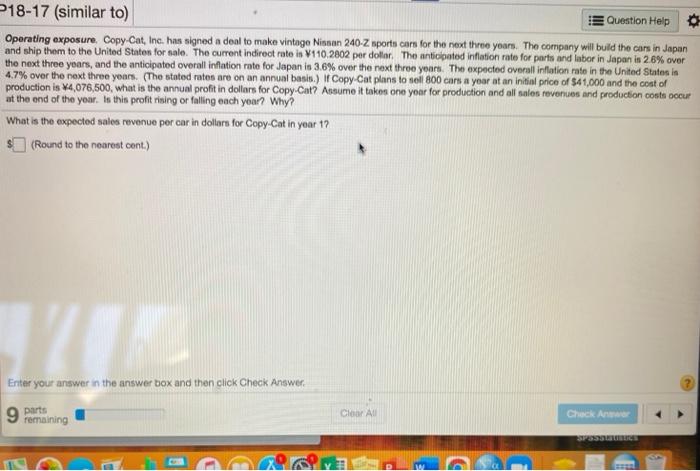

18-17 (similar to) Question Help Operating exposure Copy Cat, Inc. has signed a deal to make vintage Nissan 240-Z sports cars for the next three years. The company will build the cars in Japan and ship them to the United States for sale. The current indirect rate is 110.2802 per dollar. The anticipated inflation rate for parts and labor in Japan is 2.6% over the next three years, and the anticipated overall inflation rate for Japan is 3.6% over the next three years. The expected overall inflation rate in the United States in 4.7% over the next three years. (The stated rates are on an annual basis.) If Copy Cat plans to soll 800 cars a year at an initial price of $41,000 and the cost of production is 44,076,500, what is the annual profit in dollars for Copy Cat? Assume it takes one year for production and all sales revenues and production costs occur at the end of the year. Is this profit rining or falling each year? Why What is the expected sales revenue por car in dollars for Copy-Cat in year 1? (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer 9 Pemaining parts Clear All Check And 18-17 (similar to) Question Help Operating exposure Copy Cat, Inc. has signed a deal to make vintage Nissan 240-Z sports cars for the next three years. The company will build the cars in Japan and ship them to the United States for sale. The current indirect rate is 110.2802 per dollar. The anticipated inflation rate for parts and labor in Japan is 2.6% over the next three years, and the anticipated overall inflation rate for Japan is 3.6% over the next three years. The expected overall inflation rate in the United States in 4.7% over the next three years. (The stated rates are on an annual basis.) If Copy Cat plans to soll 800 cars a year at an initial price of $41,000 and the cost of production is 44,076,500, what is the annual profit in dollars for Copy Cat? Assume it takes one year for production and all sales revenues and production costs occur at the end of the year. Is this profit rining or falling each year? Why What is the expected sales revenue por car in dollars for Copy-Cat in year 1? (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer 9 Pemaining parts Clear All Check And