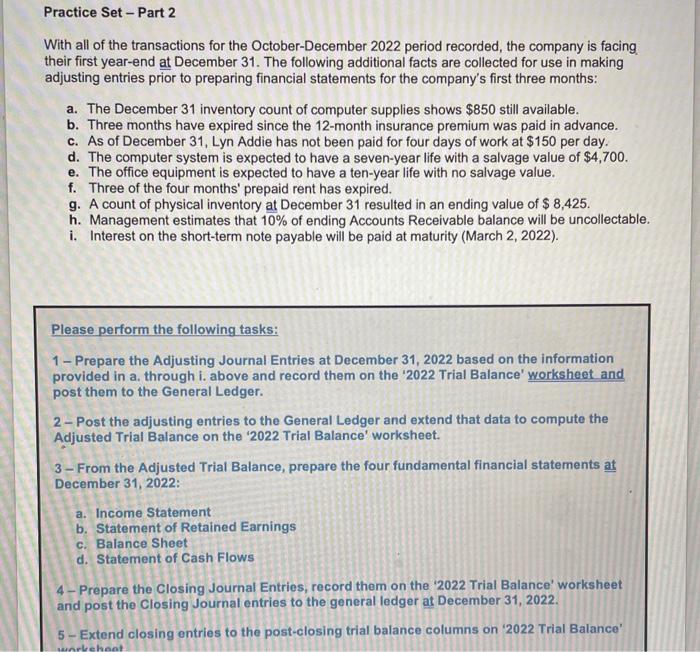

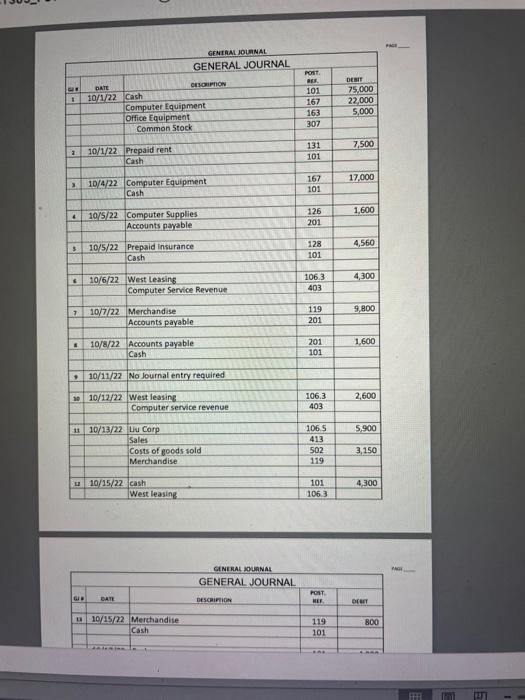

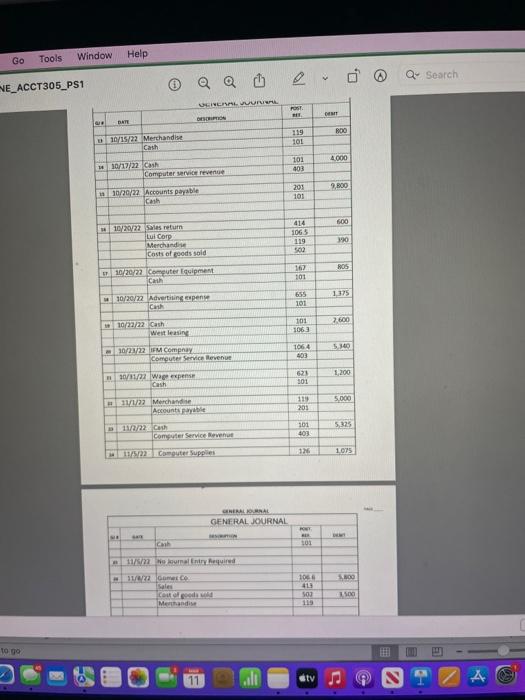

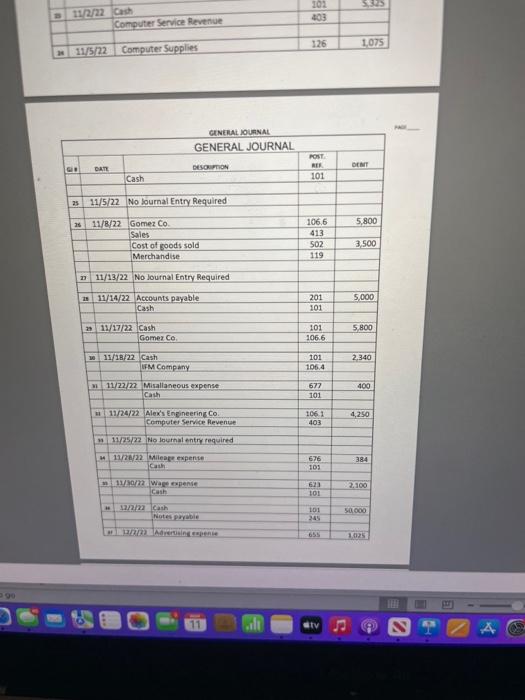

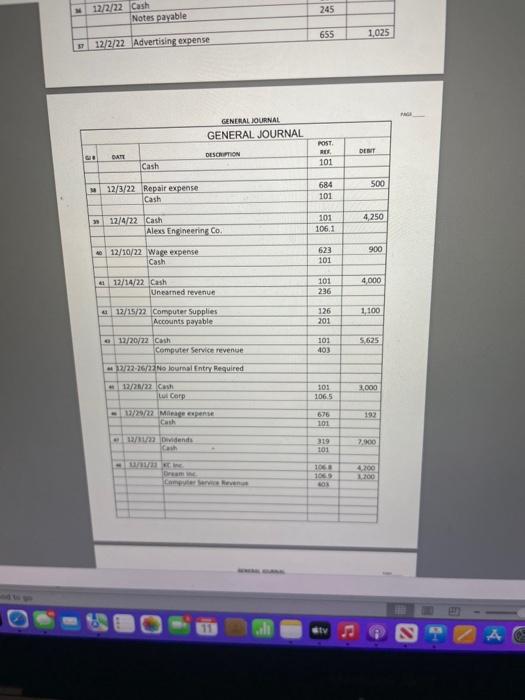

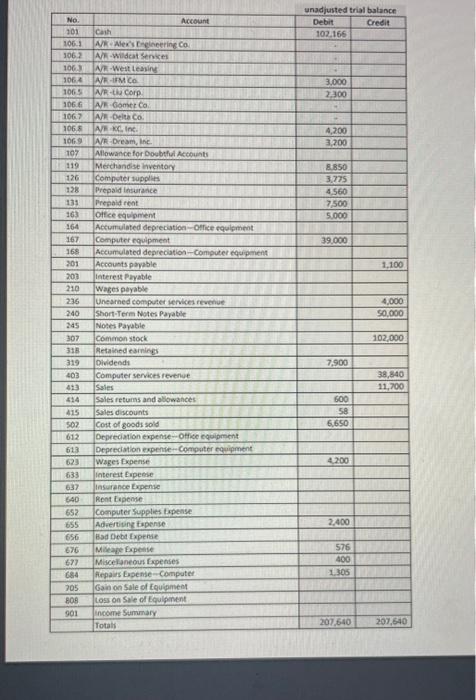

With all of the transactions for the October-December 2022 period recorded, the company is facing their first year-end at December 31 . The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months: a. The December 31 inventory count of computer supplies shows $850 still available. b. Three months have expired since the 12-month insurance premium was paid in advance. c. As of December 31, Lyn Addie has not been paid for four days of work at $150 per day. d. The computer system is expected to have a seven-year life with a salvage value of $4,700. e. The office equipment is expected to have a ten-year life with no salvage value. f. Three of the four months' prepaid rent has expired. g. A count of physical inventory at December 31 resulted in an ending value of $8,425. h. Management estimates that 10% of ending Accounts Receivable balance will be uncollectable. i. Interest on the short-term note payable will be paid at maturity (March 2, 2022). Please perform the following tasks: 1 - Prepare the Adjusting Journal Entries at December 31, 2022 based on the information provided in a. through i. above and record them on the '2022 Trial Balance' worksheet and post them to the General Ledger. 