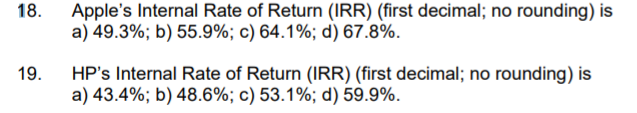

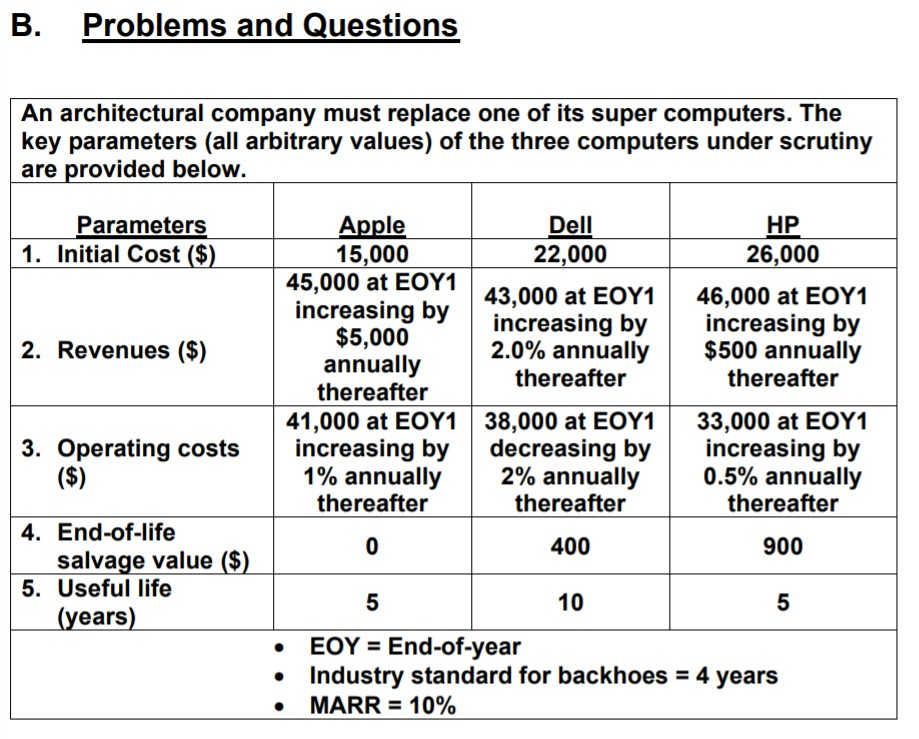

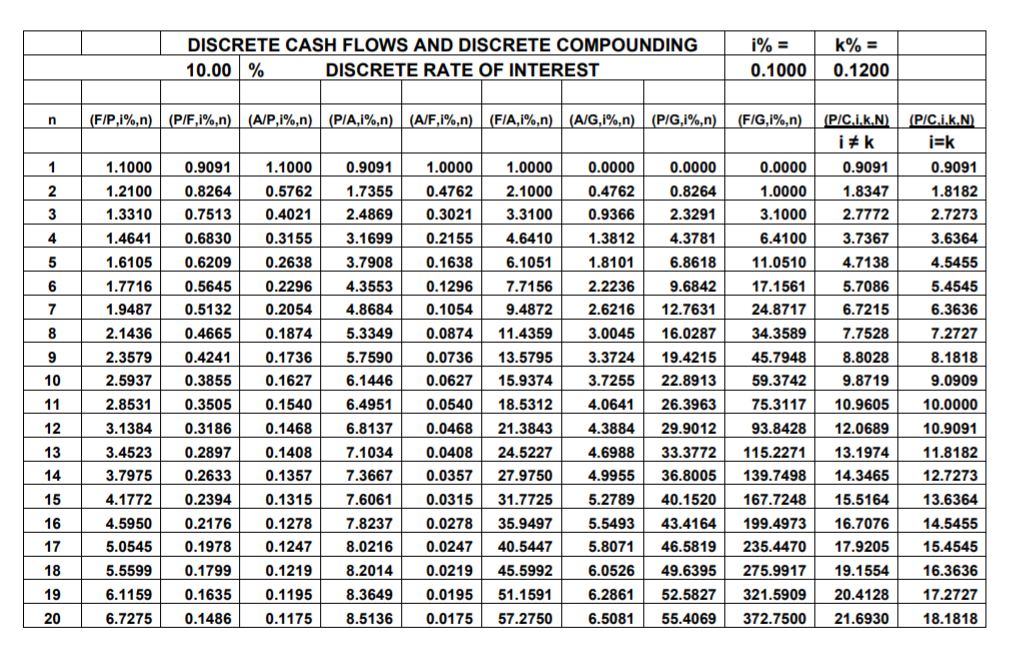

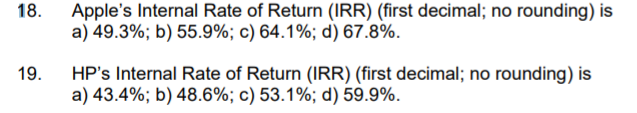

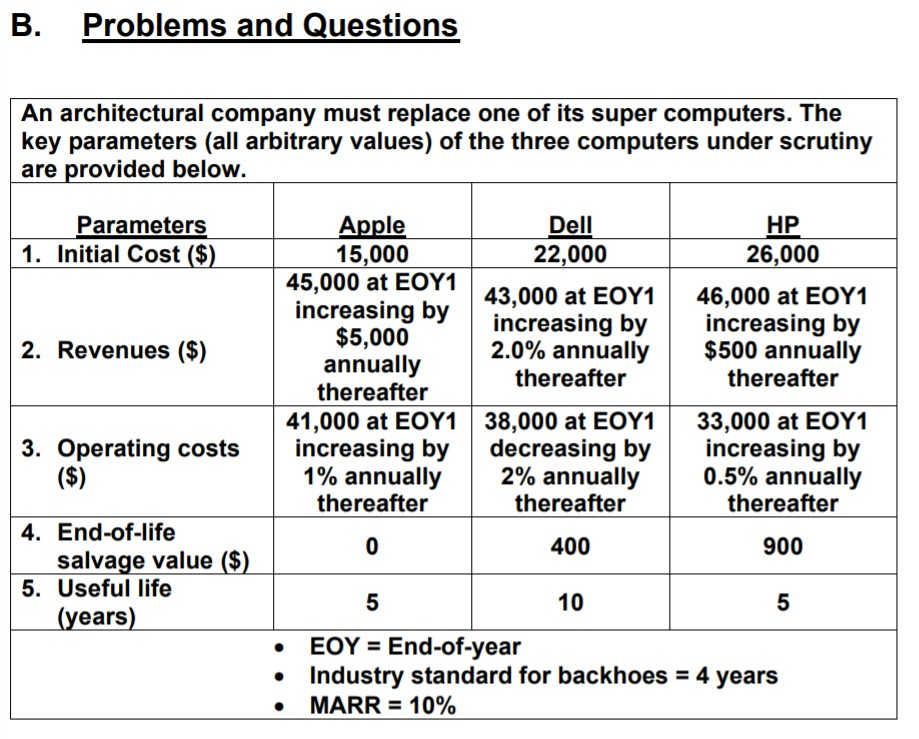

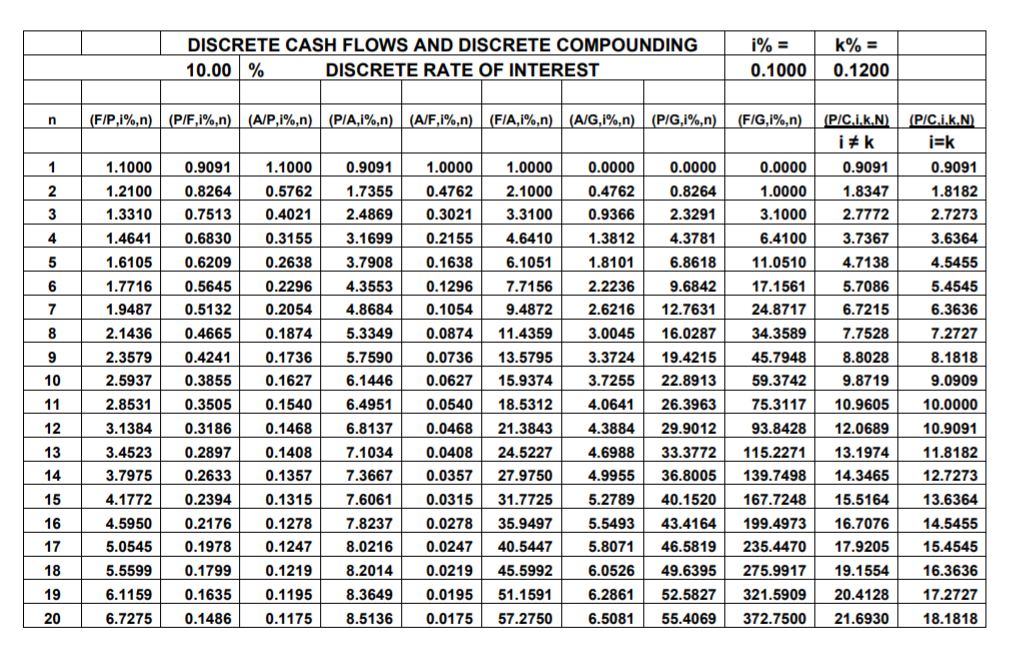

18. 18. ape Apple's Internal Rate of Return (IRR) (first decimal; no rounding) is a) 49.3%; b) 55.9%; c) 64.1%; d) 67.8%. berte de ngan cara decimal, no rounding) is HP's Internal Rate of Return (IRR) (first decimal; no rounding) is a) 43.4%; b) 48.6%; c) 53.1%; d) 59.9%. B. Problems and Questions An architectural company must replace one of its super computers. The key parameters (all arbitrary values) of the three computers under scrutiny are provided below. Parameters 1. Initial Cost ($) HP 26,000 Apple Dell 15,000 22.000 45,000 at EOY1 43,000 at EOY1 increasing by increasing by $5,000 2.0% annually annually thereafter thereafter 41,000 at EOY1 38,000 at EOY1 increasing by decreasing by 1% annually 2% annually thereafter thereafter 46,000 at EOY1 increasing by $500 annually thereafter 2. Revenues ($) 3. Operating costs ($) 33,000 at EOY1 increasing by 0.5% annually thereafter 400 900 4. End-of-life salvage value ($) 5. Useful life (years) 5 10 EOY = End-of-year Industry standard for backhoes = 4 years MARR = 10% DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING 10.00 % DISCRETE RATE OF INTEREST i% = 0.1000 k% = 0.1200 n (F/P,1%,n) (P/F,1%,n) (A/P,1%,n) (PIA,1%,n) (A/F,1%,n) (F/A,1%,n) (A/G,1%,n) (P/G,1%,n) (F/G,1%,n) 2 1.1000 1.2100 1.3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 3.7975 4.1772 4.5950 5.0545 5.5599 6.1159 6.7275 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 0.2176 0.1978 0.1799 0.1635 0.1486 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0.1219 0.1195 0.1175 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 6.4951 6.8137 7.1034 7.3667 7.6061 7.8237 .0216 8.2014 8.3649 8.5136 1.0000 0.4762 0.3021 0.2155 0.1638 0.1296 0.1054 0.0874 0.0736 0.0627 0.0540 0.0468 0.0408 0.0357 0.0315 0.0278 0.0247 0.0219 0.0195 0.0175 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5795 15.9374 18.5312 21.3843 24.5227 27.9750 31.7725 35.9497 40.5447 45.5992 51.1591 57.2750 0.0000 0.4762 0.9366 1.3812 1.8101 2.2236 2.6216 3.0045 3.3724 3.7255 4.0641 4.3884 4.6988 4.9955 5.2789 5.5493 5.8071 6.0526 6.2861 6.5081 0.0000 0.8264 2.3291 4.3781 6.8618 9.6842 12.7631 16.0287 19.4215 22.8913 26.3963 29.9012 33.3772 36.8005 40.1520 43.4164 46.5819 49.6395 52.5827 55.4069 0.0000 1.0000 3.1000 6.4100 11.0510 17.1561 24.8717 34.3589 45.7948 59.3742 75.3117 93.8428 115.2271 139.7498 167.7248 199.4973 235.4470 275.9917 321.5909 372.7500 (PIC.I.k.n) i #k 0.9091 1.8347 2.7772 3.7367 4.7138 5.7086 6.7215 7.7528 8.8028 9.8719 10.9605 12.0689 13.1974 14.3465 15.5164 16.7076 17.9205 19.1554 20.4128 21.6930 (PIC.i.k.N) i=k 0.9091 1.8182 2.7273 3.6364 4.5455 5.4545 6.3636 7.2727 8.1818 9.0909 10.0000 10.9091 11.8182 12.7273 13.6364 14.5455 15.4545 16.3636 17.2727 18.1818 11 12 13 14 15 8 16 17 18 19 20 18. 