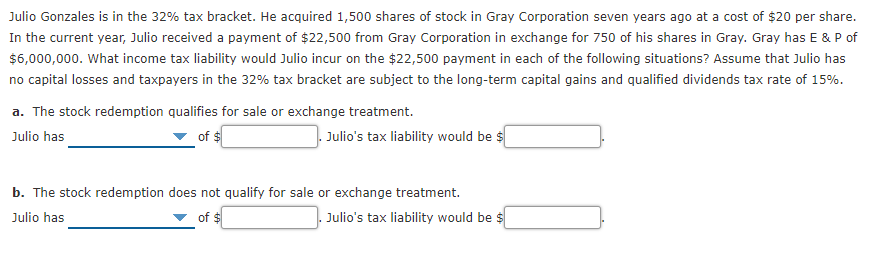

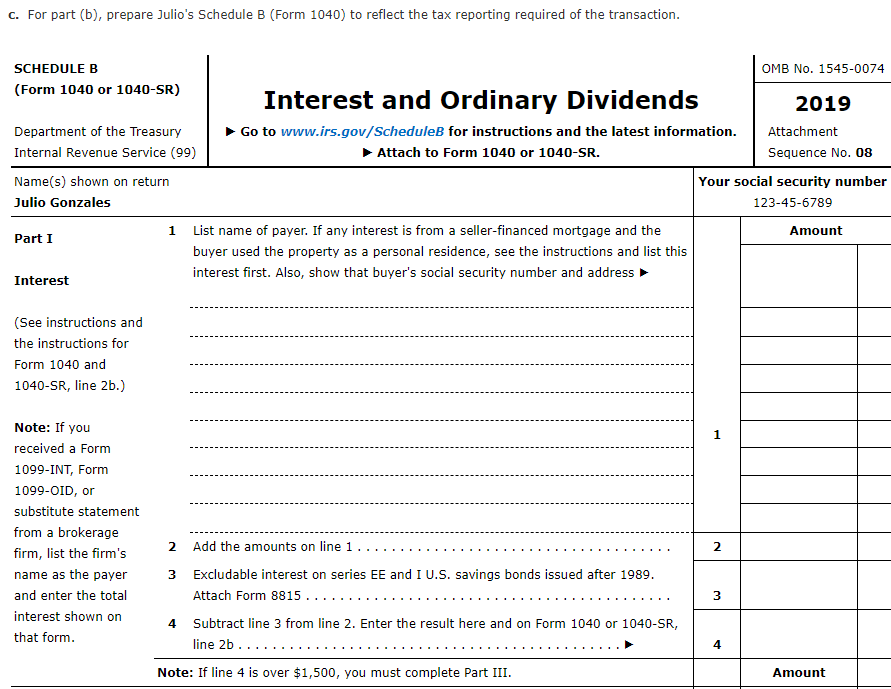

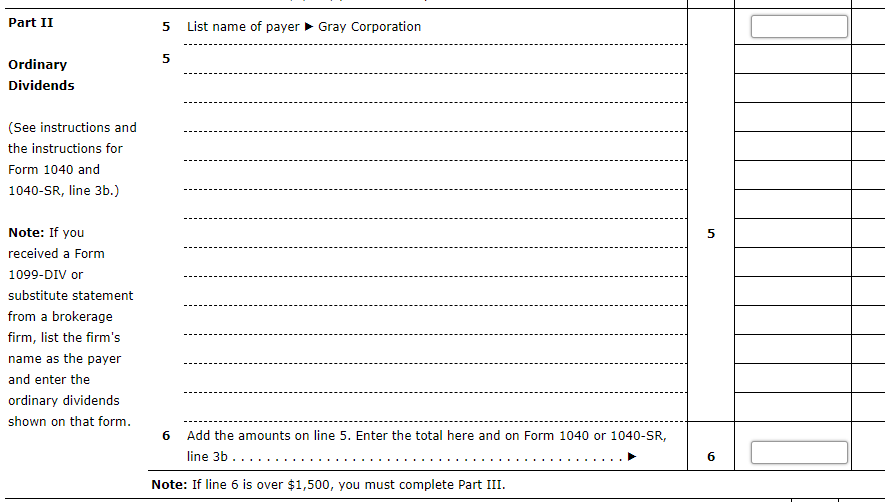

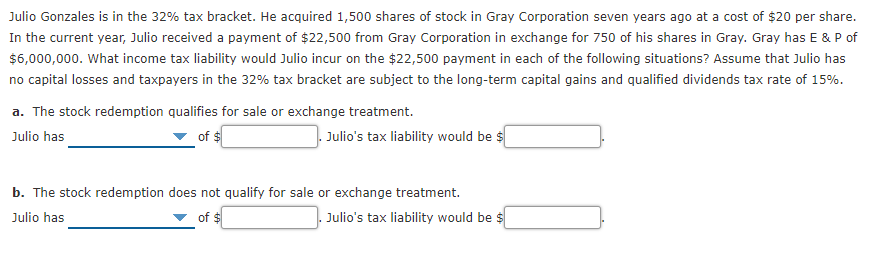

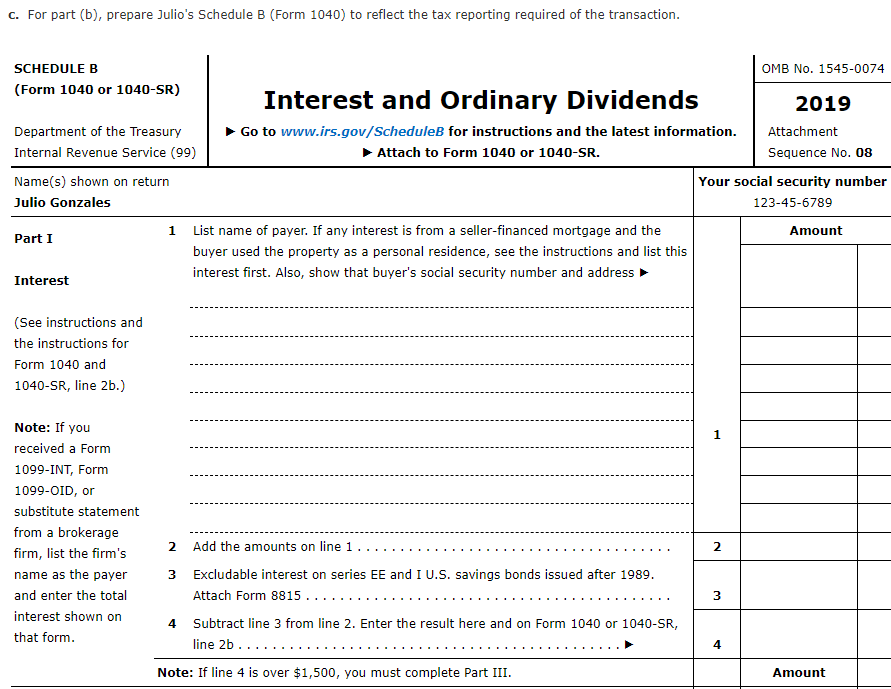

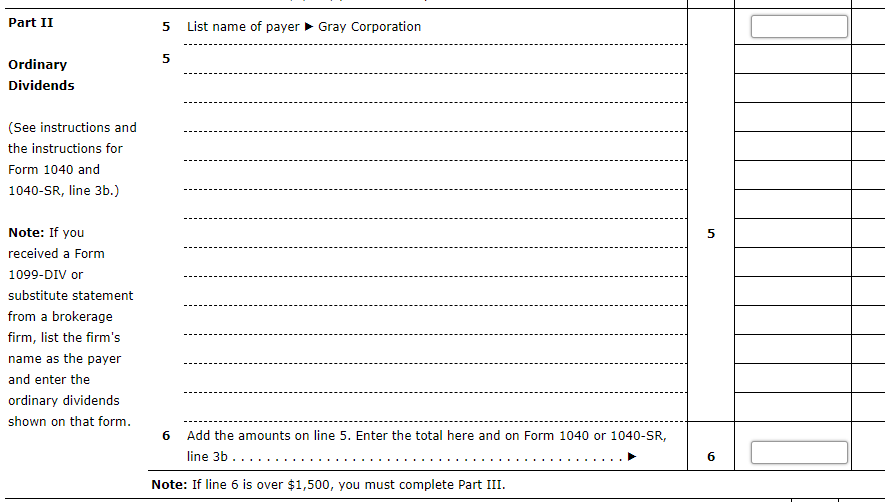

Julio Gonzales is in the 32% tax bracket. He acquired 1,500 shares of stock in Gray Corporation seven years ago at a cost of $20 per share. In the current year, Julio received a payment of $22,500 from Gray Corporation in exchange for 750 of his shares in Gray. Gray has E & P of $6,000,000. What income tax liability would Julio incur on the $22,500 payment in each of the following situations? Assume that Julio has no capital losses and taxpayers in the 32% tax bracket are subject to the long-term capital gains and qualified dividends tax rate of 15%. a. The stock redemption qualifies for sale or exchange treatment. Julio has of $ Julio's tax liability would be s b. The stock redemption does not qualify for sale or exchange treatment. Julio has of $ Julio's tax liability would be $ C. For part (b), prepare Julio's Schedule B (Form 1040) to reflect the tax reporting required of the transaction. SCHEDULE B OMB No. 1545-0074 (Form 1040 or 1040-SR) Interest and Ordinary Dividends 2019 Department of the Treasury Go to www.irs.gov/Schedules for instructions and the latest information. Attachment Internal Revenue Service (99) Attach to Form 1040 or 1040-SR. Sequence No. 08 Name(s) shown on return Your social security number Julio Gonzales 123-45-6789 List of payer. If any interest is from a seller-financed mortgage and the Amount Part I buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that buyer's social security number and address Interest 