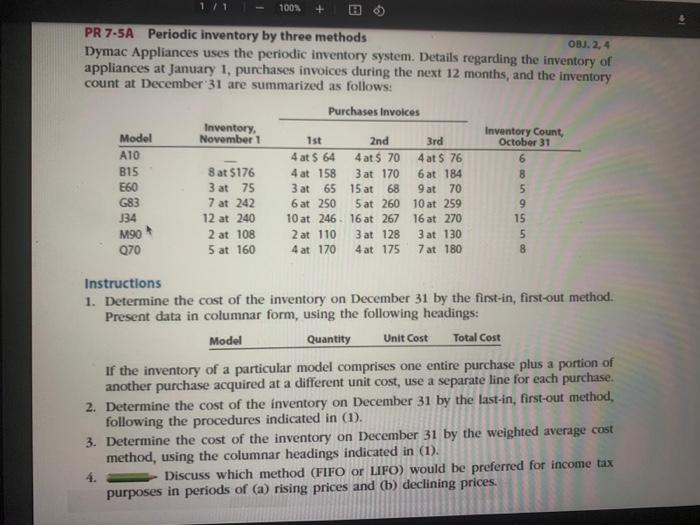

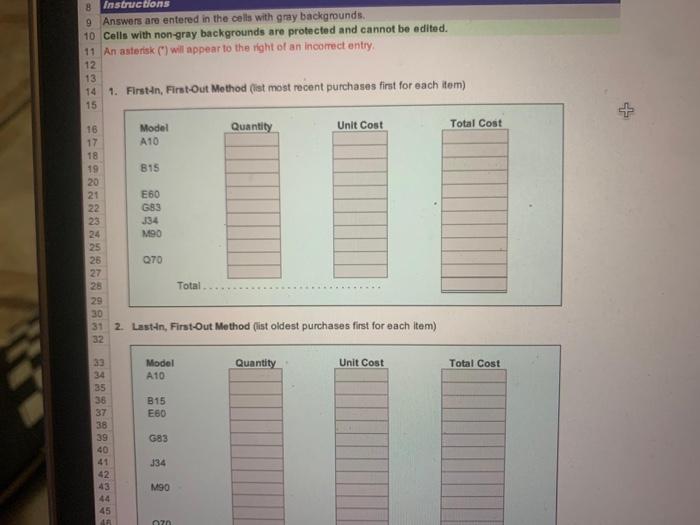

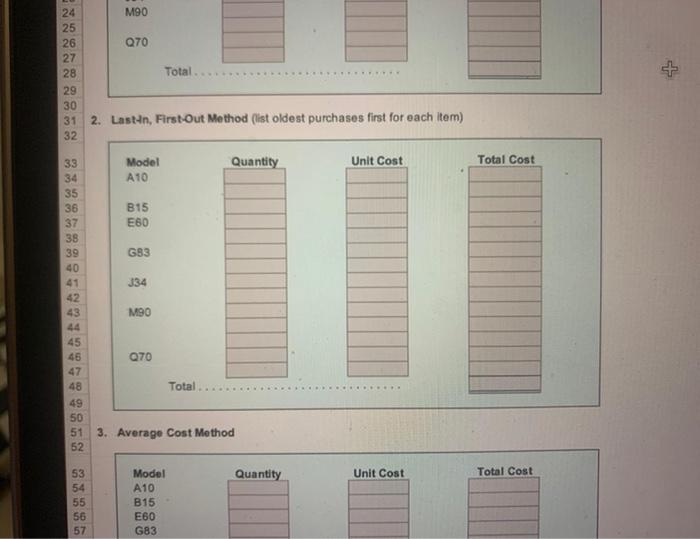

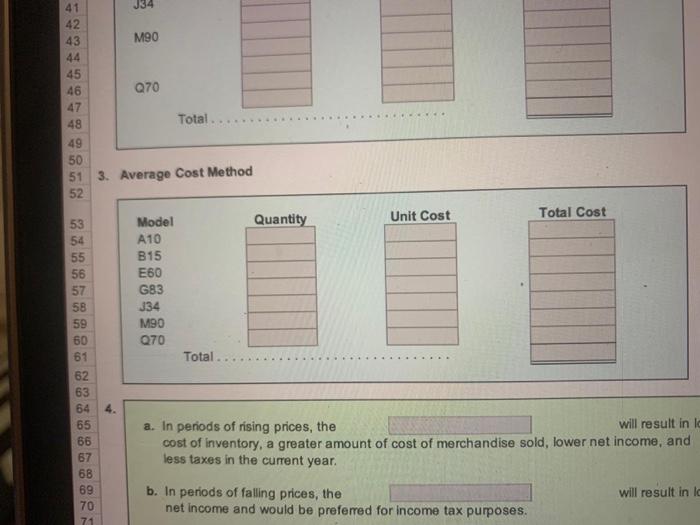

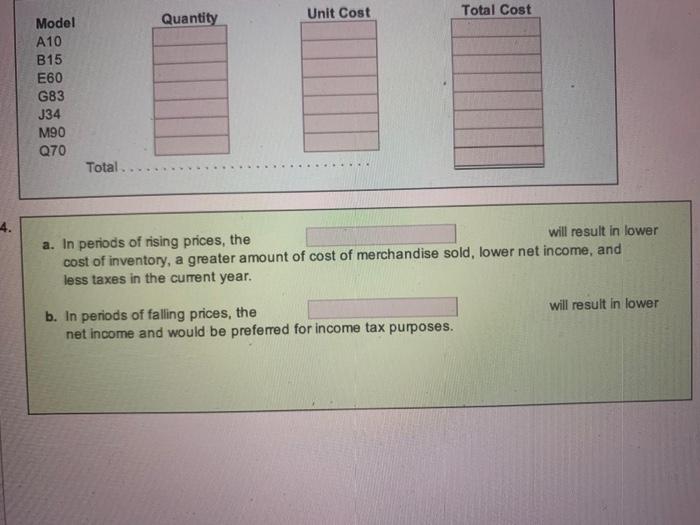

171 100% PR 7-5A Periodic inventory by three methods OBJ. 2. 4 Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows: Purchases Invoices Inventory November 1 1st Model ATO B15 E60 G83 34 M90 070 8 at $176 3 at 75 7 at 242 12 at 240 2 at 108 5 at 160 2nd 3rd 4 at $ 64 4 at $ 70 4 at $ 76 4 at 158 3 at 170 6 at 184 3 at 65 15 at 68 9 at 70 6 at 250 5 at 260 10 at 259 10 at 246 16 at 267 16 at 270 2 at 110 3 at 128 3 at 130 4 at 170 4 at 175 7 at 180 Inventory Count October 31 6 8 5 9 15 5 8 Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: Model Quantity Unit Cost Total Cost If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices. 8 9 Instructions Answers are entered in the cells with gray backgrounds. 10 Cells with non-gray backgrounds are protected and cannot be edited. 11 An asterisk (*) will appear to the right of an incorrect entry 12 13 14 1. Firsten, First-Out Method (ist most recent purchases first for each item) 15 Total Cost 16 Model Quantity Unit Cost A10 18 19 B15 20 21 E60 22 G93 23 334 M90 25 26 Q70 27 28 Total 29 30 31 2. Last-n, First-Out Method (ist oldest purchases