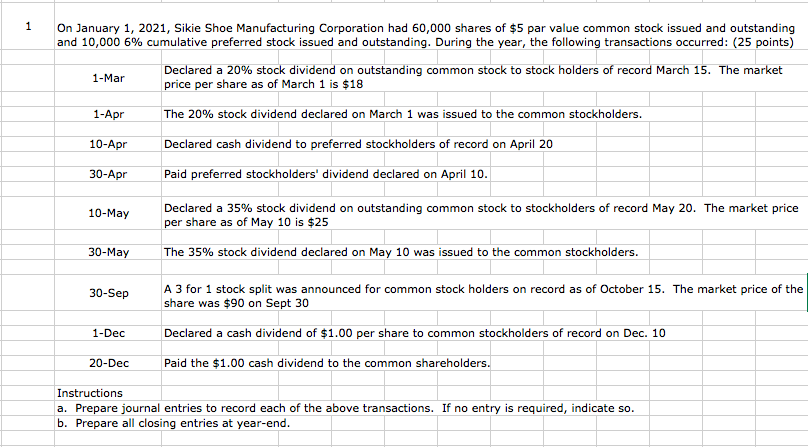

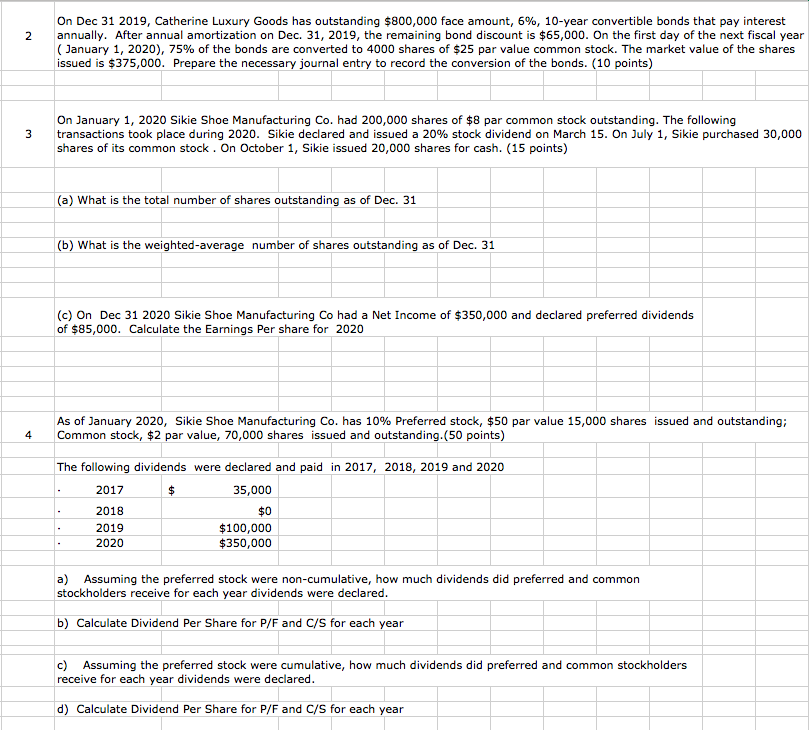

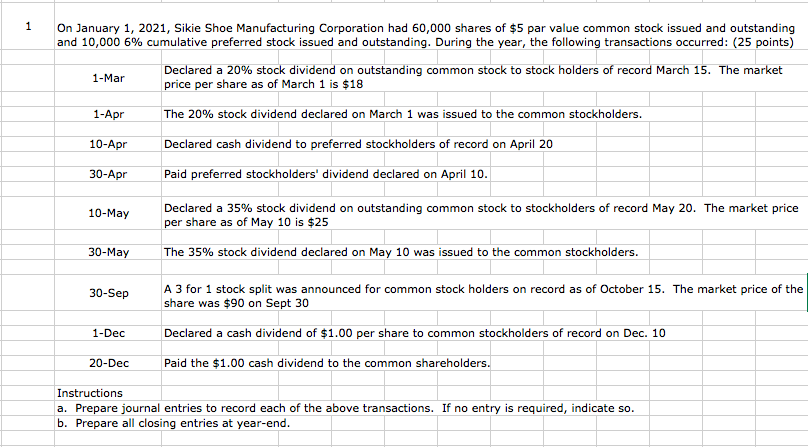

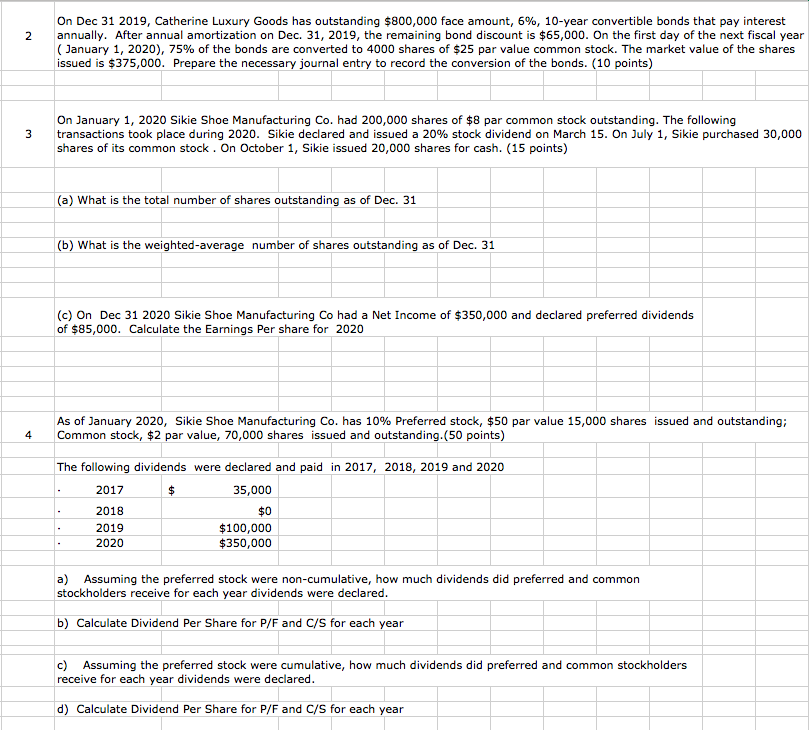

1On January 1, 2021, Sikie Shoe Manufacturing Corporation had 60,000 shares of $5 par value common stock issued and outstanding and 10,000 6% cumulative preferred stock issued and outstanding. During the year, the following transactions occurred: (25 points) Declared a 20% stock dividend on outstanding common stock to stock holders of record March 15, The market 1-Mar 1-Apr 10-Apr 30-Apr price per share as of March 1 is $18 The 20% stock dividend declared on March 1 was issued to the common stockholders. Declared cash dividend to preferred stockholders of record on April 20 Paid preferred stockholders' dividend declared on April 10 Declared a 35% stock dividend on outstanding common stock to stockholders of record May 20, The market price 10-May per share as of May 10 is $25 The 35% stock dividend declared on May 10 was issued to the common stockholders. A 3 for 1 stock split was announced for common stock holders on record as of October 15. The market price of the 30-May 30-Sep share was $90 on Sept 30 Declared a cash dividend of $1.00 per share to common stockholders of record on Dec. 10 Paid the $1.00 cash dividend to the common shareholders 1-Dec 20-Dec Instructions a. Prepare journal entries to record each of the above transactions. If no entry is required, indicate so b. Prepare all closing entries at year-end On Dec 31 2019, Catherine Luxury Goods has outstanding $800,000 face amount, 696, 10-year convertible bonds that pay interest annually. After annual amortization on Dec. 31, 2019, the remaining bond discount is $65,000. On the first day of the next fiscal year (January 1, 2020), 75% of the bonds are converted to 4000 shares of $25 par value common stock. The market value of the shares issued is $375,000. Prepare the necessary journal entry to record the conversion of the bonds. (10 points) 2 On January 1, 2020 Sikie Shoe Manufacturing Co. had 200,000 shares of $8 par common stock outstanding. The following transactions took place during 2020. Sikie declared and issued a 20% stock dividend on March 