Answered step by step

Verified Expert Solution

Question

1 Approved Answer

18 & 19 18. Don Driller, who is 56 years old, is provided with $120,000 of group-term life insurance by his employer. Based on the

18 & 19

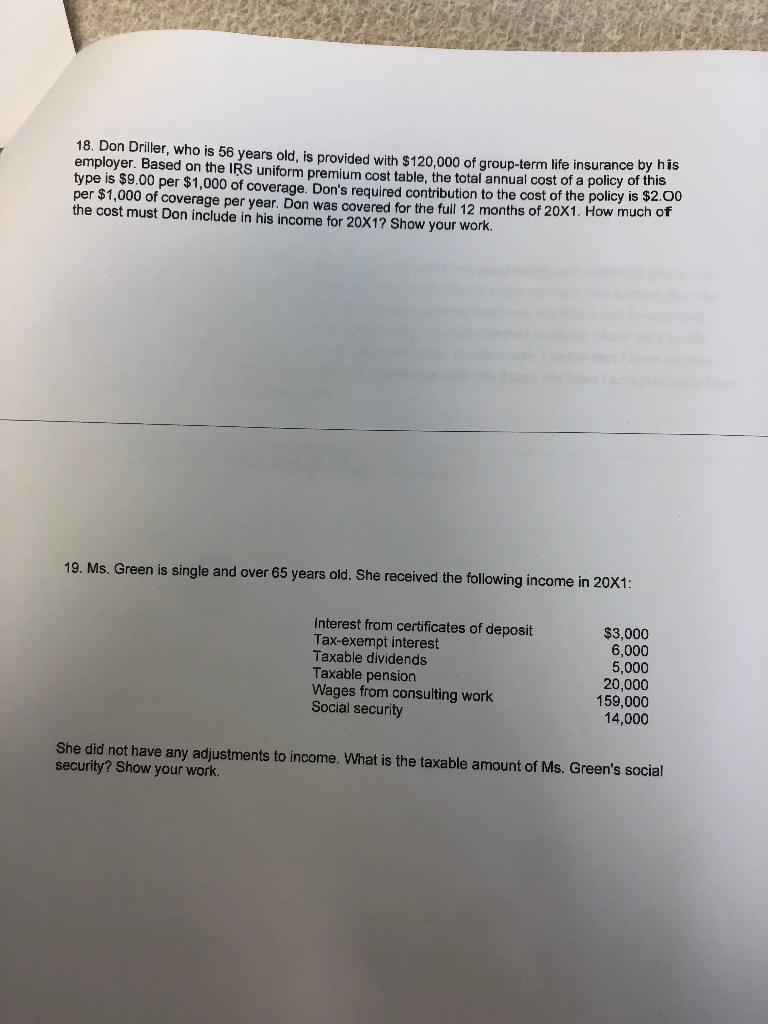

18. Don Driller, who is 56 years old, is provided with $120,000 of group-term life insurance by his employer. Based on the IS uniform premium cost table, the total annual cost of a policy of this type is $9.00 per $1,000 of coverage. Don's required contribution to the cost of the policy is $2.00 per $1,000 of coverage per year. Don was covered for the full 12 months of 20X1. How much of the cost must Don include in his income for 20X1? Show your work. 19. Ms. Green is single and over 65 years old. She received the following income in 20X1: Interest from certificates of deposit Tax-exempt interest Taxable dividends Taxable pension Wages from consulting work Social security $3,000 6,000 5,000 20,000 159,000 14,000 She did not have any adjustments to income. What is the taxable amount of Ms. Green's social security? Show your workStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started