Question

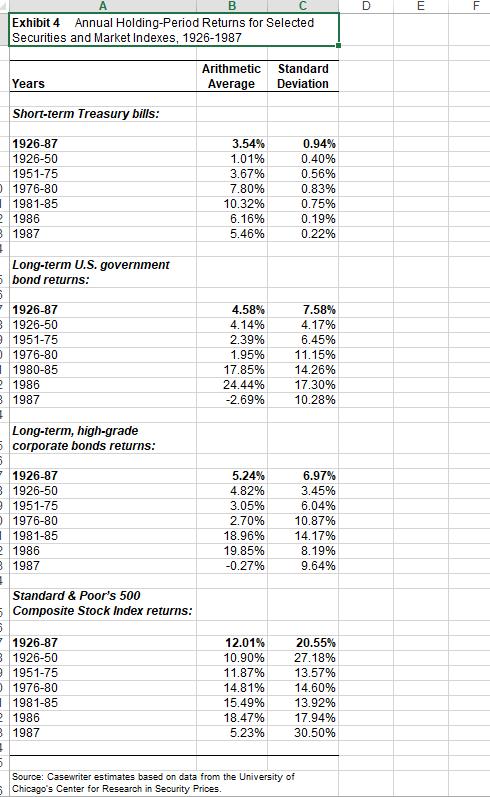

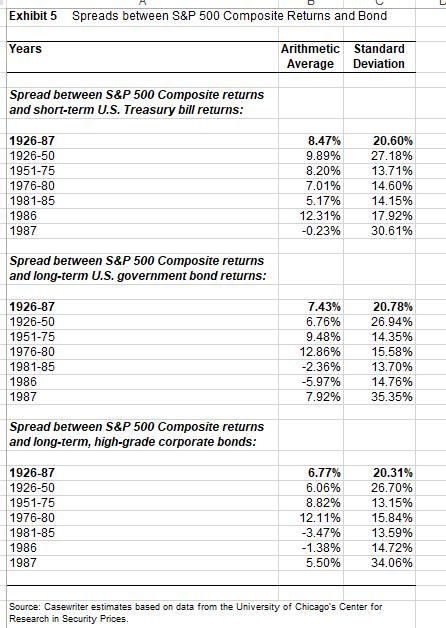

1.Compute the WACC for Marriott Corporation. What risk-free rate and risk premium did you use to calculate the cost of equity? How did you measure

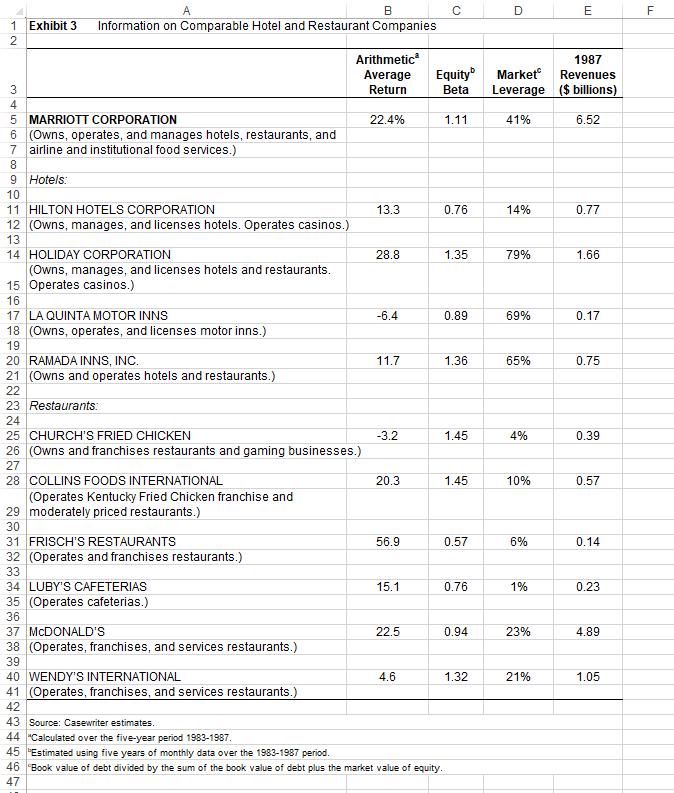

1.Compute the WACC for Marriott Corporation. What risk-free rate and risk premium did you use to calculate the cost of equity? How did you measure Marriott’s cost of debt? 2. What type of investments would you value using Marriott’s WACC? [Divisional Hurdle Rates] 3. What is the overall WACC used for? When should Marriott use divisional hurdle rates? 4. If Marriott uses a single corporate hurdle rate for evaluating investment opportunities in each of its lines of business, what would happen to the company over time? 5. Explain how divisional hurdle rates are measured? a. Using comparable to get divisional betas b. Divisional leverage and debt rates 6. Estimate the hurdle rates of each division.

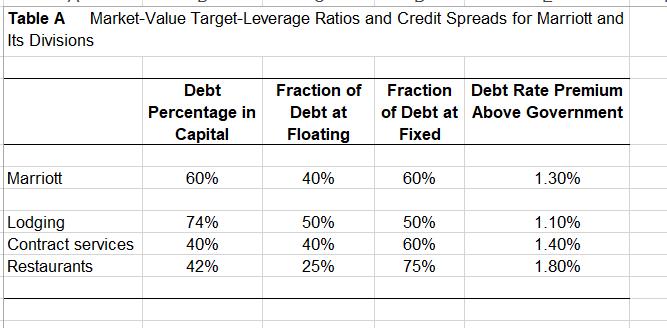

Table A Market-Value Target-Leverage Ratios and Credit Spreads for Marriott and Its Divisions Marriott Lodging Contract services Restaurants Debt Percentage in Capital 60% 74% 40% 42% Fraction of Debt at Floating 40% 50% 40% 25% Fraction Debt Rate Premium of Debt at Above Government Fixed 60% 50% 60% 75% 1.30% 1.10% 1.40% 1.80%

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Introduction The events surrounding the killing of George Floyd in 2020 ignited widespread protests and discussions about systemic racism and discrimination particularly within law enforcement In resp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started