Question

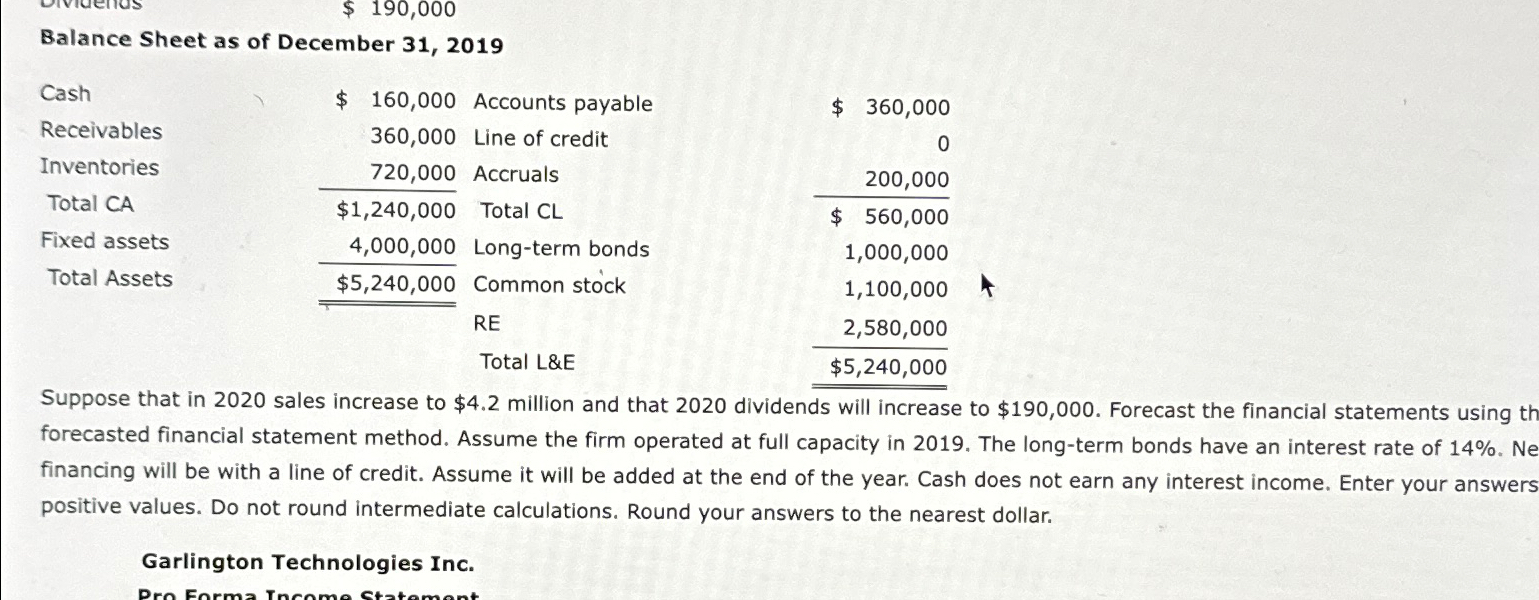

$190,000 Balance Sheet as of December 31, 2019 Suppose that in 2020 sales increase to $4.2 million and that 2020 dividends will increase to

$190,000\ Balance Sheet as of December 31, 2019\ Suppose that in 2020 sales increase to

$4.2million and that 2020 dividends will increase to

$190,000. Forecast the financial statements using th forecasted financial statement method. Assume the firm operated at full capacity in 2019. The long-term bonds have an interest rate of

14%. Ne financing will be with a line of credit. Assume it will be added at the end of the year. Cash does not earn any interest income. Enter your answers positive values. Do not round intermediate calculations. Round your answers to the nearest dollar.\ Garlington Technologies Inc.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started