Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. (20 points) The corporate bond market has increased in importance recently. Large corporations have increasingly turn to this market to raise financial capi- tal.

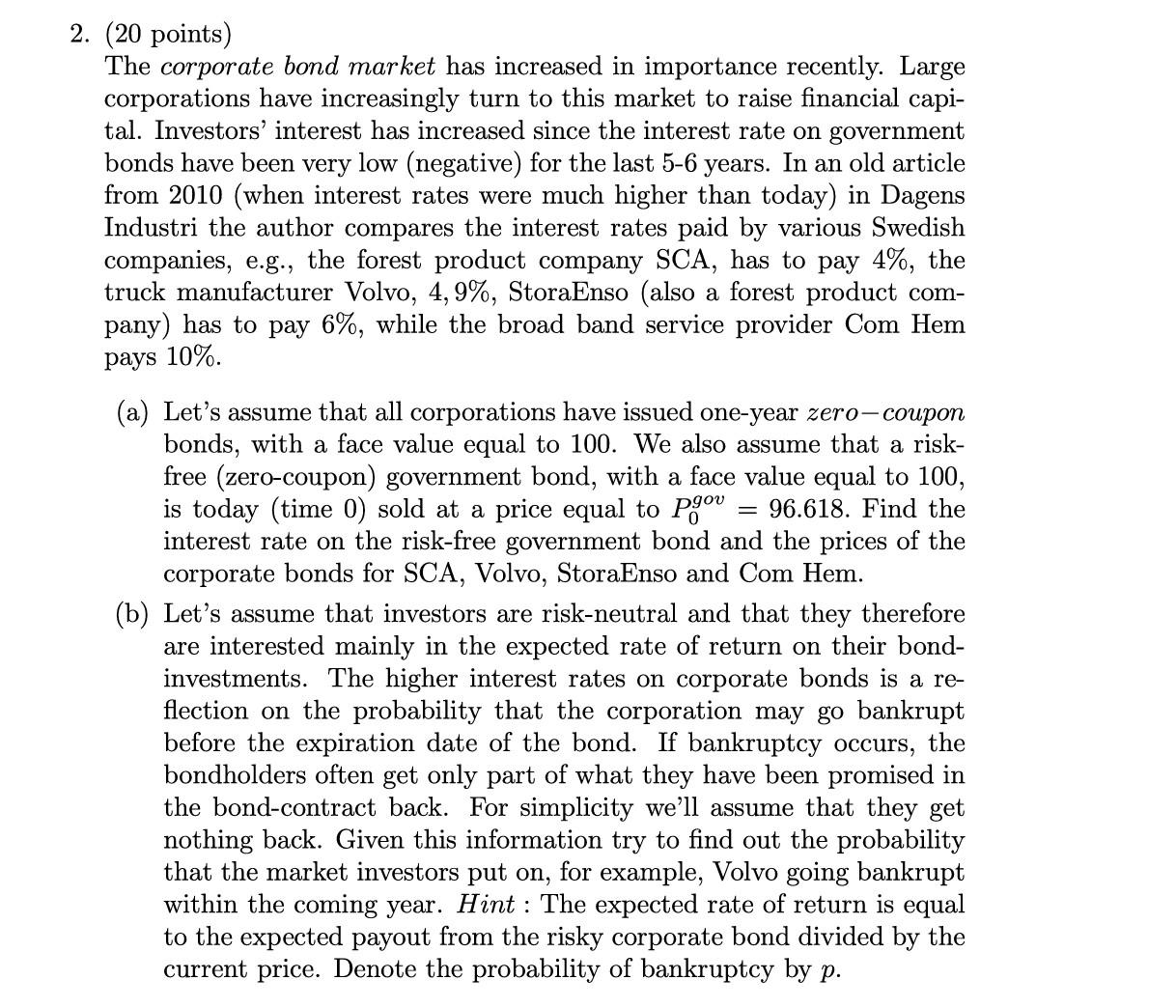

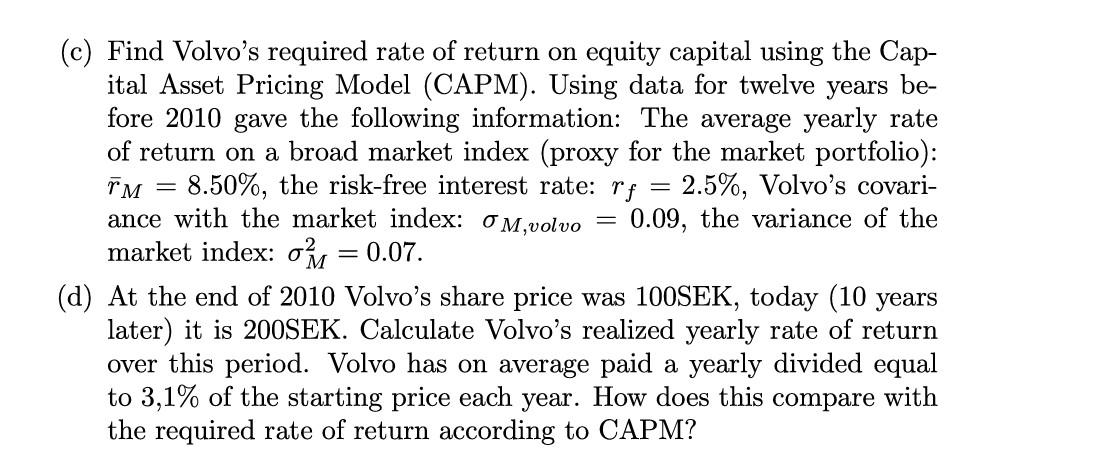

2. (20 points) The corporate bond market has increased in importance recently. Large corporations have increasingly turn to this market to raise financial capi- tal. Investors' interest has increased since the interest rate on government bonds have been very low (negative) for the last 5-6 years. In an old article from 2010 (when interest rates were much higher than today) in Dagens Industri the author compares the interest rates paid by various Swedish companies, e.g., the forest product company SCA, has to pay 4%, the truck manufacturer Volvo, 4,9%, StoraEnso (also a forest product com- pany) has to pay 6%, while the broad band service provider Com Hem pays 10%. (a) Let's assume that all corporations have issued one-year zero-coupon bonds, with a face value equal to 100. We also assume that a risk- free (zero-coupon) government bond, with a face value equal to 100, is today (time 0) sold at a price equal to Pgou 96.618. Find the interest rate on the risk-free government bond and the prices of the corporate bonds for SCA, Volvo, StoraEnso and Com Hem. (b) Lets assume that investors are risk-neutral and that they therefore are interested mainly in the expected rate of return on their bond- investments. The higher interest rates on corporate bonds is a re- flection on the probability that the corporation may go bankrupt before the expiration date of the bond. If bankruptcy occurs, the bondholders often get only part of what they have been promised in the bond-contract back. For simplicity we'll assume that they get nothing back. Given this information try to find out the probability that the market investors put on, for example, Volvo going bankrupt within the coming year. Hint: The expected rate of return is equal to the expected payout from the risky corporate bond divided by the current price. Denote the probability of bankruptcy by p. (c) Find Volvo's required rate of return on equity capital using the Cap- ital Asset Pricing Model (CAPM). Using data for twelve years be- fore 2010 gave the following information: The average yearly rate of return on a broad market index (proxy for the market portfolio): T 8.50%, the risk-free interest rate: rg = 2.5%, Volvo's covari- ance with the market index: 0M,volvo = 0.09, the variance of the market index: om = 0.07. (d) At the end of 2010 Volvo's share price was 100SEK, today (10 years later) it is 200SEK. Calculate Volvo's realized yearly rate of return over this period. Volvo has on average paid a yearly divided