1 (See instructions and the instructions for Form 1040 and 1040-SR, line 2b.) 1 Note: If you received a Form 1099-INT, Form 1099-OID, or substitute statement from a brokerage firm, list the firm's name as the payer and enter the total interest shown on that form. 2 2 3 3 Add the amounts on line 1 Excludable interest on series EE and I U.S. savings bonds issued after 1989. Attach Form 8815 ... 4 Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR, line 2b ..... Note: If line 4 is over $1,500, you must complete Part III. 4 Amount Part II 5 List name of payer Gray Corporation 5 Ordinary Dividends (See instructions and the instructions for Form 1040 and 1040-SR, line 3b.) 5 Note: If you received a Form 1099-DIV or substitute statement from a brokerage firm, list the firm's name as the payer and enter the ordinary dividends shown on that form. 6 Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR, line 3b.. Note: If line 6 is over $1,500, you must complete Part III. 6 Julio Gonzales is in the 32% tax bracket. He acquired 1,500 shares of stock in Gray Corporation seven years ago at a cost of $20 per share. In the current year, Julio received a payment of $22,500 from Gray Corporation in exchange for 750 of his shares in Gray. Gray has E & P of $6,000,000. What income tax liability would Julio incur on the $22,500 payment in each of the following situations? Assume that Julio has no capital losses and taxpayers in the 32% tax bracket are subject to the long-term capital gains and qualified dividends tax rate of 15%. a. The stock redemption qualifies for sale or exchange treatment. Julio has of $ Julio's tax liability would be s b. The stock redemption does not qualify for sale or exchange