Question

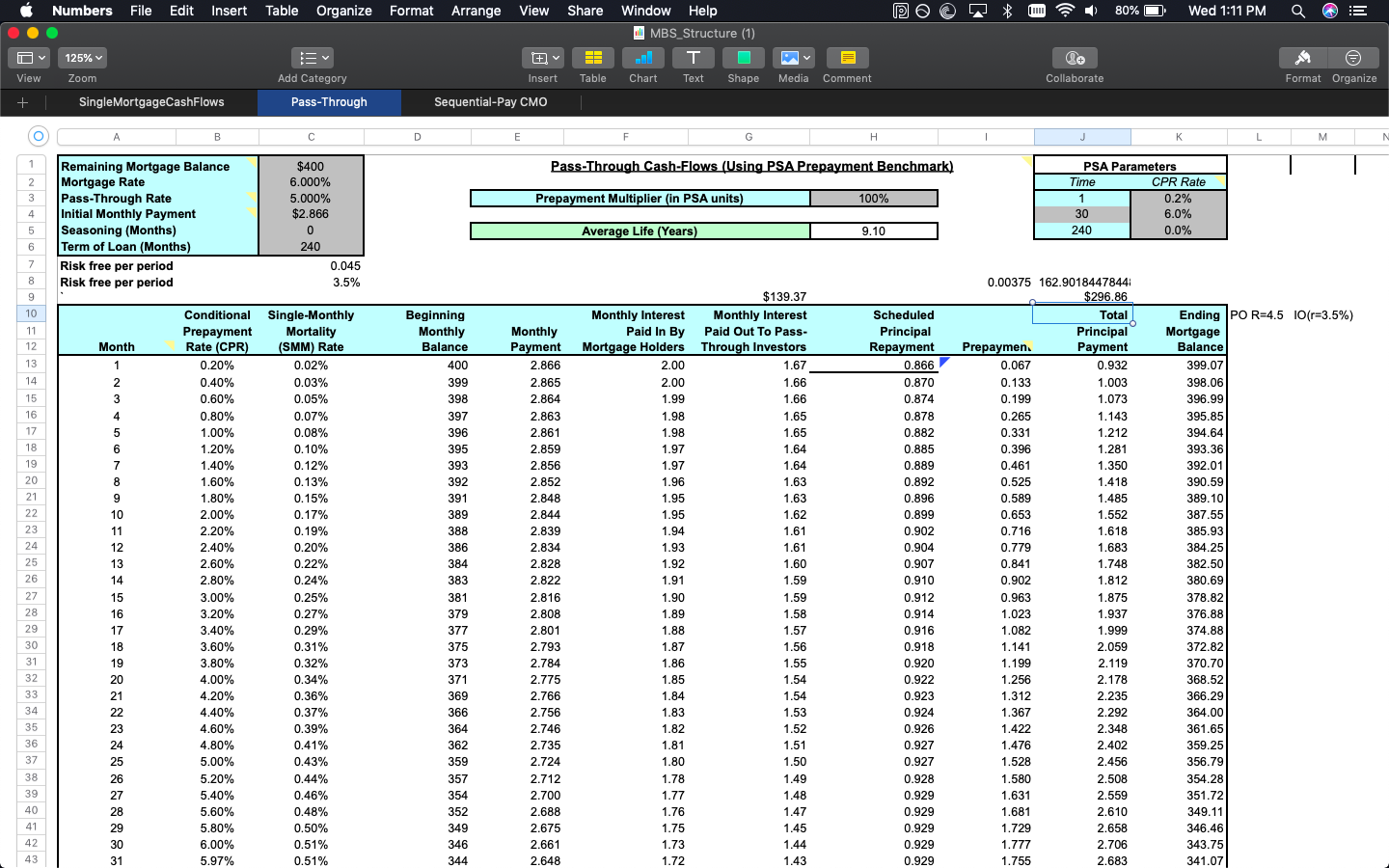

1.(Principal-Only MBS and Interest-Only MBS) Suppose we construct principal-only (PO) and interest-only (IO) mortgage-backed securities (MBS) using the mortgage pass-through of the previous questions. Assume

1.(Principal-Only MBS and Interest-Only MBS) Suppose we construct principal-only (PO) and interest-only (IO) mortgage-backed securities (MBS) using the mortgage pass-through of the previous questions. Assume a prepayment multiplier of 100 PSA. What is the present value of the PO MBS if we use an annual risk-free rate of 4.5% to value the cash-flows?

1.(Principal-Only MBS and Interest-Only MBS) Suppose we construct principal-only (PO) and interest-only (IO) mortgage-backed securities (MBS) using the mortgage pass-through of the previous questions. Assume a prepayment multiplier of 100 PSA. What is the present value of the PO MBS if we use an annual risk-free rate of 4.5% to value the cash-flows?

