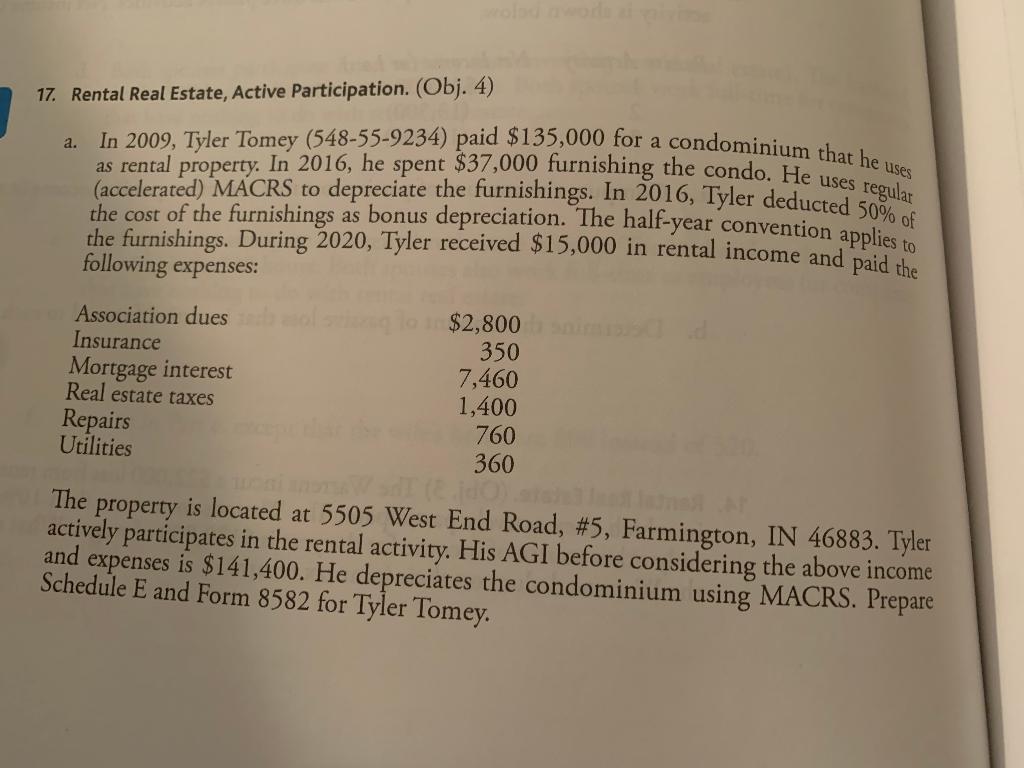

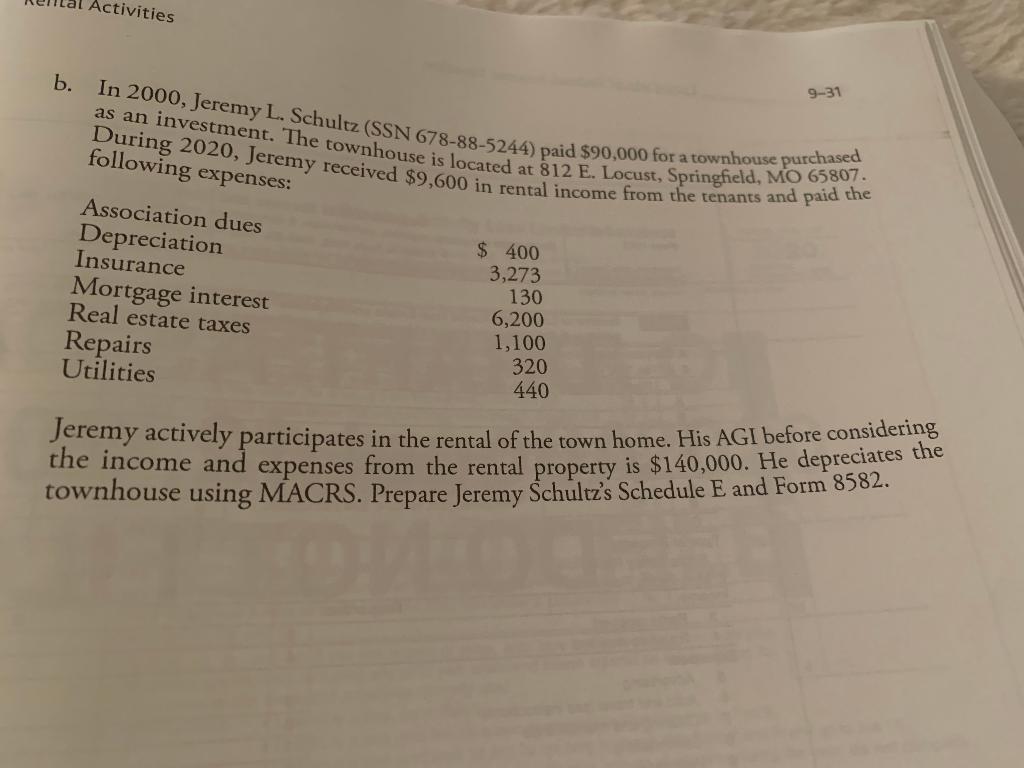

17. Rental Real Estate, Active Participation. (Obj. 4) In 2009, Tyler Tomey (548-55-9234) paid $135,000 for a condominium that he uses a. as rental property. In 2016, he spent $37,000 furnishing the condo. He usat (accelerated) MACRS to depreciate the furnishings. In 2016, Tyler deducted 50% of the cost of the furnishings as bonus depreciation. The half-year convention applies to the furnishings. During 2020, Tyler received $15,000 in rental income and paid the following expenses: Association dues $2,800 Insurance 350 Mortgage interest 7,460 Real estate taxes 1,400 Repairs 760 Utilities 360 e do The property is located at 5505 West End Road, #5, Farmington, IN 46883. Tyler actively participates in the rental activity. His AGI before considering the above income and expenses Schedule E and Form 8582 for Tyler Tomey. is $141,400. He depreciates the condominium using MACRS. Prepare Activities 9-31 b. In 2000, Jeremy L. Schultz (SSN 678-88-5244) paid $90,000 for a townhouse purchased as an investment. The townhouse is located at 812 E. Locust, Springfield, MO 65807. During 2020, Jeremy received $9,600 in rental income from the tenants and paid the following expenses: Association dues Depreciation Insurance Mortgage interest Real estate taxes Repairs Utilities $ 400 3,273 130 6,200 1,100 320 440 Jeremy actively participates in the rental of the town home. His AGI before considering the income and expenses from the rental property is $140,000. He depreciates the townhouse using MACRS. Prepare Jeremy Schultz's Schedule E and Form 8582. 