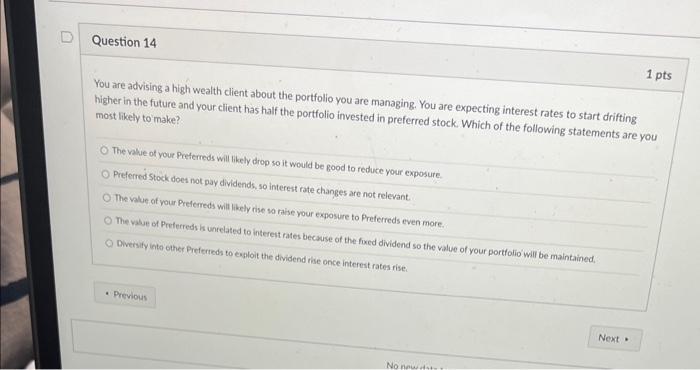

Question: 1pts higher in the future and your client has half the portfolio invested in preferred stock. Which of the following statements are you most likely

1pts higher in the future and your client has half the portfolio invested in preferred stock. Which of the following statements are you most likely to make? The value of your Preferreds will likely drop so it would be good to reduce your exposure. Preferred stock does not pay dividends, so interest rate changes are not relevant. The value of your Prelerreds will likely rise so rabe your exposure to Preferreds even more. The vasue of Preferreds is unrelated to interest rates becsuse of the fixed dividend so the value of your portfolio' will be maintained, Diversify into other Prefecreds to esploit the dividend rise once interest rates rise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts