Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Provide a brief description of the individual or familys current financial situation. 2.Discuss the financial strengths and weaknesses of the individual or familys situation. 3.Explain

1.Provide a brief description of the individual or family’s current financial situation.

2.Discuss the financial strengths and weaknesses of the individual or family’s situation.

3.Explain any misunderstanding the individual or family has about financial issues.

4.You should comment about their cash flow situation.

5.Use appropriate ratios to discuss the financial situation of the individual or family.

6.You should also calculate the savings required to reach financial goals.

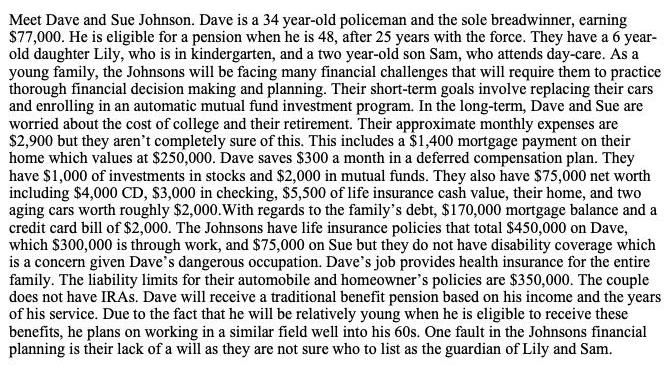

Meet Dave and Sue Johnson. Dave is a 34 year-old policeman and the sole breadwinner, earning $77,000. He is eligible for a pension when he is 48, after 25 years with the force. They have a 6 year- old daughter Lily, who is in kindergarten, and a two year-old son Sam, who attends day-care. As a young family, the Johnsons will be facing many financial challenges that will require them to practice thorough financial decision making and planning. Their short-term goals involve replacing their cars and enrolling in an automatic mutual fund investment program. In the long-term, Dave and Sue are worried about the cost of college and their retirement. Their approximate monthly expenses are $2,900 but they aren't completely sure of this. This includes a $1,400 mortgage payment on their home which values at $250,000. Dave saves $300 a month in a deferred compensation plan. They have $1,000 of investments in stocks and $2,000 in mutual funds. They also have $75,000 net worth including $4,000 CD, $3,000 in checking, $5,500 of life insurance cash value, their home, and two aging cars worth roughly $2,000.With regards to the family's debt, $170,000 mortgage balance and a credit card bill of $2,000. The Johnsons have life insurance policies that total $450,000 on Dave, which $300,000 is through work, and $75,000 on Sue but they do not have disability coverage which is a concern given Dave's dangerous occupation. Dave's job provides health insurance for the entire family. The liability limits for their automobile and homeowner's policies are $350,000. The couple does not have IRAs. Dave will receive a traditional benefit pension based on his income and the years of his service. Due to the fact that he will be relatively young when he is eligible to receive these benefits, he plans on working in a similar field well into his 60s. One fault in the Johnsons financial planning is their lack of a will as they are not sure who to list as the guardian of Lily and Sam.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 The Johnsons are a young family with two children a 6yearold daughter and a 2yearold son Dave is the sole breadwinner earning 77000 annually as a po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started