Question

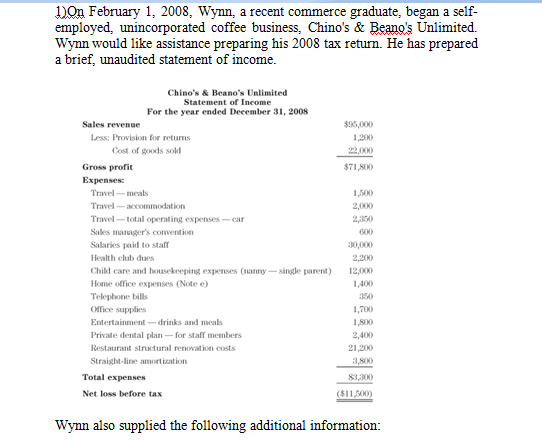

1)On February 1, 2008, Wynn, a recent commerce graduate, began a self-employed, unincorporated coffee business, Chino's & Beano's Unlimited. Wynn would like assistance preparing his

1)On February 1, 2008, Wynn, a recent commerce graduate, began a self-employed, unincorporated coffee business, Chino's & Beano's Unlimited. Wynn would like assistance preparing his 2008 tax return. He has prepared a brief, unaudited statement of income.

Wynn also supplied the following additional information:

(a) Wynn used his personal automobile for all his business travel. The $2,350 represents his total expenses for the 12-month period. His travel log included business mileage of 14,400 kilometres; the total number of kilometres driven during the 12-month period totalled 18,000 kilometres.

(b) Wynn would like to deduct all of his nanny expenses against his income since the expenses were incurred to earn income.

(c) There are no unrecorded revenues. However, Wynn feels that $380 of his accounts receivable balance is uncollectible because the customers recently declared bankruptcy. Wynn did not provide for this bad debt expense in his financial statements.

(d) The structural renovation of the coffee shop included new walls, flooring, an office for Wynn, and a kitchen.

(e) To ease the burden of being a single parent, Wynn set up a home office. Wynn uses the office to complete his administrative work in the evenings. The home office expenses relate to a proportion of heat, light and power.

REQUIRED

1.Ignoring CCA, compute Wynn's net income from a business for tax purposes

2)Discuss whether the following items would be a taxable benefit to an employee that receives them. If it depends, discuss what it would depend on. Please provide a reference to the appropriate source used. a) The company gives the employee a birthday gift worth $300

b) The company provides subsidized meals in the work cafeteria

c) The company provides a discount on the companys merchandise

d) The company pays for an all-inclusive vacation down South for an employee that exceeded his/her sales target by 25%.

Ms. Janet Hockey is employed as an internal auditor of Goddards Limited, a public company. On her auditing trips, she is away for a minimum of five days. Ms. Hockey is considered to be a key employee and receives various benefits, including stock options. Ms. Hockey presents you with a shopping bag full of receipts and notes written on scraps of paper from which you develop the following information for the year 2015:

Gross salary $100,000

Withholdings from salary

Income tax $42,000

Registered Pension Plan 8,000

Canada Pension Plan 2,480

Employment Insurance 931

Charitable donations to United Way 500

Group disability insurance 400

Group term life insurance policy premium 125

Net salary $45,564

Travel allowance paid by employer $ 9,000 (actual travelling expenses for 2015 were $1,800 for meals, $4,000 for accommodation, and $4,500 for air and ground transportation; all expense amounts were considered reasonable)

Employer contributions

Group term life insurance policy premium 450

Group disability insurance plan 600

Liberty Health extended medical insurance premium 900

Liberty Health extended dental insurance premium 1,100

Registered Pension Plan 8,000

Retirement counselling services 2,000

Ms. Hockey exercised options for 250 shares of Goddards Limited for $15 each when the share price in the market was $17. She was issued the options in 2013 when the stock price was $14. She has not yet sold the shares. Company paid travel for Ms. Hockey to go to Anaheim for two weeks. The first week, she attended a work conference. The second week was a well-deserved vacation. 5,000 Ms. Hockey has a $50,000, 0.25%, outstanding employee loan from the purchase of her home several years ago. At the time the loan was issued, the prescribed rate of interest was 0.5%. Interest owing to Goddards for 2015 was paid on February 2, 2016. Bonus payable on Dec. 31, 2014 but not paid to Ms. Hockey until Jan. 2015 6,000

