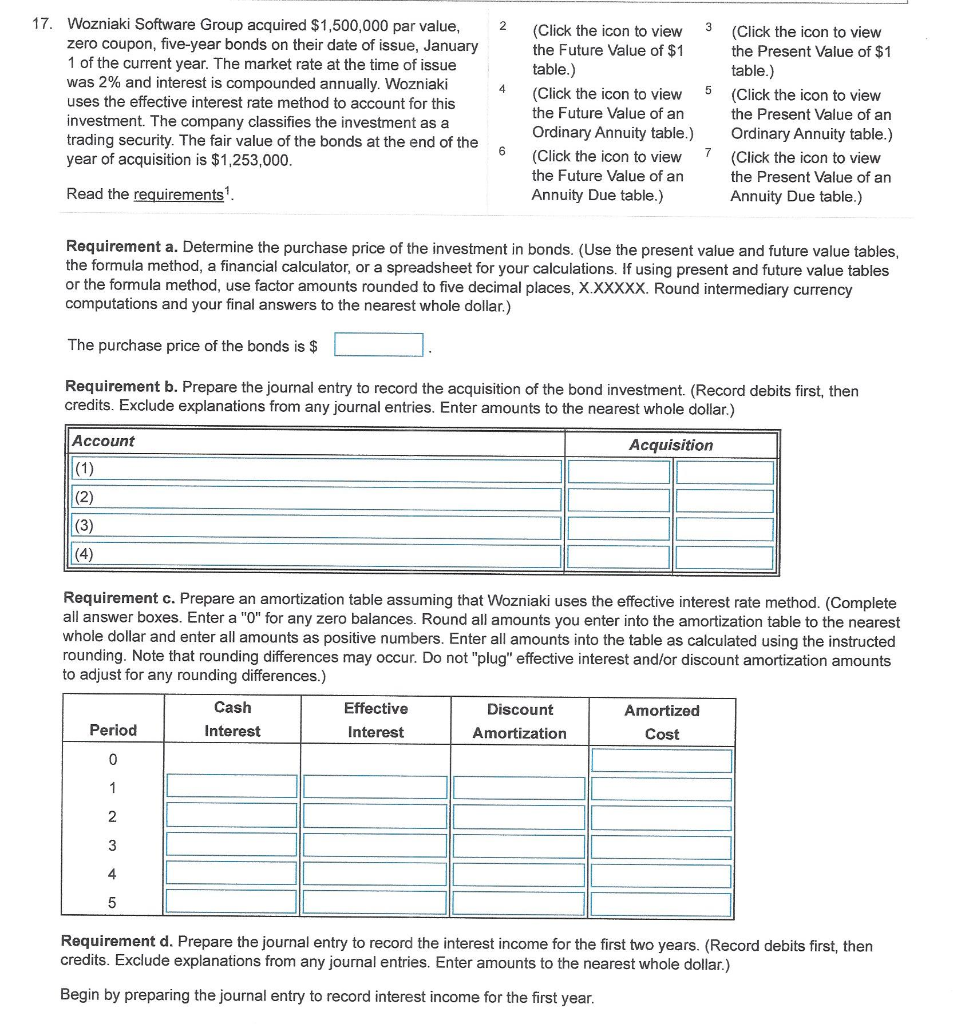

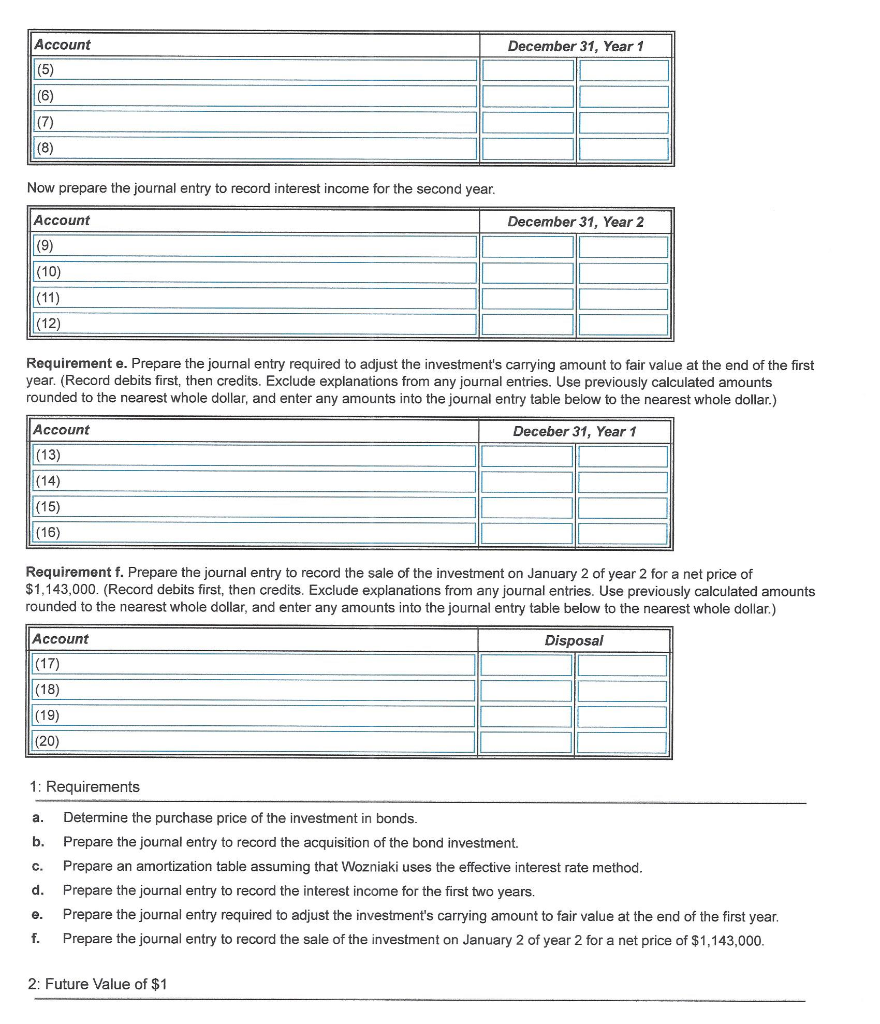

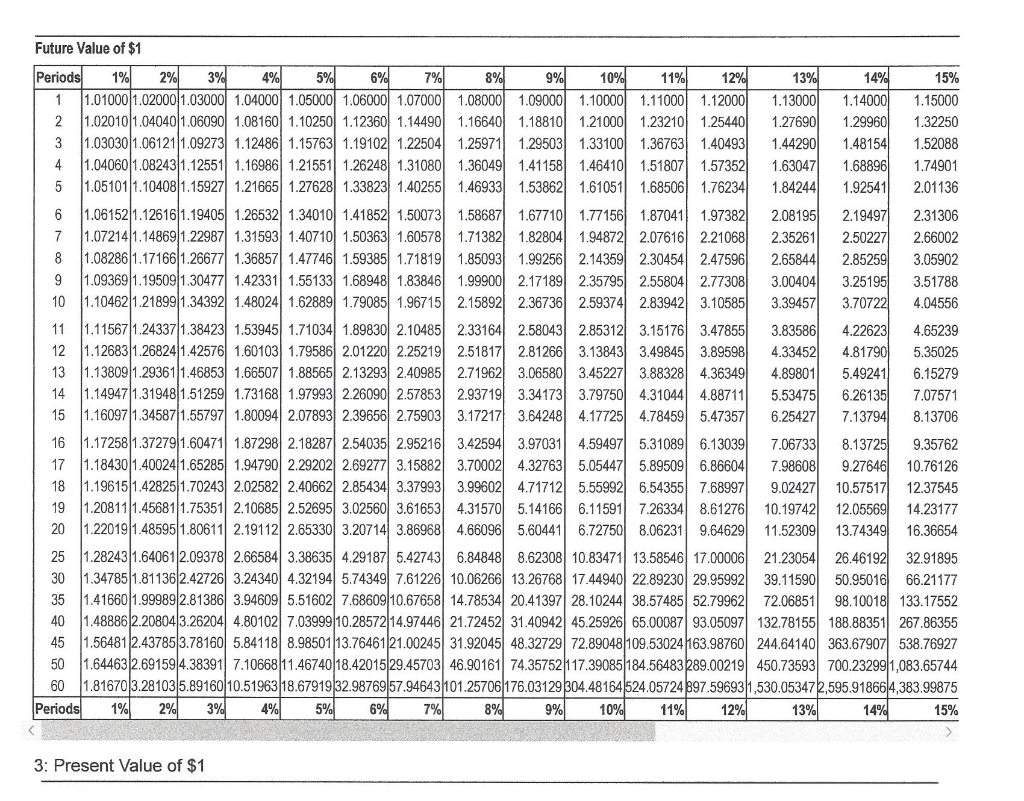

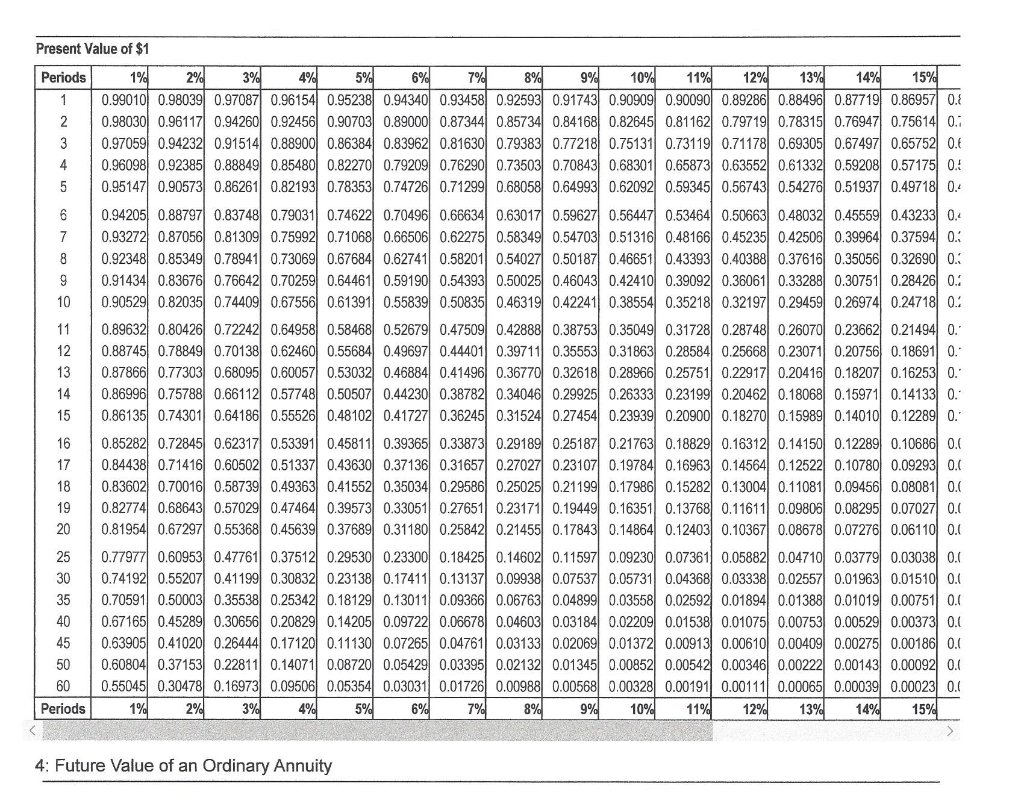

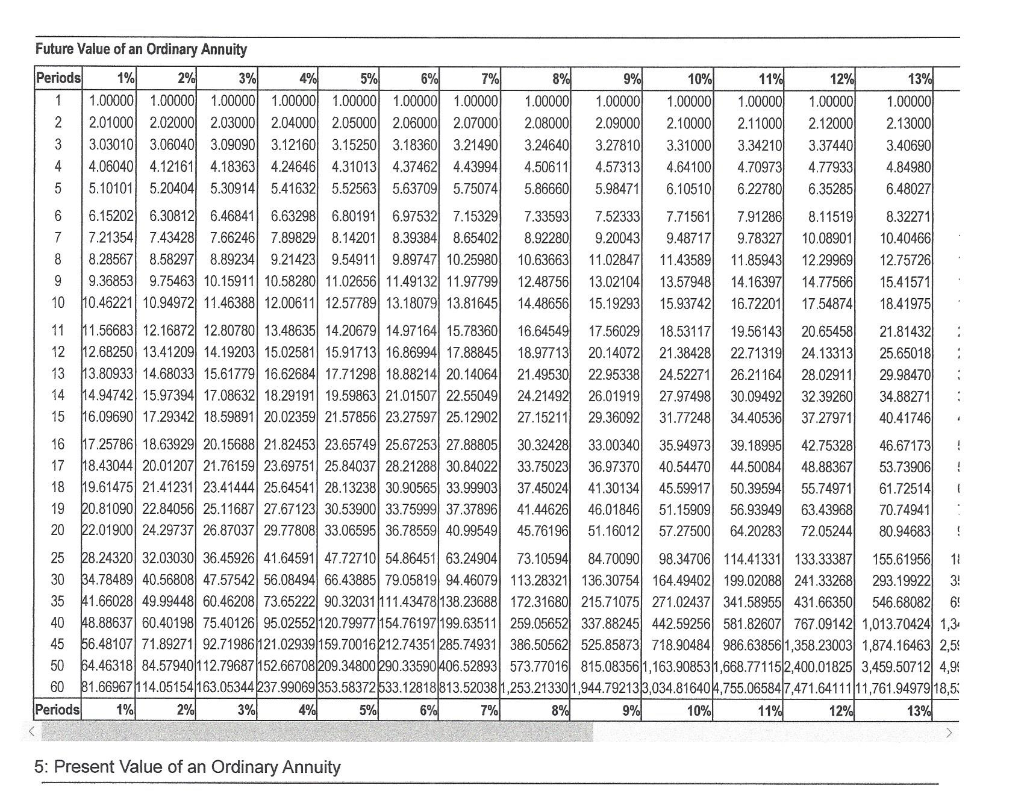

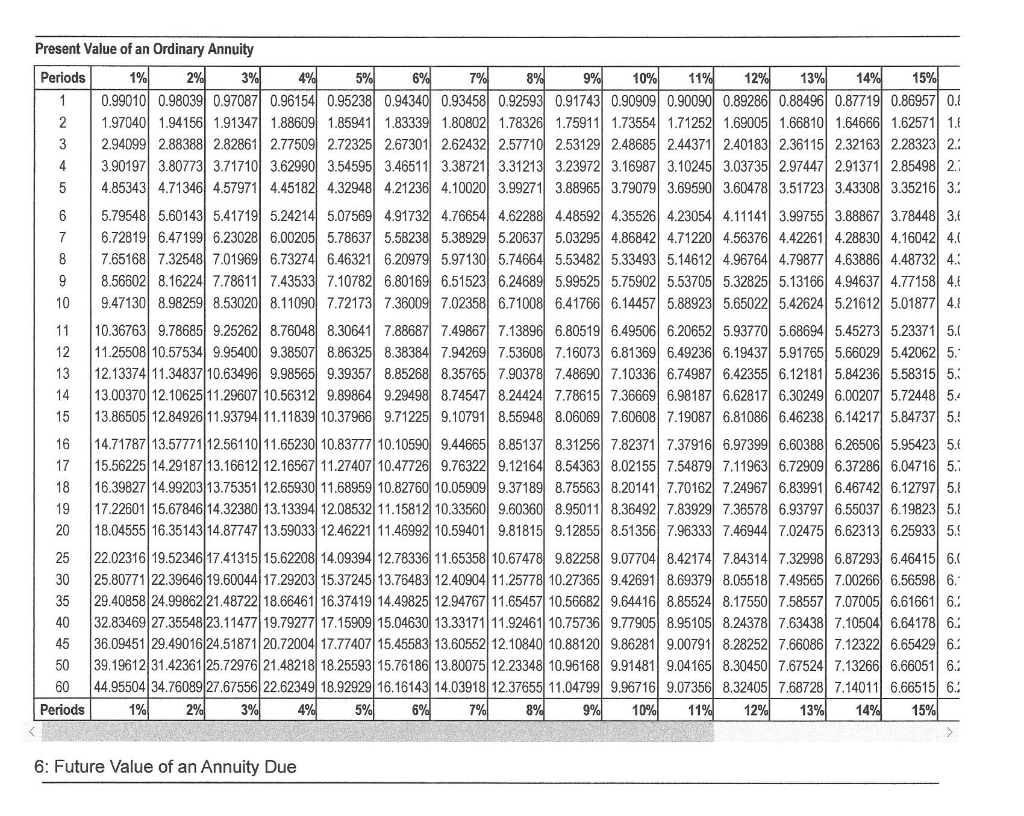

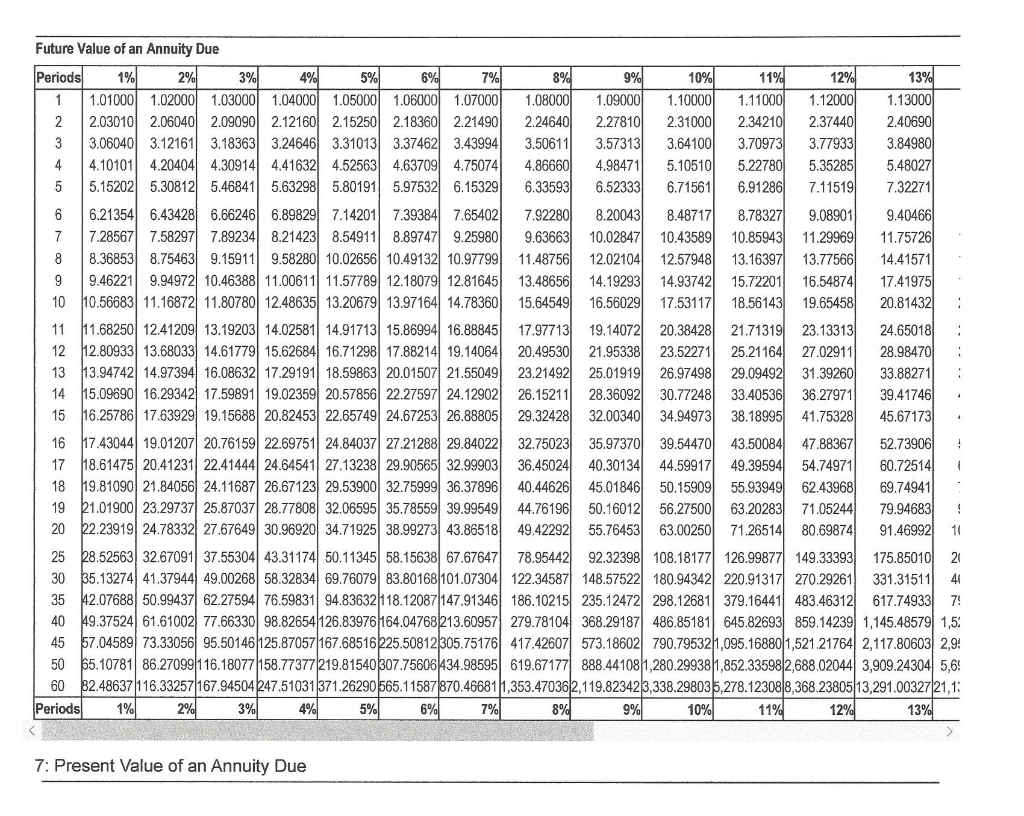

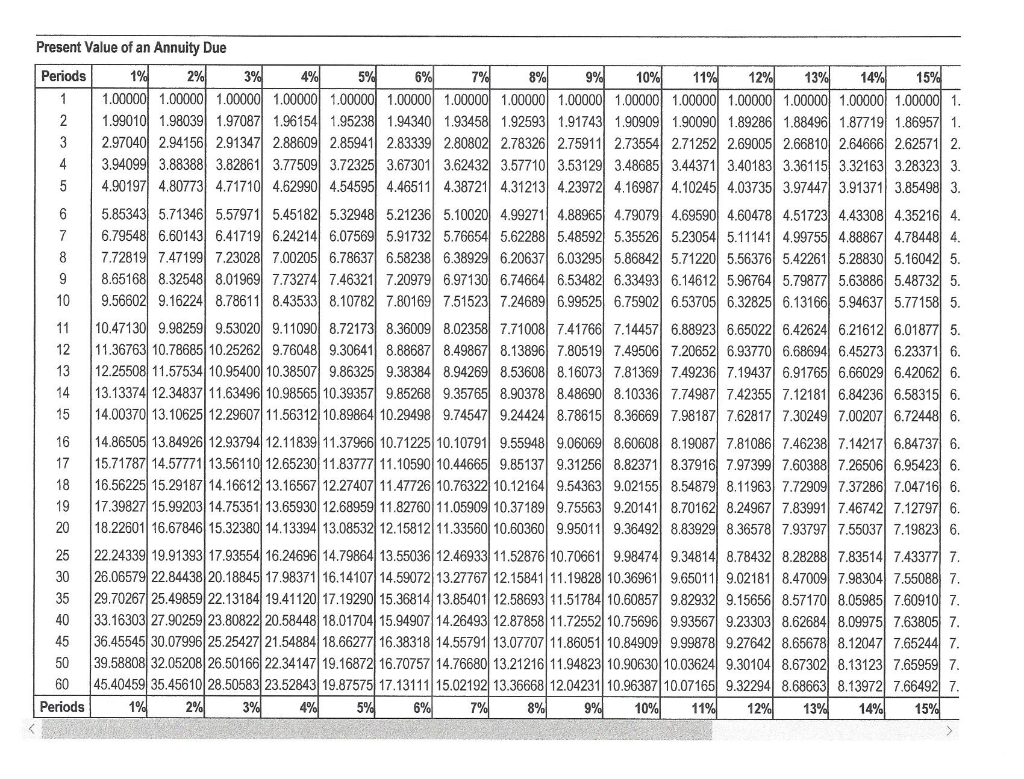

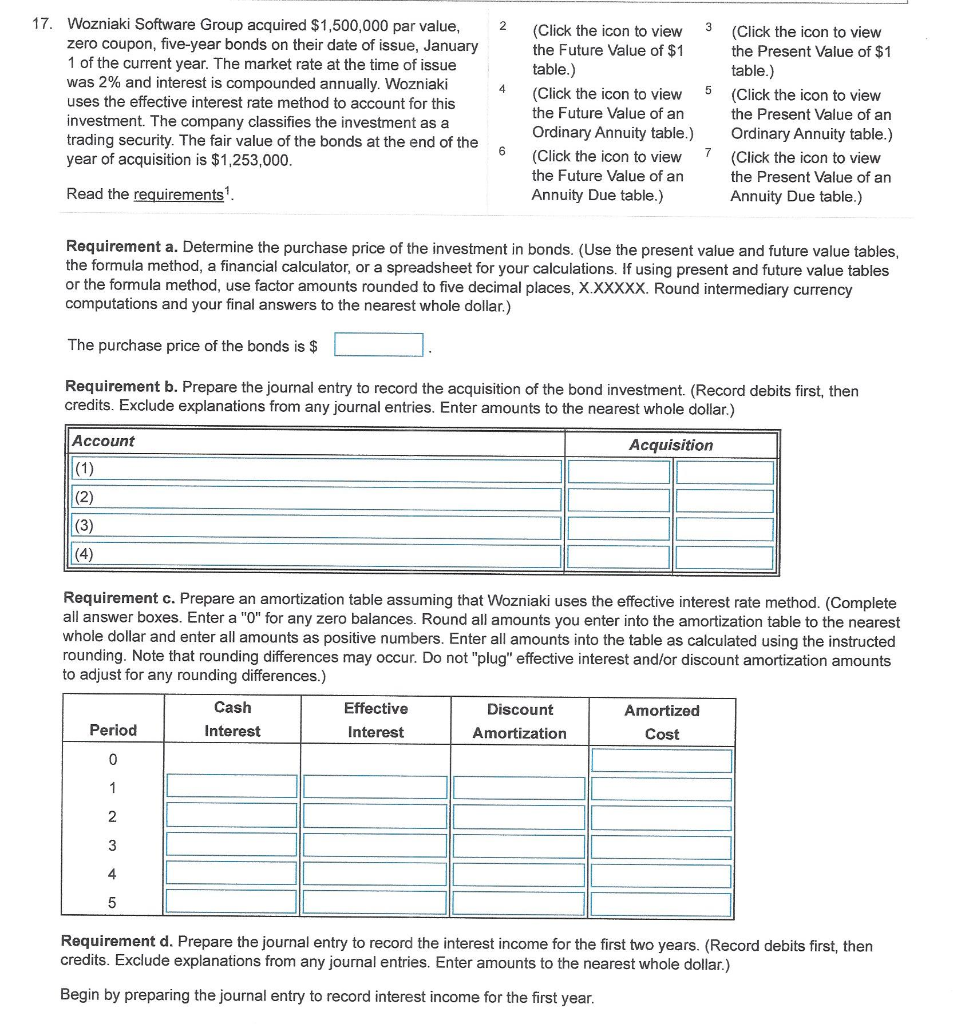

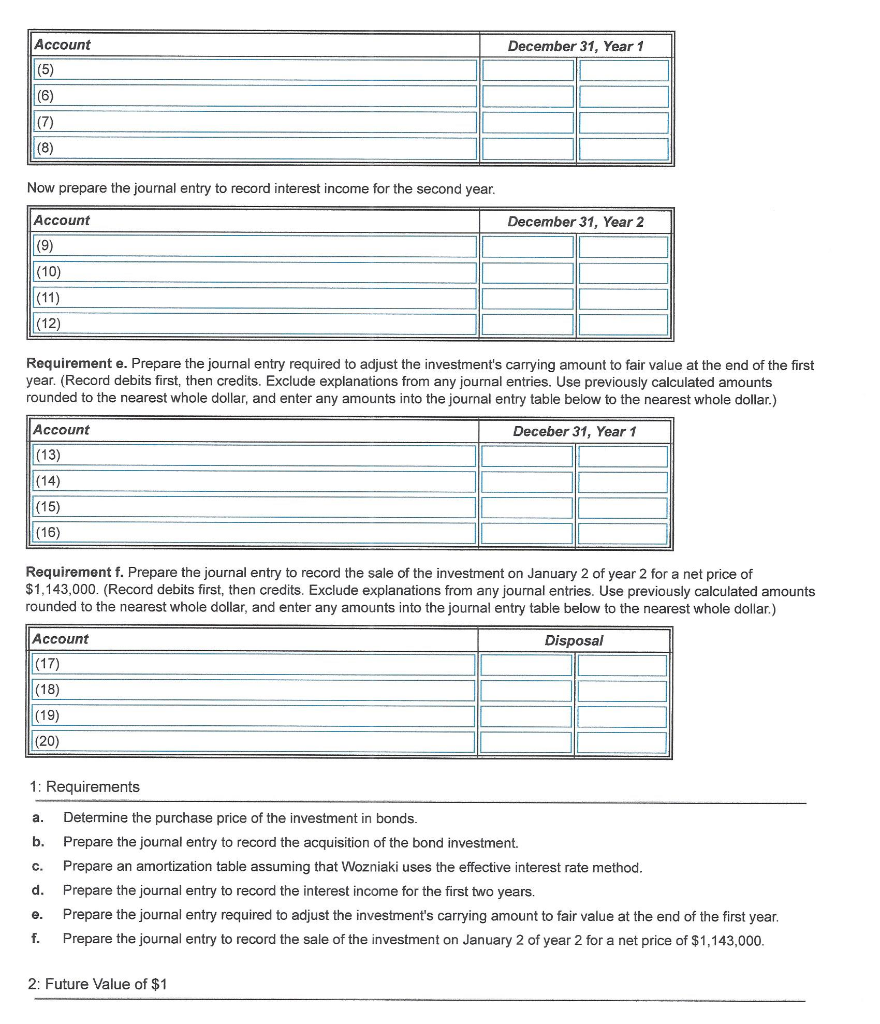

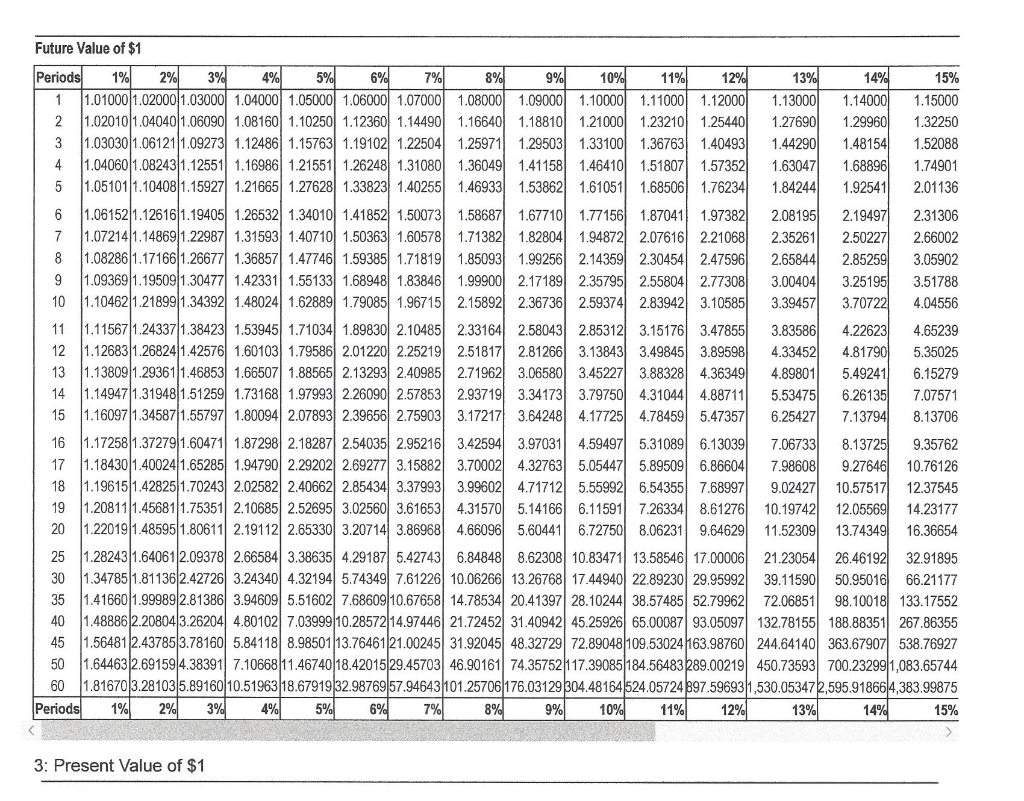

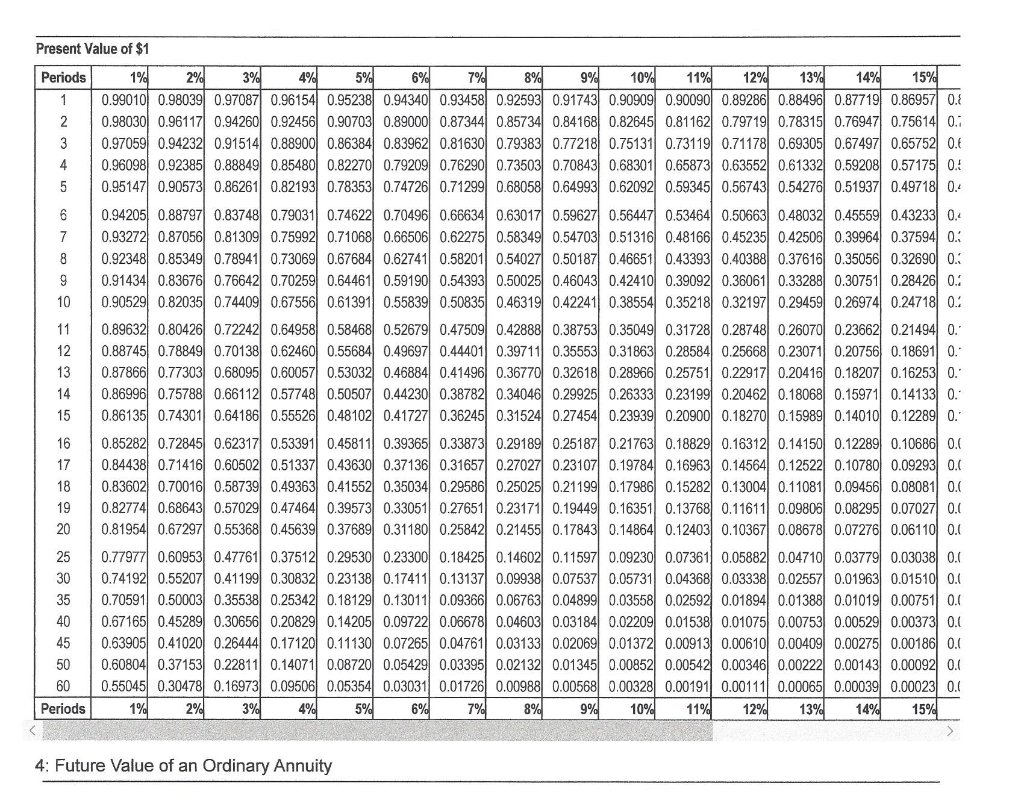

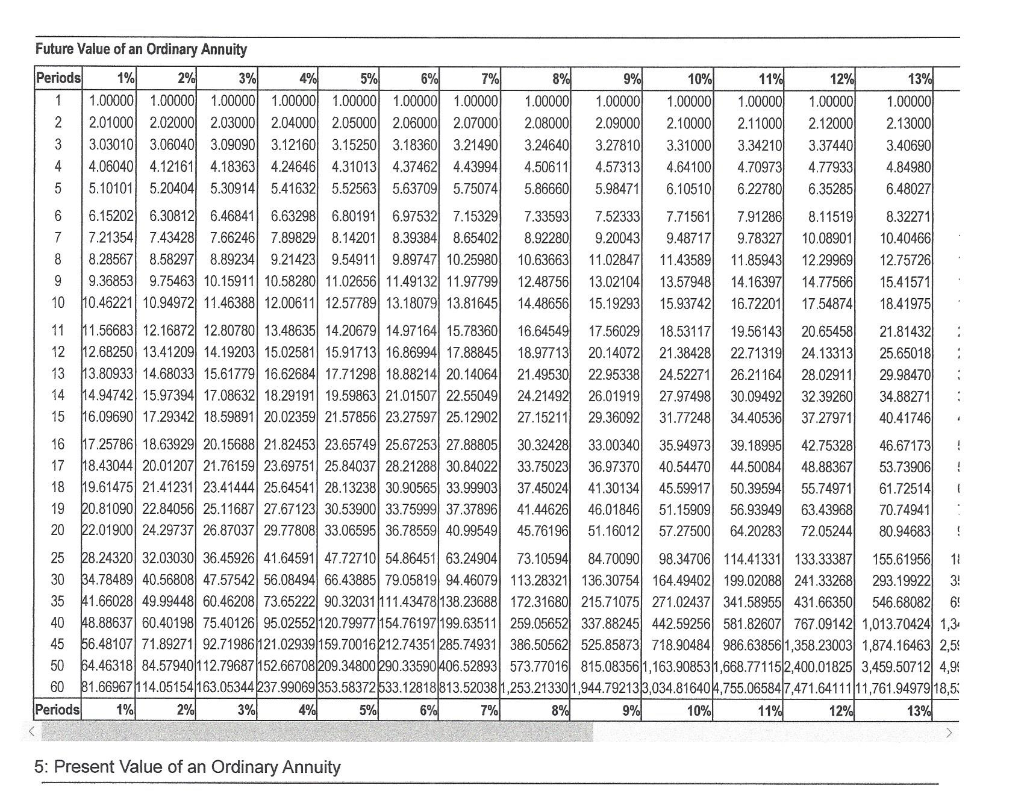

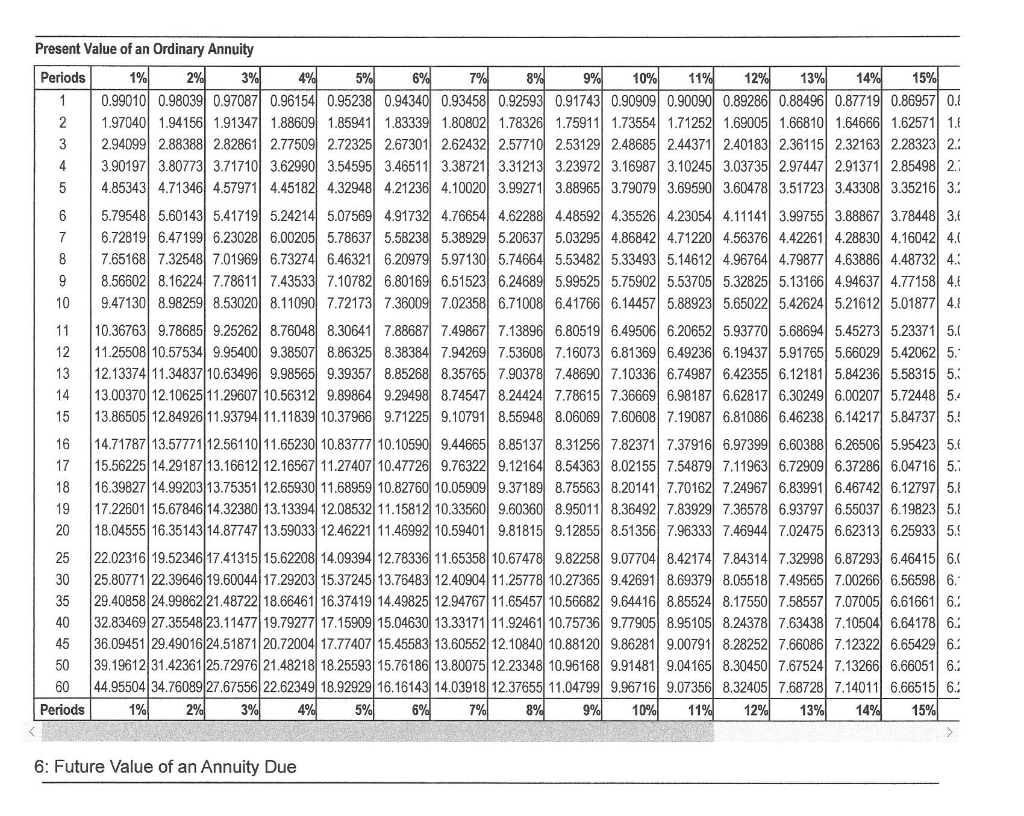

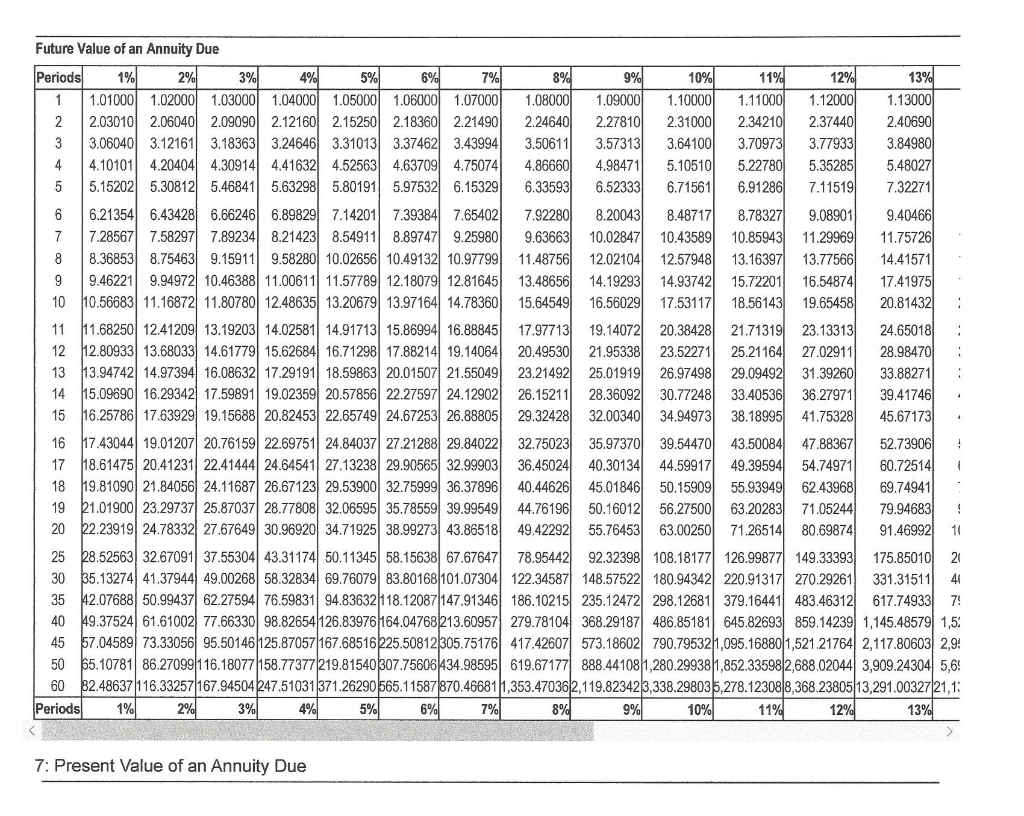

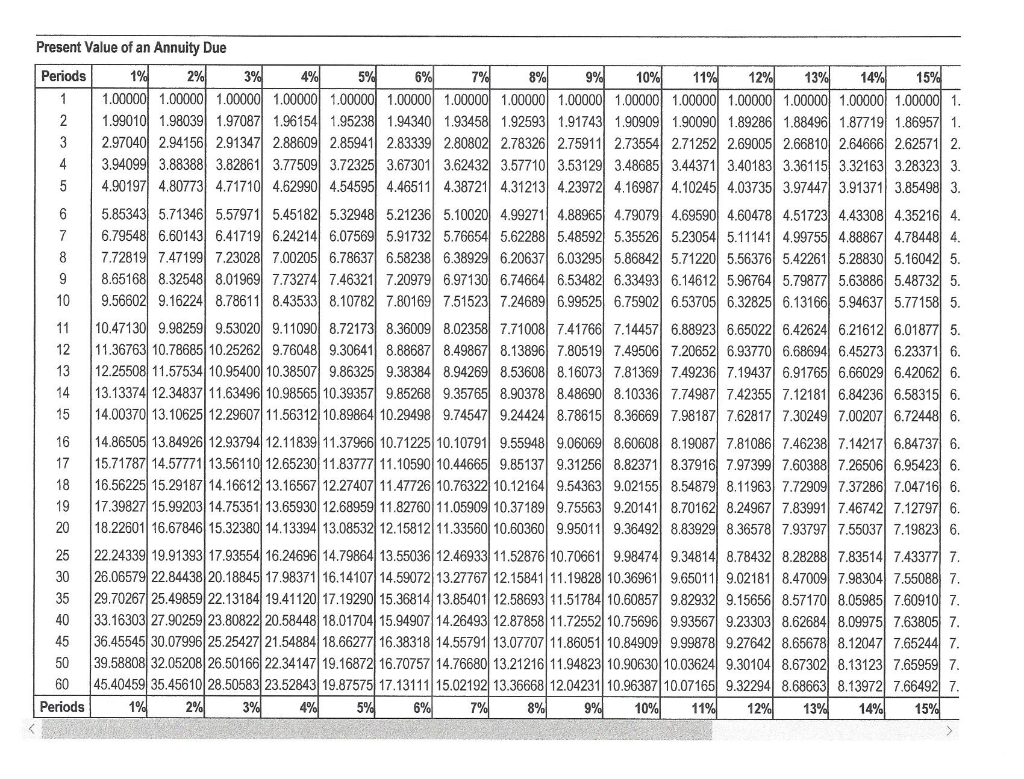

17 Wozniaki Software Group acquired $1,500,000 par value, zero coupon, five-year bonds on their date of issue, January 1 of the current year. The market rate at the time of issue was 2% and interest is compounded annually. Wozniaki uses the effective interest rate method to account for this 2 3 (Click the icon to view the Future Value of $1 table.) (Click the icon to view the Present Value of $1 table.) 