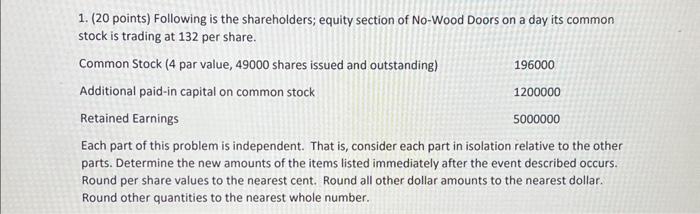

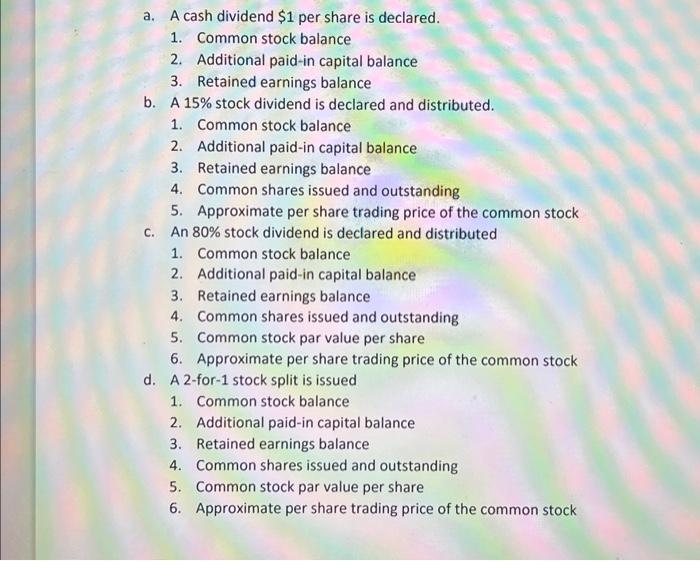

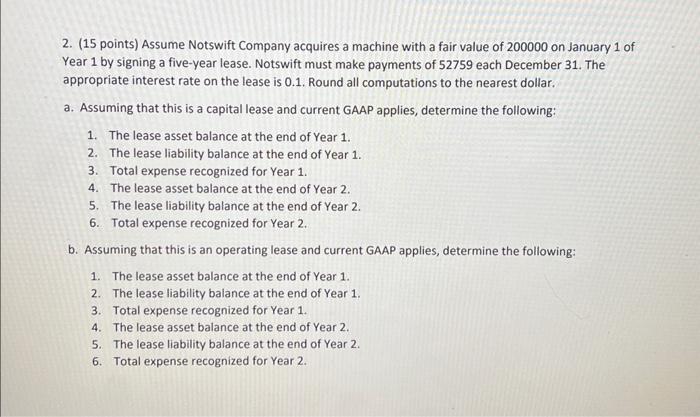

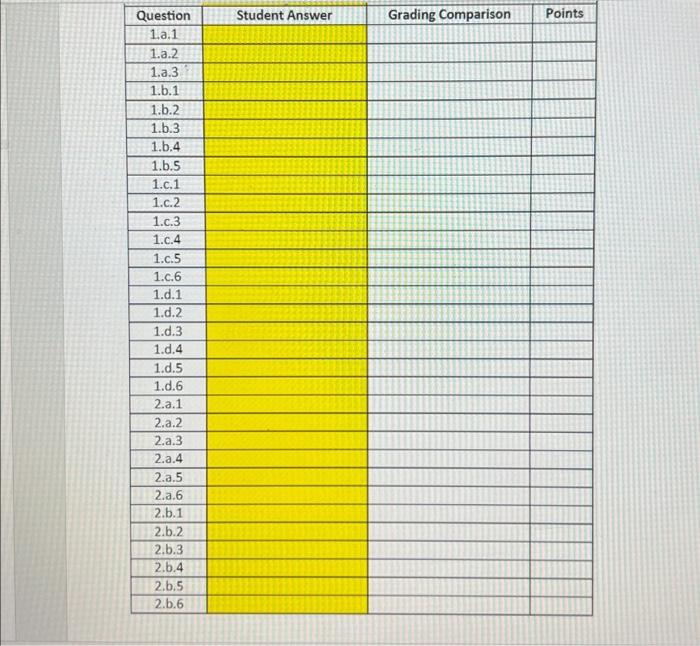

2. (15 points) Assume Notswift Company acquires a machine with a fair value of 200000 on January 1 of Year 1 by signing a five-year lease. Notswift must make payments of 52759 each December 31 . The appropriate interest rate on the lease is 0.1 . Round all computations to the nearest dollar. a. Assuming that this is a capital lease and current GAAP applies, determine the following: 1. The lease asset balance at the end of Year 1. 2. The lease liability balance at the end of Year 1. 3. Total expense recognized for Year 1. 4. The lease asset balance at the end of Year 2. 5. The lease liability balance at the end of Year 2. 6. Total expense recognized for Year 2. b. Assuming that this is an operating lease and current GAAP applies, determine the following: 1. The lease asset balance at the end of Year 1. 2. The lease liability balance at the end of Year 1. 3. Total expense recognized for Year 1. 4. The lease asset balance at the end of Year 2. 5. The lease liability balance at the end of Year 2 . 6. Total expense recognized for Year 2. 1. ( 20 points) Following is the shareholders; equity section of No-Wood Doors on a day its common stock is trading at 132 per share. Each part of this problem is independent. That is, consider each part in isolation relative to the other parts. Determine the new amounts of the items listed immediately after the event described occurs. Round per share values to the nearest cent. Round all other dollar amounts to the nearest dollar. Round other quantities to the nearest whole number. a. A cash dividend $1 per share is declared. 1. Common stock balance 2. Additional paid-in capital balance 3. Retained earnings balance b. A 15% stock dividend is declared and distributed. 1. Common stock balance 2. Additional paid-in capital balance 3. Retained earnings balance 4. Common shares issued and outstanding 5. Approximate per share trading price of the common stock c. An 80% stock dividend is declared and distributed 1. Common stock balance 2. Additional paid-in capital balance 3. Retained earnings balance 4. Common shares issued and outstanding 5. Common stock par value per share 6. Approximate per share trading price of the common stock d. A 2-for-1 stock split is issued 1. Common stock balance 2. Additional paid-in capital balance 3. Retained earnings balance 4. Common shares issued and outstanding 5. Common stock par value per share 6. Approximate per share trading price of the common stock