18. ape Apple's Internal Rate of Return (IRR) (first decimal; no rounding) is a) 49.3%; b) 55.9%; c) 64.1%; d) 67.8%. berte de ngan cara decimal, no rounding) is HP's Internal Rate of Return (IRR) (first decimal; no rounding) is a) 43.4%; b) 48.6%; c) 53.1%; d) 59.9%. B. Problems and Questions An architectural company must replace one of its super computers. The key parameters (all arbitrary values) of the three computers under scrutiny are provided below. Parameters 1. Initial Cost ($) HP 26,000 Apple Dell 15,000 22.000 45,000 at EOY1 43,000 at EOY1 increasing by increasing by $5,000 2.0% annually annually thereafter thereafter 41,000 at EOY1 38,000 at EOY1 increasing by decreasing by 1% annually 2% annually thereafter thereafter 46,000 at EOY1 increasing by $500 annually thereafter 2. Revenues ($) 3. Operating costs ($) 33,000 at EOY1 increasing by 0.5% annually thereafter 400 900 4. End-of-life salvage value ($) 5. Useful life (years) 5 10 EOY = End-of-year Industry standard for backhoes = 4 years MARR = 10% DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING 10.00 % DISCRETE RATE OF INTEREST i% = 0.1000 k% = 0.1200 n (F/P,1%,n) (P/F,1%,n) (A/P,1%,n) (PIA,1%,n) (A/F,1%,n) (F/A,1%,n) (A/G,1%,n) (P/G,1%,n) (F/G,1%,n) 2 1.1000 1.2100 1.3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 