equal to 3,1% of the starting price each year. How does this compare with the required rate of return according to CAPM? 2. (20 points) The corporate bond market has increased in importance recently. Large corporations have increasingly turn to this market to raise financial capi- tal. Investors' interest has increased since the interest rate on government bonds have been very low (negative) for the last 5-6 years. In an old article from 2010 (when interest rates were much higher than today) in Dagens Industri the author compares the interest rates paid by various Swedish companies, e.g., the forest product company SCA, has to pay 4%, the truck manufacturer Volvo, 4,9%, StoraEnso (also a forest product com- pany) has to pay 6%, while the broad band service provider Com Hem pays 10%. (a) Let's assume that all corporations have issued one-year zero-coupon bonds, with a face value equal to 100. We also assume that a risk- free (zero-coupon) government bond, with a face value equal to 100, is today (time 0) sold at a price equal to Pgou 96.618. Find the interest rate on the risk-free government bond and the prices of the corporate bonds for SCA, Volvo, StoraEnso and Com Hem. (b) Lets assume that investors are risk-neutral and that they therefore are interested mainly in the expected rate of return on their bond- investments. The higher interest rates on corporate bonds is a re- flection on the probability that the corporation may go bankrupt before the expiration date of the bond. If bankruptcy occurs, the bondholders often get only part of what they have been promised in the bond-contract back. For simplicity we'll assume that they get nothing back. Given this information try to find out the probability that the market investors put on, for example, Volvo going bankrupt within the coming year. Hint: The expected rate of return is equal to the expected payout from the risky corporate bond divided by the current price. Denote the probability of bankruptcy by p. (c) Find Volvo's required rate of return on equity capital using the Cap- ital Asset Pricing Model (CAPM). Using data for twelve years be- fore 2010 gave the following information: The average yearly rate of return on a broad market index (proxy for the market portfolio): T 8.50%, the risk-free interest rate: rg = 2.5%, Volvo's covari- ance with the market index: 0M,volvo = 0.09, the variance of the market index: om = 0.07. (d) At the end of 2010 Volvo's share price was 100SEK, today (10 years later) it is 200SEK. Calculate Volvo's realized yearly rate of return over this period. Volvo has on average paid a yearly divided equal to 3,1% of the starting price each year. How does this compare with the required rate of return according to CAPM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started