Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. (21 points, as indicated) (You may handwrite the answer to this question). Consider a simple Weber model that gets modified a bit as the

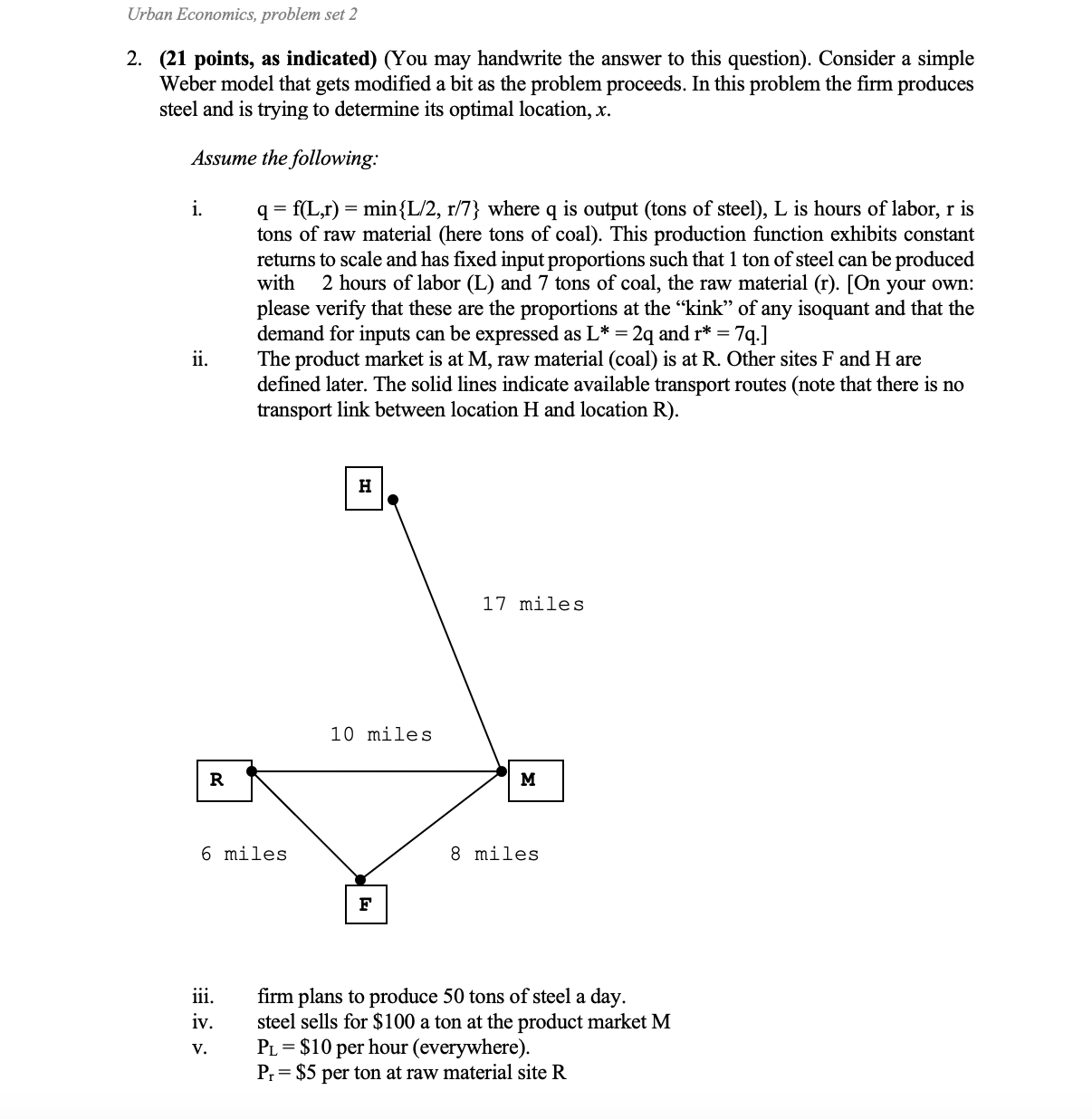

2. (21 points, as indicated) (You may handwrite the answer to this question). Consider a simple Weber model that gets modified a bit as the problem proceeds. In this problem the firm produces steel and is trying to determine its optimal location, x. Assume the following: i. q=f(L,r)=min{L/2,r/7} where q is output (tons of steel), L is hours of labor, r is tons of raw material (here tons of coal). This production function exhibits constant returns to scale and has fixed input proportions such that 1 ton of steel can be produced with 2 hours of labor (L) and 7 tons of coal, the raw material (r). [On your own: please verify that these are the proportions at the "kink" of any isoquant and that the demand for inputs can be expressed as L=2q and r=7q.] ii. The product market is at M, raw material (coal) is at R. Other sites F and H are defined later. The solid lines indicate available transport routes (note that there is no transport link between location H and location R ). iii. firm plans to produce 50 tons of steel a day. iv. steel sells for $100 a ton at the product market M v. PL=$10 per hour (everywhere). Pr=$5 per ton at raw material site R Urban Economics, problem set 2 vi. coal must be transported to the factory site at x, where x is distance (in miles) from location R to the factory site. vi. transport costs are the same along all routes (note: "ton-mile" is shorthand for "per ton per mile") tr=$1 per ton-mile of coal tq=$2 per ton-mile of steel Answer the following: a. (9 points, 3 each part) First consider the line segment connecting R and M. Assume the firm sells steel at M and buys coal from site R. i. State the firm's location choice criteria. Discuss how the goals of profit maximization and transport cost minimization are related in this problem. ii. Make a table showing transport costs per unit of output (input, output and total) at M, R, and 5 miles from R. Which site is best, and why? iii. Finally draw a graph to support your answer. Your graph should show the trio of transport costs per unit of output. Be sure to label the best site and explain why it is best. b. (2 points) Is this steel firm a resource-oriented firm or a market-oriented firm? Why? c. (6 points) Suppose a cheap labor site developed at F, where wages fall to only $1 per hour. Should the firm move? Why? (Assume PL=$10 per hour at every location but F). d. (4 points) Suppose site H is another raw material site under control of a zealous redevelopment group. The group wants to attract steel firms to site H. Therefore they will only sell coal to firms locating at H. What is the maximum the H-authorities could charge for the raw material to ensure that a steel firm will relocate at H ? Show all computations and explain your answer. 2. (21 points, as indicated) (You may handwrite the answer to this question). Consider a simple Weber model that gets modified a bit as the problem proceeds. In this problem the firm produces steel and is trying to determine its optimal location, x. Assume the following: i. q=f(L,r)=min{L/2,r/7} where q is output (tons of steel), L is hours of labor, r is tons of raw material (here tons of coal). This production function exhibits constant returns to scale and has fixed input proportions such that 1 ton of steel can be produced with 2 hours of labor (L) and 7 tons of coal, the raw material (r). [On your own: please verify that these are the proportions at the "kink" of any isoquant and that the demand for inputs can be expressed as L=2q and r=7q.] ii. The product market