4 5 (Click the icon to view (Click the icon to view the Present Value of an Ordinary Annuity table.) the Future Value of an investment. The company classifies the investment as a trading security. The fair value of the bonds at the end of the year of acquisition is $1,253,000. Ordinary Annuity table.) 6 7 (Click the icon to view the Future Value of an (Click the icon to view the Present Value of an Read the requirements. Annuity Due table.) Annuity Due table.) Requirement a. Determine the purchase price of the investment in bonds. (Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calcu lations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round intermediary currency computations and your final answers to the nearest whole dollar.) The purchase price of the bonds is $ Requirement b. Prepare the journal entry to record the acquisition of the bond investment. (Record debits first, then credits. Exclude explanations from any journal entries. Enter amounts to the nearest whole dollar.) Account Acquisition |(1) (2) (3) (4) Requirement c. Prepare an amortization table assuming that Wozniaki uses the effective interest rate method. (Complete all answer boxes. Enter a "0" for any zero balances. Round all amounts you enter into the amortization table to the nearest whole dollar and enter all amounts as positive numbers. Enter all amounts into the table as calculated using the instructed rounding. Note that rounding differences may occur. Do not "plug" effective interest and/or discount amortization amounts to adjust for any rounding differences.) Cash Effective Discount Amortized Period Interest Interest Amortization Cost 0 3 4 Requirement d. Prepare the journal entry to record the interest income for the first two years. (Record debits first, then credits. Exclude explanations from any journal entries. Enter amounts to the nearest whole dollar.) Begin by preparing the journal entry to record interest income for the first year. Account December 