Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Prepare a consolidation worksheet for this business combination.2.Prepare the consolidating entry *C that would have been required if Naomi had used the initial value method

1.Prepare a consolidation worksheet for this business combination.2.Prepare the consolidating entry “*C” that would have been required if Naomi had used the initial value method for accounting for its investment in Winnie.3.Prepare the consolidating entry “*C” that would have been required if Naomi had used the partial equity method for accounting for its investment in Winnie.

1.Prepare a consolidation worksheet for this business combination.2.Prepare the consolidating entry “*C” that would have been required if Naomi had used the initial value method for accounting for its investment in Winnie.3.Prepare the consolidating entry “*C” that would have been required if Naomi had used the partial equity method for accounting for its investment in Winnie.

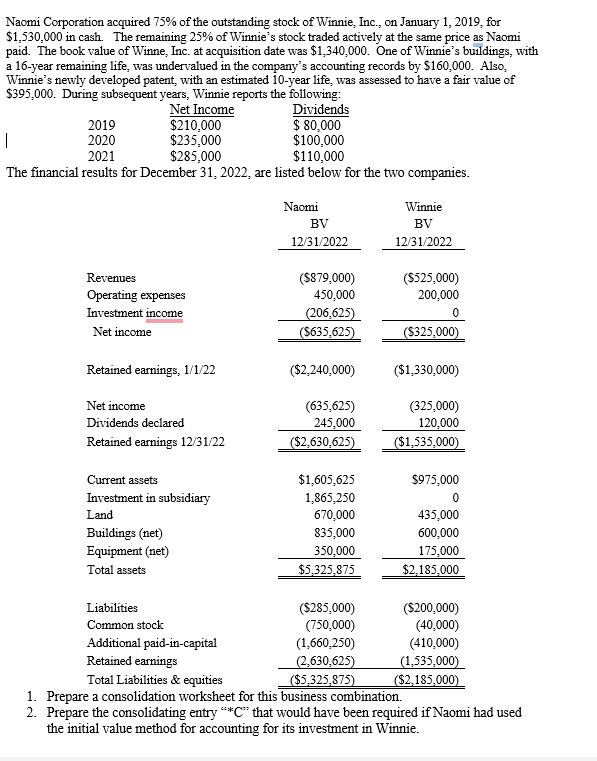

Naomi Corporation acquired 75% of the outstanding stock of Winnie, Inc., on January 1, 2019, for $1,530,000 in cash. The remaining 25% of Winnie's stock traded actively at the same price as Naomi paid. The book value of Winne, Inc. at acquisition date was $1,340,000. One of Winnie's buildings, with a 16-year remaining life, was undervalued in the company's accounting records by $160,000. Also, Winnie's newly developed patent, with an estimated 10-year life, was assessed to have a fair value of $395,000. During subsequent years, Winnie reports the following: Net Income 2019 Dividends $ 80,000 $100,000 I 2020 2021 $110,000 The financial results for December 31, 2022, are listed below for the two companies. $210,000 $235,000 $285,000 Revenues Operating expenses Investment income Net income Retained earnings, 1/1/22 Net income Dividends declared Retained earnings 12/31/22 Current assets Investment in subsidiary Land Buildings (net) Equipment (net) Total assets Liabilities Common stock Additional paid-in-capital Retained earnings Naomi BV 12/31/2022 ($879,000) 450,000 (206,625) ($635,625) ($2,240,000) (635,625) 245,000 ($2,630,625) $1,605,625 1,865,250 670,000 835,000 350,000 $5,325,875 ($285,000) (750,000) (1,660,250) (2,630,625) ($5.325,875) Winnie BV 12/31/2022 ($525,000) 200,000 0 ($325,000) ($1,330,000) (325,000) 120,000 ($1,535,000) $975,000 0 435,000 600,000 175,000 $2,185,000 ($200,000) (40,000) (410,000) (1,535,000) ($2,185,000) Total Liabilities & equities 1. Prepare a consolidation worksheet for this business combination. 2. Prepare the consolidating entry ***C" that would have been required if Naomi had used the initial value method for accounting for its investment in Winnie.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started