is at M, raw material (coal) is at R. Other sites F and H are defined later. The solid lines indicate available transport routes (note that there is no transport link between location H and location R ). iii. firm plans to produce 50 tons of steel a day. iv. steel sells for $100 a ton at the product market M v. PL=$10 per hour (everywhere). Pr=$5 per ton at raw material site R Urban Economics, problem set 2 vi. coal must be transported to the factory site at x, where x is distance (in miles) from location R to the factory site. vi. transport costs are the same along all routes (note: "ton-mile" is shorthand for "per ton per mile") tr=$1 per ton-mile of coal tq=$2 per ton-mile of steel Answer the following: a. (9 points, 3 each part) First consider the line segment connecting R and M. Assume the firm sells steel at M and buys coal from site R. i. State the firm's location choice criteria. Discuss how the goals of profit maximization and transport cost minimization are related in this problem. ii. Make a table showing transport costs per unit of output (input, output and total) at M, R, and 5 miles from R. Which site is best, and why? iii. Finally draw a graph to support your answer. Your graph should show the trio of transport costs per unit of output. Be sure to label the best site and explain why it is best. b. (2 points) Is this steel firm a resource-oriented firm or a market-oriented firm? Why? c. (6 points) Suppose a cheap labor site developed at F, where wages fall to only $1 per hour. Should the firm move? Why? (Assume PL=$10 per hour at every location but F). d. (4 points) Suppose site H is another raw material site under control of a zealous redevelopment group. The group wants to attract steel firms to site H. Therefore they will only sell coal to firms locating at H. What is the maximum the H-authorities could charge for the raw material to ensure that a steel firm will relocate at H ? Show all computations and explain your

2. (21 points, as indicated) (You may handwrite the answer to this question). Consider a simple Weber model that gets modified a bit as the problem proceeds. In this problem the firm produces steel and is trying to determine its optimal location, x. Assume the following: i. q=f(L,r)=min{L/2,r/7} where q is output (tons of steel), L is hours of labor, r is tons of raw material (here tons of coal). This production function exhibits constant returns to scale and has fixed input proportions such that 1 ton of steel can be produced with 2 hours of labor (L) and 7 tons of coal, the raw material (r). [On your own: please verify that these are the proportions at the "kink" of any isoquant and that the demand for inputs can be expressed as L=2q and r=7q.] ii. The product market is at M, raw material (coal) is at R. Other sites F and H are defined later. The solid lines indicate available transport routes (note that there is no transport link between location H and location R ). iii. firm plans to produce 50 tons of steel a day. iv. steel sells for $100 a ton at the product market M v. PL=$10 per hour (everywhere). Pr=$5 per ton at raw material site R Urban Economics, problem set 2 vi. coal must be transported to the factory site at x, where x is distance (in miles) from location R to the factory site. vi. transport costs are the same along all routes (note: "ton-mile" is shorthand for "per ton per mile") tr=$1 per ton-mile of coal tq=$2 per ton-mile of steel Answer the following: a. (9 points, 3 each part) First consider the line segment connecting R and M. Assume the firm sells steel at M and buys coal from site R. i. State the firm's location choice criteria. Discuss how the goals of profit maximization and transport cost minimization are related in this problem. ii. Make