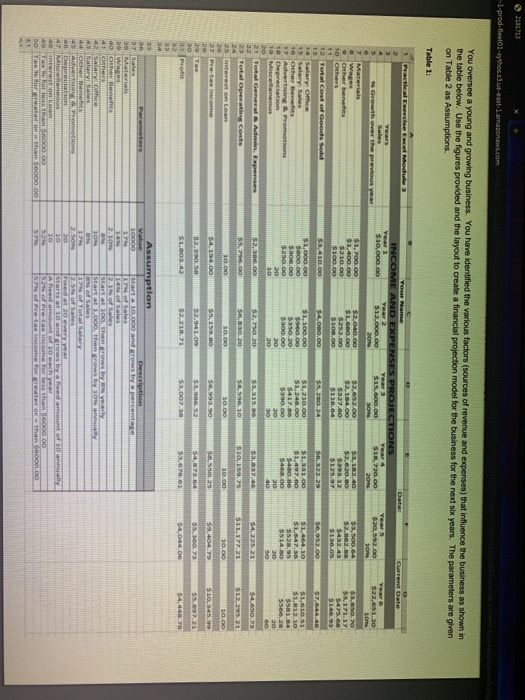

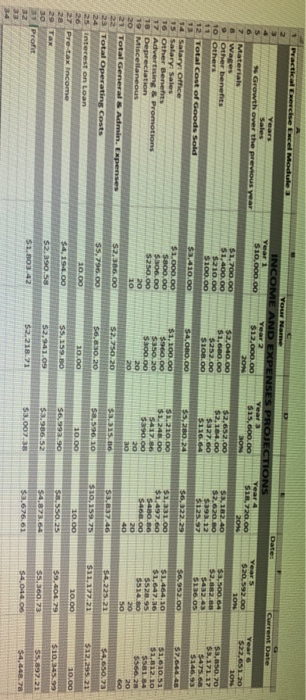

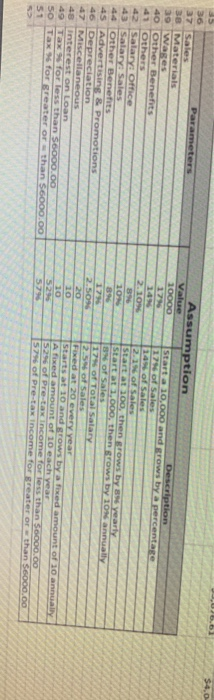

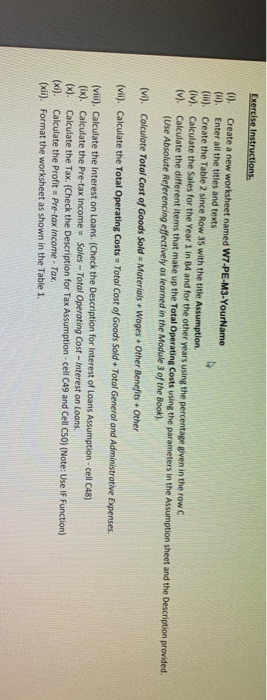

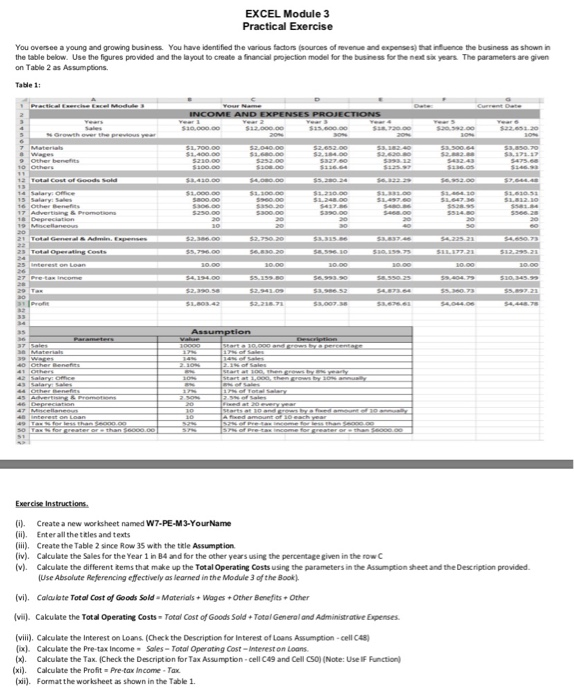

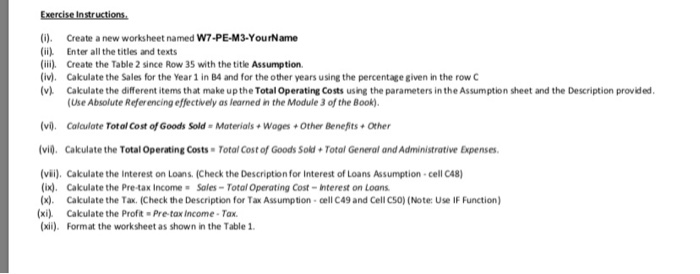

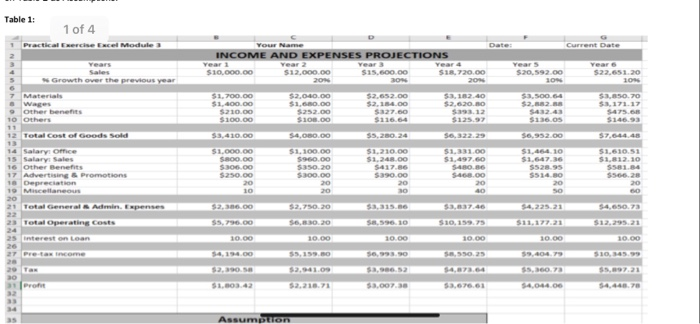

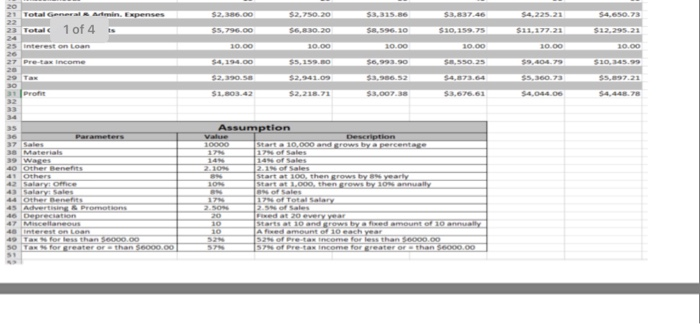

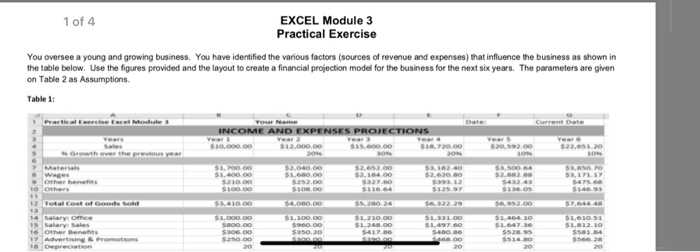

1-prod-fleet01.xyth e ast-lamazonaws.com You Oversee a young and growing business. You have identified the various factors (sources of revenue and expenses) that influence the business as shown in the table below. Use the figures provided and the layout to create a financial projection model for the business for the needs years. The parameters are given on Table 2 as Assumptions Table 1: INCOME AND EXPENSES PROJECTIONS INCOME AND EXPENSES PROJECTIONS Year 1 Year $10.000.00 $12,000.00 SAS,000.00 $1,720.00 Growth over the previous year $20.592.00 7 Materials B Wages other benefits $1,700.00 $1,400.00 5210.00 5100.00 52.040.00 $1,000.00 5252.00 3108.OO $2.652.00 52, 164.00 $327.00 52.620.80 $293.12 $125.97 00.04 $2,082. 5432.43 12 Total Cost of Goods Sold 5.4.000,00 56,322.25 14 Salary: office 13 Salary: Sales 16 Other Benefits 17 Advertising & Promotions 10 Depreciation 19 Miscellaneous 20 21 Total General Admin. Eupe $1.000.00 3800.00 $106.00 5250.00 $1,100.00 $260.00 $1.497.60 SABORG SACO 5390.00 23 Total Operating costs 25 Interest on Loan 26 27 Pre-tax income 29 Tax 28 30 Profit 53.00738 37 Sales Assumption 30 Materials 39 Wages 10000 179 Start a 10.000 and grow 14 of Sales other Benefits 41 Others 42 Salary Office Salary Sales 44 Other Benefits 2. of Sales Start at 100, then grows by 40 Depreciation 47 MIN 43 interest on Loan 49 Tax for less than SoOOOOO 50 Tax for greater or than $6000.00 do by a ed amount of 10 annual a ntolochy 32 of Pre-taxncome for less than SoOOOOO me or greater or tha ore than $6000.00 NININ Exercise Instructions. 00). Create a new worksheet named W7-PE-M3-YourName (1). Enter all the titles and texts (IH). Create the Table 2 since Row 35 with the title Assumption (iv). Calculate the sales for the Year 1 in 84 and for the other years using the percentage given in the row (v). Calculate the different items that make up the Total Operating costs using the parameters in the Assumption sheet and the Description provided. (Use Absolute Referencing effectively as learned in the Module 3 of the Book) (vi). Calculate Total Cost of Goods Sold - Materials + Woges Other Benefits. Other (vii). Calculate the Total Operating costs Total cost of Goods SoldTotol General and Administrative Expenses. (viil). Calculate the interest on Loans (Check the Description for Interest of Loans Assumption - cell 048) (ix). Calculate the Pre-tax Income Sales - Total Operating Cost - Interest on Loons. (x). Calculate the Tax. (Check the Description for Tax