1.What learnings should be derived from Stella's early positioning and image problems in the UK market?

2.Can you diagnose what went wrong with the Mexico market launch of the Stella brand? Is this campaign appropriate for a new brand launch? How do you think the cause marketing issue of water would resonate with consumers in a market like Mexico?

3.In planning for the South Africa launch, Ricardo Tadeu's team considered the success of the BALAD campaign in the US and many other markets. The team also had some knowledge of the disappointing results in Mexico. What are the pros and cons of centering the introduction activities on Stella Artois' global sponsorship of Water.org? What would be your recommendation for introduction activities?

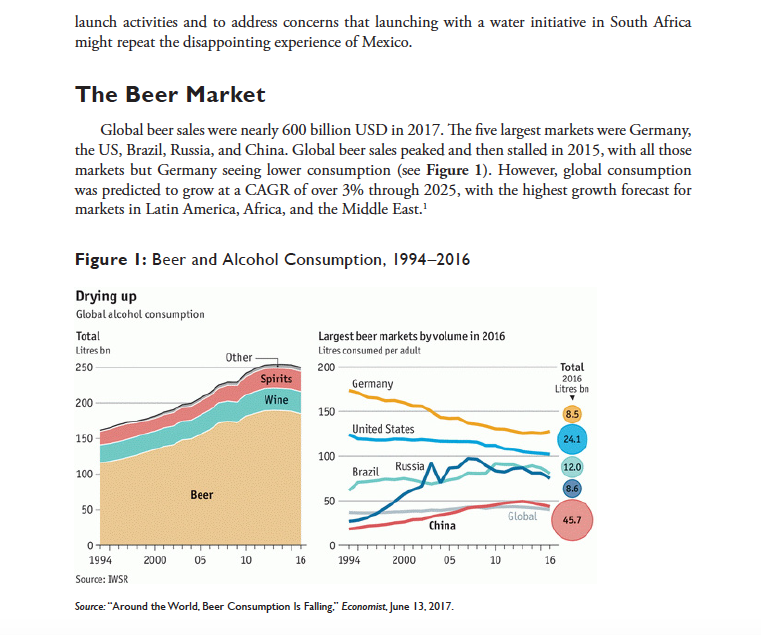

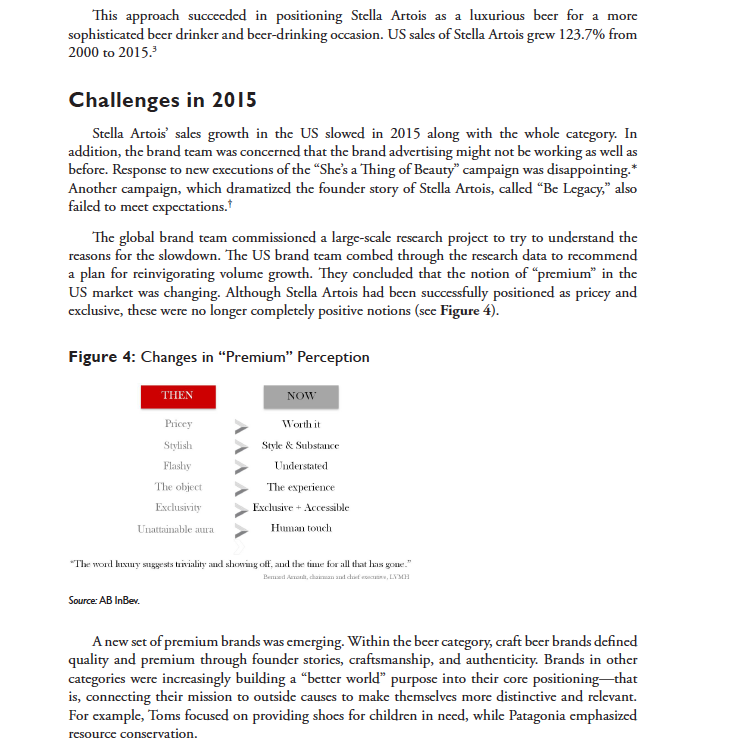

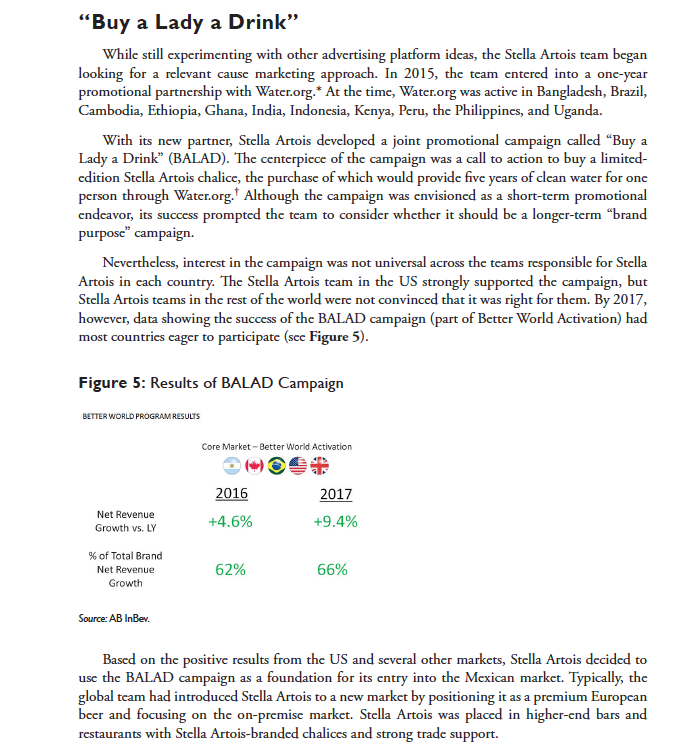

Stella Artois in South Africa: Cause Marketing and the Building of a Global Brand On January 17, 2017, Ricardo Tadeu, AB InBev Zone President for Africa, sat in his office in Sandton, South Africa. He could not remember being more excited about a business opportunity than he was about launching Stella Artois beer in South Africa. He was thrilled not only by the challenge of introducing the premium brand to the South African market but also by the opportunity to further a cause marketing effort about which he was passionate.* Tadeu had just returned from the World Economic Forum in Davos, Switzerland, where he had spoken on a panel alongside Matt Damon and Gary White, cofounders of Stella Artois partner Water.org, a leading global nonprofit created to help provide access to clean water and sanitation to people in the developing world. The trio used the conference as the platform to announce a new four-year partnership renewal that planned to reach 3.5 million people by 2020. From 2015 to 2017, Stella Artois had not only reached over a million people through its promotional campaign selling limited-edition Stella Artois branded chalices but also had increased its sales in markets where the campaign had run, with one exception: Mexico. With water supply problems fresh in the minds of South African consumers due to water shortages in the country's capital of Cape Town, Tadeu felt the timing could not be better to use the water initiative to launch the brand. He began working to finalize his recommendations forlaunch activities and to address concerns that launching with a water initiative in South Africa might repeat the disappointing experience of Mexico. The Beer Market Global beer sales were nearly 600 billion USD in 2017. The five largest markets were Germany, the US, Brazil, Russia, and China. Global beer sales peaked and then stalled in 2015, with all those markets but Germany seeing lower consumption (see Figure 1). However, global consumption was predicted to grow at a CAGR of over 3% through 2025, with the highest growth forecast for markets in Latin America, Africa, and the Middle East.' Figure I: Beer and Alcohol Consumption, 1994-2016 Drying up Global alcohol consumption Total Largest beer markets byvolume in 2016 Litres bri Other Litres consumed per adult 250 200 Total Spirits Germany 2016 Litres bn 200 Wine 150 8.5 150 United States 24.1 100 100 Brazil Russia 12.0 Beer 8.6 50 50 China Global 45.7 1994 2000 05 10 16 1994 2000 05 10 16 Source: IWSR Source: "Around the World, Beer