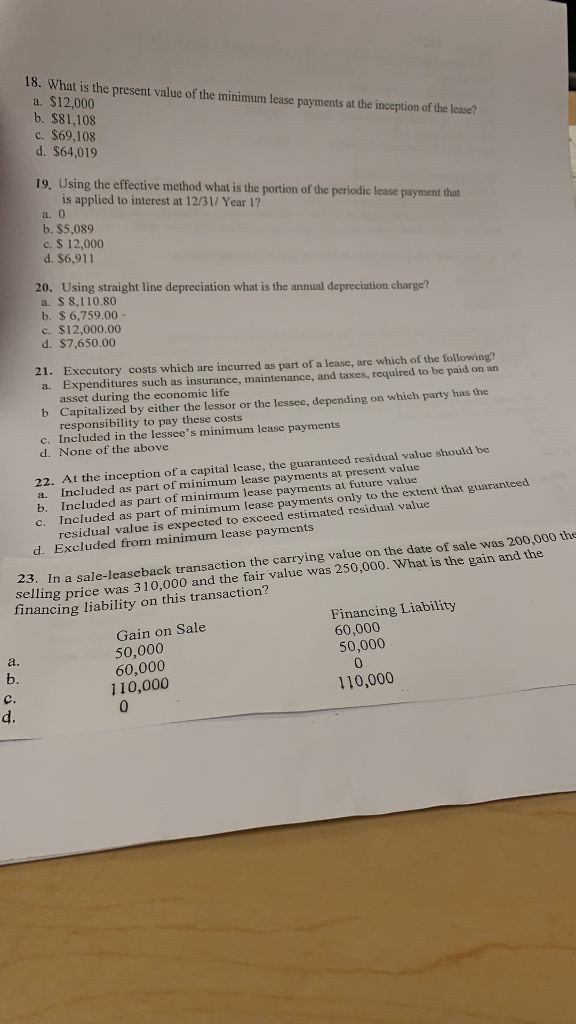

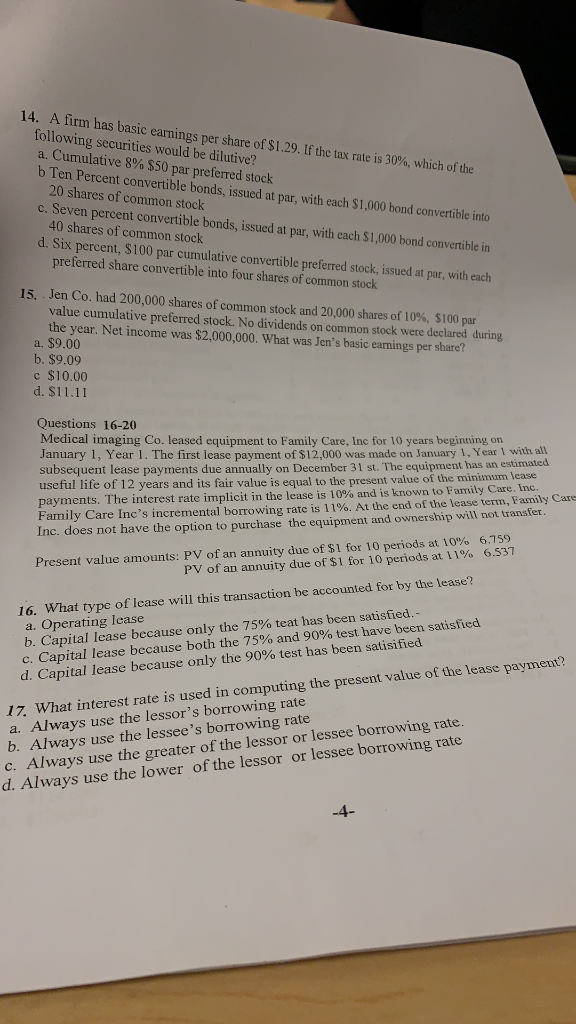

18. What is the present value of the minimum lease payments at the inception of the lease? a. $12,000 b. $81,108 c. $69,108 d. $64,019 19, Using the effective method what is the portion of the periodic lease payment that is applied to interest at 12/31/ Year 1? a. 0 b. $5,089 c. $ 12,000 d. $6,911 20. Using straight line depreciation what is the annual depreciation charge? a. $ 8,110.80 b. $ 6,759.00 c. $12,000.00 d. $7,650.00 21 fa lease, are which of the following? Execito Lch as insurance, maintenance, and taxes, required to be paid on an which are incurred as part a. asset during the economic life b Capitalized by either the lessor or the lessee, depending on which party has the responsibility to pay these um lease payments C. Included in the les see's m None of the abovo inception of a capital lease, the guaranteed residual value should be luded as part of minimum lease pay Included as part of minim lease payments only1 22. At s at present value t future value ments xtent that guaranteed Included as part of mi residual value is expected to exceed estimated residual value d. Excluded from n C. nimum lease payments value on the date of sale was 200,000 the 23. In a sale-leaseback transaction the carryi selling price was 310,000 and the fair value was 250,000. What is the gain and the financing liability on this transaction? Financing Liability 60,000 50,000 0 Gain on Sale 50,000 60,000 a. b. 110,000 110,000 c. d. 14. A firm has basic earnings per share of $1.29. If the tax rate is 30%, which of the following securities would be dilutive? a. Cumulative 8% $50 par preferred stock b Ten Percent convertible bonds, issued at par, with each $1,000 bond convertible into 20 shares of common stock c. Seven percent convertible bonds, issued at par, with each $1,000 bond convertible in 40 shares of common stock d. Six percent, $100 par cumulative convertible preferred stock, issued at par, with each preferred share convertible into four shares of common stock 15, Jen Co. had 200,000 shares of common stock and 20,000 shares of 10 % , $100 par value cumulative preferred stock. No dividends on common stock were declared during the year. Net income was $2,000,000. What was Jen's basic earnings per share? a, $9,00 b. $9.09 c $10.00 d. $11.11 Questions 16-20 Medical imaging Co. leased equipment to Family Care, Inc for 10 years beginning on January 1, Year 1. The first lease payment of $12,000 was made on January 1, Y ear 1 with all subsequent lease payments due annually on December 31 st. The equipment has an estimated useful life of 12 years and its fair value payments. The interest rate implicit in the lease is e end of the lease term, Family Car Family Care Inc's incremental borrowing Inc. does not have the option to purchase the equipment and ownership will not transfer. equal to the present value of ily Care. Inc. Present value amounts: PV of an annuity duc of $1 for 10 periods at 10% 6.759 PV of an annuity due of$1 for 10 periods at 11% 6.537 16. What type of lease will this transaction be accounted for by the lease? a. Operating Iease b. Capital c. Capital lease because both the 75% and 90 % test have been satisfied d. Capital lease because only the 90% test has been satisified ase because only the 75% teat has been satisfied. 