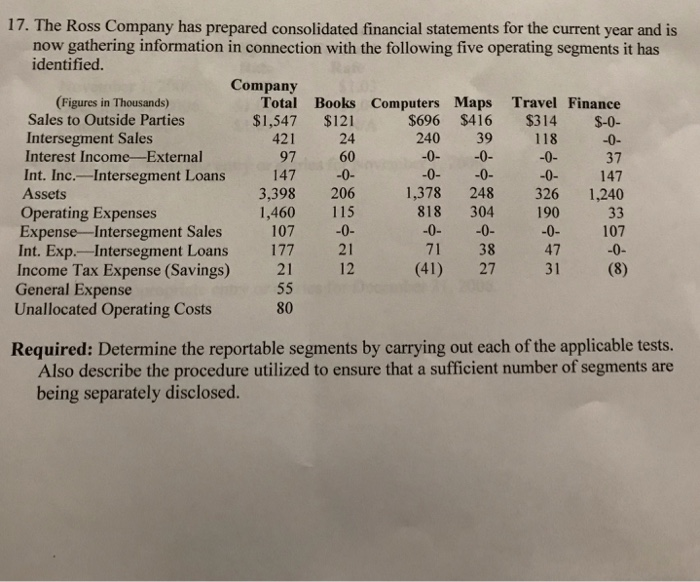

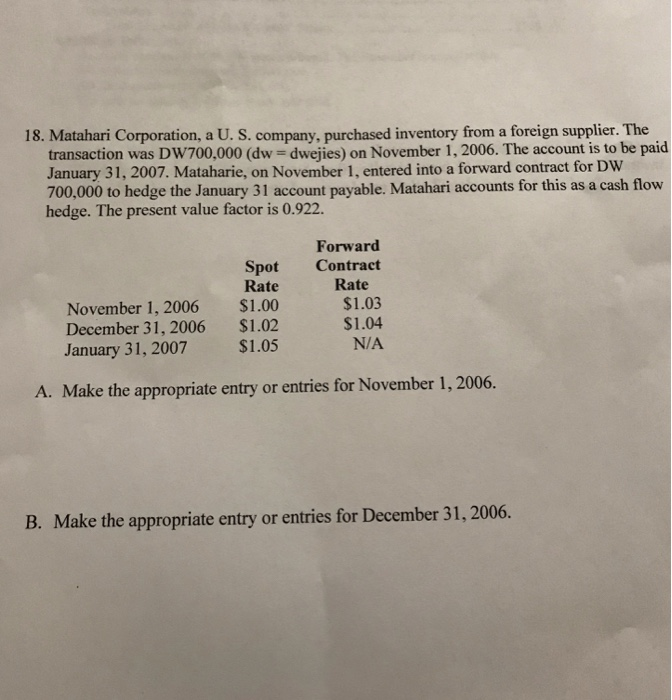

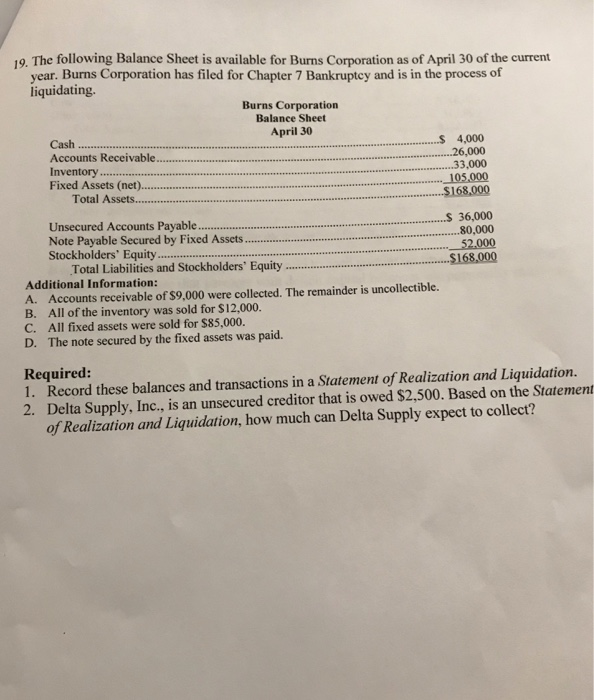

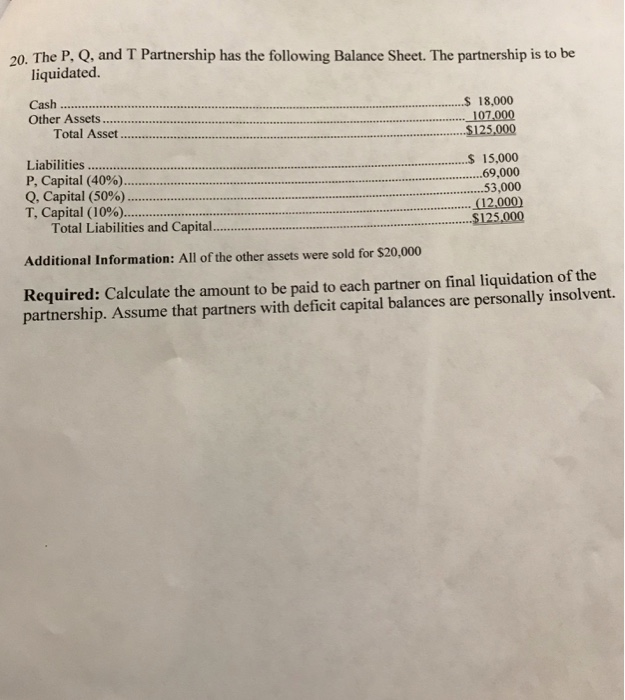

17. The Ross Company has prepared consolidated financial statements for the current year and is now gathering information in connection with the following five operating segments it has identified. Company (Figures in Thousands) Total Books Computers Maps Travel Finance $696 $416 $314 $-0- $1,547 $121 24 60 Int. Inc.-Intersegment Loans 147 0 Sales to Outside Parties Intersegment Sales Interest Income -External 421 97 240 39 37 -0- 0- 0- 147 3,398 206 1,378 248 326 1,240 1,460 115 107 -0- 21 Income Tax Expense (Savings) 21 12 Assets Operating Expenses Expense-Intersegment Sales Int. Exp.-Intersegment Loans 818 304 190 0 107 0- (41) 27 3 (8) 71 38 47 General Expense Unallocated Operating Costs 80 Required: Determine the reportable segments by carrying out each of the applicable tests. Also describe the procedure utilized to ensure that a sufficient number of segments are being separately disclosed. 18. Matahari Corporation, a U. S. company, purchased inventory from a foreign supplier. The transaction was DW700,000 (dw dwejies) on November 1, 2006. The account is to be paid January 31, 2007. Mataharie, on November 1, entered into a forward contract for DW 700,000 to hedge the January 31 account payable. Matahari accounts for this as a cash flow hedge. The present value factor is 0.922. Forward Spot Contract Rate $1.00 $1.02 $1.05 Rate November 1, 2006 December 31, 2006 January 31, 2007 $1.03 $1.04 N/A A. M ake the appropriate