first for each item) 32 33 Quantity Unit Cost Model A10 Total Cost B15 E60 G83 35 36 37 38 39 40 41 42 43 44 45 334 M90 24 M90 25 26 Q70 27 28 Total 29 30 31 2. LasNn, First-Out Method (list oldest purchases first for each item) 32 + Quantity Unit Cost Total Cost Model A10 B15 E60 33 34 35 36 37 38 39 40 41 42 43 G83 J34 M90 45 45 Q70 47 48 Total 49 50 51 3. Average Cost Method 52 53 Quantity Unit Cost Total Cost 54 55 56 57 Model A10 B15 E60 G83 41 J34 42 43 M90 44 45 46 Q70 47 48 Total.. 49 50 51 3. Average Cost Method 52 Quantity Unit Cost Total Cost 53 54 55 56 57 58 59 60 61 Model A10 B15 E60 G83 J34 M90 Q70 Total 62 63 64 4. 65 66 67 6B 69 70 71 a. In periods of rising prices, the will result in lo cost of inventory, a greater amount of cost of merchandise sold, lower net income, and less taxes in the current year. b. In periods of falling prices, the net income and would be preferred for income tax purposes. will result in lc Unit Cost Total Cost Quantity Model A10 B15 E60 G83 J34 M90 Q70 Total 4. a. In periods of rising prices, the will result in lower cost of inventory, a greater amount of cost of merchandise sold, lower net income, and less taxes in the current year. will result in lower b. In periods of falling prices, the net income and would be preferred for income tax purposes