Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me Buyer wants to acquire company Co. The following projections in millions are used to value Co: Revenues Costs Year 1 200 100

please help me

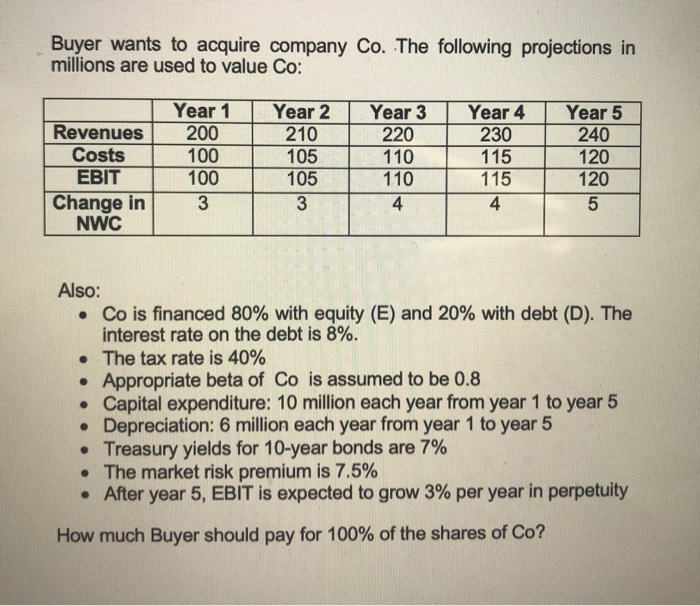

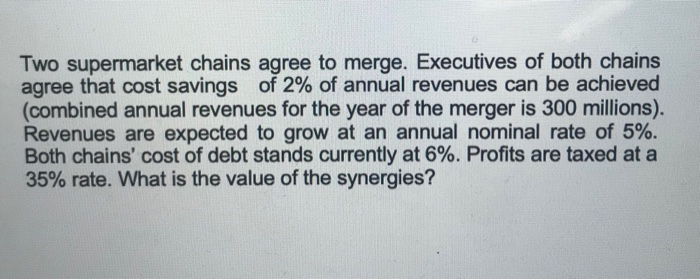

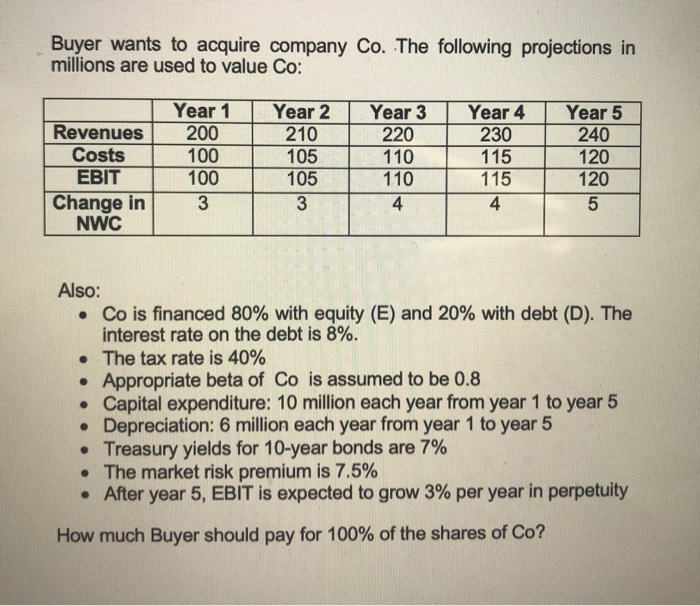

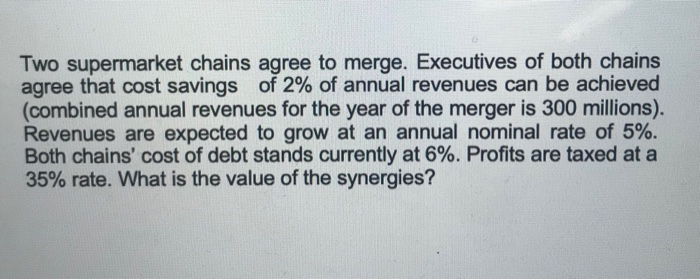

Buyer wants to acquire company Co. The following projections in millions are used to value Co: Revenues Costs Year 1 200 100 Year 2 210 105 105 Year 3 220 110 Year 4 230 115 115 Year 5 240 120 EBIT 100 1 110 120 5 4 Change in NWC Also: Co is financed 80% with equity (E) and 20% with debt (D). The interest rate on the debt is 8%. The tax rate is 40% Appropriate beta of Co is assumed to be 0.8 Capital expenditure: 10 million each year from year 1 to year 5 Depreciation: 6 million each year from year 1 to year 5 Treasury yields for 10-year bonds are 7% The market risk premium is 7.5% After year 5, EBIT is expected to grow 3% per year in perpetuity How much Buyer should pay for 100% of the shares of Co? Two supermarket chains agree to merge. Executives of both chains agree that cost savings of 2% of annual revenues can be achieved (combined annual revenues for the year of the merger is 300 millions). Revenues are expected to grow at an annual nominal rate of 5%. Both chains' cost of debt stands currently at 6%. Profits are taxed at a 35% rate. What is the value of the synergies? Buyer wants to acquire company Co. The following projections in millions are used to value Co: Revenues Costs Year 1 200 100 Year 2 210 105 105 Year 3 220 110 Year 4 230 115 115 Year 5 240 120 EBIT 100 1 110 120 5 4 Change in NWC Also: Co is financed 80% with equity (E) and 20% with debt (D). The interest rate on the debt is 8%. The tax rate is 40% Appropriate beta of Co is assumed to be 0.8 Capital expenditure: 10 million each year from year 1 to year 5 Depreciation: 6 million each year from year 1 to year 5 Treasury yields for 10-year bonds are 7% The market risk premium is 7.5% After year 5, EBIT is expected to grow 3% per year in perpetuity How much Buyer should pay for 100% of the shares of Co? Two supermarket chains agree to merge. Executives of both chains agree that cost savings of 2% of annual revenues can be achieved (combined annual revenues for the year of the merger is 300 millions). Revenues are expected to grow at an annual nominal rate of 5%. Both chains' cost of debt stands currently at 6%. Profits are taxed at a 35% rate. What is the value of the synergies

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started