Question

1)The following instructions relate to the Land: a) Prepare the journal entry to revalue the Land if the fair value at the end of 2020

1)The following instructions relate to the Land:

a) Prepare the journal entry to revalue the Land if the fair value at the end of 2020 is $30,000.

b) Prepare the journal entry to revalue the Land if the fair value at the end of 2020 is $15,000.

2)The following instructions relate to the building (assume there is just one):

a) Calculate the age of the building as at the end of 2020.

b) Assume the estimated fair value of the Building at the end of 2020 is $120,000. Prepare the journal entries to revalue the Building.

c) Carrying on from b), prepare the journal entries to revalue the Building at the end of 2021 if the balance in Accumulated Depreciation is $4,000 and the Building has an estimated fair value of $100,000.

d) Now assume the estimated fair value of the Building at the end of 2020 is $100,000 (instead of $120,000). Prepare the journal entries to revalue the Building.

e) Carrying on from d), prepare the journal entries to revalue the Building at the end of 2021 if the balance in Accumulated Depreciation is $3,200 and the Building has an estimated fair value of $115,000.

f) Prepare the closing entry for 2 e). The business uses the Income Summary account, as needed.

3)The estimated fair value of the Equipment at the end of 2020 is $20,000. Discuss if a revaluation journal entry is required.

4)Where on the SOCI (prepared using the format prescribed by this course) will you find the Revaluation Gain/Loss account?

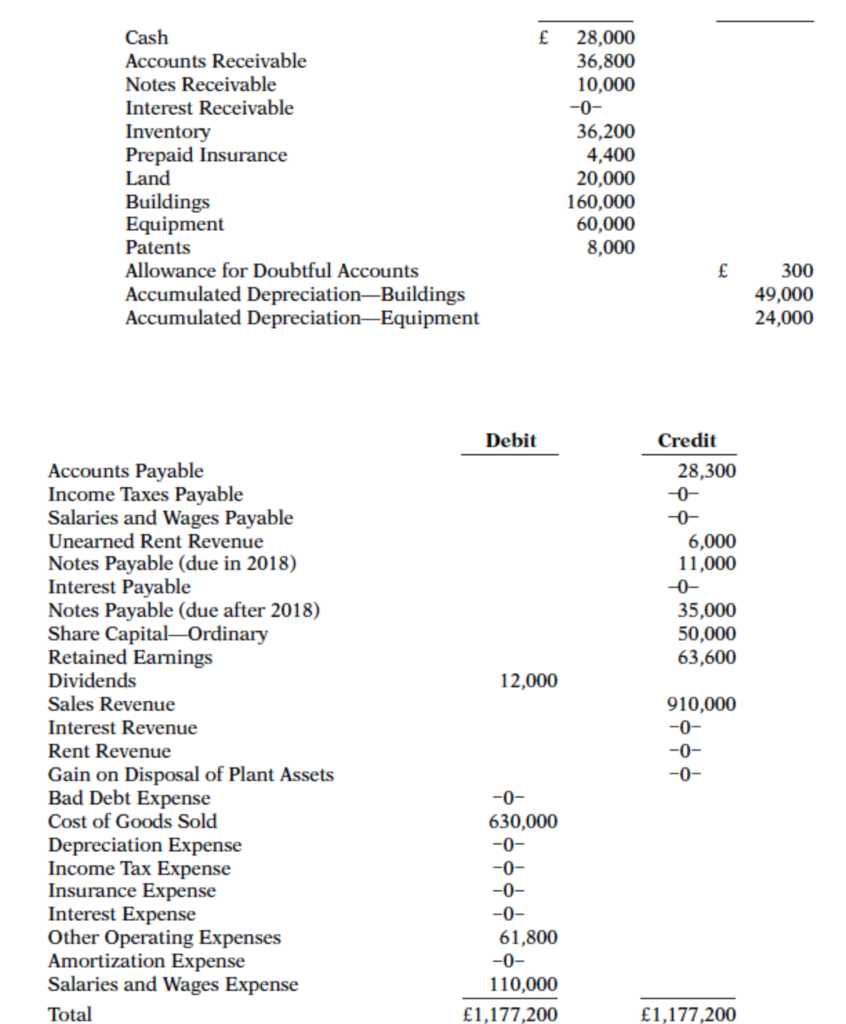

Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Insurance Land Buildings Equipment Patents Allowance for Doubtful Accounts Accumulated DepreciationBuildings Accumulated Depreciation Equipment 28,000 36,800 10,000 -0- 36,200 4,400 20,000 160,000 60,000 8,000 300 49,000 24,000 Debit Credit 28,300 -0- 6,000 11,000 0- 35,000 50,000 63,600 12,000 Accounts Payable Income Taxes Payable Salaries and Wages Payable Unearned Rent Revenue Notes Payable (due in 2018) Interest Payable Notes Payable (due after 2018) Share CapitalOrdinary Retained Earnings Dividends Sales Revenue Interest Revenue Rent Revenue Gain on Disposal of Plant Assets Bad Debt Expense Cost of Goods Sold Depreciation Expense Income Tax Expense Insurance Expense Interest Expense Other Operating Expenses Amortization Expense Salaries and Wages Expense Total 910,000 -0- -0- -0- -0- 630,000 -0- -0- -0- -0- 61,800 -0- 110,000 1,177,200 1,177,200 Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Insurance Land Buildings Equipment Patents Allowance for Doubtful Accounts Accumulated DepreciationBuildings Accumulated Depreciation Equipment 28,000 36,800 10,000 -0- 36,200 4,400 20,000 160,000 60,000 8,000 300 49,000 24,000 Debit Credit 28,300 -0- 6,000 11,000 0- 35,000 50,000 63,600 12,000 Accounts Payable Income Taxes Payable Salaries and Wages Payable Unearned Rent Revenue Notes Payable (due in 2018) Interest Payable Notes Payable (due after 2018) Share CapitalOrdinary Retained Earnings Dividends Sales Revenue Interest Revenue Rent Revenue Gain on Disposal of Plant Assets Bad Debt Expense Cost of Goods Sold Depreciation Expense Income Tax Expense Insurance Expense Interest Expense Other Operating Expenses Amortization Expense Salaries and Wages Expense Total 910,000 -0- -0- -0- -0- 630,000 -0- -0- -0- -0- 61,800 -0- 110,000 1,177,200 1,177,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started