2. (Principal-Only MBS and Interest-Only MBS) Referring to the previous question, what is the value of the IO MBS?

3.(Principal-Only MBS and Interest-Only MBS) Referring to the previous question, what is the average life of the IO MBS?

4.(Principal-Only MBS and Interest-Only MBS) Suppose now that you purchased the IO MBS of the previous question and that the price you paid was the same price that you calculated in the previous question. The risk-free interest rate suddenly changes from 4.5% to 3.5%. Everything else stays the same. How much money have you made or lost on your investment?

5.(Principal-Only MBS and Interest-Only MBS) Referring to the previous question, suppose the risk-free interest rate suddenly changes from 4.5% to 3.5% and that the pre-payment multiplier changes from 100 PSA to 150 PSA. How much money have you made or lost on your investment in the IO MBS?

P>S NO answers already present in this website are correct, I checked them all. Please try to give me correct answers

IF you zoom you can see all the necessary infos.

Numbers File Edit Insert Table Organize Format Arrange View poc C) 80% Wed 1:11 PM a Share Window Help MBS Structure (1) T Table Chart Text Shape 125% View Zoom Insert Media Comment Collaborate Format Organize Add Category Pass-Through + L Single MortgageCashFlows Sequential-Pay CMO A B D E F - G K L M N 1 Pass-Through Cash-Flows (Using PSA Prepayment Benchmark) Prepayment Multiplier (in PSA units) 100% 2 3 4 5 6 1 Remaining Mortgage Balance Mortgage Rate Pass-Through Rate Initial Monthly Payment Seasoning (Months) Term of Loan (Months) Risk free per period Risk free per period $400 6.000% 5.000% $2.866 0 240 0.045 3.5% PSA Parameters Time CPR Rate 0.2% 30 6.0% 240 0.0% Average Life (Years) 9.10 7 8 9 10 11 12 13 Beginning Monthly Balance 400 399 398 397 396 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 Conditional Prepayment Rate (CPR) 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 2.60% 2.80% Single-Monthly Mortality (SMM) Rate 0.02% 0.03% 0.05% 0.07% 0.08% 0.10% 0.12% 0.13% 0.15% 0.17% 0.19% 0.20% 0.22% 0.24% 0.25% 0.27% 0.29% 0.31% 0.32% 0.34% 0.36% 0.37% 0.39% 0.41% 0.43% 0.44% 0.46% 0.48% 0.50% 0.51% 0.51% Month 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 $139.37 Monthly Interest Monthly Interest Paid In By Paid Out To Pass- Mortgage Holders Through Investors 2.00 1.67 2.00 1.66 1.99 1.66 1.98 1.65 1.98 1.65 1.97 1.64 1.97 1.64 1.96 1.63 1.95 1.63 1.95 1.62 1.94 1.61 1.93 1.61 1.92 1.60 1.91 1.59 1.90 1.59 1.89 1.58 1.88 1.57 1.87 1.56 1.86 1.55 1.85 1.54 1.84 1.54 1.83 1.53 1.82 1.52 1.81 1.51 1.80 1.50 1.78 1.49 1.77 1.48 1.76 1.47 1.75 1.45 1.73 1.44 1.72 1.43 Monthly Payment 2.866 2.865 2.864 2.863 2.861 2.859 2.856 2.852 2.848 2.844 2.839 2.834 2.828 2.822 2.816 2.808 2.801 2.793 2.784 2.775 2.766 2.756 2.746 2.735 2.724 2.712 2.700 2.688 2.675 2.661 2.648 395 393 392 391 389 388 386 384 383 381 379 377 375 373 371 369 366 364 362 359 357 354 352 349 346 344 Scheduled Principal Repayment 0.866 0.870 0.874 0.878 0.882 0.885 0.889 0.892 0.896 0.899 0.902 0.904 0.907 0.910 0.912 0.914 0.916 0.918 0.920 0.922 0.923 0.924 0.926 0.927 0.927 0.928 0.929 0.929 0.929 0.929 0.929 3.00% 0.00375 162.9018447844 $296.86 Total Principal Prepaymen Payment 0.067 0.932 0.133 1.003 0.199 1.073 0.265 1.143 0.331 1.212 0.396 1.281 0.461 1.350 0.525 1.418 0.589 1.485 0.653 1.552 0.716 1.618 0.779 1.683 0.841 1.748 0.902 1.812 0.963 1.875 1.023 1.937 1.082 1.999 1.141 2.059 1.199 2.119 1.256 2.178 1.312 2.235 1.367 2.292 