Question

1Aguila Sweets Factory manufactures coconut candy called Coco which is sold for P50 per box. The manufacturingl process also yields a by-product named Soloc. Without

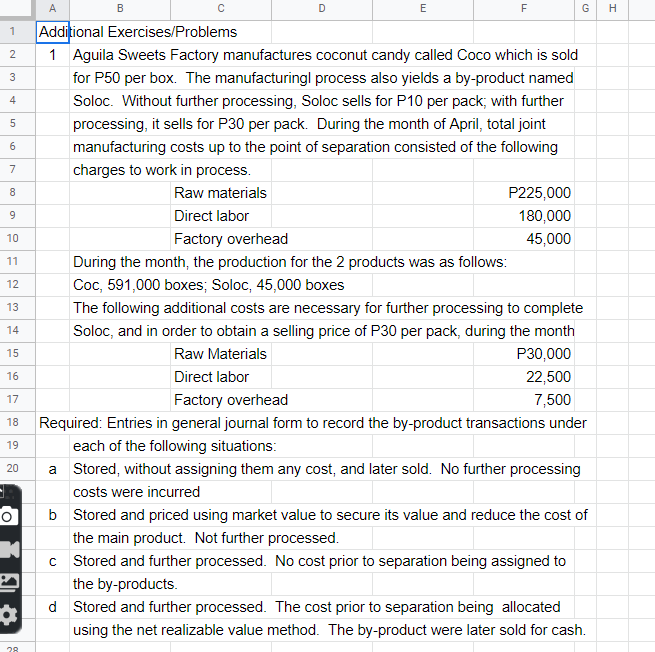

1Aguila Sweets Factory manufactures coconut candy called Coco which is sold

for P50 per box. The manufacturingl process also yields a by-product named

Soloc. Without further processing, Soloc sells for P10 per pack; with further

processing, it sells for P30 per pack. During the month of April, total joint

manufacturing costs up to the point of separation consisted of the following

charges to work in process.

Raw materials: P225,000

Direct labor: 180,000

Factory overhead: 45,000

During the month, the production for the 2 products was as follows:

Coc, 591,000 boxes;

Soloc, 45,000 boxes

The following additional costs are necessary for further processing to complete

Soloc, and in order to obtain a selling price of P30 per pack, during the month

Raw Materials: P30,000

Direct labor: 22,500

Factory overhead: 7,500

Required: Entries in general journal form to record the by-product transactions under

each of the following situations:

a.) Stored, without assigning them any cost, and later sold. No further processing

costs were incurred

b.) Stored and priced using market value to secure its value and reduce the cost of

the main product. Not further processed.

c.) Stored and further processed. No cost prior to separation being assigned to

the by-products.

d.) Stored and further processed. The cost prior to separation being allocated

using the net realizable value method. The by-product were later sold for cash.

1 2 3 4 60 5 A Additional Exercises/Problems D E F G H 1 Aguila Sweets Factory manufactures coconut candy called Coco which is sold for P50 per box. The manufacturingl process also yields a by-product named Soloc. Without further processing, Soloc sells for P10 per pack; with further processing, it sells for P30 per pack. During the month of April, total joint manufacturing costs up to the point of separation consisted of the following charges to work in process. 7 8 Raw materials P225,000 9 Direct labor 180,000 10 Factory overhead 45,000 11 12 During the month, the production for the 2 products was as follows: Coc, 591,000 boxes; Soloc, 45,000 boxes 13 14 The following additional costs are necessary for further processing to complete Soloc, and in order to obtain a selling price of P30 per pack, during the month Raw Materials Direct labor P30,000 22,500 7,500 15 16 17 Factory overhead 18 Required: Entries in general journal form to record the by-product transactions under each of the following situations: 19 20 20 a Stored, without assigning them any cost, and later sold. No further processing costs were incurred b Stored and priced using market value to secure its value and reduce the cost of the main product. Not further processed. c Stored and further processed. No cost prior to separation being assigned to the by-products. d Stored and further processed. The cost prior to separation being allocated using the net realizable value method. The by-product were later sold for cash. 28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started