Consumption Is Falling," Economist, June 13, 2017.Although beer was a truly global category, consumption patterns varied according to the maturity of each market. As markets matured, consumer demographics, usage occasions, competition, and price points evolved in predictable ways. Market maturity was categorized as follows: Law! I: In Level 1 markets, beer was consumed primarily by men, usually at a bar or on very informal occasions without food. At bar was often nodiing more than a stand or shed with a few tables and potential access to ice or refrigeration. Homerbnewed beverages were also sometimes served at bars; commercially produced beer was usually the most expensive prOduct available. That said, Level 1 markets had no premium beer segment or higherr priced brands. Uruguay and Uganda were examples oflevel l markets. . Level 2: In a Level 2 market, women began to enter the beer category, and consumption occasions expanded to include mixed-gender parties and social gatherings, sometimes accompanied by food. Category pricing began to expand, and premium-priced beers emerged. Brazil was a Level 2 market. Level 3: When a market matured to Level 3, consumption moved for the first time to the home. Relaxed occasions, including parties and other events, occurred at home, usually with meals. Women and families were present, and food was plentiful and important. Beer was often not the only alcoholic beverage option; wine and spirit-based mixed drinks also played a role. Category pricing expanded further, and premium-priced options experienced the greatest growth. The US and Germany were Level 3 markets. It should be noted that these levels were not mutually exclusive. Level 3 markets such as the US also had Level 2 occasions and establishments. The level of a market, therefore, referred to the highest level of maturity within it. Stella Artois History Stella Artois had a long and notable history. In 1717, in Leuven, Belgium, Sebastien Artois purchased a brewery that had been established in 1366 and renamed it Brouwerij Artois.* Stella Artois was created as a seasonal beer in 1926 and was produced year-round beginning in the 1930s. A premium brand in most markets, it has been depicted served in a trademark glass or chalice (see Figure 2). In 2017, Stella Artois was available in most drinking establishments in Belgium. Although "common" in terms of being readily available, Stella Artois was viewed by Belgians as a brand with a reputation for quality.\fStella Artois' first major overseas market was the UK, where the beer was brewed under license starting in 1976. The brand was positioned as a premium product with a high price and supported by a famous advertising campaign called "Reassuringly Expensive." The campaign, which ran from 1982 to 2007, emphasized the unique quality of Stella Artois beer and the lengths customers would go to get it.* The original formulation sold in the UK had an alcohol content of 5.2%, which was stronger than most mainstream lagers. Deep discounts offered to the retail trade throughout the 1990s and early 2000s helped the brand gain wide distribution, but the combination of high alcohol content and low price created an unanticipated reputation as the drink of choice for "lager louts- stereotypical binge drinking and pub brawling scoundrels who you normally associate with football hooliganism."