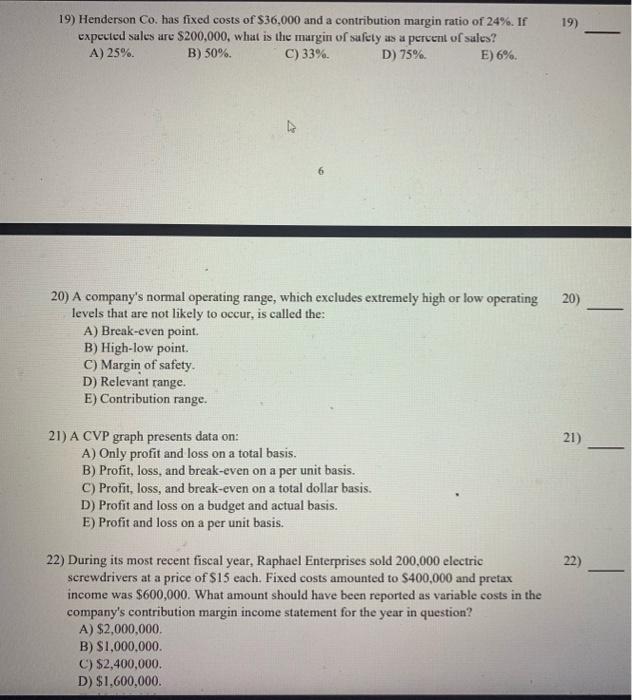

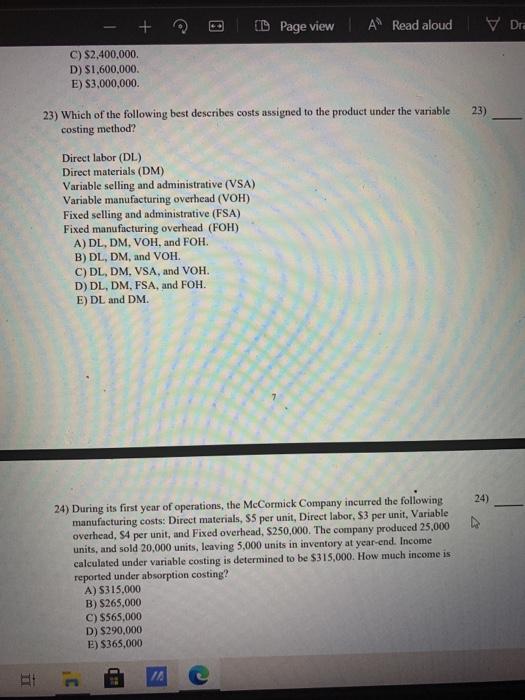

19) 19) Henderson Co. has fixed costs of $36,000 and a contribution margin ratio of 24%. If expected sales are $200,000, what is the margin of safety as a percent of sales? A) 25%. B) 50% C) 33%. D) 75% E) 6%. 6 20) 20) A company's normal operating range, which excludes extremely high or low operating levels that are not likely to occur, is called the: A) Break-even point B) High-low point. C) Margin of safety D) Relevant range. E) Contribution range. 21) 21) A CVP graph presents data on: A) Only profit and loss on a total basis. B) Profit, loss, and break-even on a per unit basis. C) Profit, loss, and break-even on a total dollar basis. D) Profit and loss on a budget and actual basis. E) Profit and loss on a per unit basis. 22) 22) During its most recent fiscal year, Raphael Enterprises sold 200.000 electric screwdrivers at a price of $15 each. Fixed costs amounted to $400,000 and pretax income was $600,000. What amount should have been reported as variable costs in the company's contribution margin income statement for the year in question? A) $2,000,000 B) $1,000,000 C) $2,400,000 D) $1,600,000. + ID Page view A Read aloud V Dra C) $2,400.000 D) $1,600,000 E) $3.000.000 23) 23) Which of the following best describes costs assigned to the product under the variable costing method? Direct labor (DL) Direct materials (DM) Variable selling and administrative (VSA) Variable manufacturing overhead (VOH) Fixed selling and administrative (FSA) Fixed manufacturing overhead (FOH) A) DL, DM, VOH, and FOH. B) DL, DM, and VOH. C) DL, DM. VSA, and VOH. D) DL, DM, FSA, and FOH. E) DL and DM 24) 24) During its first year of operations, the McCormick Company incurred the following manufacturing costs: Direct materials, 55 per unit, Direct labor, 53 per unit, Variable overhead, S4 per unit, and Fixed overhead, S250,000. The company produced 25,000 units, and sold 20,000 units, leaving 5,000 units in inventory at year-end. Income calculated under variable costing is determined to be $315,000. How much income is reported under absorption costing? A) S315.000 B) S265,000 C) $565.000 D) $290,000 E) $365,000 C