Assumption-cell C49 and Cell CSO) (Note: Use IF Function) (xi). Calculate the Profit Pre-tax Income Tox. (xii). Format the worksheet as shown in the Table 1. EXCEL Module 3 Practical Exercise You oversee a young and growing business. You have identified the various factors sources of revenue and expenses) that influence the business as shown in the table below. Use the figures provided and the layout to create a financial projection model for the business for the next six years. The parameters are given on Table 2 as Assumptions. Table 1: INCOME AND EXPENSES PROJECTIONS 8 888888 8 8 8 8 8 88888888888 1352 Exercise Instructions. (i). Create a new worksheet named W7-PE-M 3-Your Name (ii). Enter all the tries and texts (iii). Create the Table 2 since Row 35 with the title Assumption (iv). Calculate the Sales for the Year 1 in B4 and for the other years using the percentage given in the rowc (V). Calculate the different items that make up the Total Operating costs using the parameters in the Assumption sheet and the Description provided (Use Absolute Referencing effectively as learned in the Module 3 of the Book) (vi). Calculate Total Cost of Goods Sold - Materials + Wages Other Benefits Other (vii). Calculate the Total Operating costs - Total Cost of Goods Sold Total General and Administrative Expenses. (viii). Calculate the interest on Loans (Check the Description for Interest of Loans Assumption-cell CAS) b) Calculate the Pre-tax income Sales - Total Operating cost-interest on Loans 1x). Calculate the Tax Check the Description for Tax Assumption-cell 49 and Cell CSO) (Note: Uself Function (xi). Calculate the Profit Pre-tax Income Tax (xii). Format the worksheet as shown in the Table 1. Exercise Instructions. (i). (ii) (iii). (iv) (v) Create a new worksheet named W7-PE-M3-Your Name Enter all the titles and texts Create the Table 2 since Row 35 with the title Assumption. Calculate the Sales for the Year 1 in B4 and for the other years using the percentage given in the row C Cakulate the different items that make up the Total Operating costs using the parameters in the Assumption sheet and the Description provided (Use Absolute Referencing effectively as learned in the Module 3 of the Book). (vi). Calculate Total Cost of Goods Sold - Materials + Wages Other Benefits Other (vid. Calculate the Total Operating costs - Total Cost of Goods Sold Total General and Administrative Expenses. (vii), Cakulate the interest on Loans (Check the Description for Interest of Loans Assumption cell 048) (1x). Cakulate the Pre-tax income Sales - Total Operating cost- terest on Loans (x). Calculate the Tax. (Check the Description for Tax Assumption. Cell C49 and Cell C50) (Note: Use IF Function) (xi). Cakulate the Profit Pre-tax Income Tax. (xii). Format the worksheet as shown in the Table 1. Table 1: 1 of 4 Practical Exerci E l Module Your Name INCOME AND EXPENSES PROJECTIONS Sales $10,000.00 $12,000.00 209 SI5.600.00 S1,720.00 $20.592.00 $22.65110 $1.700.00 52.040.00 $1..00 5252.00 $10.00 52.652.00 52. 