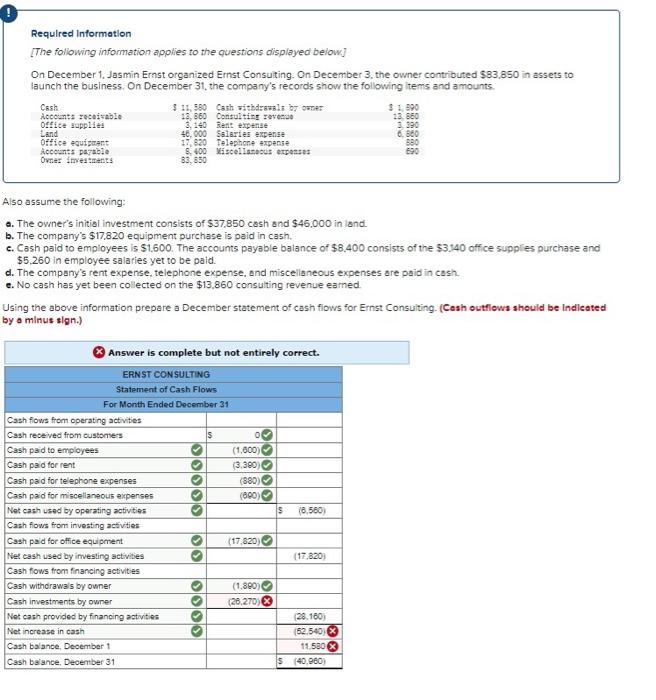

17 Part 3 of 4 Required information The following information apples to the questions displayed below) On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $83.850 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cach $ 11.580 Cash withdrawals by mer $ 1.890 Accounts receivable 13,860 Consulting revenue 13,860 Office supplies 3. 140 Rent expense 3.390 Land 46.000 Salaries expense 6,860 office equipment 17.820 Telephone expense 880 Accounts payable 8.400 Miscellaneous expenses 690 Omer investments 83.850 10 points Use the above information to prepare a December 31 balance sheet for Ernst Consulting, > Assets Cash Accounts receivable Land Office equipment Office supplies Answer is complete but not entirely correct ERNST CONSULTING Balance Sheet December 31 Liabilities $ 11,580 Accounts payable $ 8,400 13,860 Accounts payable 8,400 46,000 17 820 Equity 3.140 Owner investments 83,850 J Emst, Capital 84.000 Total equity 167.850 $ 92.400 Total llabilities and equity $ 184.650 C O Total assets Required Information {The following information applies to the questions displayed below.] On December 1. Jasmin Ernst organized Ernst Consulting. On December 3. the owner contributed $83.850 in assets to faunch the business. On December 31, the company's records show the following items and amounts. Cash $ 11,580 Cash withdrawals 7 ORE $ 1.590 Accounts receivable 13,860 Consultin ravno 13.560 Office Supplies 3.140 Best expense Land 46.000 salaries expense 6.880 0:!ice equipment 17.820 Telephone expense 380 Accents parable 8.400 Miscellaneous expenses 190 Ower investments 83,850 3390 Also assume the following: a. The owner's initial investment consists of $37.850 cash and $46,000 in land. b. The company's $17.820 equipment purchase is paid in cash. c. Cash paid to employees is $1.600. The accounts payable balance of $8.400 consists of the 53.140 office supples purchase and $5.260 in employee salaries yet to be paid. d. The company's rent expense, telephone expense and miscellaneous expenses are paid in cash e. No cash has yet been collected on the $13.860 consulting revenue eamed. Using the above information prepare a December statement of cash flows for Ernst Consulting (Cash outflows should be indicated by o minus slgn.) Answer is complete but not entirely correct. ERNST CONSULTING Statement of Cash Flows For Month Ended December 31 Cash flows from operating activities Cash received from customers S Cash paid to employees (1.600) Cash pad for rent (3.300) Cash paid for telephone expenses (880) Cash paid for miscellaneous expenses (800) Net cash used by operating activities S (0.560) Cash flows from investing activities Cash paid for office equipment (17.820) Ner cash used by investing activities (17,820) Cash flows from financing activities Cash withdrawals by owner (1.800) Cash investments by owner (26,270) Net cash provided by financing activities 28.160) Net increase in cash (52.540) Cash balance, December 1 19.580 X Cash balance, December 31 $ 40.960) OOOOO OOOO olo OOOO