treatment. Julio has of $ Julio's tax liability would be $ C. For part (b), prepare Julio's Schedule B (Form 1040) to reflect the tax reporting required of the transaction. SCHEDULE B OMB No. 1545-0074 (Form 1040 or 1040-SR) Interest and Ordinary Dividends 2019 Department of the Treasury Go to www.irs.gov/Schedules for instructions and the latest information. Attachment Internal Revenue Service (99) Attach to Form 1040 or 1040-SR. Sequence No. 08 Name(s) shown on return Your social security number Julio Gonzales 123-45-6789 List of payer. If any interest is from a seller-financed mortgage and the Amount Part I buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that buyer's social security number and address Interest 1 (See instructions and the instructions for Form 1040 and 1040-SR, line 2b.) 1 Note: If you received a Form 1099-INT, Form 1099-OID, or substitute statement from a brokerage firm, list the firm's name as the payer and enter the total interest shown on that form. 2 2 3 3 Add the amounts on line 1 Excludable interest on series EE and I U.S. savings bonds issued after 1989. Attach Form 8815 ... 4 Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR, line 2b ..... Note: If line 4 is over $1,500, you must complete Part III. 4 Amount Part II 5 List name of payer Gray Corporation 5 Ordinary Dividends (See instructions and the instructions for Form 1040 and 1040-SR, line 3b.) 5 Note: If you received a Form 1099-DIV or substitute statement from a brokerage firm, list the firm's name as the payer and enter the ordinary dividends shown on that form. 6 Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR, line 3b.. Note: If line 6 is over $1,500, you must complete Part III. 6