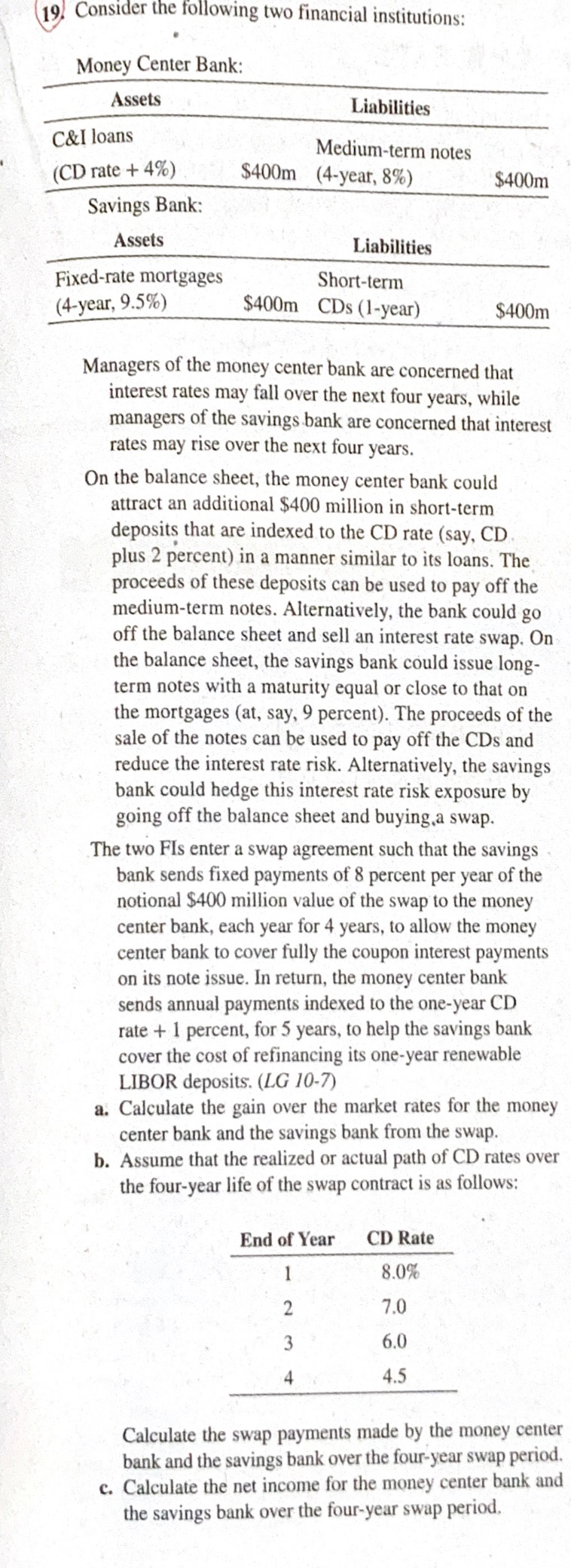

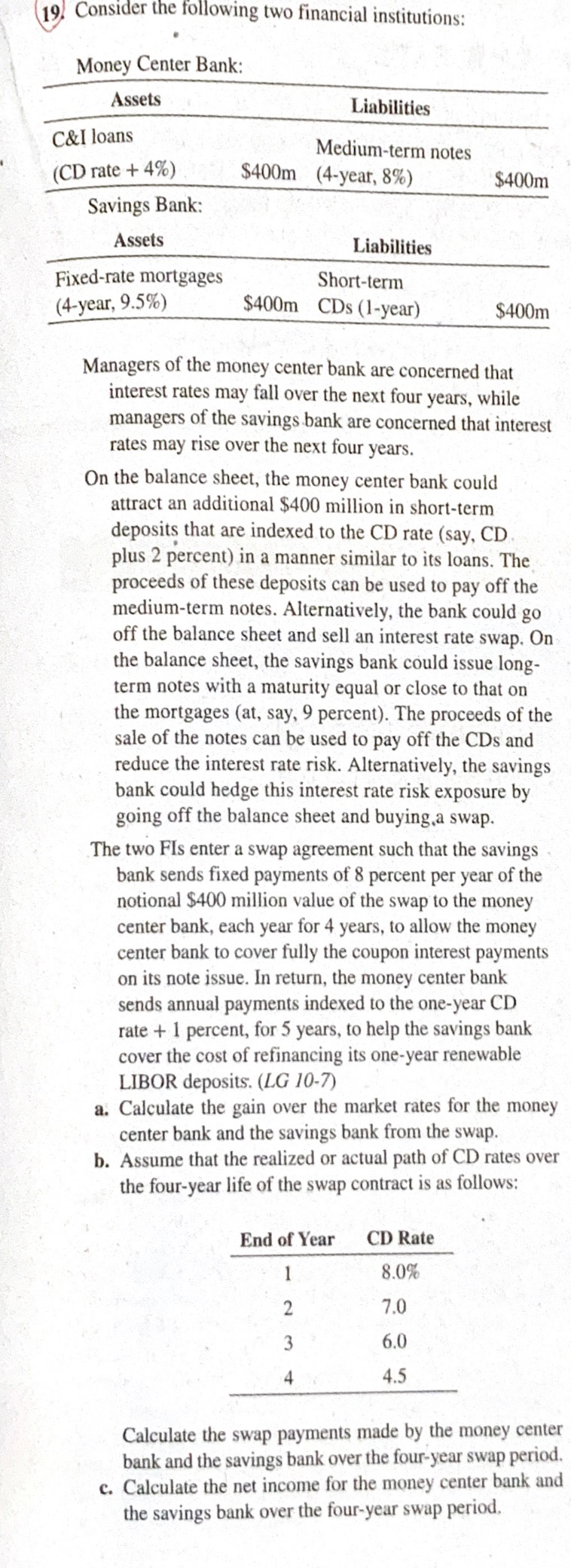

19. Consider the following two financial institutions: Money Center Bank: Assets Liabilities C&I loans Medium-term notes $400m (4-year, 8%) $400m (CD rate + 4%) Savings Bank: Assets Liabilities Fixed-rate mortgages Short-term $400m CDs (1-year) (4-year, 9.5%) $400m Managers of the money center bank are concerned that interest rates may fall over the next four years, while managers of the savings bank are concerned that interest rates may rise over the next four years. On the balance sheet, the money center bank could attract an additional $400 million in short-term deposits that are indexed to the CD rate (say, CD plus 2 percent) in a manner similar to its loans. The proceeds of these deposits can be used to pay off the medium-term notes. Alternatively, the bank could go off the balance sheet and sell an interest rate swap. On the balance sheet, the savings bank could issue long- term notes with a maturity equal or close to that on the mortgages (at, say, 9 percent). The proceeds of the sale of the notes can be used to pay off the CDs and reduce the interest rate risk. Alternatively, the savings bank could hedge this interest rate risk exposure by going off the balance sheet and buying,a swap. The two Fls enter a swap agreement such that the savings bank sends fixed payments of 8 percent per year of the notional $400 million value of the swap to the money center bank, each year for 4 years, to allow the money center bank to cover fully the coupon interest payments on its note issue. In return, the money center bank sends annual payments indexed to the one-year CD rate + 1 percent, for 5 years, to help the savings bank cover the cost of refinancing its one-year renewable LIBOR deposits. (LG 10-7) a. Calculate the gain over the market rates for the money center bank and the savings bank from the swap. b. Assume that the realized or actual path of CD rates over the four-year life of the swap contract is as follows: End of Year CD Rate 8.0% 2 7.0 3 6.0 4 4.5 Calculate the swap payments made by the money center bank and the savings bank over the four-year swap period. c. Calculate the net income for the money center bank and the savings bank over the four-year swap period. 