Answered step by step

Verified Expert Solution

Question

1 Approved Answer

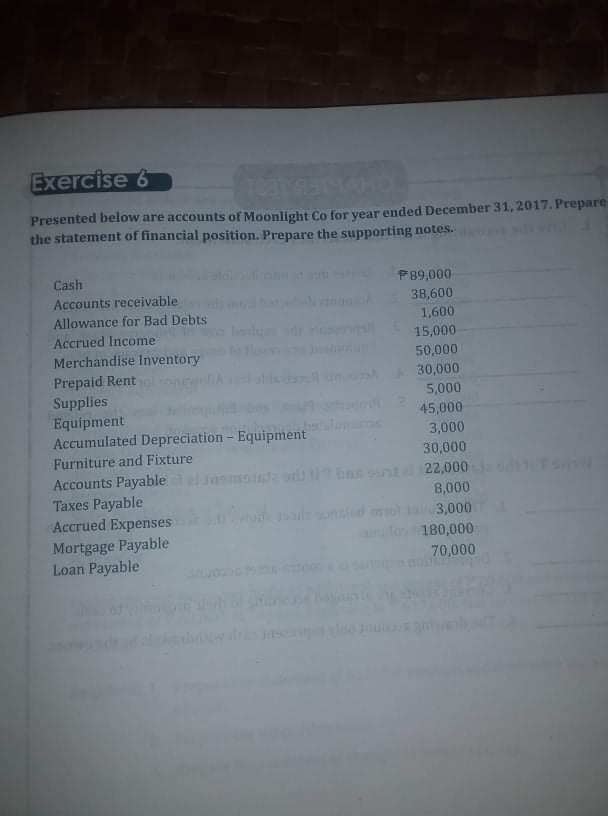

Exercise 6 Presented below are accounts of Moonlight Co for year ended December 31, 2017. Prepare the statement of financial position. Prepare the supporting notes.

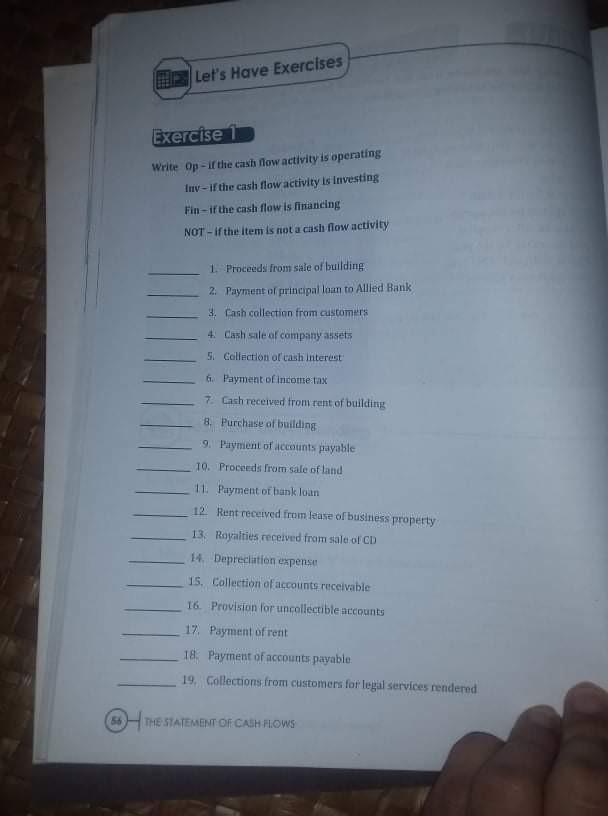

Exercise 6 Presented below are accounts of Moonlight Co for year ended December 31, 2017. Prepare the statement of financial position. Prepare the supporting notes. Cash Accounts receivable Allowance for Bad Debts Accrued Income Merchandise Inventory Prepaid Rent Supplies Equipment Accumulated Depreciation - Equipment Furniture and Fixture Accounts Payable Taxes Payable Accrued Expenses Mortgage Payable Loan Payable P89.000 38,600 1,600 15,000 50,000 30,000 5,000 45,000 3,000 30,000 22,000 8,000 3,000 180,000 70,000 Let's Have Exercises Exercise 1 Write Op - if the cash flow activity is operating Imv-If the cash flow activity is Investing Fin- if the cash flow is financing NOT - If the item is not a cash flow activity 1. Proceeds from sale of building 2. Payment of principal loan to Allied Bank 3. Cash collection from customers 4. Cash sale of company assets 5. Collection of cash interest 6. Payment of income tax 7. Cash received from rent of building 8. Purchase of building 9. Payment of accounts payable 10. Proceeds from sale of land 11. Payment of bank loan 12 Rent received from lease of business property 13. Royalties received from sale of CD 14 Depreciation expense 15. Collection of accounts receivable 16. Provision for uncollectible accounts 17. Payment of rent 18. Payment of accounts payable 19. Collections from customers for legal services rendered 56 THE STATEMENT OF CASH FLOWS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started