15. On July 1, Sike purchased 30,000 shares of its common stock. On October 1, Sikie issued 20,000 shares for cash. (15 points) 3 (a) What is the total number of shares outstanding as of Dec. 31 (b) What is the weighted-average number of shares outstanding as of Dec. 31 (c) On Dec 31 2020 Sikie Shoe Manufacturing Co had a Net Income of $350,000 and declared preferred dividends of $85,000. Calculate the Earnings Per share for 2020 As of January 2020, Sike Shoe Manufacturing Co. has 10% Preferred stock, $50 par value 15,000 shares issued and outstanding; 4 Common stock, $2 par value, 70,000 shares issued and outstanding.(50 points) The following dividends were declared and paid in 2017, 2018, 2019 and 2020 2017 2018 2019 2020 35,000 $0 $100,000 $350,000 a) Assuming the preferred stock were non-cumulative, how much dividends did preferred and common stockholders receive for each year dividends were declared b) Calculate Dividend Per Share for P/F and C/S for each year c) Assuming the preferred stock were cumulative, how much dividends did preferred and common stockholders receive for each year dividends were declared. d) Calculate Dividend Per Share for P/F and C/S for each year 1On January 1, 2021, Sikie Shoe Manufacturing Corporation had 60,000 shares of $5 par value common stock issued and outstanding and 10,000 6% cumulative preferred stock issued and outstanding. During the year, the following transactions occurred: (25 points) Declared a 20% stock dividend on outstanding common stock to stock holders of record March 15, The market 1-Mar 1-Apr 10-Apr 30-Apr price per share as of March 1 is $18 The 20% stock dividend declared on March 1 was issued to the common stockholders. Declared cash dividend to preferred stockholders of record on April 20 Paid preferred stockholders' dividend declared on April 10 Declared a 35% stock dividend on outstanding common stock to stockholders of record May 20, The market price 10-May per share as of May 10 is $25 The 35% stock dividend declared on May 10 was issued to the common stockholders. A 3 for 1 stock split was announced for common stock holders on record as of October 15. The market price of the 30-May 30-Sep share was $90 on Sept 30 