19. Consider the following two financial institutions: Money Center Bank: Assets Liabilities C&I loans Medium-term notes $400m (4-year, 8%) $400m (CD rate + 4%) Savings Bank: Assets Liabilities Fixed-rate mortgages Short-term $400m CDs (1-year) (4-year, 9.5%) $400m Managers of the money center bank are concerned that interest rates may fall over the next four years, while managers of the savings bank are concerned that interest rates may rise over the next four years. On the balance sheet, the money center bank could attract an additional $400 million in short-term deposits that are indexed to the CD rate (say, CD plus 2 percent) in a manner similar to its loans. The proceeds of these deposits can be used to pay off the medium-term notes. Alternatively, the bank could go off the balance sheet and sell an interest rate swap. On the balance sheet, the savings bank could issue long- term notes with a maturity equal or close to that on the mortgages (at, say, 9 percent). The proceeds of the sale of the notes can be used to pay off the CDs and reduce the interest rate risk. Alternatively, the savings bank could hedge this interest rate risk exposure by going off the balance sheet and buying,a swap. The two Fls enter a swap agreement such that the savings bank sends fixed payments of 8 percent per year of the notional $400 million value of the swap to the money center bank, each year for 4 years, to allow the money center bank to cover fully the coupon interest payments on its note issue. In return, the money center bank sends annual payments indexed to the one-year CD rate + 1 percent, for 5 years, to help the savings bank cover the cost of refinancing its one-year renewable LIBOR deposits. (LG 10-7) a. Calculate the gain over the market rates for the money center bank and the savings bank from the swap. b. Assume that the realized or actual path of CD rates over the four-year life of the swap contract is as follows: End of Year CD Rate 8.0% 2 7.0 3 6.0 4 4.5 Calculate the swap payments made by the money center bank and the savings bank over the four-year swap period. c. Calculate the net income for the money center bank and the savings bank over the four-year swap period