Question

1.Question 1: Based on the following data, is there any arbitrage opportunities? Please detail the action plan to generate arbitrage profit/loss. Spot rate CAD/EUR 0.7322

1.Question 1:

Based on the following data, is there any arbitrage opportunities? Please detail the action plan to generate arbitrage profit/loss.

| Spot rate CAD/EUR | 0.7322 44 |

| 180day-Forward rate CAD/EUR | 0.7330 58 |

| CADs APR | 5%-6% |

| EURs APR | 7%-8% |

2. Question 2 :

Google will receive a payment totaling 10million next month from Italian suppliers. It can buy euro put options with a strike price of $1.07 at a premium of 2.0 cents per euro. The spot price of the euro is currently $1.05, and the euro is expected to trade in the range of $1.01 to $1.20. Google also can take a short position in the euro futures contract with futures price at $1.03.

a.How many options and futures contracts will Google need to protect its payment? Each contract size is 62,500 for options and 125,000 for futures and calculate the breakeven points.

b.Diagram Google's profit and loss associated with the put option position and futures position within its range of expected exchange rates. Ignore transaction costs and margins.

c.Calculate what Google would gain or lose on the option and the future within the range of expected future exchange rates at three points: $1.01, $1.06 & $1.11.

3.Question 3 :

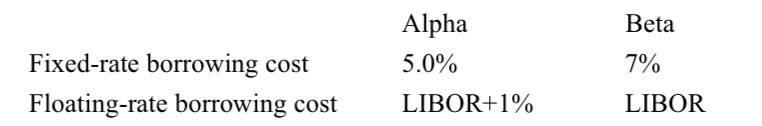

Alpha and Beta Companies can borrow for a ten-year term at the following rates:

a. Calculate the quality spread differential (QSD).How do Alpha and Beta swap their borrowings?

b. Calculate all in-cost in which both Alpha enjoys 60% of total cost savings while Beta enjoys 40% total cost savings in their borrowing costs.

c. Suppose a bank charges 1% to arrange the swap and Alpha and Beta split the resulting cost savings. Calculate all incost in this case.

4.Question 4:

Suppose that the US government imposes higher tax applied on rice imported from Vietnam. How do these events affect exchange rates between USD and VND on the foreign exchange market (FX)? The central bank of Vietnam (SBV) would like to maintain the previous rate. What actions they will do?

Fixed-rate borrowing cost Floating-rate borrowing cost Alpha 5.0% LIBOR+1% Beta 7% LIBOR Fixed-rate borrowing cost Floating-rate borrowing cost Alpha 5.0% LIBOR+1% Beta 7% LIBORStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started