1.422 2.348 1.476 2.402 1.528 2.456 1.580 2.508 1.631 2.559 1.681 2.610 1.729 2.658 1.777 2.706 1.755 2.683 Ending PO R=4.5 10(r=3.5%) Mortgage Balance 399.07 398.06 396.99 395.85 394.64 393.36 392.01 390.59 389.10 387.55 385.93 384.25 382.50 380.69 378.82 376.88 374.88 372.82 370.70 368.52 366.29 364.00 361.65 359.25 356.79 354.28 351.72 349.11 346.46 343.75 341.07 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 4.40% 4.60% 4.80% 5.00% 5.20% 5.40% 5.60% 5.80% 6.00% 5.97% 38 39 40 41 42 43 Numbers File Edit Insert Table Organize Format Arrange View poc C) 80% Wed 1:11 PM a Share Window Help MBS Structure (1) T Table Chart Text Shape 125% View Zoom Insert Media Comment Collaborate Format Organize Add Category Pass-Through + L Single MortgageCashFlows Sequential-Pay CMO A B D E F - G K L M N 1 Pass-Through Cash-Flows (Using PSA Prepayment Benchmark) Prepayment Multiplier (in PSA units) 100% 2 3 4 5 6 1 Remaining Mortgage Balance Mortgage Rate Pass-Through Rate Initial Monthly Payment Seasoning (Months) Term of Loan (Months) Risk free per period Risk free per period $400 6.000% 5.000% $2.866 0 240 0.045 3.5% PSA Parameters Time CPR Rate 0.2% 30 6.0% 240 0.0% Average Life (Years) 9.10 7 8 9 10 11 12 13 Beginning Monthly Balance 400 399 398 397 396 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 Conditional Prepayment Rate (CPR) 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 2.60% 2.80% Single-Monthly Mortality (SMM) Rate 0.02% 0.03% 0.05% 0.07% 0.08% 0.10% 0.12% 0.13% 0.15% 0.17% 0.19% 0.20% 0.22% 0.24% 0.25% 0.27% 0.29% 0.31% 0.32% 0.34% 0.36% 0.37% 0.39% 0.41% 0.43% 0.44% 0.46% 0.48% 0.50% 0.51% 0.51% Month 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 $139.37 Monthly Interest Monthly Interest Paid In By Paid Out To Pass- Mortgage Holders Through Investors 2.00 1.67 2.00 1.66 1.99 1.66 1.98 1.65 1.98 1.65 1.97 1.64 1.97 1.64 1.96 1.63 1.95 1.63 1.95 1.62 1.94 1.61 1.93 1.61 1.92 1.60 1.91 1.59 1.90 1.59 1.89 1.58 1.88 1.57 1.87 1.56 1.86 1.55 1.85 1.54 1.84 1.54 1.83 1.53 1.82 1.52 1.81 1.51 1.80 1.50 1.78 1.49 1.77 1.48 1.76 1.47 1.75 1.45 1.73 1.44 1.72 1.43 Monthly Payment 2.866 2.865 2.864 2.863 2.861 2.859 2.856 2.852 2.848 2.844 2.839 2.834 2.828 2.822 2.816 2.808 2.801 2.793 2.784 2.775 2.766 2.756 2.746 2.735 2.724 2.712 2.700 2.688 2.675 2.661 2.648 395 393 392 391 389 388 386 384 383 381 379 377 375 373 371 369 366 364 362 359 357 354 352 349 346 344 Scheduled Principal Repayment 0.866 0.870 0.874 0.878 0.882 0.885 0.889 0.892 0.896 0.899 0.902 0.904 0.907 0.910 0.912 0.914 0.916 0.918 0.920 0.922 0.923 0.924 0.926 0.927 0.927 0.928 0.929 0.929 0.929 0.929 0.929 3.00% 0.00375 162.9018447844 $296.86 Total Principal Prepaymen Payment 0.067 0.932 0.133 1.003 0.199 1.073 0.265 1.143 0.331 1.212 0.396 1.281 0.461 1.350 0.525 1.418 0.589 1.485 0.653 1.552 0.716 1.618 0.779 1.683 0.841 1.748 0.902 1.812 0.963 1.875 1.023 1.937 1.082 1.999 1.141 2.059 1.199 2.119 1.256 2.178 1.312 2.235 1.367 2.292 1.422 2.348 1.476 2.402 1.528 2.456 1.580 2.508 1.631 2.559 1.681 2.610 1.729 2.658 1.777 2.706 1.755 2.683 Ending PO R=4.5 10(r=3.5%) Mortgage Balance 399.07 398.06 396.99 395.85 394.64 393.36 392.01 390.59 389.10 387.55 385.93 384.25 382.50 380.69 378.82 376.88 374.88 372.82 370.70 368.52 366.29 364.00 361.65 359.25 356.79 354.28 351.72 349.11 346.46 343.75 341.07 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 4.40% 4.60% 4.80% 5.00% 5.20% 5.40% 5.60% 5.80% 6.00% 5.97% 38 39 40 41 42 43Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started