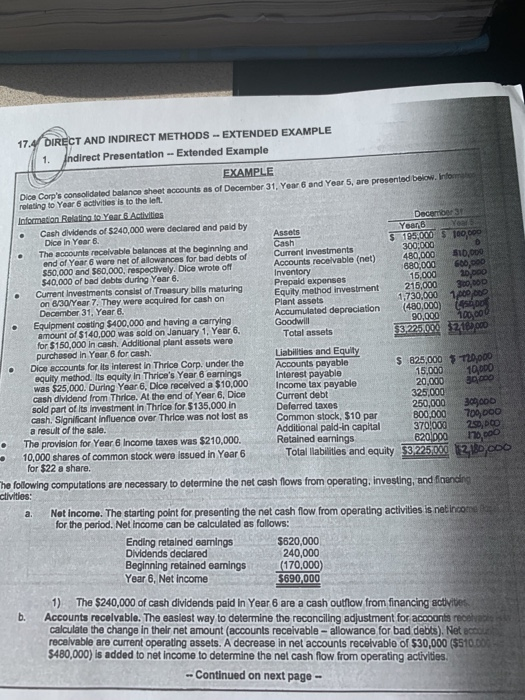

17.4 DIRECT AND INDIRECT METHODS-EXTENDED EXAMPLE irect Presentation - Extended Example Dice Corp's consolidated balance sheet accounts as of December 31. Year 6 and Year 5, are presented below. Intfomrs relating to Year 6 activitios is to the let Year 6 Cash dividends of $240,000 were declared and pald by Dice in Year 6 end of Year 6 were net of allowances 40,000 of bad debts during Year 6 The accounts receivable balances at the beginning and $50,000 and 560,000, respectively. Dice wrote off Current Investments consist of Troasury bills maturing 300:00s1D.0 880,000 6o0,p00 Current Investments Accounts recelvable (net) 480,00010,000 for bad debts of 15,000 Prepaid expenses Equity method investment 215,00030o,00D Plant assots Accumulated depreciation on 630/Year 7. They were acquired for cash on 1,730,000 1 December 31, Year 6 (480,000) Equipment costing $400,000 and having a carrying amount of $140,000 was sold on January 1. Year 6 or $150,000 in cash. Additional plant assets ware 0,000100,00 . Total assets purchased in Year 6 for cash. Dice accounts for its interest in Thrice Corp. under the equity method. Its equity in Thrice's Year 6 eamings was $25,000. During Year 6. Dice recelved a $10,000 cash dlvidend from Thrice. At the end of Year 6, Dice sold part of its investment in Thrice for $135,000 in cash. Signilicant influence over Thrice was not lost as 0000 s 825,000 Accounts payable Interest payable Income tax payable Current debt Deferred taxes Common stock, $10 par Additional pald-in capital 370 000 Retained earnings . 15,00010DD0 20,000Bpco 325,000 250,0003000D B00.000: 700,D00 a result of the sale. . The provision for Year 6 Income taxes was $210,000 6201000 70 0o 3ooo 10,.000 shares of common stock were issued in Year 6 Tolal labilities and equity for $22 a share. he folowing computations are necessary to determine the net cash flows from operating, investing, and foanding Net income. The starting point for presenting the net cash flow from operating activities is netincone a. for the period. Net income can be calculated as follows: Ending retained eanings $620,000 240,000 Dividends declared Beginning retained eamings(170,000 Year 6, Net income $690,000 1) The $240,000 of cash dividends paid in Year 6 are a cash outflow from financing activites b. Accounts recelvable. The easiest way to determine the reconcilling adjustment for acoants rece calculate the change in their net amount (accounts receivable-allowance for bad debts). Net recelvable are current operating assets. A decrease in net accounts receivablo of $30,000($510.00 $480,000) is added to net income to determine the net cash flow from operating activities Continued on next page 17.4 DIRECT AND INDIRECT METHODS-EXTENDED EXAMPLE irect Presentation - Extended Example Dice Corp's consolidated balance sheet accounts as of December 31. Year 6 and Year 5, are presented below. Intfomrs relating to Year 6 activitios is to the let Year 6 Cash dividends of $240,000 were declared and pald by Dice in Year 6 end of Year 6 were net of allowances 40,000 of bad debts during Year 6 The accounts receivable balances at the beginning and $50,000 and 560,000, respectively. Dice wrote off Current Investments consist of Troasury bills maturing 300:00s1D.0 880,000 6o0,p00 Current Investments Accounts recelvable (net) 480,00010,000 for bad debts of 15,000 Prepaid expenses Equity method investment 215,00030o,00D Plant assots Accumulated depreciation on 630/Year 7. They were acquired for cash on 1,730,000 1 December 31, Year 6 (480,000) Equipment costing $400,000 and having a carrying amount of $140,000 was sold on January 1. Year 6 or $150,000 in cash. Additional plant assets ware 0,000100,00 . Total assets purchased in Year 6 for cash. Dice accounts for its interest in Thrice Corp. under the equity method. Its equity in Thrice's Year 6 eamings was $25,000. During Year 6. Dice recelved a $10,000 cash dlvidend from Thrice. At the end of Year 6, Dice sold part of its investment in Thrice for $135,000 in cash. Signilicant influence over Thrice was not lost as 0000 s 825,000 Accounts payable Interest payable Income tax payable Current debt Deferred taxes Common stock, $10 par Additional pald-in capital 370 000 Retained earnings . 15,00010DD0 20,000Bpco 325,000 250,0003000D B00.000: 700,D00 a result of the sale. . The provision for Year 6 Income taxes was $210,000 6201000 70 0o 3ooo 10,.000 shares of common stock were issued in Year 6 Tolal labilities and equity for $22 a share. he folowing computations are necessary to determine the net cash flows from operating, investing, and foanding Net income. The starting point for presenting the net cash flow from operating activities is netincone a. for the period. Net income can be calculated as follows: Ending retained eanings $620,000 240,000 Dividends declared Beginning retained eamings(170,000 Year 6, Net income $690,000 1) The $240,000 of cash dividends paid in Year 6 are a cash outflow from financing activites b. Accounts recelvable. The easiest way to determine the reconcilling adjustment for acoants rece calculate the change in their net amount (accounts receivable-allowance for bad debts). Net recelvable are current operating assets. A decrease in net accounts receivablo of $30,000($510.00 $480,000) is added to net income to determine the net cash flow from operating activities Continued on next page