31, Year 1 (5) (6) (7) (8 Now prepare the journal entry to record interest income for the second year. Account December 31, Year 2 (9) (10) (11) (12) Requirement e. Prepare the journal entry required to adjust the investment's carrying amount to fair value at the end of the first year. (Record debits first, then credits. Exclude explanations from any journal entries. Use previously calculated amounts rounded to the nearest whole dollar, and enter any amounts into the journal entry table below to the nearest whole dollar.) Account Deceber 31, Year 1 (13) (14) (15) (16) Requirement f. Prepare the journal entry to record the sale of the investment on January 2 of year 2 for a net price of $1,143,000. (Record debits first, then credits. Exclude explanations from any journal entries. Use previously calculated amounts rounded to the nearest whole dollar, and enter any amounts into the journal entry table below to the nearest whole dollar.) Account Disposal (17) (18) (19) (20) 1: Requirements Determine the purchase price of the investment in bonds a Prepare the journal entry to record the acquisition of the bond investment. Prepare an amortization table assuming that Wozniaki uses the effective interest rate method. C. Prepare the journal entry to record the interest income for the first two years. d. Prepare the journal entry required to adjust the investment's carrying amount to fair value at the end of the first year. e. f. Prepare the journal entry to record the sale of the investment on January 2 of year 2 for a net price of $1,143,000. 2: Future Value of $1 Future Value of $1 Periods 1% 6% 9% 10% 1.10000 1.1000 1.12000 4% 1.01000 1.02000 1.03000 1.04000 1.05000 1.06000 1.07000 5% 11% 12% 13% 14% 2% 7% 8% 3% 15% 1.14000 1.29960 1.48154 1.08000 1.09000 1.15000 1.13000 1.18810 1.21000 1.23210 1.29503 1.33100 1.41158 1.46410 1.51807 1.61051 1.68506 1.27690 1.44290 1.25440 1.40493 1.02010 1.04040 1.06090 1.08160 1.10250 1.12360 1.144901.16640 1.03030 1.06121 1.09273 1.12486 1.157631.19102 1.22504 1.25971 