2 - Post the adjusting entries to the General Ledger and extend that data to compute the Adjusted Trial Balance on the '2022 Trial Balance' worksheet. 3 - From the Adjusted Trial Balance, prepare the four fundamental financial statements at December 31, 2022: a. Income Statement b. Statement of Retained Earnings c. Balance Sheet d. Statement of Cash Flows 4 - Prepare the Closing Journal Entries, record them on the '2022 Trial Balance' worksheet and post the Closing Journal entries to the general ledger at December 31, 2022. 5 - Extend closing entries to the post-closing trial balance columns on '2022 Trial Balance' GEATRALIOUMNAL GENIRAL IOLANA GENERAL JOURNAL Window Help \( \frac{\text { Go Tools Win }}{\text { NE_ACCT305_PS1 }} \) (1) Q. sesrch s. \begin{tabular}{|l|l|l|l|r|} \hline a & 11/2/22 & Cath & 102 & 5.335 \\ \hline & & Computer Service Revenue & 403 & \\ \hline & & & & \\ \hline at & 11/5/22 & Computer Supplies & 126 & 1.075 \\ \hline \end{tabular} CENERAL JOUENAL \begin{tabular}{|l|l|l|c|r|} \hline * & 12/2/22 & Cash & 245 & \\ \hline & & Notes payable & & \\ \hline & & & 655 & 1,025 \\ \hline \end{tabular}