? The Stella Artois brand management team's efforts to counter these associations were notably aided by lowering the alcohol content to 4.8% in 2012, by discouraging discounting, and by trimming distribution. Stella Artois was introduced to the US in the carly 2000s. Because it was European and sold in a green bottle, it was perceived as a premium beer. Marketing efforts prioritized on-premise sales (bars and restaurants) versus off-premise (liquor and grocery stores). Having Stella served on-premise in the branded chalice was a successful marketing tactic in the US. Whereas the use of branded glasses was a common practice in European bars and pubs, it was novel in the US and enhanced the beer's premium image. Stella Artois continued to use highly distinctive advertising to build its brand reputation in the US market. Print ads supported Stella Artois in the "She's a Thing of Beauty" campaign. The advertising was shot by well-known photographer Bert Stern, with a Vogue-like, artistic style that was distinctly different from advertising for other beer brands (see Figure 3). A similarly distinctive approach was used in TV advertising, which became increasingly sophisticated over the years. Figure 3: "She's a Thing of Beauty" AdThis approach succeeded in positioning Stella Artois as a luxurious beer for a more sophisticated beer drinker and beer-drinking occasion. US sales of Stella Artois grew 123.7% from 2000 to 2015.3 Challenges in 2015 Stella Artois' sales growth in the US slowed in 2015 along with the whole category. In addition, the brand team was concerned that the brand advertising might not be working as well as before. Response to new executions of the "She's a Thing of Beauty" campaign was disappointing.* Another campaign, which dramatized the founder story of Stella Artois, called "Be Legacy," also failed to meet expectations. The global brand team commissioned a large-scale research project to try to understand the reasons for the slowdown. The US brand team combed through the research data to recommend a plan for reinvigorating volume growth. They concluded that the notion of "premium" in the US market was changing. Although Stella Artois had been successfully positioned as pricey and exclusive, these were no longer completely positive notions (see Figure 4). Figure 4: Changes in "Premium" Perception THEN NOW Pricey Worth it Stylish Style & Substance Flashy Understated The object The experience Exclusivity Exclusive + Accessible Unattainable aura Human touch The word luxury suggests triviality and showing off, and the time for all that has gone." Berand Amraul, chairman and chief execman, LVMH Source: AB InBer. A new set of premium brands was emerging. Within the beer category, craft beer brands defined quality and premium through founder stories, craftsmanship, and authenticity. Brands in other categories were increasingly building a "better world" purpose into their core positioning-that is, connecting their mission to outside causes to make themselves more distinctive and relevant. For example, Toms focused on providing shoes for children in need, while Patagonia emphasized resource conservation."Buy a Lady a Drink" While still experimenting with other advertising platform ideas, the Stella Artois team began looking for a relevant cause marketing approach. In 2015, the team entered into a one-year promotional partnership with Water.org.