Question

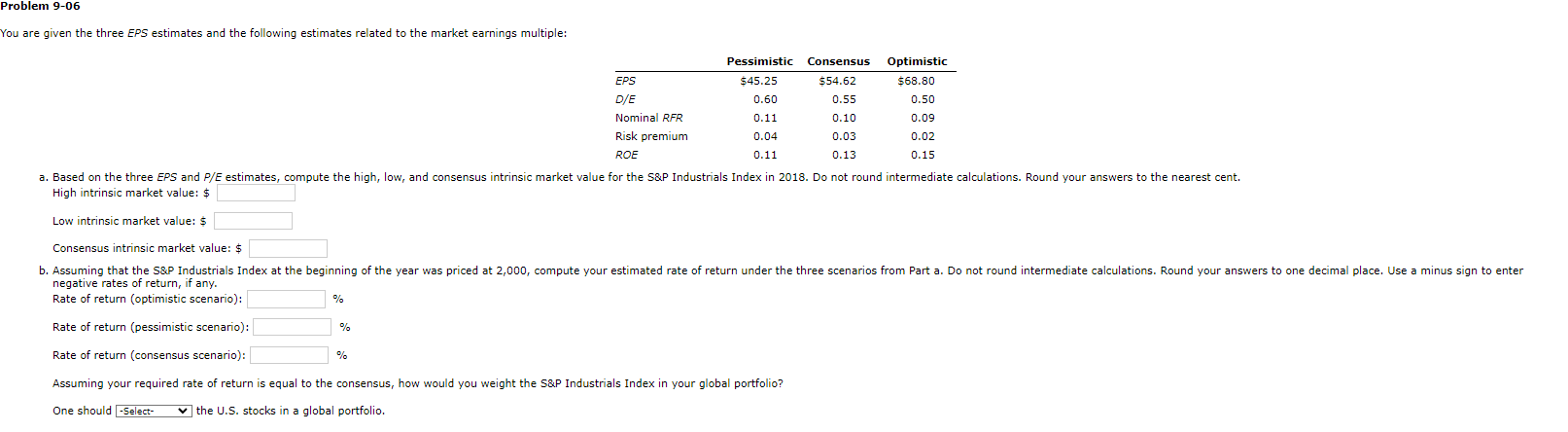

1.Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P Industrials Index in 2018. Do

1.Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P Industrials Index in 2018. Do not round intermediate calculations. Round your answers to the nearest cent.

1.Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P Industrials Index in 2018. Do not round intermediate calculations. Round your answers to the nearest cent.

High intrinsic market value: $

Low intrinsic market value: $

Consensus intrinsic market value: $

2.Assuming that the S&P Industrials Index at the beginning of the year was priced at 2,000, compute your estimated rate of return under the three scenarios from Part a. Do not round intermediate calculations. Round your answers to one decimal place. Use a minus sign to enter negative rates of return, if any.

Rate of return (optimistic scenario): %

Rate of return (pessimistic scenario): %

Rate of return (consensus scenario): %

Assuming your required rate of return is equal to the consensus, how would you weight the S&P Industrials Index in your global portfolio?

One should -Select-underweightoverweightItem 7 the U.S. stocks in a global portfolio.

You are given the three EPS estimates and the following estimates related to the market earnings multiple: High intrinsic market value: $ Low intrinsic market value: \$ Consensus intrinsic market value: \$ negative rates of return, if any. Rate of return (optimistic scenario): Rate of return (pessimistic scenario): Rate of return (consensus scenario): % Assuming your required rate of return is equal to the consensus, how would you weight the S\&P Industrials Index in your global portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started