Answered step by step

Verified Expert Solution

Question

1 Approved Answer

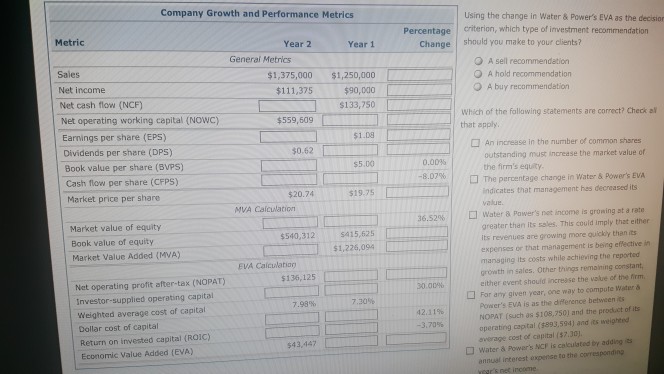

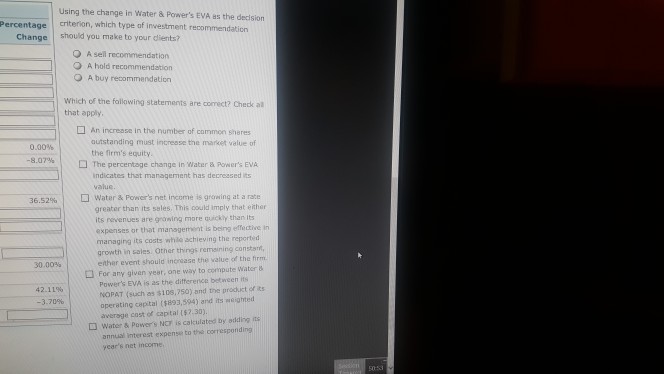

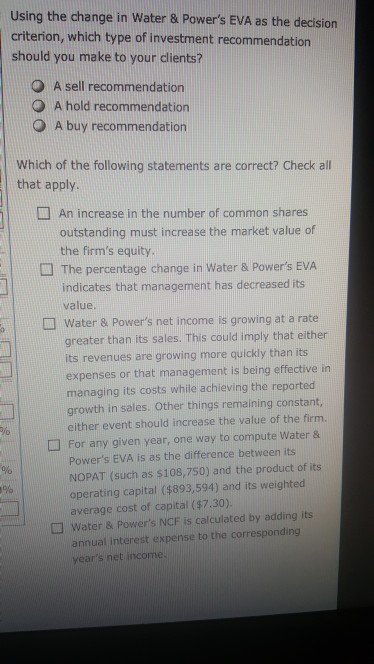

17. The calculation of a firm's Market Value Added (MVA) and Economic Value Added (EVA) Tristan, your newly appointed boss, has tasked you with evaluating

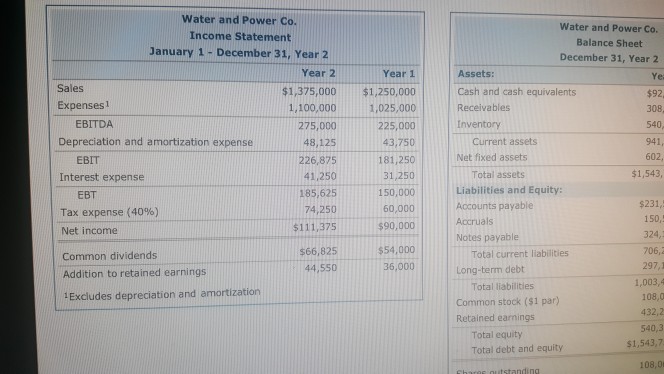

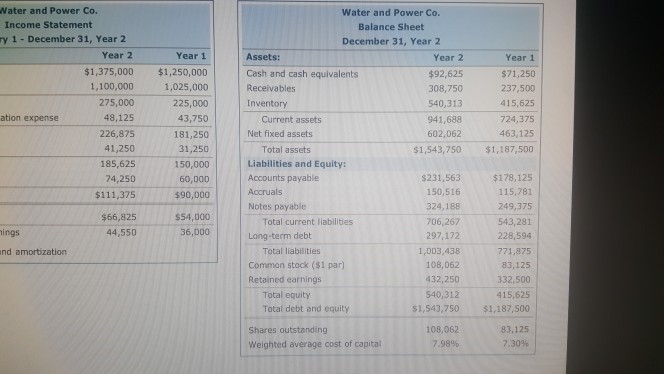

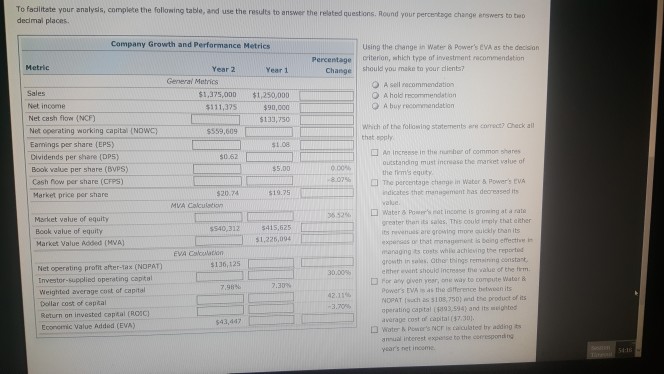

17. The calculation of a firm's Market Value Added (MVA) and Economic Value Added (EVA) Tristan, your newly appointed boss, has tasked you with evaluating the following financial data for Water and Power Co to determine how Water & Power's value has changed over the past year. The investment firm for which you work will make a postive (or "buy) recommendation to its investing clents ir water a Power's value has increased over the past year, a neutral (or "hold recommendation if the value has remeined constant, or a negative for sel" recommendation If the value has decreased. He has recommended that you use several metrics to ascertain how the frm's value hes chartged, and he hes provided you with the fallowing income staterment and balance sheet Water and Power Co Income Statement January 1 - December 31, Year 2 Water and Power Co. December 31, Year 2 Year 1 Asets Year 2 ear 2 92625 08,750 540,313 941,688 602,062 Year 1 Sales $1,375,000 1,250,000 1,025,000 225,000 43,750 181,250 31,250 150,000 60,000 90,000 $54,000 Cash and cash essuivalerts Recelvables Inventory 71,250 1,100,000 275,000 48,125 226,875 41,250 185,625 74,250 $111,32S EBITDA Depreciation and amortization expense Cutrent assets Not fiwed assets 15.625 24,375 463,125 EBIT Interest expense Toral assets Liabilities and Equity Accourns peyable 543,750 $1,187,500 EBT $231,563 150,536 $178,125 15,781 Tax expense (40%) Notes payabla 124,188 Comman dividends Addition to retaired earnings Excludes depreciation and amortization $66,825 4,550 Total current abilbes Long-temm debt 297,372 ,003,438 108,062 432,250 540,312 706.267543,283 228,594 71,875 83, 125 332,500 415,625 Common slock (SI par Retained eamings Total equity Total dobt ard equlty $1.543,750 51,382 500 108,062 Shares outstandng Weighted avage cat of captar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started