* At the time, Water.org was active in Bangladesh, Brazil, Cambodia, Ethiopia, Ghana, India, Indonesia, Kenya, Peru, the Philippines, and Uganda. With its new partner, Stella Artois developed a joint promotional campaign called "Buy a Lady a Drink" (BALAD). The centerpiece of the campaign was a call to action to buy a limited- edition Stella Artois chalice, the purchase of which would provide five years of clean water for one person through Waterorg. Although the campaign was envisioned as a short-term promotional endeavor, its success prompted the team to consider whether it should be a longer-term "brand purpose" campaign. Nevertheless, interest in the campaign was not universal across the teams responsible for Stella Artois in each country. The Stella Artois team in the US strongly supported the campaign, but Stella Artois teams in the rest of the world were not convinced that it was right for them. By 2017, however, data showing the success of the BALAD campaign (part of Better World Activation) had most countries eager to participate (see Figure 5). Figure 5: Results of BALAD Campaign BETTER WORLD PROGRAM RESULTS Core Market - Better World Activation 2016 2017 Net Revenue Growth v5. LY +4.6% +9.4% % of Total Brand Net Revenue 62% 66% Growth Source: AB InBev. Based on the positive results from the US and several other markets, Stella Artois decided to use the BALAD campaign as a foundation for its entry into the Mexican market. Typically, the global team had introduced Stella Artois to a new market by positioning it as a premium European beer and focusing on the on-premise market. Stella Artois was placed in higher-end bars and restaurants with Stella Artois-branded chalices and strong trade support.In Mexico, however, the water campaign was included as a central part of the Stella Artois brand launch as soon as awareness for the beer reached about 15%. Results were disappointing, which made Mexico the first market in which the water campaign failed to produce significant revenue gains. Plans for South Africa Following its 2016 combination with SAB, AB InBev was planning for the introduction of Stella Artois to South Africa in 2017. The South African beer market was growing, but beer still held a relatively low share of total alcohol consumption. Beer consumption was predominantly a male activity in off-premise social occasions; penetration for women was 37% vs. 62% for the overall population. The beer market was dominated by SAB, which had 85% share, mostly through local brands Castle and Castle Lite. Heineken was the leader in the small premium segment, which had a total share of less than 8% by volume. The introduction of Stella Artois was a major undertaking for Tadeu and his team. After his presentation at Davos with Water.org, he was anxious to make the BALAD water campaign a central part of the launch. Water.org was not active in South Africa, but access to water had recently been a high-profile issue in Cape Town, which had imposed extreme water use restrictions in the midst of a countdown to Day Zero, when the city expected to run out of water. The timing for the launch could not be better, Tadeu thought. He was aware of the troubles with the brand launch in Mexico, but he was confident that circumstances were different in South Africa. He needed to prepare arguments to convince the doubters and to develop his recommendations for introduction activities