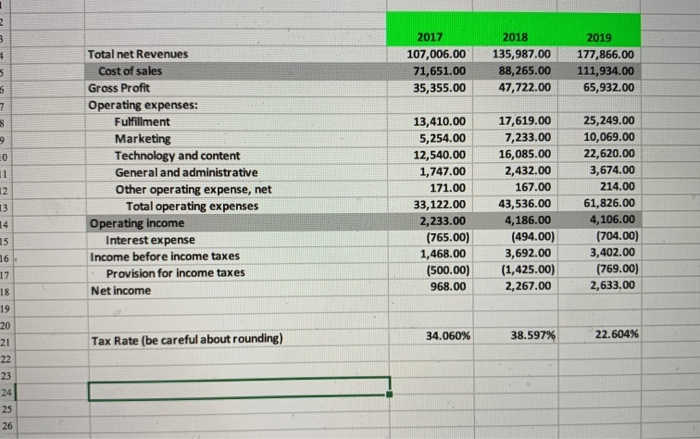

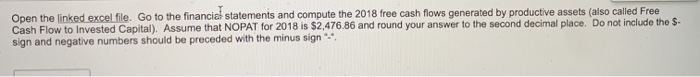

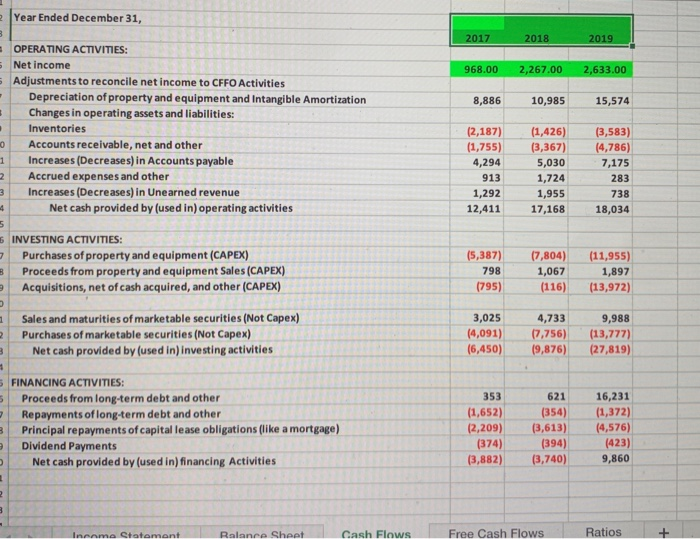

2 3 11 2017 107,006.00 71,651.00 35,355.00 2018 135,987.00 88,265.00 47,722.00 2019 177,866.00 111,934.00 65,932.00 5 5 7 3 9 10 Total net Revenues Cost of sales Gross Profit Operating expenses: Fulfillment Marketing Technology and content General and administrative Other operating expense, net Total operating expenses Operating income Interest expense Income before income taxes Provision for income taxes Net income 12 13 13,410.00 5,254.00 12,540.00 1,747.00 171.00 33, 122.00 2,233.00 (765.00) 1,468.00 (500.00) 968.00 17,619.00 7,233.00 16,085.00 2,432.00 167.00 43,536.00 4,186.00 (494.00) 3,692.00 (1,425.00) 2,267.00 25,249.00 10,069.00 22,620.00 3,674.00 214.00 61,826.00 4,106.00 (704.00) 3,402.00 (769.00) 2,633.00 15 16 17 18 19 20 21 34.060% Tax Rate (be careful about rounding) 38.597% 22.604% 22 23 24 25 26 Open the linked excel file. Go to the financial statements and compute the 2018 free cash flows generated by productive assets (also called Free Cash Flow to Invested Capital). Assume that NOPAT for 2018 is $2,476.86 and round your answer to the second decimal place. Do not include the $- sign and negative numbers should be preceded with the minus sign Year Ended December 31, 3 2017 2018 2019 968.00 2,267.00 2,633.00 8,886 10,985 15,574 - OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to CFFO Activities Depreciation of property and equipment and Intangible Amortization Changes in operating assets and liabilities: Inventories 0 Accounts receivable, net and other Increases (Decreases) in Accounts payable Accrued expenses and other Increases (Decreases) in Unearned revenue Net cash provided by (used in) operating activities (2,187) (1,755) 4,294 913 1,292 12,411 (1,426) (3,367) 5,030 1,724 1,955 17,168 2 3 (3,583) (4,786) 7,175 283 738 18,034 5 7 INVESTING ACTIVITIES: Purchases of property and equipment (CAPEX) Proceeds from property and equipment Sales (CAPEX) Acquisitions, net of cash acquired, and other (CAPEX) (5,387) 798 (795) (7,804) 1,067 (116) (11,955) 1,897 (13,972) m U 22 3,025 (4,091) (6,450) 4,733 (7,756) (9,876) 9,988 (13,777) (27,819) TT Sales and maturities of marketable securities (Not Capex) Purchases of marketable securities (Not Capex) Net cash provided by (used in) Investing activities FINANCING ACTIVITIES: Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of capital lease obligations (like a mortgage) Dividend Payments Net cash provided by (used in) financing Activities 5 353 (1,652) (2,209) (374) (3,882) m 621 (354) (3,613) (394) (3,740) 16,231 (1,372) (4,576) (423) 9,860 2 2 m