Required: a) Determine the amount of Ms. Hockey's income from employment for 2015. Show all aspects of the required calculations, whether or not necessary to the final answer.

b) Assume that Ms. Hockey also has the following:

$600 of interest income

$6,000 of capital gains

$1,000 of prior year net capital loss carryover

Calculate Ms. Hockeys net income for tax purposes and taxable income.

(c) There are no unrecorded revenues. However, Wynn feels that $380 of his accounts receivable balance is uncollectible because the customers recently declared bankruptcy. Wynn did not provide for this bad debt expense in his financial statements.

(d) The structural renovation of the coffee shop included new walls, flooring, an office for Wynn, and a kitchen.

(e) To ease the burden of being a single parent, Wynn set up a home office. Wynn uses the office to complete his administrative work in the evenings. The home office expenses relate to a proportion of heat, light and power.

REQUIRED

1.Ignoring CCA, compute Wynn's net income from a business for tax purposes

2)Discuss whether the following items would be a taxable benefit to an employee that receives them. If it depends, discuss what it would depend on. Please provide a reference to the appropriate source used. a) The company gives the employee a birthday gift worth $300

b) The company provides subsidized meals in the work cafeteria

c) The company provides a discount on the companys merchandise

d) The company pays for an all-inclusive vacation down South for an employee that exceeded his/her sales target by 25%.

Ms. Janet Hockey is employed as an internal auditor of Goddards Limited, a public company. On her auditing trips, she is away for a minimum of five days. Ms. Hockey is considered to be a key employee and receives various benefits, including stock options. Ms. Hockey presents you with a shopping bag full of receipts and notes

written on scraps of paper from which you develop the following information for the year 2015:

Gross salary $100,000

Withholdings from salary

Income tax $42,000

Registered Pension Plan 8,000

Canada Pension Plan 2,480

Employment Insurance 931

Charitable donations to United Way 500

Group disability insurance 400

Group term life insurance policy premium 125

Net salary $45,564

Travel allowance paid by employer $ 9,000 (actual travelling expenses for 2015 were $1,800 for meals, $4,000 for accommodation, and $4,500 for air and ground transportation; all expense amounts were considered reasonable)

Employer contributions

Group term life insurance policy premium 450

Group disability insurance plan 600

Liberty Health extended medical insurance premium 900

Liberty Health extended dental insurance premium 1,100

Registered Pension Plan 8,000

Retirement counselling services 2,000

Ms. Hockey exercised options for 250 shares of Goddards Limited for $15 each when the share price in the market was $17. She was issued the options in 2013 when the stock price was $14. She has not yet sold the shares. Company paid travel for Ms. Hockey to go to Anaheim for two weeks. The first week, she attended a work conference. The second week was a well-deserved vacation. 5,000 Ms. Hockey has a $50,000, 0.25%, outstanding employee loan from the purchase of her home several years ago. At the time the loan was issued, the prescribed rate of interest was 0.5%. Interest owing to Goddards for 2015 was paid on February 2, 2016. Bonus payable on Dec. 31, 2014 but not paid to Ms. Hockey until Jan. 2015 6,000

Required: a) Determine the amount of Ms. Hockey's income from employment for 2015. Show all aspects of the required calculations, whether or not necessary to the final answer.

b) Assume that Ms. Hockey also has the following:

$600 of interest income

$6,000 of capital gains

$1,000 of prior year net capital loss carryover

Calculate Ms. Hockeys net income for tax purposes and taxable income.

c) Briefly comment on why you consider any of the above amounts that we unused in your calcuations (i.e. were inapplicable to the calculations required in parts (a) or (b))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started