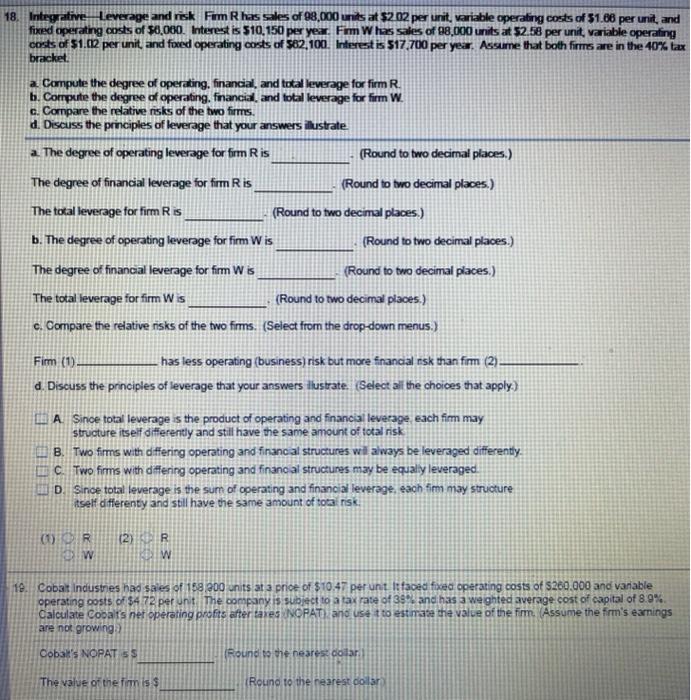

18. Integrative Leverage and risk Frm Rhas sales of 98,000 units at $2.02 per unit, variable operating costs of 51.66 per unit, and fixed operating costs of 30,000. Interest is 510,150 per year. Firm Was sales of 98.000 units at $2.58 per unit, variable operating costs of $1.612 per unit and fixed operating costs of $82,100. Interest is $17.700 per year. Assume that both firms are in the 40% tax bracket a Compute the degree of operating, financial, and total leverage for firm R. b. Compute the degree of operating, financial, and totalleverage for firm W. c. Compare the relative risks of the two firms d. Discuss the principles of leverage that your answers illustrate a. The degree of operating leverage for firm Ris (Round to two decimal places.) The degree of financial leverage for firm R is (Round to two decimal places.) The total leverage for firm Ris (Round to two decimal places) b. The degree of operating leverage for fimm W is (Round to two decimal places.) The degree of financal leverage for fimm W is (Round to two decimal places.) The total leverage for firm Wis (Round to two decimal places.) c. Compare the relative nisks of the two firms. (Select from the drop-down menus.) Fimm (1 has less operating (business) risk but more financial nsk than fimm (2) d. Discuss the prnciples of leverage that your answers illustrate. (Select all the choices that apply.) LA Since total leverage is the product of operating and financial leverage each fimm may structure itself differently and still have the same amount of total risk B. Two firms with differing operating and financial structures will always be leveraged differently. C. Two firms with differing operating and financial structures may be equally leveraged D. Since total leverage is the sum of operating and financial leverage, each fim may structure Aself different and still have the same amount of total risk DUR w (2) VER NEW 18. Cobalt industries had sales of 188 200 units at a price of $10:47 perunt lifaced fixed operating costs of $260.000 and variable operating costs of $472 per unit. The company is subject to a tax rate of 399 and has a weghted average cost of capital of 8.9% Calculate Cobalt net operating profits after taxes NOPAT) and use to estimate the value of the fim. Assume the firm's earnings are not growinga Cobal's NOPAT 55 (Round to the nearest dolari The value of the firm is $ Roung to the nearest dolar