1.04060 1.08243 1.12551 1.16986 1.21551 1.26248 1.31080 1.05101 1.10408|1.15927 1.21665 1.27628 1.33823 1.40255 2 1.32250 1.52088 3 1.36763 1.57352 1.76234 4 1.36049 1.63047 1.68896 1.74901 1,46933 1.84244 1.92541 2.01136 1.53862 1.06152 1.12616 1.19405 1.26532 1.34010 1.418521.50073 1.07214 1.148691.22987 1.31593 1.40710 1.50363 1.60578 1.08286 1.17166 1.26677 1.36857 1.47746 1.59385 1.71819 1.09369 1.19509 1.30477 1.42331 1.55133| 1.68948| 1.83846 1.99900 2.171892.35795 2.558042.77308 1.10462 1.21899 1.34392 1.48024 1.67710 1.77156 187041 1.97382 1.94872 2.07616 2.21068 1.99256 2.14359 2.30454 2.47596 6 .58687 2.08195 2.19497 2.31306 1.71382 1.82804 7 2.35261 2.50227 2.66002 2.85259 3.25195 2.65844 1.85093 3.05902 3.00404 9 3.51788 1.62889 1.79085 1.96715 2.15892 2.367362.593742.83942 3.10585 10 3.39457 3.70722 4.04556 1.11567 1.243371.38423 1.53945 1.71034| 1.89830 2.10485 2.331642.58043 2.85312 3.151776 3.47855 1.12683 1.268241.42576 1.60103 1.79586 2.01220 2.25219 2.51817 2.81266 3.138433.49845 1.13809 