Answered step by step

Verified Expert Solution

Question

1 Approved Answer

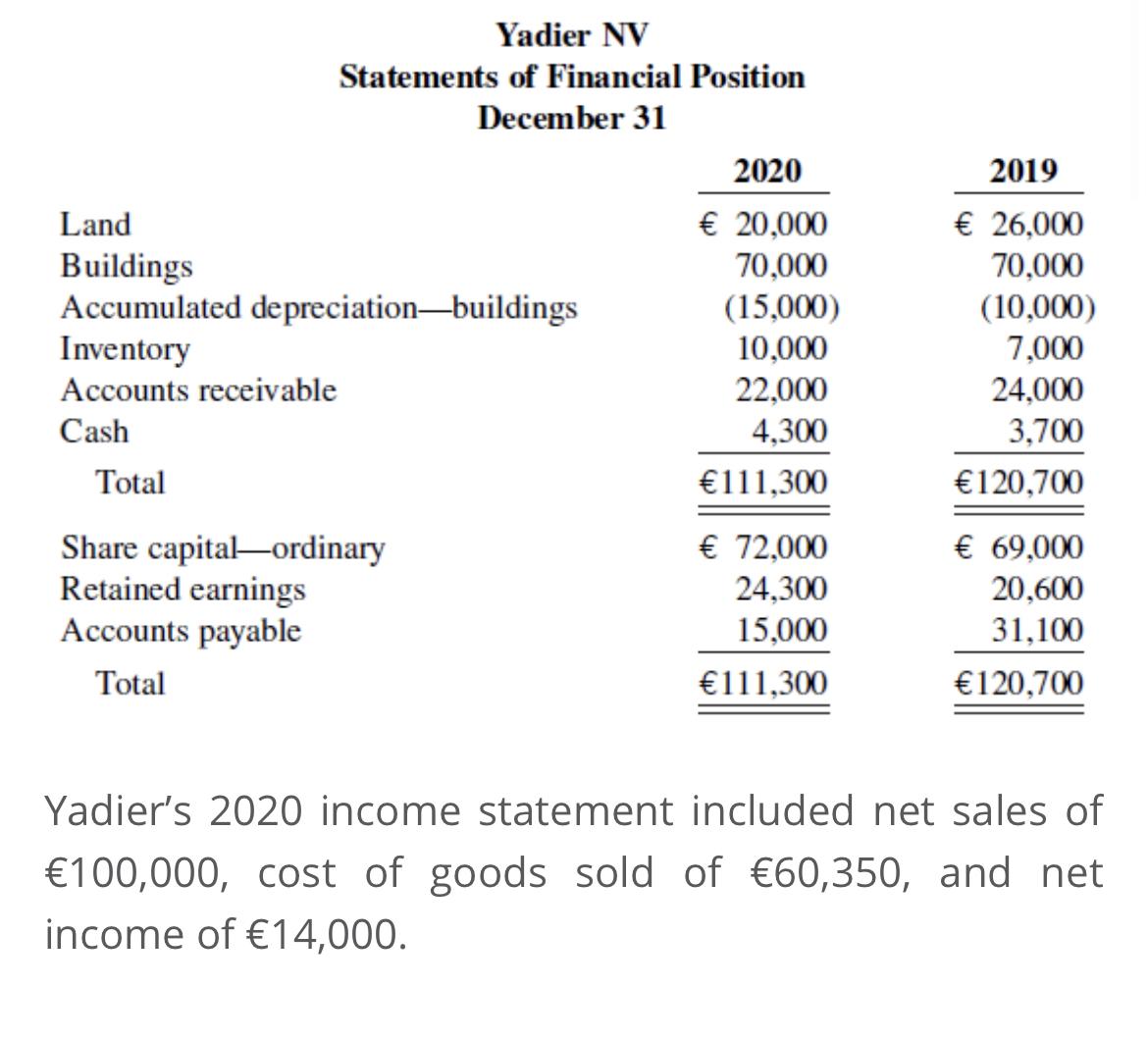

1.return on ordinary shareholders equity 2.accounts receivable turnover 3.acid test 4.asset turnover 5.inventory turnover 6.return on asset 7.profit margin Yadier NV Statements of Financial Position

1.return on ordinary shareholders’ equity

1.return on ordinary shareholders’ equity

2.accounts receivable turnover

3.acid test

4.asset turnover

5.inventory turnover

6.return on asset

7.profit margin

Yadier NV Statements of Financial Position December 31 2020 2019 20,000 26,000 Land Buildings 70,000 70,000 Accumulated depreciation-buildings (15,000) (10,000) Inventory 10,000 7,000 Accounts receivable 22,000 24,000 Cash 4,300 3,700 Total 111,300 120,700 Share capital-ordinary 72,000 69,000 Retained earnings 24,300 20,600 Accounts payable 15,000 31,100 Total 111,300 120,700 Yadier's 2020 income statement included net sales of 100,000, cost of goods sold of 60,350, and net income of 14,000.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Calculations for following ratios in 2020 1 Current ratio current assets Current liabilities Current ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started