entry or entries for November 1, 2006. B. Make the appropriate entry or entries for December 31, 2006 19. The following Balance Sheet is available for Burns Corporation as of April 30 of the current year. Burns Corporation has filed for Chapter 7 Bankruptcy and is in the process of liquidating. Burns Corporation Balance Sheet Cash April 30 S 4,000 26,000 33,000 105,000 $168,000 Inventory Unsecured Accounts Payable... Note Payable Secured by Fixed Assets... 36,000 80,000 Stockholders' Equity Total Liabilities and Stockholders' Equity. $168,000 Additional Information: A. Accounts receivable of $9,000 were collected. The remainder is uncollectible. B. All of the inventory was sold for $12,000. C. All fixed assets were sold for $85,000. D. The note secured by the fixed assets was paid. Required: 1. Record these balances and transactions in a Statement of Realization and Liquidation. 2. Delta Supply, Inc., is an unsecured creditor that is owed $2,500. Based on the Statemen of Realization and Liquidation, how much can Delta Supply expect to collect? 20. The P, Q, and T Partnership has the following Balance Sheet. The partnership is to be liquidated. Cash Other Assets $ 18,000 .107.000 $125,000 Total Asset. Liabilities P, Capital (4096) Q, Capital (5096) T, Capital (1006) S 15,000 ...69,000 53,000 12,000) $125,000 . Total Liabilities and Capital. Additional Information: All of the other assets were sold for $20,000 Required: Calculate the amount to be paid to each partner on final liquidation of the partnership. Assume that partners with deficit capital balances are personally insolvent