Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1st drop down list: 6.43/13.79/17.24/26.03 2nd drop down list: 4.90/17.24/26.03/22.13 Using Approximate Yield with Mutual Funds The formula for approximate yield of an investment can

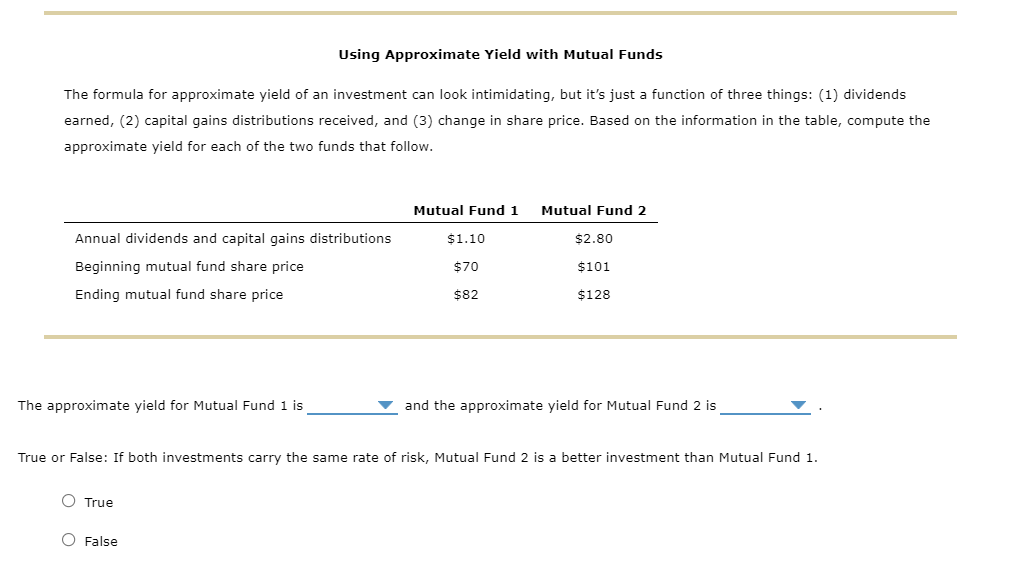

1st drop down list: 6.43/13.79/17.24/26.03

2nd drop down list: 4.90/17.24/26.03/22.13

Using Approximate Yield with Mutual Funds The formula for approximate yield of an investment can look intimidating, but it's just a function of three things: (1) dividends earned, (2) capital gains distributions received, and (3) change in share price. Based on the information in the table, compute the approximate yield for each of the two funds that follow. Mutual Fund 1 Mutual Fund 2 $1.10 $2.80 Annual dividends and capital gains distributions Beginning mutual fund share price Ending mutual fund share price $ 70 $101 $82 $128 The approximate yield for Mutual Fund 1 is and the approximate yield for Mutual Fund 2 is True or False: If both investments carry the same rate of risk, Mutual Fund 2 is a better investment than Mutual Fund 1. O True O False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started