Inname Statement Ralance Sheet Cash Flows Free Cash Flows Ratios + 2 3 11 2017 107,006.00 71,651.00 35,355.00 2018 135,987.00 88,265.00 47,722.00 2019 177,866.00 111,934.00 65,932.00 5 5 7 3 9 10 Total net Revenues Cost of sales Gross Profit Operating expenses: Fulfillment Marketing Technology and content General and administrative Other operating expense, net Total operating expenses Operating income Interest expense Income before income taxes Provision for income taxes Net income 12 13 13,410.00 5,254.00 12,540.00 1,747.00 171.00 33, 122.00 2,233.00 (765.00) 1,468.00 (500.00) 968.00 17,619.00 7,233.00 16,085.00 2,432.00 167.00 43,536.00 4,186.00 (494.00) 3,692.00 (1,425.00) 2,267.00 25,249.00 10,069.00 22,620.00 3,674.00 214.00 61,826.00 4,106.00 (704.00) 3,402.00 (769.00) 2,633.00 15 16 17 18 19 20 21 34.060% Tax Rate (be careful about rounding) 38.597% 22.604% 22 23 24 25 26 Open the linked excel file. Go to the financial statements and compute the 2018 free cash flows generated by productive assets (also called Free Cash Flow to Invested Capital). Assume that NOPAT for 2018 is $2,476.86 and round your answer to the second decimal place. Do not include the $- sign and negative numbers should be preceded with the minus sign Year Ended December 31, 3 2017 2018 2019 968.00 2,267.00 2,633.00 8,886 10,985 15,574 - OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to CFFO Activities Depreciation of property and equipment and Intangible Amortization Changes in operating assets and liabilities: Inventories 0 Accounts receivable, net and other Increases (Decreases) in Accounts payable Accrued expenses and other Increases (Decreases) in Unearned revenue Net cash provided by (used in) operating activities (2,187) (1,755) 4,294 913 1,292 12,411 (1,426) (3,367) 5,030 1,724 1,955 17,168 2 3 (3,583) (4,786) 7,175 283 738 18,034 5 7 INVESTING ACTIVITIES: Purchases of property and equipment (CAPEX) Proceeds from property and equipment Sales (CAPEX) Acquisitions, net of cash acquired, and other (CAPEX) (5,387) 798 (795) (7,804) 1,067 (116) (11,955) 1,897 (13,972) m U 22 3,025 (4,091) (6,450) 4,733 (7,756) (9,876) 9,988 (13,777) (27,819) TT Sales and maturities of marketable securities (Not Capex) Purchases of marketable securities (Not Capex) Net cash provided by (used in) Investing activities FINANCING ACTIVITIES: Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of capital lease obligations (like a mortgage) Dividend Payments Net cash provided by (used in) financing Activities 5 353 (1,652) (2,209) (374) (3,882) m 621 (354) (3,613) (394) (3,740) 16,231 (1,372) (4,576) (423) 9,860 2 2 m Inname Statement Ralance Sheet Cash Flows Free Cash Flows Ratios +