Question

1.Identify the statement(s) below that correctly characterize(s) property interests held by Marcel that, at death, pass by operation of law. I.If the property passes according

1.Identify the statement(s) below that correctly characterize(s) property interests held by Marcel that, at death, pass by operation of law.

I.If the property passes according to the operation of law, the property avoids probate.

II.If the property passes according to the operation of law, it will not be included in the decedents gross estate.

III.Property that passes by operation of law cannot qualify for the marital deduction.

IV.The titling on the instrument determines who shall receive the property.

a.I only

b.I, II, and III only

c.I and IV only

d.I, II, and IV only

e.II and III only

2.As Marcel and Clio think about the value of their adjusted gross estate, they are unsure which assets and expenses might be deductible. Which of the following is a deduction from the gross estate used to calculate the adjusted gross estate?

a.Costs associated with maintaining estate assets.

b.Nontaxable gifts made within three years.

c.Federal estate tax marital deduction.

d.Property inherited from others.

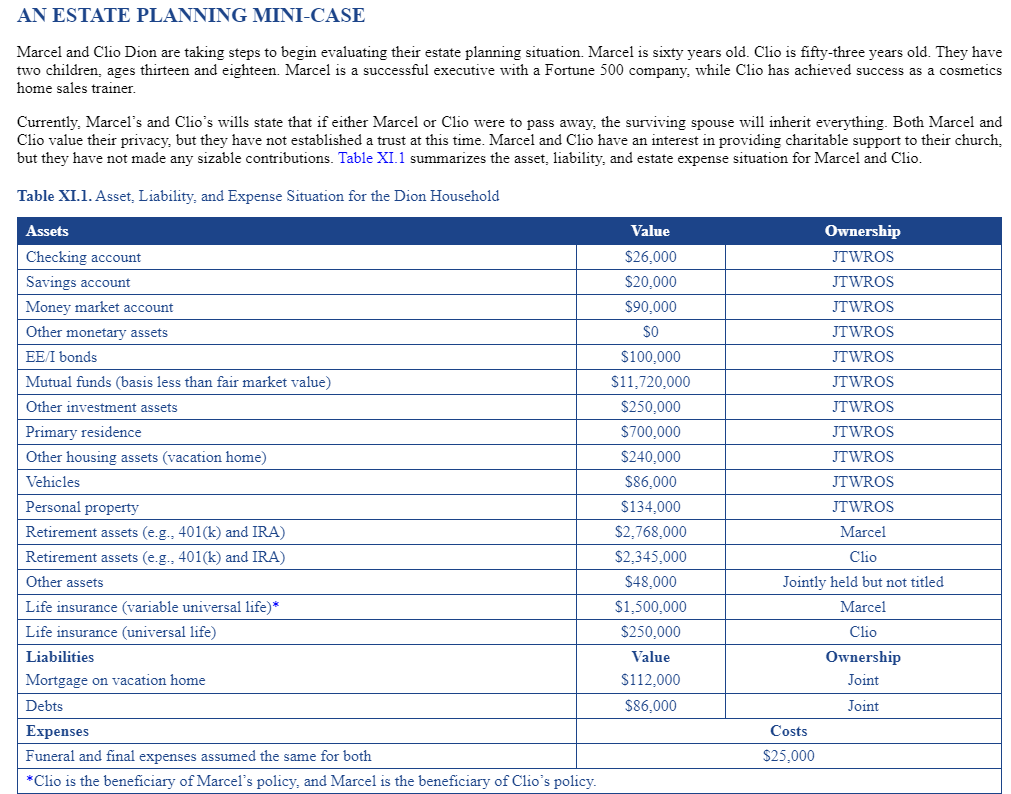

AN ESTATE PLANNING MINI-CASE Marcel and Clio Dion are taking steps to begin evaluating their estate planning situation. Marcel is sixty years old. Clio is fifty-three years old. They have two children, ages thirteen and eighteen. Marcel is a successful executive with a Fortune 500 company, while Clio has achieved success as a cosmetics home sales trainer. Currently, Marcel's and Clio's wills state that if either Marcel or Clio were to pass away, the surviving spouse will inherit everything. Both Marcel and Clio value their privacy, but they have not established a trust at this time. Marcel and Clio have an interest in providing charitable support to their church, but they have not made any sizable contributions. Table XI.1 summarizes the asset. liability, and estate expense situation for Marcel and Clio. Table XI.1. Asset, Liability, and Expense Situation for the Dion Household Value $26,000 $20,000 $90,000 $0 Assets Checking account Savings account Money market account Other monetary assets EE/I bonds Mutual funds (basis less than fair market value) Other investment assets Primary residence Other housing assets (vacation home) Vehicles Personal property Retirement assets (e.g., 401(k) and IRA) Retirement assets (e.g., 401(k) and IRA) Other assets Life insurance (variable universal life)* Life insurance (universal life) Liabilities Mortgage on vacation home Debts Expenses Funeral and final expenses assumed the same for both *Clio is the beneficiary of Marcel's policy, and Marcel is the beneficiary of Clio's policy. $100,000 $11,720,000 $250,000 $700,000 $240,000 $86,000 $134,000 $2,768,000 $2,345,000 $48,000 $1,500,000 $250,000 Value $112,000 $86,000 Ownership JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS Marcel Clio Jointly held but not titled Marcel Clio Ownership Joint Joint Costs $25,000 AN ESTATE PLANNING MINI-CASE Marcel and Clio Dion are taking steps to begin evaluating their estate planning situation. Marcel is sixty years old. Clio is fifty-three years old. They have two children, ages thirteen and eighteen. Marcel is a successful executive with a Fortune 500 company, while Clio has achieved success as a cosmetics home sales trainer. Currently, Marcel's and Clio's wills state that if either Marcel or Clio were to pass away, the surviving spouse will inherit everything. Both Marcel and Clio value their privacy, but they have not established a trust at this time. Marcel and Clio have an interest in providing charitable support to their church, but they have not made any sizable contributions. Table XI.1 summarizes the asset. liability, and estate expense situation for Marcel and Clio. Table XI.1. Asset, Liability, and Expense Situation for the Dion Household Value $26,000 $20,000 $90,000 $0 Assets Checking account Savings account Money market account Other monetary assets EE/I bonds Mutual funds (basis less than fair market value) Other investment assets Primary residence Other housing assets (vacation home) Vehicles Personal property Retirement assets (e.g., 401(k) and IRA) Retirement assets (e.g., 401(k) and IRA) Other assets Life insurance (variable universal life)* Life insurance (universal life) Liabilities Mortgage on vacation home Debts Expenses Funeral and final expenses assumed the same for both *Clio is the beneficiary of Marcel's policy, and Marcel is the beneficiary of Clio's policy. $100,000 $11,720,000 $250,000 $700,000 $240,000 $86,000 $134,000 $2,768,000 $2,345,000 $48,000 $1,500,000 $250,000 Value $112,000 $86,000 Ownership JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS JTWROS Marcel Clio Jointly held but not titled Marcel Clio Ownership Joint Joint Costs $25,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started