17. Rental Real Estate, Active Participation. (Obj. 4) In 2009, Tyler Tomey (548-55-9234) paid $135,000 for a condominium that he uses a. as rental property. In 2016, he spent $37,000 furnishing the condo. He usat (accelerated) MACRS to depreciate the furnishings. In 2016, Tyler deducted 50% of the cost of the furnishings as bonus depreciation. The half-year convention applies to the furnishings. During 2020, Tyler received $15,000 in rental income and paid the following expenses: Association dues $2,800 Insurance 350 Mortgage interest 7,460 Real estate taxes 1,400 Repairs 760 Utilities 360 e do The property is located at 5505 West End Road, #5, Farmington, IN 46883. Tyler actively participates in the rental activity. His AGI before considering the above income and expenses Schedule E and Form 8582 for Tyler Tomey. is $141,400. He depreciates the condominium using MACRS. Prepare Activities 9-31 b. In 2000, Jeremy L. Schultz (SSN 678-88-5244) paid $90,000 for a townhouse purchased as an investment. The townhouse is located at 812 E. Locust, Springfield, MO 65807. During 2020, Jeremy received $9,600 in rental income from the tenants and paid the following expenses: Association dues Depreciation Insurance Mortgage interest Real estate taxes Repairs Utilities $ 400 3,273 130 6,200 1,100 320 440 Jeremy actively participates in the rental of the town home. His AGI before considering the income and expenses from the rental property is $140,000. He depreciates the townhouse using MACRS. Prepare Jeremy Schultz's Schedule E and Form 8582