3.7975 4.1772 4.5950 5.0545 5.5599 6.1159 6.7275 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 0.2176 0.1978 0.1799 0.1635 0.1486 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0.1219 0.1195 0.1175 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 6.4951 6.8137 7.1034 7.3667 7.6061 7.8237 .0216 8.2014 8.3649 8.5136 1.0000 0.4762 0.3021 0.2155 0.1638 0.1296 0.1054 0.0874 0.0736 0.0627 0.0540 0.0468 0.0408 0.0357 0.0315 0.0278 0.0247 0.0219 0.0195 0.0175 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5795 15.9374 18.5312 21.3843 24.5227 27.9750 31.7725 35.9497 40.5447 45.5992 51.1591 57.2750 0.0000 0.4762 0.9366 1.3812 1.8101 2.2236 2.6216 3.0045 3.3724 3.7255 4.0641 4.3884 4.6988 4.9955 5.2789 5.5493 5.8071 6.0526 6.2861 6.5081 0.0000 0.8264 2.3291 4.3781 6.8618 9.6842 12.7631 16.0287 19.4215 22.8913 26.3963 29.9012 33.3772 36.8005 40.1520 43.4164 46.5819 49.6395 52.5827 55.4069 0.0000 1.0000 3.1000 6.4100 11.0510 17.1561 24.8717 34.3589 45.7948 59.3742 75.3117 93.8428 115.2271 139.7498 167.7248 199.4973 235.4470 275.9917 321.5909 372.7500 (PIC.I.k.n) i #k 0.9091 1.8347 2.7772 3.7367 4.7138 5.7086 6.7215 7.7528 8.8028 9.8719 10.9605 12.0689 13.1974 14.3465 15.5164 16.7076 17.9205 19.1554 20.4128 21.6930 (PIC.i.k.N) i=k 0.9091 1.8182 2.7273 3.6364 4.5455 5.4545 6.3636 7.2727 8.1818 9.0909 10.0000 10.9091 11.8182 12.7273 13.6364 14.5455 15.4545 16.3636 17.2727 18.1818 11 12 13 14 15 8 16 17 18 19 20