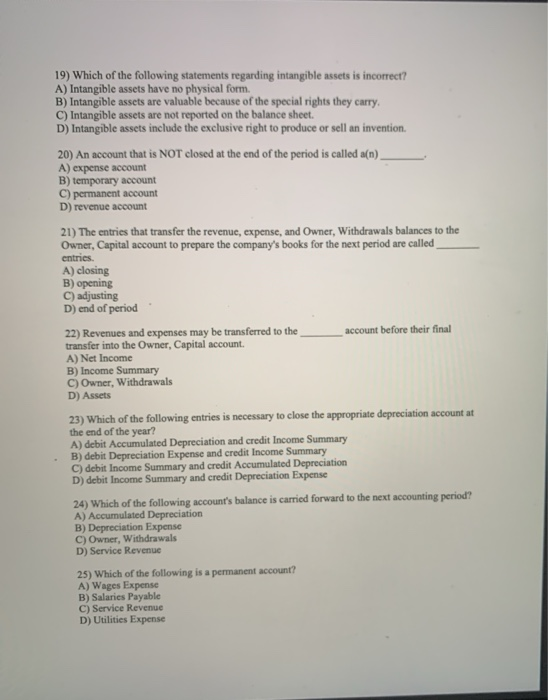

19) Which of the following statements regarding intangible assets is incorrect? A) Intangible assets have no physical form. B) Intangible assets are valuable because of the special rights they carry, C) Intangible assets are not reported on the balance sheet. D) Intangible assets include the exclusive right to produce or sell an invention 20) An account that is NOT closed at the end of the period is called a(n). A) expense account B) temporary account C) permanent account D) revenue account 21) The entries that transfer the revenue, expense, and Owner, Withdrawals balances to the Owner, Capital account to prepare the company's books for the next period are called entries. A) closing B) opening C) adjusting D) end of period account before their final 22) Revenues and expenses may be transferred to the transfer into the owner, Capital account. A) Net Income B) Income Summary C) Owner, Withdrawals D) Assets 23) Which of the following entries is necessary to close the appropriate depreciation account at the end of the year? A) debit Accumulated Depreciation and credit Income Summary B) debit Depreciation Expense and credit Income Summary C) debit Income Summary and credit Accumulated Depreciation D) dcbit Income Summary and credit Depreciation Expense 24) Which of the following account's balance is carried forward to the next accounting period? A) Accumulated Depreciation B) Depreciation Expense C) Owner, Withdrawals D) Service Revenue 25) Which of the following is a permanent account? A) Wages Expense B) Salaries Payable C) Service Revenue D) Utilities Expense 19) Which of the following statements regarding intangible assets is incorrect? A) Intangible assets have no physical form. B) Intangible assets are valuable because of the special rights they carry, C) Intangible assets are not reported on the balance sheet. D) Intangible assets include the exclusive right to produce or sell an invention 20) An account that is NOT closed at the end of the period is called a(n). A) expense account B) temporary account C) permanent account D) revenue account 21) The entries that transfer the revenue, expense, and Owner, Withdrawals balances to the Owner, Capital account to prepare the company's books for the next period are called entries. A) closing B) opening C) adjusting D) end of period account before their final 22) Revenues and expenses may be transferred to the transfer into the owner, Capital account. A) Net Income B) Income Summary C) Owner, Withdrawals D) Assets 23) Which of the following entries is necessary to close the appropriate depreciation account at the end of the year? A) debit Accumulated Depreciation and credit Income Summary B) debit Depreciation Expense and credit Income Summary C) debit Income Summary and credit Accumulated Depreciation D) dcbit Income Summary and credit Depreciation Expense 24) Which of the following account's balance is carried forward to the next accounting period? A) Accumulated Depreciation B) Depreciation Expense C) Owner, Withdrawals D) Service Revenue 25) Which of the following is a permanent account? A) Wages Expense B) Salaries Payable C) Service Revenue D) Utilities Expense