1.293611.46853 1.66507 1.14947 1.31948 1.51259 1.73168 1.97993| 2.26090 2.57853 2.93719 3.34173 3.79750431044 1.16097 1.34587 1.557971.80094| 2.07893| 2.39656| 2.75903 3.172173.64248 4.17725 4.784595.47357 3.83586 4.33452 11 4.22623 4.81790 4.65239 12 3.89598 3.06580 3.45227 3.883284.36349 5.35025 1.88565 2.13293 2.40985 2.71962 13 5.49241, 6.26135 7.13794 6.15279 4.89801 5.53475 14 4.88711 7.07571 15 6.25427 8.13706 1.17258|1.37279|1.60471 1.87298| 2.18287 2.54035 2.952163.42594 3.97031459497 5.31089 6.13039 1.18430 1.40024 1.65285 1.94790 2.29202 2.69277 3.15882 1.19615 1.42825 1.70243 2.02582| 2.40662 2.85434 3.37993 3.99602 471712 5.55992 6.543557.68997 1.20811 |1.45681 1.75351 2.10685 2.52695 3.02560 3.61653 4.31570 5.14166 1.22019 1.48595 1.80611 2.19112 2.65330 3.20714 3.869684.66096 5.604416.72750 8.06231 7.06733 7.98608 8.13725 9.27646 10.57517 12.05569 13.74349 16 9.35762 .70002 4.32763 5.054475.89509 6.86604 17 10.76126 18 9.02427 12.37545 8.61276 19 6.11591 7.26334 10.19742 14.23177 20 