Declared a cash dividend of $1.00 per share to common stockholders of record on Dec. 10 Paid the $1.00 cash dividend to the common shareholders 1-Dec 20-Dec Instructions a. Prepare journal entries to record each of the above transactions. If no entry is required, indicate so b. Prepare all closing entries at year-end On Dec 31 2019, Catherine Luxury Goods has outstanding $800,000 face amount, 696, 10-year convertible bonds that pay interest annually. After annual amortization on Dec. 31, 2019, the remaining bond discount is $65,000. On the first day of the next fiscal year (January 1, 2020), 75% of the bonds are converted to 4000 shares of $25 par value common stock. The market value of the shares issued is $375,000. Prepare the necessary journal entry to record the conversion of the bonds. (10 points) 2 On January 1, 2020 Sikie Shoe Manufacturing Co. had 200,000 shares of $8 par common stock outstanding. The following transactions took place during 2020. Sikie declared and issued a 20% stock dividend on March 15. On July 1, Sike purchased 30,000 shares of its common stock. On October 1, Sikie issued 20,000 shares for cash. (15 points) 3 (a) What is the total number of shares outstanding as of Dec. 31 (b) What is the weighted-average number of shares outstanding as of Dec. 31 (c) On Dec 31 2020 Sikie Shoe Manufacturing Co had a Net Income of $350,000 and declared preferred dividends of $85,000. Calculate the Earnings Per share for 2020 As of January 2020, Sike Shoe Manufacturing Co. has 10% Preferred stock, $50 par value 15,000 shares issued and outstanding; 4 Common stock, $2 par value, 70,000 shares issued and outstanding.(50 points) The following dividends were declared and paid in 2017, 2018, 2019 and 2020 2017 2018 2019 2020 35,000 $0 $100,000 $350,000 a) Assuming the preferred stock were non-cumulative, how much dividends did preferred and common stockholders receive for each year dividends were declared b) Calculate Dividend Per Share for P/F and C/S for each year c) Assuming the preferred stock were cumulative, how much dividends did preferred and common stockholders receive for each year dividends were declared. d) Calculate Dividend Per Share for P/F and C/S for each year