14.00 $127.60 52.0 20.0 $210.00 $125.9 00 OLOS 00 ONS 00 SOES 00 OSS $1,100.00 S960.00 $350.20 S300.00 S1.210.00 $1.248.00 $417.86 S390.00 $1,497.60 540.6 5460.00 $1.667.36 552895 5514 BO Advertising Promotions $2,386.00 $2,750.20 $3,315.36 $3,037.46 54.650.7 56.830.20 S8.596.10 S10, 159.75 $11.177.21 10.00 10.00 10.00 10.00 10.00 10.00 56,99.90 59.404.79 $10,345.95 SOGERES $2.01.09 51.03.42 52.213.71 53.00738 53.7661 54,06406 54.440.70 Assume 52.750.20 $3,315.86 S42252 1 of 4 ts $2.386.00 $5.796.00 S883746 $10,159.75 56,8:30.20 10.00 4.650.73 $12.295.21 10.00 30.00 10.00 $11.277.21 10.00 S9.404.79 $8.596.10 10.00 $6,993.30 $3,936.52 53.00738 $5,159.BO S.550.25 $10,345.99 $2,941.09 5.360.73 $2,390.SE $1.803.42 $2,218.71 53.676.61 $4,044.00 54.448.78 Assumption Value Starta 10.000 and grow by percenter 10000 2.100 Start at 100, then Start at 1.000, then by a yearly hy 10 w 2.50 10d bywed amount of 1 of 4 EXCEL Module 3 Practical Exercise You oversee a young and growing business. You have identified the various factors (sources of revenue and expenses) that influence the business as shown in the table below. Use the figures provided and the layout to create a financial projection model for the business for the next six years. The parameters are given on Table 2 as Assumptions Table 1: INCOME AND EXPENSES PROJECTIONS 10.000.00 $12.000.00 $15,000.00 1.720.00 $20.592.00 $22,65120 $1.400.00 52.184.00 15 Salary: Sales 17 Advertising Promotions 18 Depreciation 1-prod-fleet01.xyth e ast-lamazonaws.com You Oversee a young and growing business. You have identified the various factors (sources of revenue and expenses) that influence the business as shown in the table below. Use the figures provided and the layout to create a financial projection model for the business for the needs years. The parameters are given on Table 2 as Assumptions Table 1: INCOME AND EXPENSES PROJECTIONS INCOME AND EXPENSES PROJECTIONS Year 1 Year $10.000.00 $12,000.00 SAS,000.00 $1,720.00 Growth over the previous year $20.592.00 7 Materials B Wages other benefits $1,700.00 $1,400.00 5210.00 5100.00 52.040.00 $1,000.00 5252.00 3108.OO $2.652.00 52, 164.00 $327.00 52.620.80 $293.12 $125.97 00.04 $2,082. 5432.43 12 Total Cost of Goods Sold 5.4.000,00 56,322.25 14 Salary: office 13 Salary: Sales 16 Other Benefits 17 Advertising & Promotions 10 Depreciation 19 Miscellaneous 20 21 Total General Admin. Eupe $1.000.00 3800.00 $106.00 5250.00 $1,100.00 $260.00 $1.497.60 SABORG SACO 5390.00 23 Total Operating costs 25 Interest on Loan 26 27 Pre-tax income 29 Tax 28 30 Profit 53.00738 37 Sales Assumption 30 Materials 39 Wages 10000 179 Start a 10.000 and grow 14 of Sales other Benefits 41 Others 42 Salary Office Salary Sales 44 Other Benefits 2. of Sales Start at 100, then grows by 40 Depreciation 47 MIN 43 interest on Loan 49 Tax for less than SoOOOOO 50 Tax for greater or than $6000.00 do by a ed amount of 10 annual a ntolochy 32 of Pre-taxncome for less than SoOOOOO me or greater or tha ore than $6000.00 NININ Exercise Instructions. 