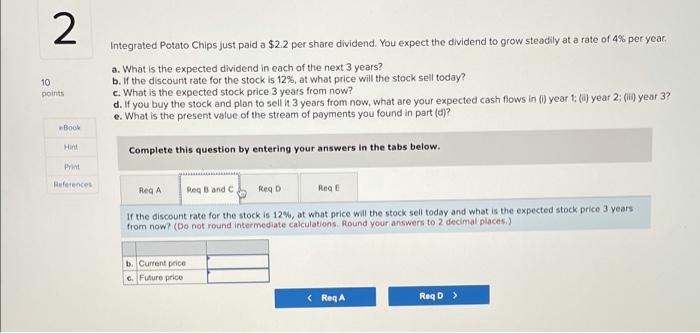

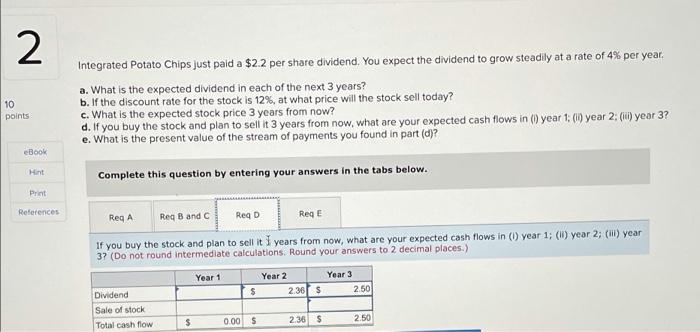

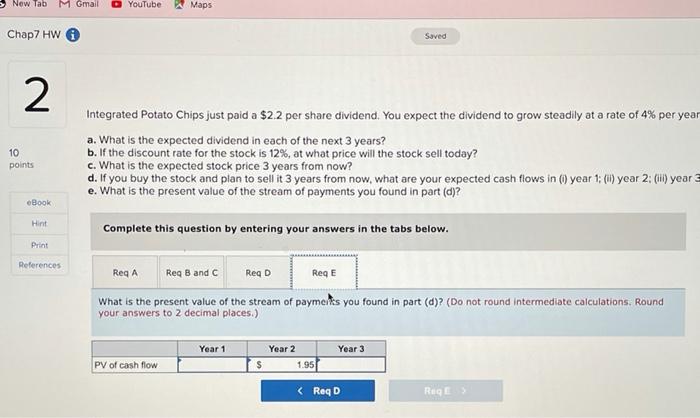

2 10 points Integrated Potato Chips just paid a $2.2 per share dividend. You expect the dividend to grow steadily at a rate of 4% per year, a. What is the expected dividend in each of the next 3 years? b. If the discount rate for the stock is 12%, at what price will the stock sell today? c. What is the expected stock price 3 years from now? d. If you buy the stock and plan to sell it 3 years from now, what are your expected cash flows in () year 13 (1) year 2:00 year 3? e. What is the present value of the stream of payments you found in part (a)? -Book Hint Complete this question by entering your answers in the tabs below. Print Heferences Reg D Reg A Reg B and c Reg if the discount rate for the stock is 12%, at what price will the stock sell today and what is the expected stock price 3 years from now? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) b. Current price c. Future price 2 10 points Integrated Potato Chips just paid a $2.2 per share dividend. You expect the dividend to grow steadily at a rate of 4% per year. a. What is the expected dividend in each of the next 3 years? b. If the discount rate for the stock is 12%, at what price will the stock sell today? c. What is the expected stock price 3 years from now? d. If you buy the stock and plan to sell it 3 years from now, what are your expected cash flows in () year 1: (1) year 2 (1) year 3? e. What is the present value of the stream of payments you found in part (d)? eBook Hint Complete this question by entering your answers in the tabs below. Print References Reg A Red Band C Reg D ReqE If you buy the stock and plan to sell it I years from now, what are your expected cash flows in (1 year 1; (I) year 2; (I) year 3? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year 1 Year 2 2.367 s Year 3 2.50 $ Dividend Sale of stock Total cash flow $ 0.00 $ 2.36 $ 2.50 New Tab M Gmail YouTube Maps Chap7 HW Saved 2 a 10 points Integrated Potato Chips just paid a $2.2 per share dividend. You expect the dividend to grow steadily at a rate of 4% per year a. What is the expected dividend in each of the next 3 years? b. If the discount rate for the stock is 12%, at what price will the stock sell today? c. What is the expected stock price 3 years from now? d. If you buy the stock and plan to sell it 3 years from now, what are your expected cash flows in year 1: (i) year 2: ) year e. What is the present value of the stream of payments you found in part (d)? Book Hint Complete this question by entering your answers in the tabs below. Print References Reg D Req A Reg B and C Reg E What is the present value of the stream of paymells you found in part (d)? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Year 1 Year 2 1.95 Year 3 PV of cash flow $