9.64629 11.52309 16.36654 26.46192 1.28243 1.640612.09378 2.66584 3.38635 4.29187 5.42743 6.848488.62308 10.8347113.5854617.00006 1.34785 1.811362.42726| 3.24340 4.32194 5.74349 7.61226 10.06266| 13.2676817.44940 22.8923029.95992 39.1159050.95016| 1.41660 1.99989 2.81386 3.94609 5.51602 7.6860910.6765814.78534 20.41397 28.10244 38.57485 52.79962 1.48886 2.20804 3.26204 4.80102| 7.0399910.2857214.97446 21.72452 31.40942 45.25926 65.00087 93.05097132.78155 188.88351267.86355 1.56481|2.43785 3.78160 5.84118 8.9850113.76461121.00245 31.92045 48.32729| 72.89048|109.53024163.98760 244.64140 363.67907538.76927 1.64463 2.69159|4.38391| 7.1066811.46740|18.42015|29.45703 46.90161 74.35752117.39085184.56483 289.00219 450.73593| 700.232991,083.65744 1.816703.28103 5.89160 10.51963 18.67919 32.98769 57.94643101.25706176.03129 304.48164 524.05724 897.596931,530.053472,595.918664,383.99875 Periods 25 21.23054 32.91895 3C 66.21177 98.10018 133.17552 35 72.06851 40 45 50 60 4% 1% 3% 5% 8% 9% 10% 7% 11% 13% 12% 14% 2% 6% 15%