00). Create a new worksheet named W7-PE-M3-YourName (1). Enter all the titles and texts (IH). Create the Table 2 since Row 35 with the title Assumption (iv). Calculate the sales for the Year 1 in 84 and for the other years using the percentage given in the row (v). Calculate the different items that make up the Total Operating costs using the parameters in the Assumption sheet and the Description provided. (Use Absolute Referencing effectively as learned in the Module 3 of the Book) (vi). Calculate Total Cost of Goods Sold - Materials + Woges Other Benefits. Other (vii). Calculate the Total Operating costs Total cost of Goods SoldTotol General and Administrative Expenses. (viil). Calculate the interest on Loans (Check the Description for Interest of Loans Assumption - cell 048) (ix). Calculate the Pre-tax Income Sales - Total Operating Cost - Interest on Loons. (x). Calculate the Tax. (Check the Description for Tax Assumption-cell C49 and Cell CSO) (Note: Use IF Function) (xi). Calculate the Profit Pre-tax Income Tox. (xii). Format the worksheet as shown in the Table 1. EXCEL Module 3 Practical Exercise You oversee a young and growing business. You have identified the various factors sources of revenue and expenses) that influence the business as shown in the table below. Use the figures provided and the layout to create a financial projection model for the business for the next six years. The parameters are given on Table 2 as Assumptions. Table 1: INCOME AND EXPENSES PROJECTIONS 8 888888 8 8 8 8 8 88888888888 1352 Exercise Instructions. (i). Create a new worksheet named W7-PE-M 3-Your Name (ii). Enter all the tries and texts (iii). Create the Table 2 since Row 35 with the title Assumption (iv). Calculate the Sales for the Year 1 in B4 and for the other years using the percentage given in the rowc (V). Calculate the different items that make up the Total Operating costs using the parameters in the Assumption sheet and the Description provided (Use Absolute Referencing effectively as learned in the Module 3 of the Book) (vi). Calculate Total Cost of Goods Sold - Materials + Wages Other Benefits Other (vii). Calculate the Total Operating costs - Total Cost of Goods Sold Total General and Administrative Expenses. (viii). Calculate the interest on Loans (Check the Description for Interest of Loans Assumption-cell CAS) b) Calculate the Pre-tax income Sales - Total Operating cost-interest on Loans 1x). Calculate the Tax Check the Description for Tax Assumption-cell 49 and Cell CSO) (Note: Uself Function (xi). Calculate