17 What interest rate is used in computing the present value of the lease payment? a. Always use the lessor's borrowing rate b. Always use the lessee's borrowing rate c. Always use the greater of the lessor or lessee borrowing rate. d. Always use the lower of the lessor or lessee borrowing rate -4- 18. What is the present value of the minimum lease payments at the inception of the lease? a. $12,000 b. $81,108 c. $69,108 d. $64,019 19, Using the effective method what is the portion of the periodic lease payment that is applied to interest at 12/31/ Year 1? a. 0 b. $5,089 c. $ 12,000 d. $6,911 20. Using straight line depreciation what is the annual depreciation charge? a. $ 8,110.80 b. $ 6,759.00 c. $12,000.00 d. $7,650.00 21 fa lease, are which of the following? Execito Lch as insurance, maintenance, and taxes, required to be paid on an which are incurred as part a. asset during the economic life b Capitalized by either the lessor or the lessee, depending on which party has the responsibility to pay these um lease payments C. Included in the les see's m None of the abovo inception of a capital lease, the guaranteed residual value should be luded as part of minimum lease pay Included as part of minim lease payments only1 22. At s at present value t future value ments xtent that guaranteed Included as part of mi residual value is expected to exceed estimated residual value d. Excluded from n C. nimum lease payments value on the date of sale was 200,000 the 23. In a sale-leaseback transaction the carryi selling price was 310,000 and the fair value was 250,000. What is the gain and the financing liability on this transaction? Financing Liability 60,000 50,000 0 Gain on Sale 50,000 60,000 a. b. 110,000 110,000 c. d. 14. A firm has basic earnings per share of $1.29. If the tax rate is 30%, which of the following securities would be dilutive? a. Cumulative 8% $50 par preferred stock b Ten Percent convertible bonds, issued at par, with each $1,000 bond convertible into 20 shares of common stock c. Seven percent convertible bonds, issued at par, with each $1,000 bond convertible in 40 shares of common stock d. Six percent, $100 par cumulative convertible preferred stock, issued at par, with each preferred share convertible into four shares of common stock 15, Jen Co. had 200,000 shares of common stock and 20,000 shares of 10 % , $100 par value cumulative preferred stock. No dividends on common stock were declared during the year. Net income was $2,000,000. What was Jen's basic earnings per share? a, $9,00 b. $9.09 c $10.00 d. $11.11 Questions 16-20 Medical imaging Co. leased equipment to Family Care, Inc for 10 years beginning on January 1, Year 1. The first lease payment of $12,000 was made on January 1, Y ear 1 with all subsequent lease payments due annually on December 31 st. The equipment has an estimated useful life of 12 years and its fair value payments. The interest rate implicit in the lease is e end of the lease term, Family Car Family Care Inc's incremental borrowing Inc. does not have the option to purchase the equipment and ownership will not transfer. equal to the present value of ily Care. Inc. Present value amounts: PV of an annuity duc of $1 for 10 periods at 10% 6.759 PV of an annuity due of$1 for 10 periods at 11% 6.537 16. What type of lease will this transaction be accounted for by the lease? a. Operating Iease b. Capital c. Capital lease because both the 75% and 90 % test have been satisfied d. Capital lease because only the 90% test has been satisified ase because only the 75% teat has been satisfied. 17 What interest rate is used in computing the present value of the lease payment? a. Always use the lessor's borrowing rate b. Always use the lessee's borrowing rate c. Always use the greater of the lessor or lessee borrowing rate. d. Always use the lower of the lessor or lessee borrowing rate -4