a table showing transport costs per unit of output (input, output and total) at M, R, and 5 miles from R. Which site is best, and why? iii. Finally draw a graph to support your answer. Your graph should show the trio of transport costs per unit of output. Be sure to label the best site and explain why it is best. b. (2 points) Is this steel firm a resource-oriented firm or a market-oriented firm? Why? c. (6 points) Suppose a cheap labor site developed at F, where wages fall to only $1 per hour. Should the firm move? Why? (Assume PL=$10 per hour at every location but F). d. (4 points) Suppose site H is another raw material site under control of a zealous redevelopment group. The group wants to attract steel firms to site H. Therefore they will only sell coal to firms locating at H. What is the maximum the H-authorities could charge for the raw material to ensure that a steel firm will relocate at H ? Show all computations and explain your answer. 2. (21 points, as indicated) (You may handwrite the answer to this question). Consider a simple Weber model that gets modified a bit as the problem proceeds. In this problem the firm produces steel and is trying to determine its optimal location, x. Assume the following: i. q=f(L,r)=min{L/2,r/7} where q is output (tons of steel), L is hours of labor, r is tons of raw material (here tons of coal). This production function exhibits constant returns to scale and has fixed input proportions such that 1 ton of steel can be produced with 2 hours of labor (L) and 7 tons of coal, the raw material (r). [On your own: please verify that these are the proportions at the "kink" of any isoquant and that the demand for inputs can be expressed as L=2q and r=7q.] ii. The product market is at M, raw material (coal) is at R. Other sites F and H are defined later. The solid lines indicate available transport routes (note that there is no transport link between location H and location R ). iii. firm plans to produce 50 tons of steel a day. iv. steel sells for $100 a ton at the product market M v. PL=$10 per hour (everywhere). Pr=$5 per ton at raw material site R Urban Economics, problem set 2 vi. coal must be transported to the factory site at x, where x is distance (in miles) from location R to the factory site. vi. transport costs are the same along all routes (note: "ton-mile" is shorthand for "per ton per mile") tr=$1 per ton-mile of coal tq=$2 per ton-mile of steel Answer the following: a. (9 points, 3 each part) First consider the line segment connecting R and M. Assume the firm sells steel at M and buys coal from site R. i. State the firm's location choice criteria. Discuss how the goals of profit maximization and transport cost minimization are related in this problem. ii. Make a table showing transport costs per unit of output (input, output and total) at M, R, and 5 miles from R. Which site is best, and why? iii. Finally draw a graph to support your answer. Your graph should show the trio of transport costs per unit of output. Be sure to label the best site and explain why it is best. b. (2 points) Is this steel firm a resource-oriented firm or a market-oriented firm? Why? c. (6 points) Suppose a cheap labor site developed at F, where wages fall to only $1 per hour. Should the firm move? Why? (Assume PL=$10 per hour at every location but F). d. (4 points) Suppose site H is another raw material site under control of a zealous redevelopment group. The group wants to attract steel firms to site H. Therefore they will only sell coal to firms locating at H. What is the maximum the H-authorities could charge for the raw material to ensure that a steel firm will relocate at H ? Show all computations and explain your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started