Question

1.ABC Company has sales of $600,000 in January. Past experience suggests that 40% of sales is cash sale. Of its credit sales, 55% is paid

1.ABC Company has sales of $600,000 in January. Past experience suggests that 40% of sales is cash sale. Of its credit sales, 55% is paid in the month following the sale, and 40% is paid in the second month following the sale. The rest is bad debt. The amount of cash collection from January sales in February is:

a.$330,000

b.$198,000

c.$144,000

d.$132,000

600,000*55%=330,000

2. Cash budget is NOT based on:

a. Variable Overheads budget

b. Production budget

c. Capital Expenditure budget

d. Sales budget

3. A business plans to make 15,000 coats per annum, each taking the 1.5 direct labour hours. If the direct labour rate is $8 per hour and a pay rise of 15% is awarded halfway through the year, what is the total annual direct labour budget?

a.$207,000

b.$193,500

c.$120,000

d.$180,000

Total labor cost = 15000 coats x 1.5 labor hour x $8 per hou = $180000

First half = $180000 / 2 = $90000

Second half awarded 15% extra = $90000 x 1.15 = $103500

Total Direct labor budget = $90000 + $103500 = $193,500.

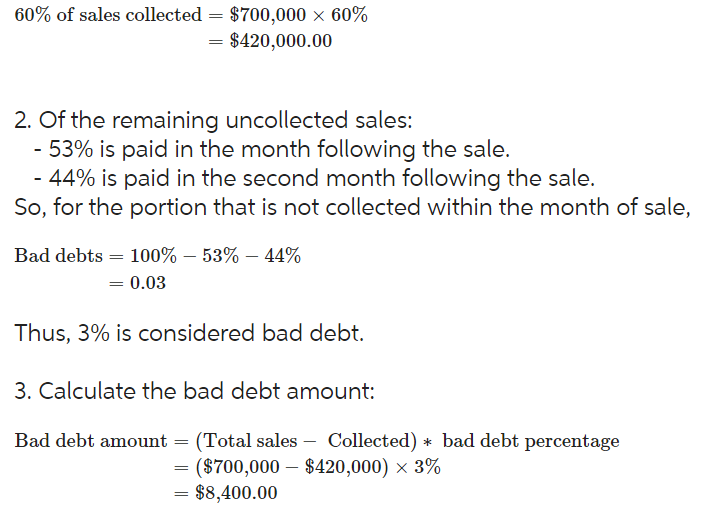

4. ABC Company has sales of $700,000 in January. Normally, 60% of sales is collected within the month of sales. Of its remaining uncollected sales, 53% is paid in the month following the sale, and 44% is paid in the second month following the sale. The rest is bad debt. The amount of bad debt from January sales is:

a.$12,600

b.$8,400

c. Cannot be determined

d.$21,000

5.Which of the following is not needed in preparing a production budget?

a. Opening balance of inventory

b. Closing balance of inventory

c. Sales

d. Production cost per unit

6. Bruno Industries expects credit sales for January, February, and March to be $200,000, $260,000, and $300,000, respectively. It is expected that 55% of the sales will be collected in the month of sale, 35% will be collected in the following month, and 10% will be collected in the second month after the sales. Closing balance of Accounts Receivable at the end of March is expected to be:

a.$161,000

b.$155,000

c.$121,000

d.$135,000

60%ofsalescollected=$700,00060%=$420,000.00 2. Of the remaining uncollected sales: - 53% is paid in the month following the sale. - 44% is paid in the second month following the sale. So, for the portion that is not collected within the month of sale, Baddebts=100%53%44%=0.03 Thus, 3% is considered bad debt. 3. Calculate the bad debt amount: Baddebtamount=(TotalsalesCollected)baddebtpercentage=($700,000$420,000)3%=$8,400.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started