the Profit Pre-tax Income Tax (xii). Format the worksheet as shown in the Table 1. Exercise Instructions. (i). (ii) (iii). (iv) (v) Create a new worksheet named W7-PE-M3-Your Name Enter all the titles and texts Create the Table 2 since Row 35 with the title Assumption. Calculate the Sales for the Year 1 in B4 and for the other years using the percentage given in the row C Cakulate the different items that make up the Total Operating costs using the parameters in the Assumption sheet and the Description provided (Use Absolute Referencing effectively as learned in the Module 3 of the Book). (vi). Calculate Total Cost of Goods Sold - Materials + Wages Other Benefits Other (vid. Calculate the Total Operating costs - Total Cost of Goods Sold Total General and Administrative Expenses. (vii), Cakulate the interest on Loans (Check the Description for Interest of Loans Assumption cell 048) (1x). Cakulate the Pre-tax income Sales - Total Operating cost- terest on Loans (x). Calculate the Tax. (Check the Description for Tax Assumption. Cell C49 and Cell C50) (Note: Use IF Function) (xi). Cakulate the Profit Pre-tax Income Tax. (xii). Format the worksheet as shown in the Table 1. Table 1: 1 of 4 Practical Exerci E l Module Your Name INCOME AND EXPENSES PROJECTIONS Sales $10,000.00 $12,000.00 209 SI5.600.00 S1,720.00 $20.592.00 $22.65110 $1.700.00 52.040.00 $1..00 5252.00 $10.00 52.652.00 52. 14.00 $127.60 52.0 20.0 $210.00 $125.9 00 OLOS 00 ONS 00 SOES 00 OSS $1,100.00 S960.00 $350.20 S300.00 S1.210.00 $1.248.00 $417.86 S390.00 $1,497.60 540.6 5460.00 $1.667.36 552895 5514 BO Advertising Promotions $2,386.00 $2,750.20 $3,315.36 $3,037.46 54.650.7 56.830.20 S8.596.10 S10, 159.75 $11.177.21 10.00 10.00 10.00 10.00 10.00 10.00 56,99.90 59.404.79 $10,345.95 SOGERES $2.01.09 51.03.42 52.213.71 53.00738 53.7661 54,06406 54.440.70 Assume 52.750.20 $3,315.86 S42252 1 of 4 ts $2.386.00 $5.796.00 S883746 $10,159.75 56,8:30.20 10.00 4.650.73 $12.295.21 10.00 30.00 10.00 $11.277.21 10.00 S9.404.79 $8.596.10 10.00 $6,993.30 $3,936.52 53.00738 $5,159.BO S.550.25 $10,345.99 $2,941.09 5.360.73 $2,390.SE $1.803.42 $2,218.71 53.676.61 $4,044.00 54.448.78 Assumption Value Starta 10.000 and grow by percenter 10000 2.100 Start at 100, then Start at 1.000, then by a yearly hy 10 w 2.50 10d bywed amount of 1 of 4 EXCEL Module 3 Practical Exercise You oversee a young and growing business. You have identified the various factors (sources of revenue and expenses) that influence the business as shown in the table below. Use the figures provided and the layout to create a financial projection model for the business for the next six years. The parameters are given on Table 2 as Assumptions Table 1: INCOME AND EXPENSES PROJECTIONS 10.000.00 $12.000.00 $15,000.00 1.720.00 $20.592.00 $22,65120 $1.400.00 52.184.00 15 Salary: Sales 17 Advertising Promotions 18 Depreciation