Answered step by step

Verified Expert Solution

Question

1 Approved Answer

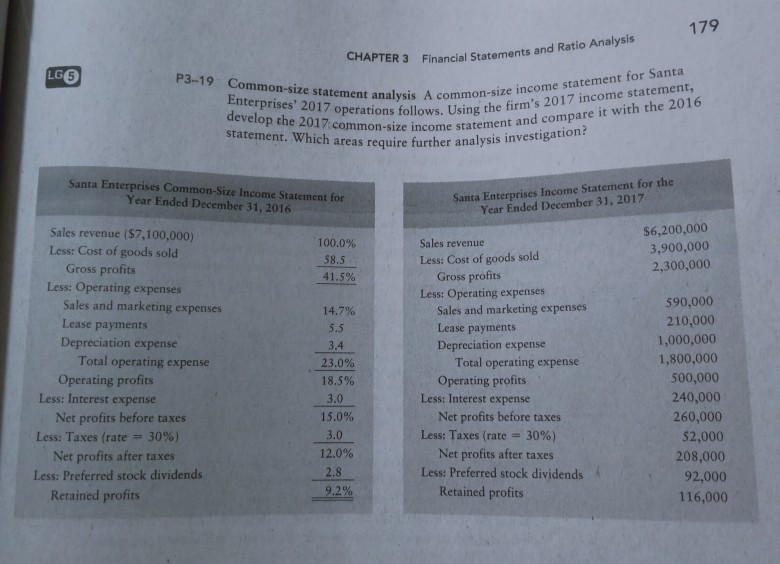

179 CHAPTER 3 Financial Statements ar Inancial Statements and Ratio Analysis P3-19 Common-size statement analysis A Enterprises' 2017 operations follows. develop the 2017 common-size income

179 CHAPTER 3 Financial Statements ar Inancial Statements and Ratio Analysis P3-19 Common-size statement analysis A Enterprises' 2017 operations follows. develop the 2017 common-size income statement statement. Which areas require further analysis common-size income statement for Santa ations follows. Using the firm's 2017 income statement, Come statement and compare it with the 2016 urther analysis investigation? Santa Enterprises Common-Size Income Statement for Year Ended December 31, 2016 Santa Enterprises Income Statement for the Year Ended December 31, 2017 100.0% $6,200,000 3,900,000 2,300,000 58.5 41.5% Sales revenue ($7,100,000) Less: Cost of goods sold Gross profits Less: Operating expenses Sales and marketing expenses Lease payments Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 30%) Net profits after taxes Less: Preferred stock dividends Retained profits 14.7% 5.5 3.4 23.0% 18.5% 3.0 15.0% 3.0 12.0% Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Sales and marketing expenses Lease payments Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 30%) Net profits after taxes Less: Preferred stock dividends Retained profits 590,000 210,000 1,000,000 1,800,000 500,000 240,000 260,000 52,000 208,000 92,000 116,000 2.8 9.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started